Columbus Ohio Local Tax

Columbus Ohio Local Tax - Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Lookup your taxing jurisdiction on crisp.columbus.gov. It is quick, secure and convenient! The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. The deadline for filing 2023 individual tax returns is april 15, 2024. Everything you need to file can be found on the filing season information page. You are responsible for paying additional tax if the tax rate where you.

Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. You are responsible for paying additional tax if the tax rate where you. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient! Lookup your taxing jurisdiction on crisp.columbus.gov. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. The deadline for filing 2023 individual tax returns is april 15, 2024. Everything you need to file can be found on the filing season information page. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated.

Lookup your taxing jurisdiction on crisp.columbus.gov. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. You are responsible for paying additional tax if the tax rate where you. Everything you need to file can be found on the filing season information page. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. The deadline for filing 2023 individual tax returns is april 15, 2024. Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. It is quick, secure and convenient!

Annex of Columbus Columbus IN

Everything you need to file can be found on the filing season information page. Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. The deadline for filing 2023 individual tax returns is april 15, 2024. It is quick, secure and convenient! Lookup your taxing jurisdiction.

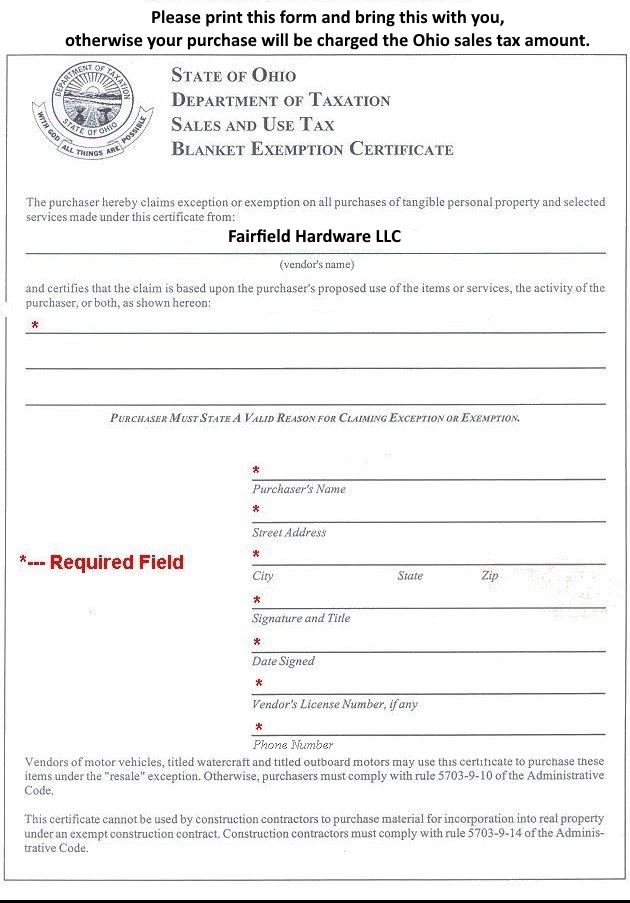

Ohio Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Everything you need to file can be found on the filing season information page. Lookup your taxing jurisdiction on.

Historic Columbus Columbus GA

Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Everything you need to file can be found on the filing season information page. It.

Breweries in Columbus Ohio Visit Ohio Today

The deadline for filing 2023 individual tax returns is april 15, 2024. It is quick, secure and convenient! Lookup your taxing jurisdiction on crisp.columbus.gov. Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. Residents of columbus pay a flat city income tax of 2.50% on.

NAACP Youth Council Columbus GA Columbus GA

You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov)..

Fairfield Hardware Ohio Tax Exemption Form

It is quick, secure and convenient! Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. You are responsible for.

Exclusive Tax Service Columbus GA

Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. Everything you need to file can be found on the filing season information page. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and.

COLUMBUS OHIO BOUNCE HOUSE RENTALS COLUMBUS OHIO INFLATABLE SLIDE

You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Everything you need to file can be found on the filing season information page. It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). The finder, from the ohio.

The Recovery Village Columbus Drug and Alcohol Rehab Columbus OH

Lookup your taxing jurisdiction on crisp.columbus.gov. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient! Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. You are responsible for paying additional tax.

Who Decides Local Values for Ohio Real Estate Tax County Auditor or

The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. It is quick, secure and convenient! You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. You are responsible for paying additional tax if the tax rate where you. Lookup your.

It Is Quick, Secure And Convenient!

The deadline for filing 2023 individual tax returns is april 15, 2024. Everything you need to file can be found on the filing season information page. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. You are responsible for paying additional tax if the tax rate where you.

Employer Tax Forms Paper Return Delays We Strongly Recommend You File And Pay With Our New Online Tax Portal, Crisp.it Is Quick, Secure And.

Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Lookup your taxing jurisdiction on crisp.columbus.gov. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all.