Dallas Local Sales Tax Rate

Dallas Local Sales Tax Rate - Look up the current rate for a specific address using the same geolocation technology that. The dallas sales tax rate is 1.0%. The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists. In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based on the particular zip code in the.

Look up the current rate for a specific address using the same geolocation technology that. The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists. The dallas sales tax rate is 1.0%. In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based on the particular zip code in the.

Look up the current rate for a specific address using the same geolocation technology that. The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists. In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based on the particular zip code in the. The dallas sales tax rate is 1.0%.

Dallas County Tax Assessment Market Value

In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based on the particular zip code in the. The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists. Look up the current rate for a specific.

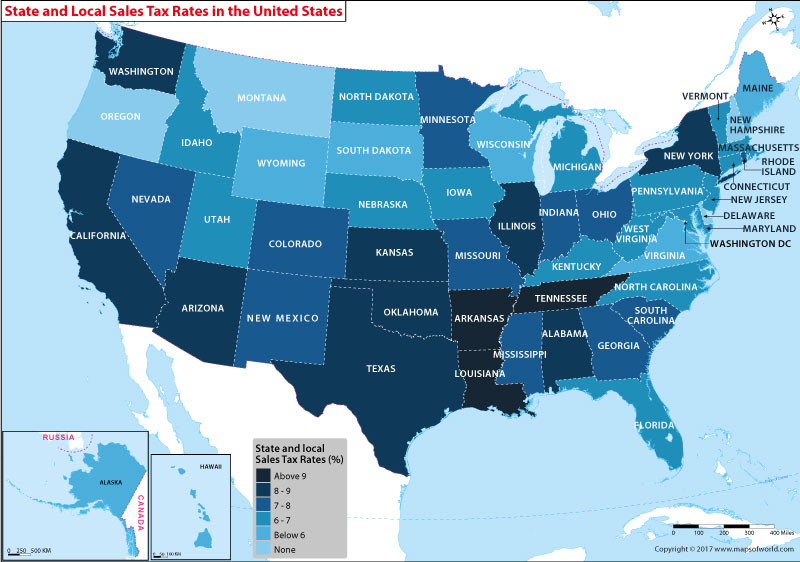

The State and Local Sales Tax Rates in The US states Our World

The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists. The dallas sales tax rate is 1.0%. In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based on the particular zip code in the. Look.

What is the Combined State and Local Sales Tax Rate in Each US State

In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based on the particular zip code in the. The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists. The dallas sales tax rate is 1.0%. Look.

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation

The dallas sales tax rate is 1.0%. In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based on the particular zip code in the. Look up the current rate for a specific address using the same geolocation technology that. The dallas, texas sales tax is 8.25%, consisting of 6.25%.

States With Highest and Lowest Sales Tax Rates

The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists. In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based on the particular zip code in the. Look up the current rate for a specific.

Dallas Sales Tax Rate 2024 Merl Stormy

Look up the current rate for a specific address using the same geolocation technology that. The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists. In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based.

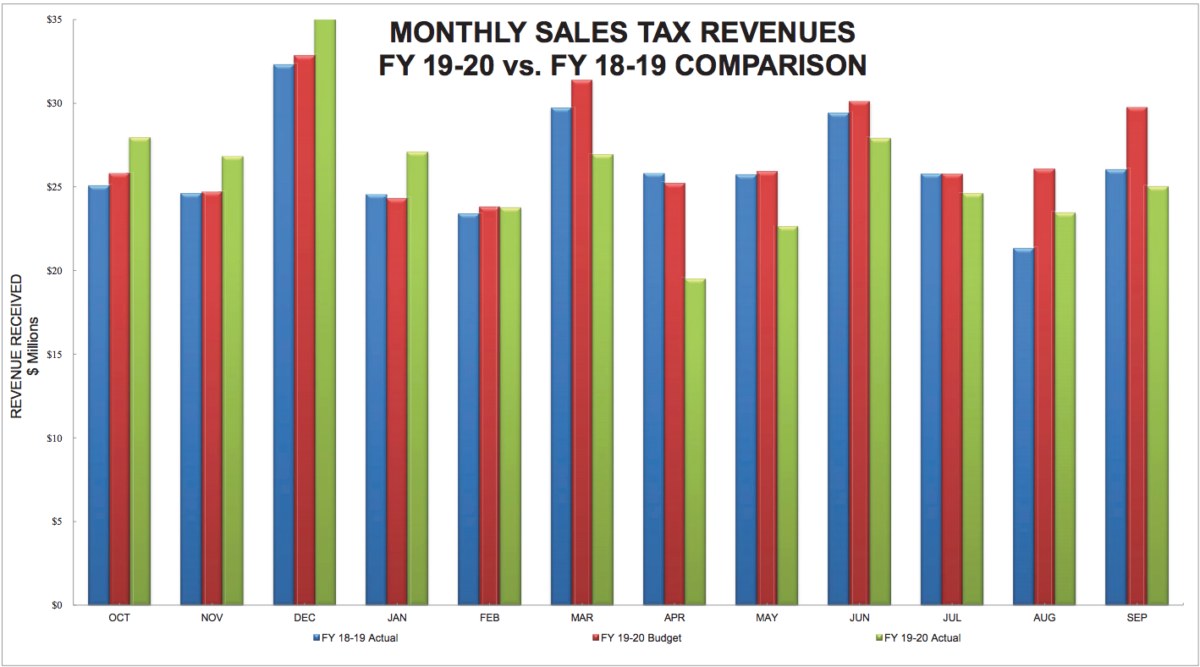

Sales Tax Revenue in Dallas Has Dropped Less Than a Percentage Point

The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists. Look up the current rate for a specific address using the same geolocation technology that. In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based.

Ranking State and Local Sales Taxes Tax Foundation

The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists. The dallas sales tax rate is 1.0%. Look up the current rate for a specific address using the same geolocation technology that. In dallas the total sales tax rate, including county and city taxes, ranges from.

Sales Tax Expert Consultants Sales Tax Rates by State State and Local

The dallas sales tax rate is 1.0%. The dallas, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% dallas local sales taxes.the local sales tax consists. In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based on the particular zip code in the. Look.

Combined State and Average Local Sales Tax Rates Tax Foundation

The dallas sales tax rate is 1.0%. Look up the current rate for a specific address using the same geolocation technology that. In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based on the particular zip code in the. The dallas, texas sales tax is 8.25%, consisting of 6.25%.

The Dallas, Texas Sales Tax Is 8.25%, Consisting Of 6.25% Texas State Sales Tax And 2.00% Dallas Local Sales Taxes.the Local Sales Tax Consists.

Look up the current rate for a specific address using the same geolocation technology that. The dallas sales tax rate is 1.0%. In dallas the total sales tax rate, including county and city taxes, ranges from 6.3% to 8.25% 0.125% to 1%) based on the particular zip code in the.

.png)

.png)