Change Llc Name With Irs

Change Llc Name With Irs - The specific action required may vary depending on the type of business. You can download our irs llc name change letter. Generally, businesses need a new ein when their ownership or structure has changed. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your registered name will match the name on your tax. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. Although changing the name of your business does not require you to obtain a new ein, you may wish to visit the. If the ein was recently assigned. Business owners and other authorized individuals can submit a name change for their business.

Business owners and other authorized individuals can submit a name change for their business. Generally, businesses need a new ein when their ownership or structure has changed. The specific action required may vary depending on the type of business. You can download our irs llc name change letter. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. If the ein was recently assigned. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your registered name will match the name on your tax. Although changing the name of your business does not require you to obtain a new ein, you may wish to visit the.

Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). Although changing the name of your business does not require you to obtain a new ein, you may wish to visit the. If the ein was recently assigned. Business owners and other authorized individuals can submit a name change for their business. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your registered name will match the name on your tax. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. You can download our irs llc name change letter. Generally, businesses need a new ein when their ownership or structure has changed. The specific action required may vary depending on the type of business.

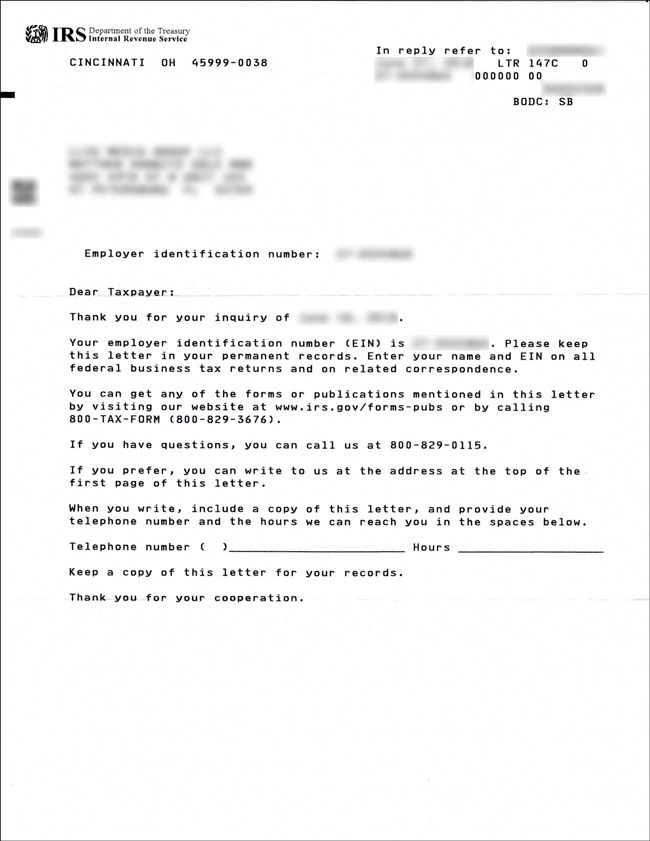

Irs Name Change Letter Sample Change of Beneficiary Form Letter (with

You can download our irs llc name change letter. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your registered name will match the name on your tax. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof.

IRS Business Name Change

The specific action required may vary depending on the type of business. You can download our irs llc name change letter. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your registered name will match the name on your tax. If the ein was recently assigned. Business owners.

Irs Business Name Change Letter Template

If the ein was recently assigned. The specific action required may vary depending on the type of business. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. Although changing the name of your business does not require you to obtain a.

How Do You Change Your Business Name with the IRS? Form Fill Out and

In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. If the ein was recently assigned. The specific action required may vary depending on the type of business. Generally, businesses need a new ein when their ownership or structure has changed. Business.

How to Change your LLC Name with the IRS? LLC University®

Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). Business owners and other authorized individuals can submit a name change for their business. If the ein was recently assigned. If you’re considering changing your name or the name of your business, you have to follow the correct procedure.

