Baltimore Tax Lien Sale

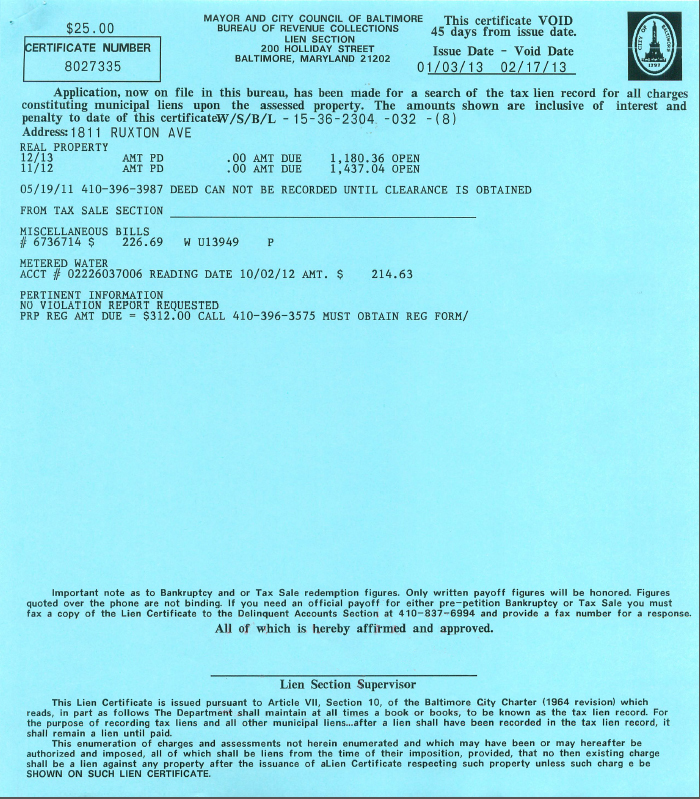

Baltimore Tax Lien Sale - This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax sale which. Every year, baltimore has a tax sale. The tax sale is used to collect delinquent real property taxes and other unpaid. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. This sale helps the city collect unpaid property taxes and charges. Any and all entities and/or individuals seeking to participate in the collector’s 2024 tax sale shall register with the collector online at:. These unpaid bills are like claims on the property. The city of baltimore holds an annual tax lien certificate sale.

The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. The city of baltimore holds an annual tax lien certificate sale. This sale helps the city collect unpaid property taxes and charges. These unpaid bills are like claims on the property. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax sale which. Every year, baltimore has a tax sale. Any and all entities and/or individuals seeking to participate in the collector’s 2024 tax sale shall register with the collector online at:. The tax sale is used to collect delinquent real property taxes and other unpaid.

This sale helps the city collect unpaid property taxes and charges. Every year, baltimore has a tax sale. The city of baltimore holds an annual tax lien certificate sale. Any and all entities and/or individuals seeking to participate in the collector’s 2024 tax sale shall register with the collector online at:. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. The tax sale is used to collect delinquent real property taxes and other unpaid. These unpaid bills are like claims on the property. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax sale which.

Property Tax Lien Sale Program Extended by City Council CityLand CityLand

Any and all entities and/or individuals seeking to participate in the collector’s 2024 tax sale shall register with the collector online at:. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. Every year, baltimore has a tax sale. This.

