Bexar County Tax Liens

Bexar County Tax Liens - Information concerning liens recorded against a property may be researched by the public in the. Enter the address and search. Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department located. San antonio’s bexar county follows standard texas procedures for property tax liens. The county clerk is located at 100 dolorosa suite 104. A tax lien is placed on every bexar resident’s property on january 1 to ensure that they are liable regarding delinquent payments — the only way to. Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. How can i find out if there is a lien on my property?

Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department located. San antonio’s bexar county follows standard texas procedures for property tax liens. Information concerning liens recorded against a property may be researched by the public in the. The county clerk is located at 100 dolorosa suite 104. A tax lien is placed on every bexar resident’s property on january 1 to ensure that they are liable regarding delinquent payments — the only way to. How can i find out if there is a lien on my property? Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. Enter the address and search.

The county clerk is located at 100 dolorosa suite 104. Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. How can i find out if there is a lien on my property? Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department located. Information concerning liens recorded against a property may be researched by the public in the. A tax lien is placed on every bexar resident’s property on january 1 to ensure that they are liable regarding delinquent payments — the only way to. Enter the address and search. San antonio’s bexar county follows standard texas procedures for property tax liens.

Bexar County property tax increase by zip code from 2014 to 2019 Infogram

Information concerning liens recorded against a property may be researched by the public in the. Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. San antonio’s bexar county follows standard texas procedures for property tax liens. The county clerk is located at 100 dolorosa suite 104. How can i find out.