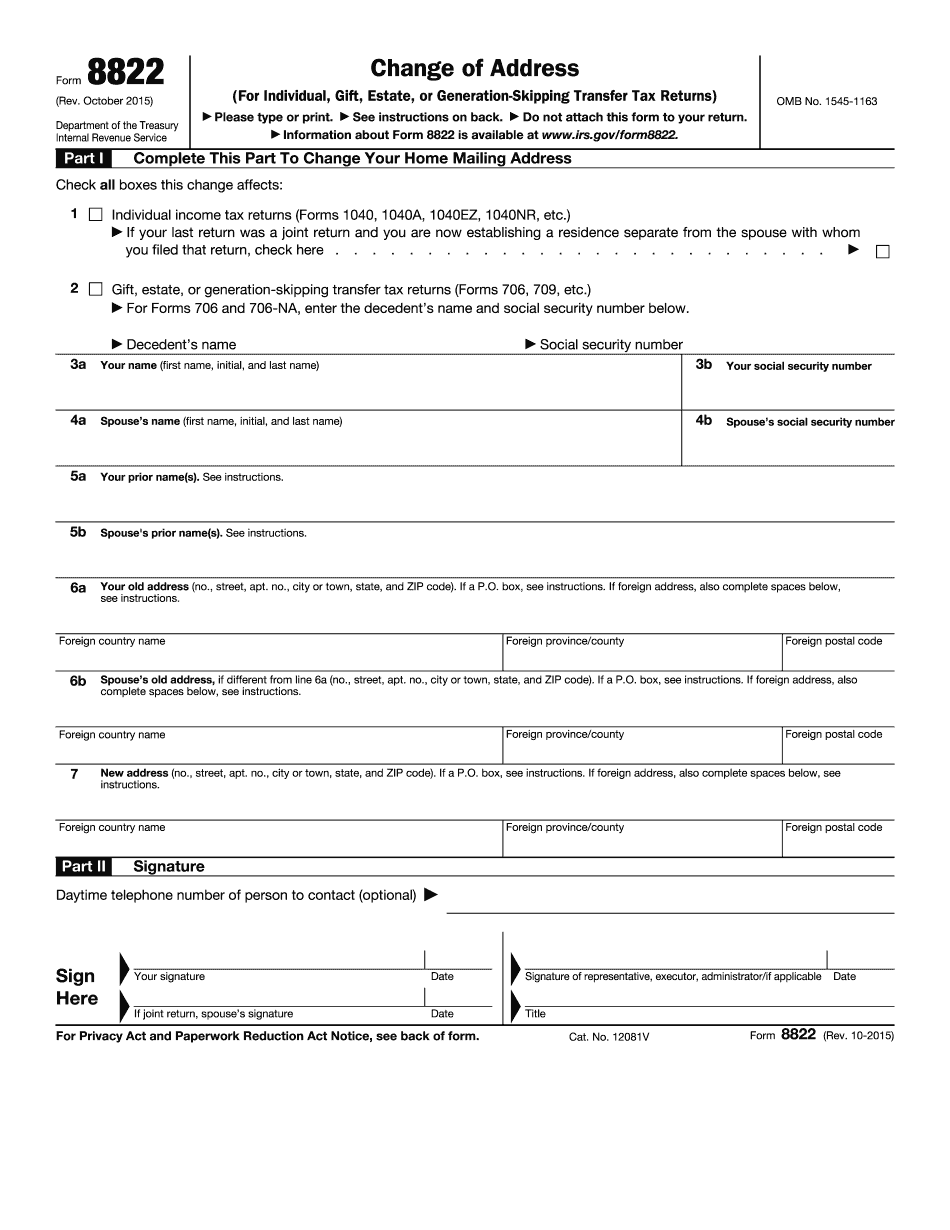

IRS Name Change How to file the IRS 8822 MissNowMrs

Although changing the name of your business does not require you to obtain a new ein, you may wish to visit the. Business owners and other authorized individuals can submit a name change for their business. If the ein was recently assigned. The specific action required may vary depending on the type of business. If you’re considering changing your name.

Business Name Change Letter Template To Irs

The specific action required may vary depending on the type of business. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. If the ein was recently assigned. If you’re considering changing your name or the name of your business, you have.

irs name change form Fill Online, Printable, Fillable Blank form

You can download our irs llc name change letter. The specific action required may vary depending on the type of business. Although changing the name of your business does not require you to obtain a new ein, you may wish to visit the. If the ein was recently assigned. In order to change your llc name with the irs, you’ll.

Letter To Irs Template Word prntbl.concejomunicipaldechinu.gov.co

Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). Generally, businesses need a new ein when their ownership or structure has changed. The specific action required may vary depending on the type of business. Although changing the name of your business does not require you to obtain a.

Business Name Change Irs Sample Letter / Irs Business Name Change

If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your registered name will match the name on your tax. Business owners and other authorized individuals can submit a name change for their business. You can download our irs llc name change letter. Although changing the name of your.

You Can Download Our Irs Llc Name Change Letter.

In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your registered name will match the name on your tax. The specific action required may vary depending on the type of business.

Generally, Businesses Need A New Ein When Their Ownership Or Structure Has Changed.

Business owners and other authorized individuals can submit a name change for their business. Although changing the name of your business does not require you to obtain a new ein, you may wish to visit the. If the ein was recently assigned.