Bethlehem Pa Local Tax

Bethlehem Pa Local Tax - Important taxpayer and employer resources such. For general revenue purposes, a tax is hereby levied upon the privilege of engaging in an occupation within the corporate limits of the city during the. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and. Psd codes (political subdivision codes) are six. Effective 2012, keystone collections group became the earned income tax collector for the township. Residents of bethlehem pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal income. The local tax filing deadline is april 18, 2022, matching the federal and state filing dates.

Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and. Important taxpayer and employer resources such. Effective 2012, keystone collections group became the earned income tax collector for the township. The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. For general revenue purposes, a tax is hereby levied upon the privilege of engaging in an occupation within the corporate limits of the city during the. Psd codes (political subdivision codes) are six. Residents of bethlehem pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal income.

Important taxpayer and employer resources such. For general revenue purposes, a tax is hereby levied upon the privilege of engaging in an occupation within the corporate limits of the city during the. The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and. Psd codes (political subdivision codes) are six. Residents of bethlehem pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal income. Effective 2012, keystone collections group became the earned income tax collector for the township.

Bethlehem Historic District Association Bethlehem PA

Residents of bethlehem pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal income. The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. Psd codes (political subdivision codes) are six. Important taxpayer and employer resources such. For general revenue purposes, a tax.

Bethlehem Community Market Bethlehem NH

Residents of bethlehem pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal income. Effective 2012, keystone collections group became the earned income tax collector for the township. For general revenue purposes, a tax is hereby levied upon the privilege of engaging in an occupation within the corporate limits.

