Best Tax Lien States

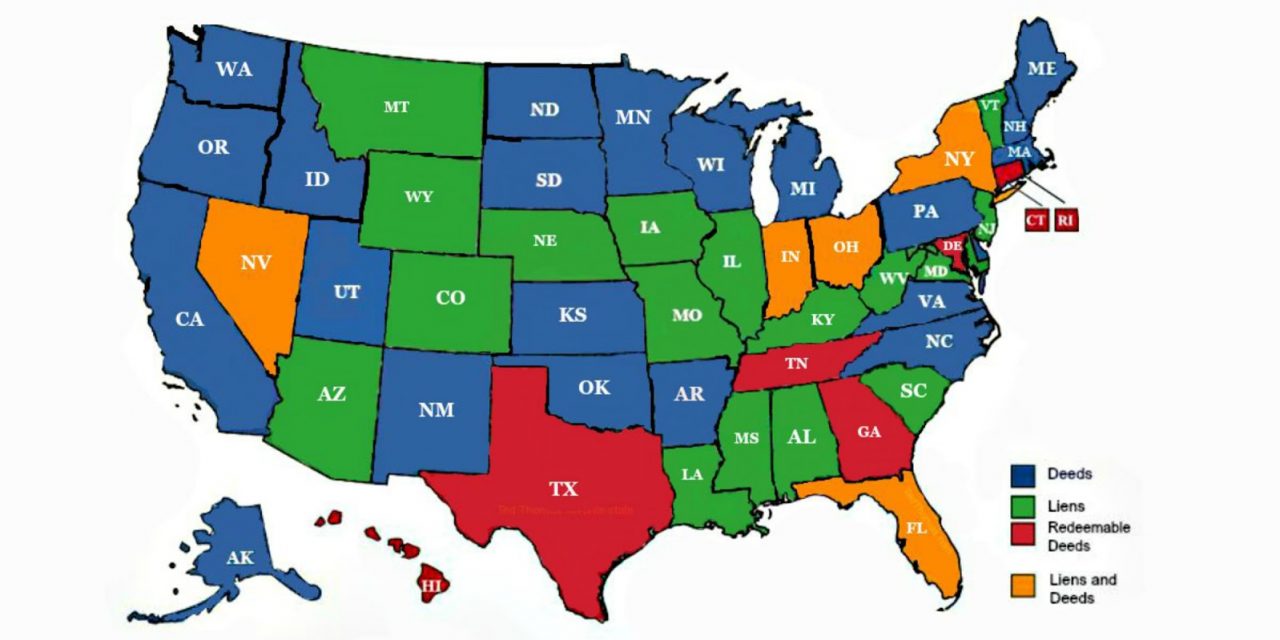

Best Tax Lien States - When a property owner has failed to pay the required property taxes, the taxing government will use one of three legal methods to settle the unpaid debt: Below are some of the best states for tax lien investing and the reasons why they are attractive: In the united states, states are classified into tax lien states, tax deed states, or hybrid states based on how they handle. Are you curious to know about the tax lien interest rate by state, specifically which states offer 16%?. Texas is known for its.

Below are some of the best states for tax lien investing and the reasons why they are attractive: Texas is known for its. When a property owner has failed to pay the required property taxes, the taxing government will use one of three legal methods to settle the unpaid debt: In the united states, states are classified into tax lien states, tax deed states, or hybrid states based on how they handle. Are you curious to know about the tax lien interest rate by state, specifically which states offer 16%?.

Are you curious to know about the tax lien interest rate by state, specifically which states offer 16%?. When a property owner has failed to pay the required property taxes, the taxing government will use one of three legal methods to settle the unpaid debt: Below are some of the best states for tax lien investing and the reasons why they are attractive: Texas is known for its. In the united states, states are classified into tax lien states, tax deed states, or hybrid states based on how they handle.

Investing in Tax Lien Seminars and Courses

Below are some of the best states for tax lien investing and the reasons why they are attractive: Are you curious to know about the tax lien interest rate by state, specifically which states offer 16%?. Texas is known for its. When a property owner has failed to pay the required property taxes, the taxing government will use one of.

Tax Lien Properties In Montana Brightside Tax Relief

When a property owner has failed to pay the required property taxes, the taxing government will use one of three legal methods to settle the unpaid debt: Texas is known for its. Are you curious to know about the tax lien interest rate by state, specifically which states offer 16%?. Below are some of the best states for tax lien.

Tax Lien Investing Secrets Unveiled

Below are some of the best states for tax lien investing and the reasons why they are attractive: When a property owner has failed to pay the required property taxes, the taxing government will use one of three legal methods to settle the unpaid debt: Texas is known for its. In the united states, states are classified into tax lien.