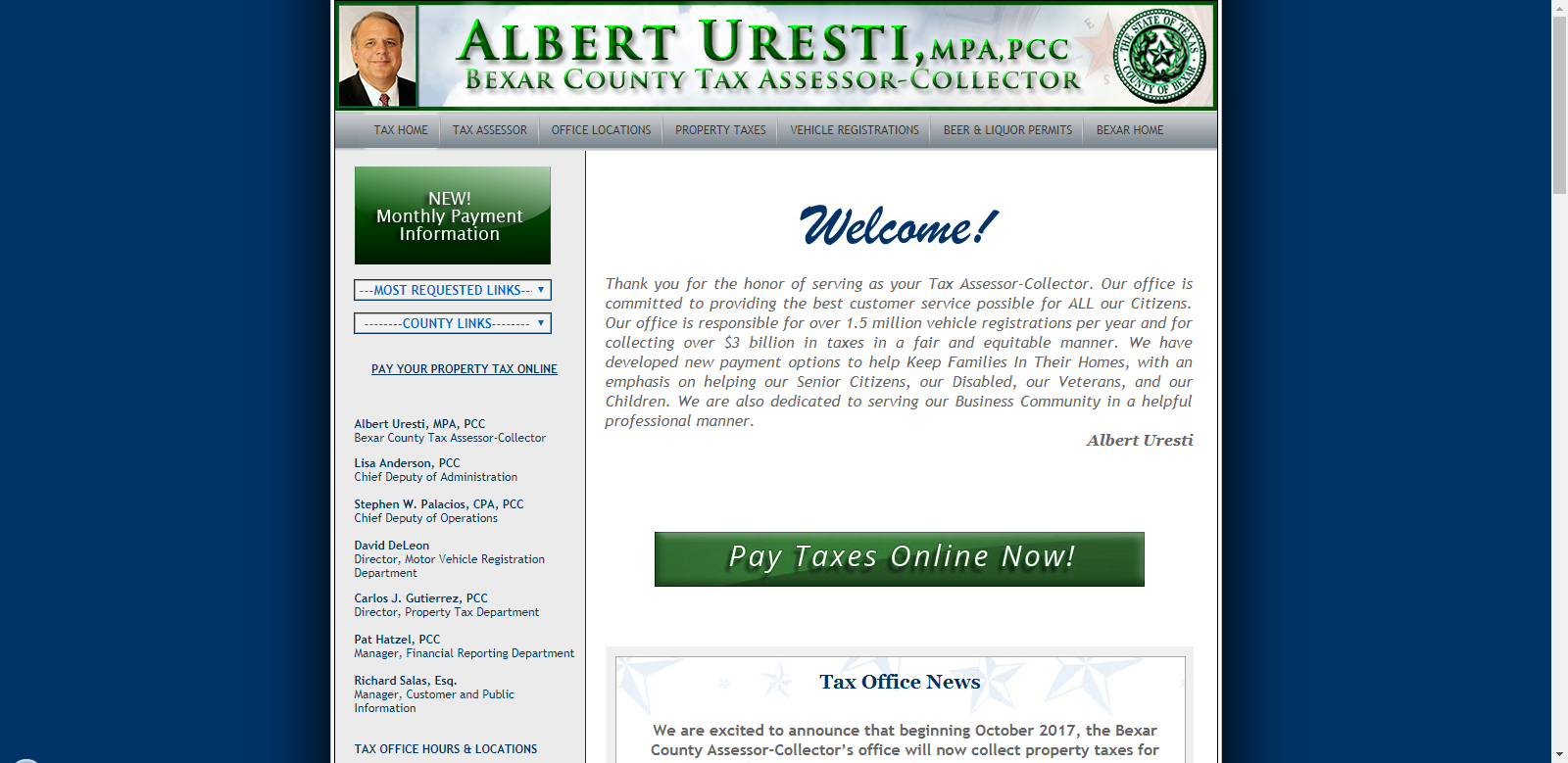

Bexar County Tax Accessor Forms

San antonio’s bexar county follows standard texas procedures for property tax liens. How can i find out if there is a lien on my property? Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. Enter the address and search. Information concerning liens recorded against a property may be researched by the.

Bexar County Tax Office Pay Online Tax Preparation Classes

Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department located. How can i find out if there is a lien on my property? San antonio’s bexar county follows standard texas procedures for property tax liens. Enter the address and search. A tax lien is placed on every bexar resident’s.

Everything You Need to Know About Bexar County Property Tax

How can i find out if there is a lien on my property? Information concerning liens recorded against a property may be researched by the public in the. The county clerk is located at 100 dolorosa suite 104. San antonio’s bexar county follows standard texas procedures for property tax liens. Enter the address and search.

Bexar County Service Coverage2Care

Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department located. Information concerning liens recorded against a property may be researched by the public in the. Enter the address and search. The county clerk is located at 100 dolorosa suite 104. How can i find out if there is a.

Everything You Need to Know About Bexar County Property Tax

Information concerning liens recorded against a property may be researched by the public in the. Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department located. Enter the address and search. How can i find out if there is a lien on my property? Bexar county, tx, currently has 36.

bexar county tax office downtown Adelina Forbes

Information concerning liens recorded against a property may be researched by the public in the. San antonio’s bexar county follows standard texas procedures for property tax liens. A tax lien is placed on every bexar resident’s property on january 1 to ensure that they are liable regarding delinquent payments — the only way to. How can i find out if.

Bexar County Tax Office Pay Online Tax Preparation Classes

A tax lien is placed on every bexar resident’s property on january 1 to ensure that they are liable regarding delinquent payments — the only way to. Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department located. Enter the address and search. The county clerk is located at 100.

Bexar County Tax Assessor Nacogdoches Road San Antonio Tx Tax Walls

A tax lien is placed on every bexar resident’s property on january 1 to ensure that they are liable regarding delinquent payments — the only way to. Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department located. Information concerning liens recorded against a property may be researched by the.

Everything You Need to Know About Bexar County Property Tax

Information concerning liens recorded against a property may be researched by the public in the. A tax lien is placed on every bexar resident’s property on january 1 to ensure that they are liable regarding delinquent payments — the only way to. San antonio’s bexar county follows standard texas procedures for property tax liens. The county clerk is located at.

Information Concerning Liens Recorded Against A Property May Be Researched By The Public In The County Clerk’s Deed Records Department Located.

Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. Enter the address and search. San antonio’s bexar county follows standard texas procedures for property tax liens. The county clerk is located at 100 dolorosa suite 104.

Information Concerning Liens Recorded Against A Property May Be Researched By The Public In The.

A tax lien is placed on every bexar resident’s property on january 1 to ensure that they are liable regarding delinquent payments — the only way to. How can i find out if there is a lien on my property?