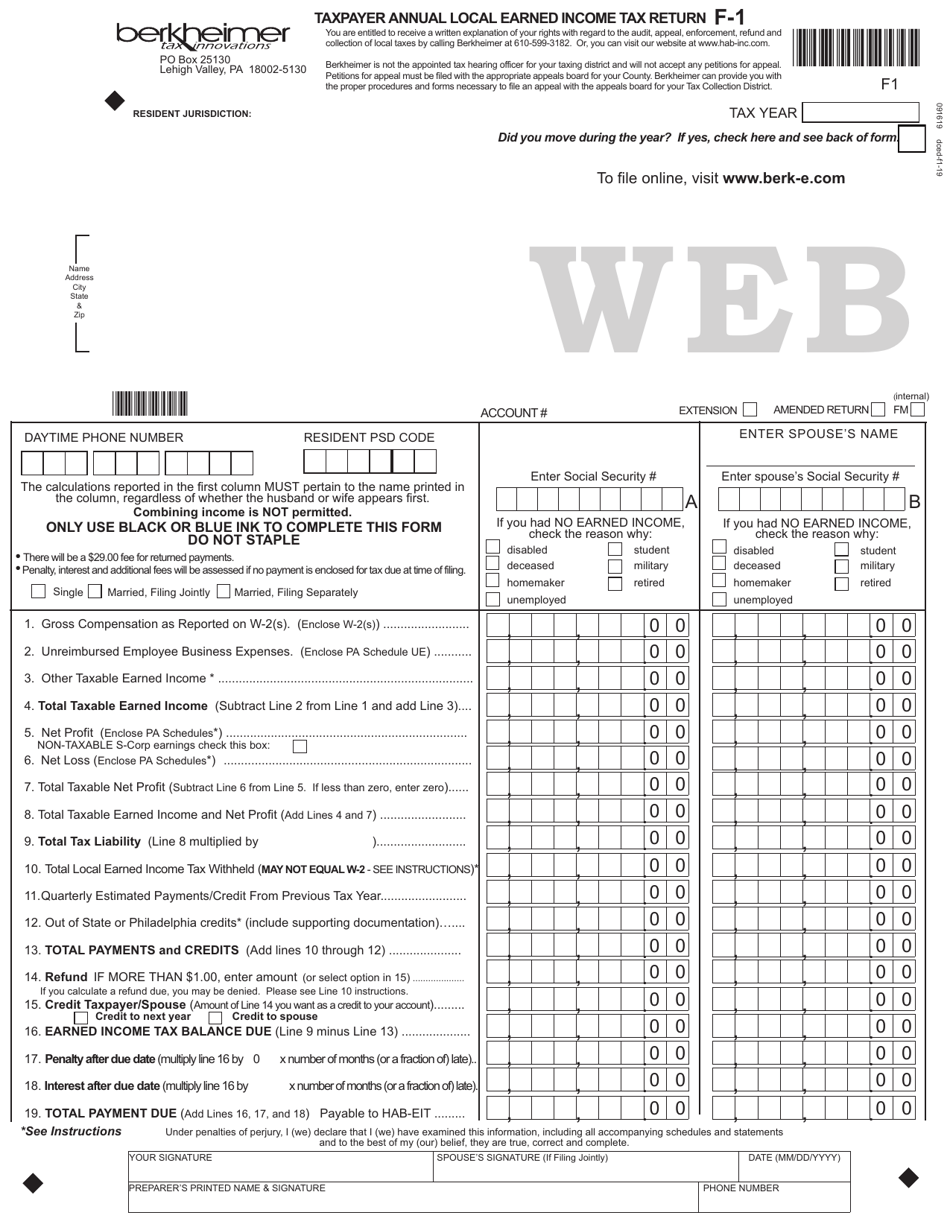

Perry County Pa Local Tax Form

The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. Important taxpayer and employer resources such. Psd codes (political subdivision codes) are six. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and. Effective 2012, keystone.

Episcopal Diocese of Bethlehem Bethlehem PA

Effective 2012, keystone collections group became the earned income tax collector for the township. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and. For general revenue purposes, a tax is hereby levied upon the privilege of engaging in an occupation within.

Bethlehem Chamber of Commerce Bethlehem PA

Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and. Important taxpayer and employer resources such. Effective 2012, keystone collections group became the earned income tax collector for the township. For general revenue purposes, a tax is hereby levied upon the privilege.

Find the Best Tax Preparation Services in Bethlehem, PA

Psd codes (political subdivision codes) are six. Important taxpayer and employer resources such. Effective 2012, keystone collections group became the earned income tax collector for the township. For general revenue purposes, a tax is hereby levied upon the privilege of engaging in an occupation within the corporate limits of the city during the. The local tax filing deadline is april.

Bethlehem Municipality بلدية بيت لحم Bethlehem

Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and. Residents of bethlehem pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal income. Psd codes (political subdivision codes) are six..

Bethlehem Housing Authority Bethlehem PA

Important taxpayer and employer resources such. Psd codes (political subdivision codes) are six. For general revenue purposes, a tax is hereby levied upon the privilege of engaging in an occupation within the corporate limits of the city during the. Residents of bethlehem pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax.

Bethlehem Free Will Baptist Church Ashland City TN

Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and. Effective 2012, keystone collections group became the earned income tax collector for the township. For general revenue purposes, a tax is hereby levied upon the privilege of engaging in an occupation within.

Bethlehem House Gallery Bethlehem PA

For general revenue purposes, a tax is hereby levied upon the privilege of engaging in an occupation within the corporate limits of the city during the. Important taxpayer and employer resources such. The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. Local services tax (lst) act 7 of 2007 amends the local tax.

Important Taxpayer And Employer Resources Such.

The local tax filing deadline is april 18, 2022, matching the federal and state filing dates. Residents of bethlehem pay a flat city income tax of 1.00% on earned income, in addition to the pennsylvania income tax and the federal income. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and. For general revenue purposes, a tax is hereby levied upon the privilege of engaging in an occupation within the corporate limits of the city during the.

Psd Codes (Political Subdivision Codes) Are Six.

Effective 2012, keystone collections group became the earned income tax collector for the township.