Baltimore City Tax Lien

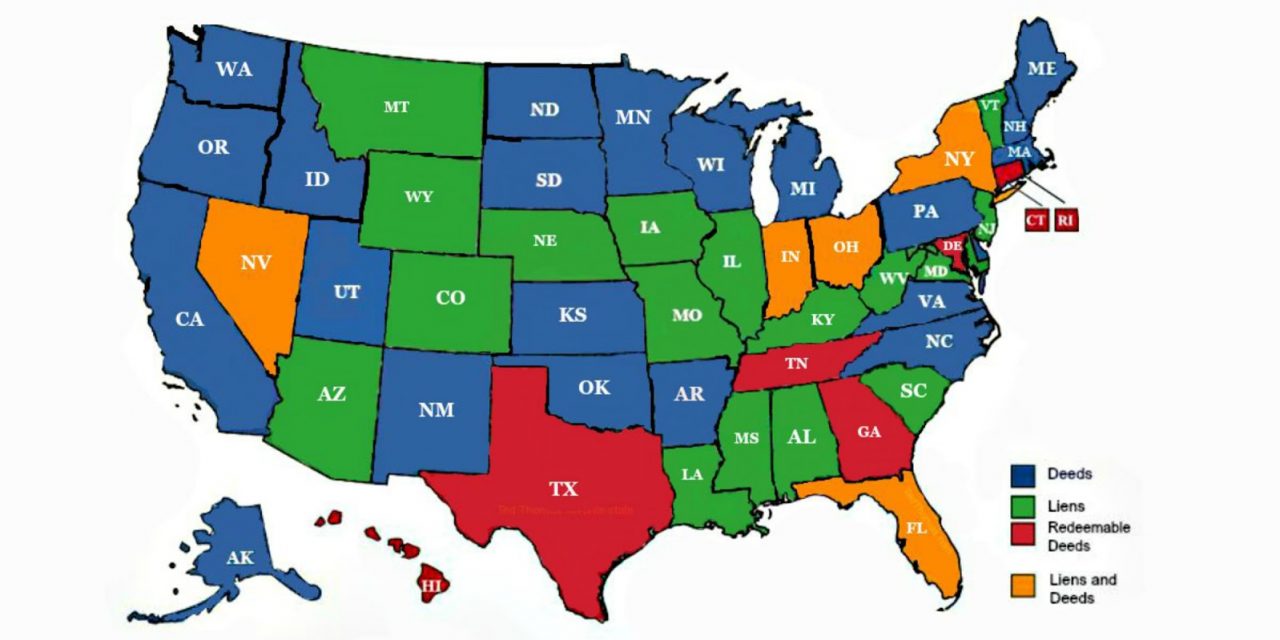

Baltimore City Tax Lien - You must pay for the lien certificate after applying online. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. There are several types of bills and municipal charges that, if. The city of baltimore holds an annual tax lien certificate sale. The tax sale is used to collect delinquent real property taxes and other unpaid.

The city of baltimore holds an annual tax lien certificate sale. There are several types of bills and municipal charges that, if. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. The tax sale is used to collect delinquent real property taxes and other unpaid. You must pay for the lien certificate after applying online.

The city of baltimore holds an annual tax lien certificate sale. The tax sale is used to collect delinquent real property taxes and other unpaid. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. There are several types of bills and municipal charges that, if. You must pay for the lien certificate after applying online.

Baltimore City Tax Lien List 2024 Karee Marjory

The tax sale is used to collect delinquent real property taxes and other unpaid. The city of baltimore holds an annual tax lien certificate sale. There are several types of bills and municipal charges that, if. You must pay for the lien certificate after applying online. The annual tax sale process begins in the first week of february when the.

Faith leaders demand elimination of city tax lien sales

There are several types of bills and municipal charges that, if. You must pay for the lien certificate after applying online. The tax sale is used to collect delinquent real property taxes and other unpaid. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property.

Baltimore City Tax Lien List 2024 Karee Marjory

You must pay for the lien certificate after applying online. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. The tax sale is used to collect delinquent real property taxes and other unpaid. The city of baltimore holds an.

Tax Lien Sale Download Free PDF Tax Lien Taxes

The city of baltimore holds an annual tax lien certificate sale. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. You must pay for the lien certificate after applying online. The tax sale is used to collect delinquent real.

Baltimore City sued over tax sale system

The tax sale is used to collect delinquent real property taxes and other unpaid. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. The city of baltimore holds an annual tax lien certificate sale. There are several types of.

EasytoUnderstand Tax Lien Code Certificates Posteezy

The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. The tax sale is used to collect delinquent real property taxes and other unpaid. You must pay for the lien certificate after applying online. The city of baltimore holds an.

Baltimore City Tax Night — Baltimore CONNECT

The tax sale is used to collect delinquent real property taxes and other unpaid. There are several types of bills and municipal charges that, if. The city of baltimore holds an annual tax lien certificate sale. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the.

Bureau of the Budget and Management Research

The city of baltimore holds an annual tax lien certificate sale. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. The tax sale is used to collect delinquent real property taxes and other unpaid. You must pay for the.

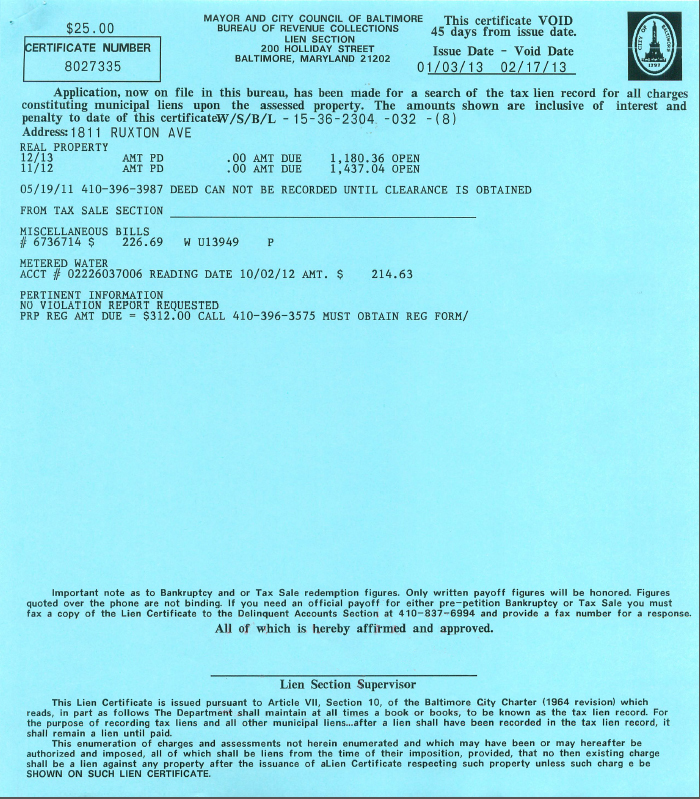

Baltimore City Md Lien Certificate Application prosecution2012

The city of baltimore holds an annual tax lien certificate sale. You must pay for the lien certificate after applying online. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. There are several types of bills and municipal charges.

Fillable Online Baltimore City Lien Affidavit Fax Email Print pdfFiller

There are several types of bills and municipal charges that, if. The city of baltimore holds an annual tax lien certificate sale. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. You must pay for the lien certificate after.

The Tax Sale Is Used To Collect Delinquent Real Property Taxes And Other Unpaid.

The city of baltimore holds an annual tax lien certificate sale. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. There are several types of bills and municipal charges that, if. You must pay for the lien certificate after applying online.