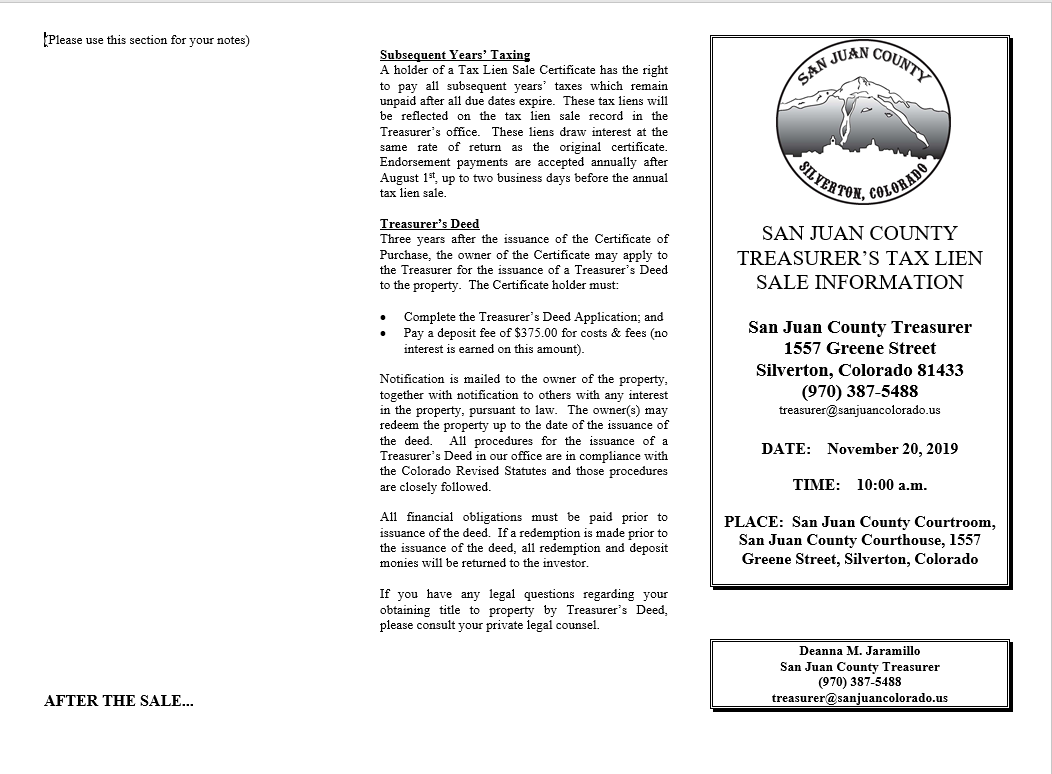

Tax Lien Sale San Juan County

The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. Any and all entities and/or individuals seeking to participate in the collector’s 2024 tax sale shall register with the collector online at:. These unpaid bills are like claims on the.

Baltimore City Tax Lien List 2024 Karee Marjory

Any and all entities and/or individuals seeking to participate in the collector’s 2024 tax sale shall register with the collector online at:. This sale helps the city collect unpaid property taxes and charges. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax sale which. Every year, baltimore.

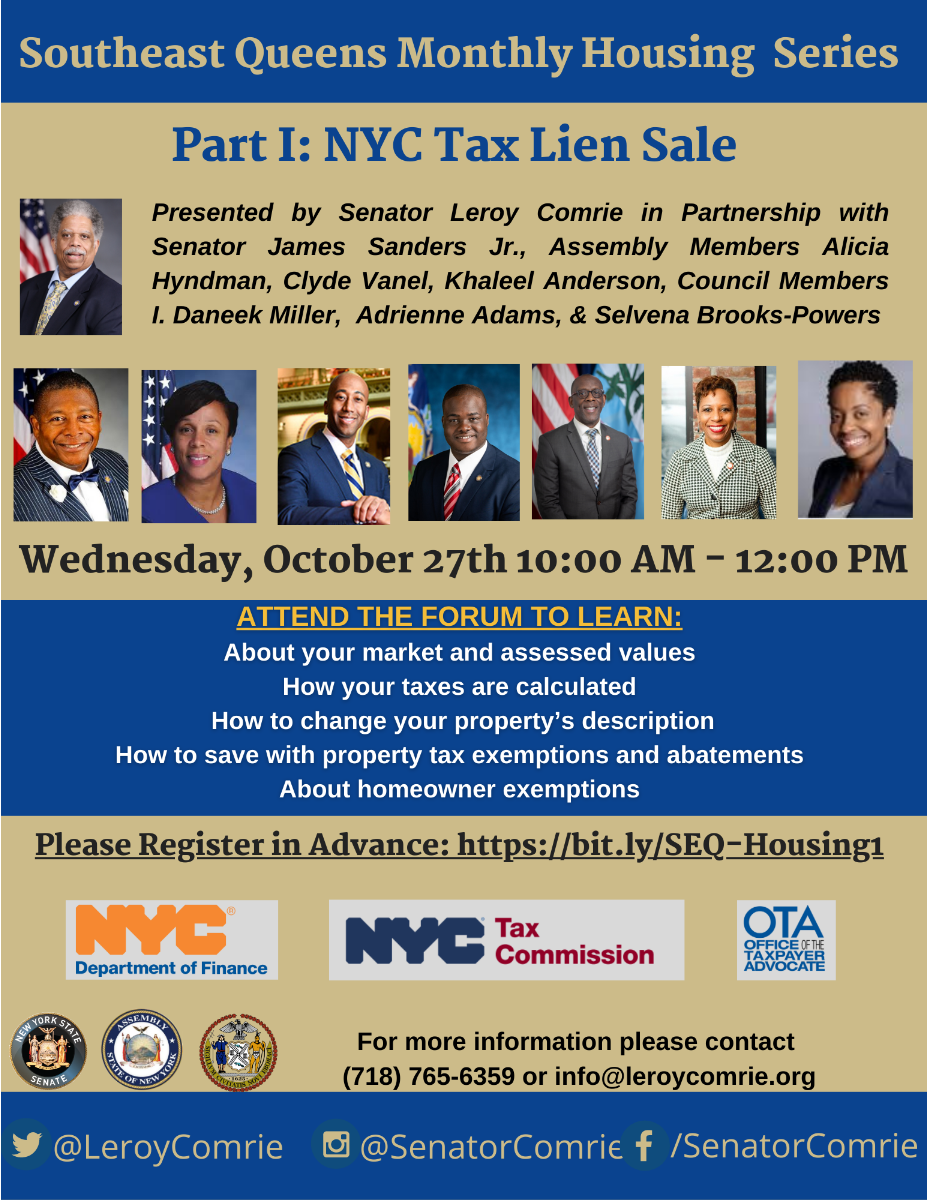

NYC Tax Lien Sale Information Session Jamaica311

This sale helps the city collect unpaid property taxes and charges. The city of baltimore holds an annual tax lien certificate sale. Every year, baltimore has a tax sale. Any and all entities and/or individuals seeking to participate in the collector’s 2024 tax sale shall register with the collector online at:. The annual tax sale process begins in the first.

