Commercial Foreclosure

Commercial Foreclosure - How nonjudicial commercial foreclosures work; Understanding these risks and opportunities is. Commercial foreclosure is a legal process that allows creditors to reclaim property used as collateral for a loan when the borrower defaults. Commercial foreclosure is a complex legal process when a property owner defaults on their mortgage payments, leading to the lender taking possession of the property. The role of a receiver in a. While each state has specific laws. Commercial real estate foreclosures present unique opportunities for savvy investors willing to take calculated risks. When does a commercial foreclosure start? How judicial commercial foreclosures work; In a commercial foreclosure, the lender goes through a legal process to sell the property and uses the proceeds to pay off the loan.

When does a commercial foreclosure start? Commercial foreclosure is a legal process that allows creditors to reclaim property used as collateral for a loan when the borrower defaults. The role of a receiver in a. Understanding these risks and opportunities is. Commercial foreclosure is a complex legal process when a property owner defaults on their mortgage payments, leading to the lender taking possession of the property. How judicial commercial foreclosures work; The process generally follows the. In a commercial foreclosure, the lender goes through a legal process to sell the property and uses the proceeds to pay off the loan. While each state has specific laws. How nonjudicial commercial foreclosures work;

Commercial foreclosure is a complex legal process when a property owner defaults on their mortgage payments, leading to the lender taking possession of the property. Understanding these risks and opportunities is. Commercial foreclosure is a legal process that allows creditors to reclaim property used as collateral for a loan when the borrower defaults. When does a commercial foreclosure start? While each state has specific laws. In a commercial foreclosure, the lender goes through a legal process to sell the property and uses the proceeds to pay off the loan. The process generally follows the. The role of a receiver in a. Commercial real estate foreclosures present unique opportunities for savvy investors willing to take calculated risks. How nonjudicial commercial foreclosures work;

What to Expect During Commercial Foreclosure Loan Lawyers

The process generally follows the. While each state has specific laws. The role of a receiver in a. How nonjudicial commercial foreclosures work; Understanding these risks and opportunities is.

Expedite Commercial Foreclosure Process with Order to Show Cause

The role of a receiver in a. How judicial commercial foreclosures work; While each state has specific laws. How nonjudicial commercial foreclosures work; In a commercial foreclosure, the lender goes through a legal process to sell the property and uses the proceeds to pay off the loan.

Foreclosure Defense

The process generally follows the. The role of a receiver in a. In a commercial foreclosure, the lender goes through a legal process to sell the property and uses the proceeds to pay off the loan. Commercial real estate foreclosures present unique opportunities for savvy investors willing to take calculated risks. How nonjudicial commercial foreclosures work;