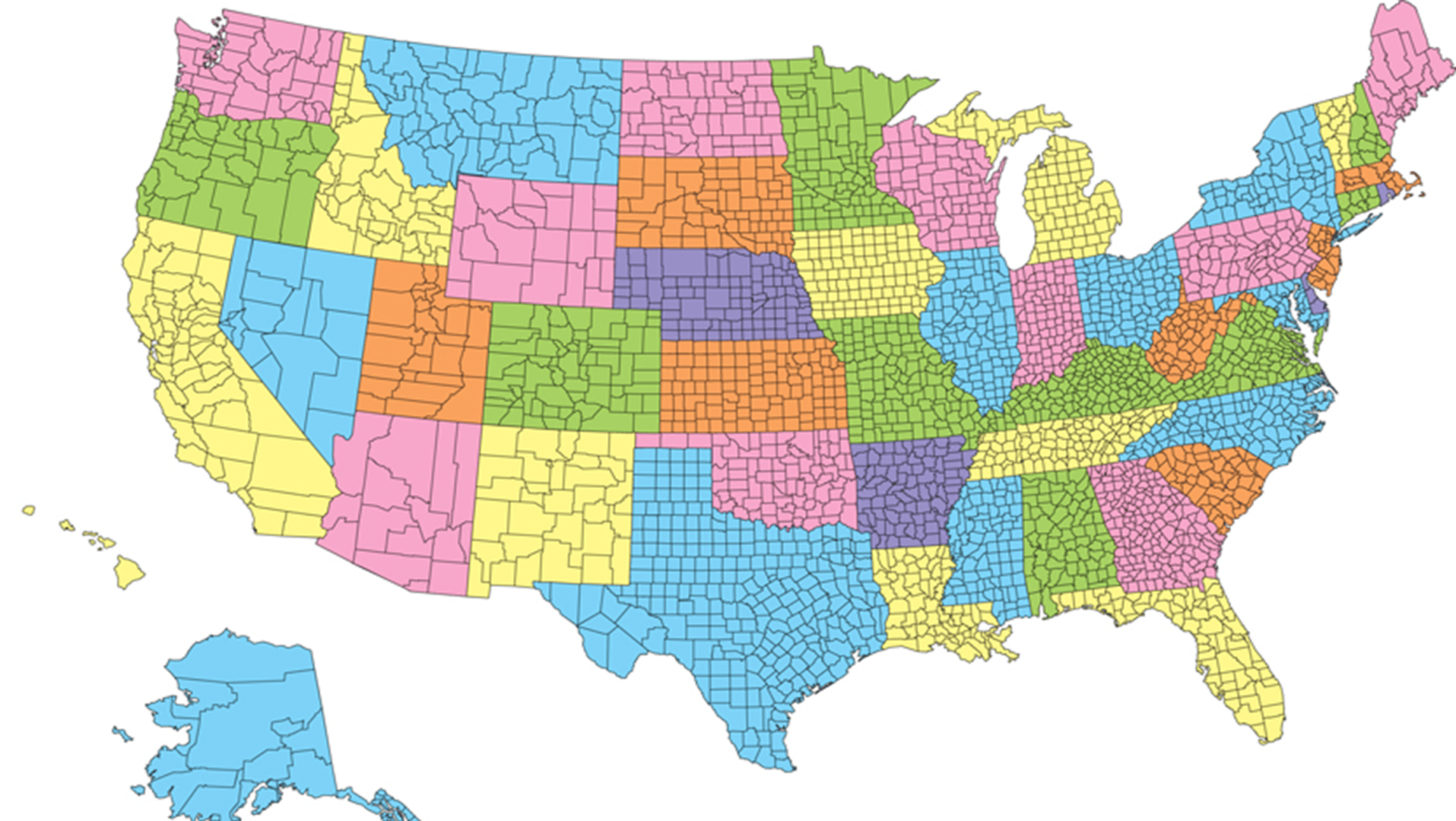

Tax Lien States Map 2024 Wilow Kaitlynn

Below are some of the best states for tax lien investing and the reasons why they are attractive: When a property owner has failed to pay the required property taxes, the taxing government will use one of three legal methods to settle the unpaid debt: Texas is known for its. Are you curious to know about the tax lien interest.

Tax Lien Investing Resources from

Texas is known for its. Below are some of the best states for tax lien investing and the reasons why they are attractive: Are you curious to know about the tax lien interest rate by state, specifically which states offer 16%?. In the united states, states are classified into tax lien states, tax deed states, or hybrid states based on.

The Guide To Tax Lien States How Do They Work?

Are you curious to know about the tax lien interest rate by state, specifically which states offer 16%?. Below are some of the best states for tax lien investing and the reasons why they are attractive: When a property owner has failed to pay the required property taxes, the taxing government will use one of three legal methods to settle.

Tax Lien States Map Time Zones Map

When a property owner has failed to pay the required property taxes, the taxing government will use one of three legal methods to settle the unpaid debt: Texas is known for its. Below are some of the best states for tax lien investing and the reasons why they are attractive: Are you curious to know about the tax lien interest.

Tax Lien States Map 2024 Wilow Kaitlynn

Below are some of the best states for tax lien investing and the reasons why they are attractive: When a property owner has failed to pay the required property taxes, the taxing government will use one of three legal methods to settle the unpaid debt: In the united states, states are classified into tax lien states, tax deed states, or.

The Essential List Of Tax Lien Certificate States Tax Lien

In the united states, states are classified into tax lien states, tax deed states, or hybrid states based on how they handle. Are you curious to know about the tax lien interest rate by state, specifically which states offer 16%?. Texas is known for its. When a property owner has failed to pay the required property taxes, the taxing government.

Tax Lien States Map 2024 Wilow Kaitlynn

Are you curious to know about the tax lien interest rate by state, specifically which states offer 16%?. Below are some of the best states for tax lien investing and the reasons why they are attractive: When a property owner has failed to pay the required property taxes, the taxing government will use one of three legal methods to settle.

Are You Curious To Know About The Tax Lien Interest Rate By State, Specifically Which States Offer 16%?.

When a property owner has failed to pay the required property taxes, the taxing government will use one of three legal methods to settle the unpaid debt: In the united states, states are classified into tax lien states, tax deed states, or hybrid states based on how they handle. Below are some of the best states for tax lien investing and the reasons why they are attractive: Texas is known for its.