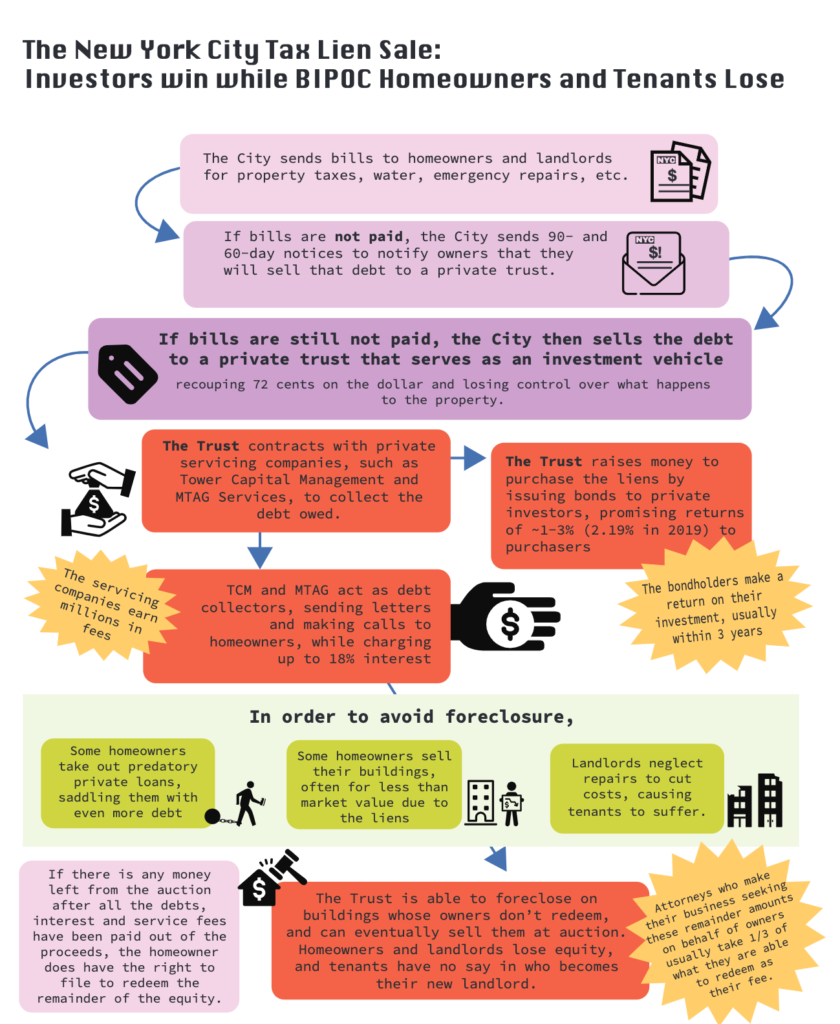

NYC Tax Lien Sale Reform Conference EastNewYorkCLT

Any and all entities and/or individuals seeking to participate in the collector’s 2024 tax sale shall register with the collector online at:. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax sale which. The annual tax sale process begins in the first week of february when the.

Tax Review PDF Taxes Tax Lien

Every year, baltimore has a tax sale. The city of baltimore holds an annual tax lien certificate sale. This sale helps the city collect unpaid property taxes and charges. These unpaid bills are like claims on the property. Any and all entities and/or individuals seeking to participate in the collector’s 2024 tax sale shall register with the collector online at:.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

These unpaid bills are like claims on the property. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax sale which. This sale helps the city collect unpaid property taxes and charges. Any and all entities and/or individuals seeking to participate in the collector’s 2024 tax sale shall.

Informational Brochure About the Tax Lien Sale EastNewYorkCLT

The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. Every year, baltimore has a tax sale. These unpaid bills are like claims on the property. This sale helps the city collect unpaid property taxes and charges. Any and all.

EasytoUnderstand Tax Lien Code Certificates Posteezy

This sale helps the city collect unpaid property taxes and charges. These unpaid bills are like claims on the property. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax sale which. The city of baltimore holds an annual tax lien certificate sale. The tax sale is used.

Abolish The Tax Lien Sale EastNewYorkCLT

The tax sale is used to collect delinquent real property taxes and other unpaid. Every year, baltimore has a tax sale. The city of baltimore holds an annual tax lien certificate sale. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record.

These Unpaid Bills Are Like Claims On The Property.

Every year, baltimore has a tax sale. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of record at the. The tax sale is used to collect delinquent real property taxes and other unpaid. This sale helps the city collect unpaid property taxes and charges.

Any And All Entities And/Or Individuals Seeking To Participate In The Collector’s 2024 Tax Sale Shall Register With The Collector Online At:.

This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax sale which. The city of baltimore holds an annual tax lien certificate sale.