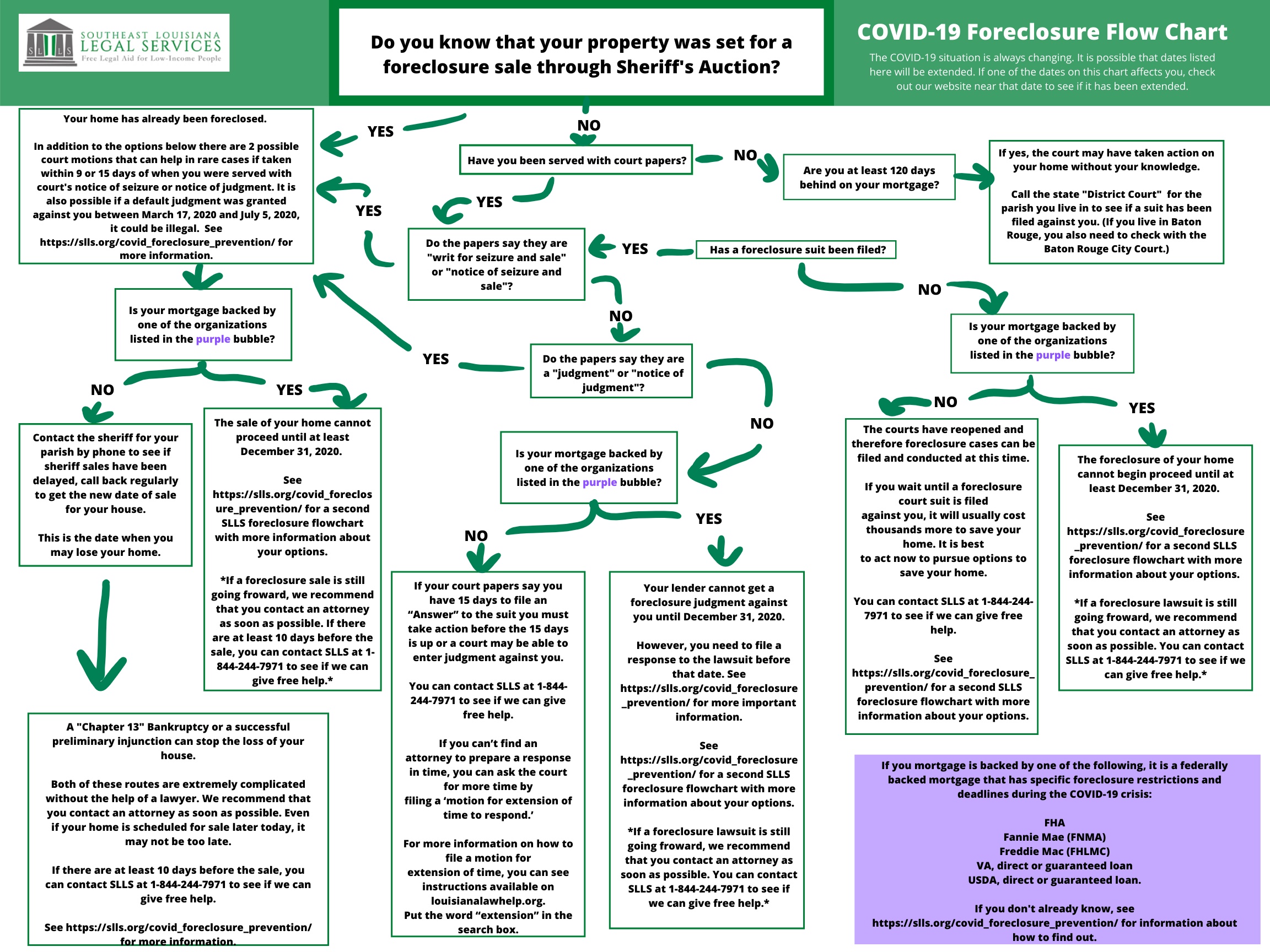

Updated Foreclosure Flow Chart SLLS

How nonjudicial commercial foreclosures work; The role of a receiver in a. The process generally follows the. How judicial commercial foreclosures work; When does a commercial foreclosure start?

Phases of a Commercial Foreclosure Filing LP

While each state has specific laws. Commercial foreclosure is a complex legal process when a property owner defaults on their mortgage payments, leading to the lender taking possession of the property. How nonjudicial commercial foreclosures work; When does a commercial foreclosure start? The process generally follows the.

Legal Aspects of Commercial Foreclosure Total Lender Solutions

Understanding these risks and opportunities is. Commercial foreclosure is a complex legal process when a property owner defaults on their mortgage payments, leading to the lender taking possession of the property. How nonjudicial commercial foreclosures work; Commercial foreclosure is a legal process that allows creditors to reclaim property used as collateral for a loan when the borrower defaults. Commercial real.

There are many aspects about the commercial real estate which are not

Commercial foreclosure is a legal process that allows creditors to reclaim property used as collateral for a loan when the borrower defaults. Commercial foreclosure is a complex legal process when a property owner defaults on their mortgage payments, leading to the lender taking possession of the property. How nonjudicial commercial foreclosures work; In a commercial foreclosure, the lender goes through.

Potential Defenses to Commercial Foreclosure Loan Lawyers

Understanding these risks and opportunities is. In a commercial foreclosure, the lender goes through a legal process to sell the property and uses the proceeds to pay off the loan. Commercial foreclosure is a legal process that allows creditors to reclaim property used as collateral for a loan when the borrower defaults. How nonjudicial commercial foreclosures work; The role of.

What's the First Step in the Commercial Foreclosure Process?

Commercial foreclosure is a complex legal process when a property owner defaults on their mortgage payments, leading to the lender taking possession of the property. Commercial foreclosure is a legal process that allows creditors to reclaim property used as collateral for a loan when the borrower defaults. In a commercial foreclosure, the lender goes through a legal process to sell.

Commercial Foreclosure Is A Complex Legal Process When A Property Owner Defaults On Their Mortgage Payments, Leading To The Lender Taking Possession Of The Property.

The process generally follows the. How nonjudicial commercial foreclosures work; The role of a receiver in a. When does a commercial foreclosure start?

While Each State Has Specific Laws.

How judicial commercial foreclosures work; Commercial foreclosure is a legal process that allows creditors to reclaim property used as collateral for a loan when the borrower defaults. Understanding these risks and opportunities is. Commercial real estate foreclosures present unique opportunities for savvy investors willing to take calculated risks.