Dc Tax Lien Sale

Dc Tax Lien Sale - A tax lien is attached to a property as soon as it becomes delinquent. Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. Any property that is deemed residential and owner occupied,. (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Liens for taxes or assessments — confirmation of sale;

Any property that is deemed residential and owner occupied,. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. A tax lien is attached to a property as soon as it becomes delinquent. Liens for taxes or assessments — confirmation of sale; (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter.

(a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. A tax lien is attached to a property as soon as it becomes delinquent. Liens for taxes or assessments — confirmation of sale; (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. Any property that is deemed residential and owner occupied,. Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar.

Tax Lien Sale San Juan County

Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Any property that is deemed residential and owner occupied,. A tax lien is attached to a property as soon as it becomes.

TAX2 TSN (REMEDIES) PDF Taxes Tax Lien

A tax lien is attached to a property as soon as it becomes delinquent. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. Liens for taxes or assessments — confirmation of.

Tax Review PDF Taxes Tax Lien

Liens for taxes or assessments — confirmation of sale; Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. Any property that is deemed residential and owner occupied,. A.

Analysis of Bulk Tax Lien Sale Center for Community Progress

Liens for taxes or assessments — confirmation of sale; (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Any property that is deemed residential and owner occupied,. A tax lien is attached to a property as soon as it becomes delinquent. Please encourage any individual interested in purchasing property at the.

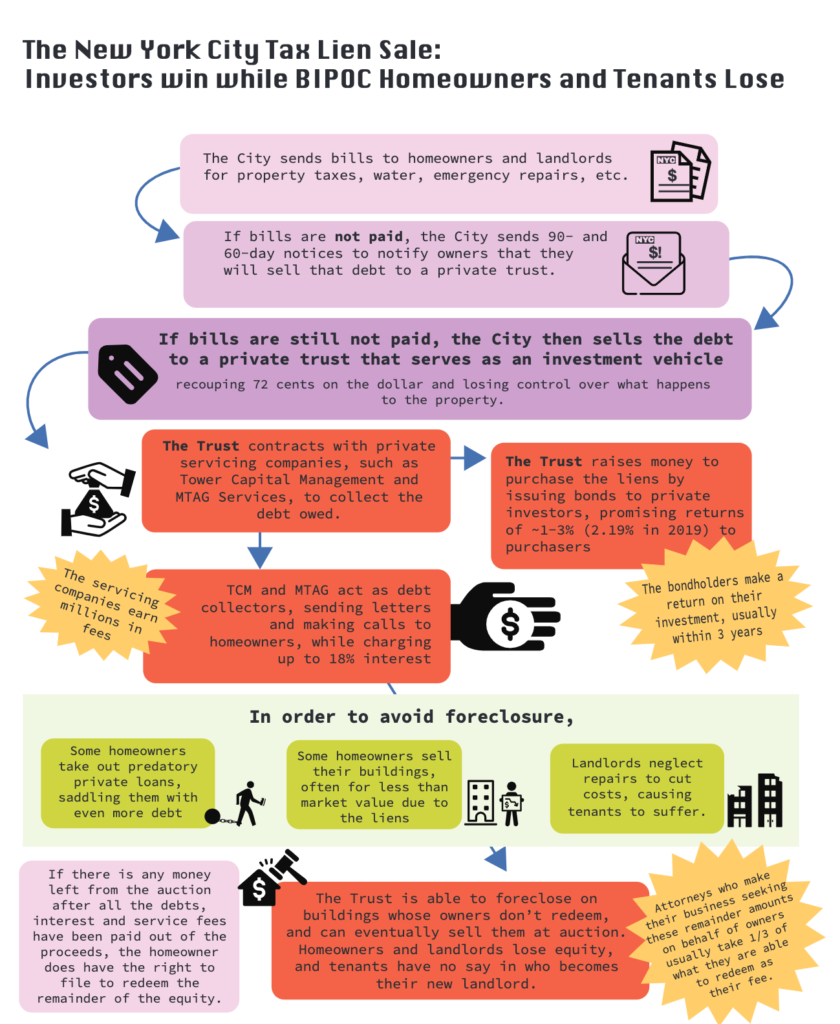

NYC Tax Lien Sale Reform Conference EastNewYorkCLT

(a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. Liens.

Abolish The Tax Lien Sale EastNewYorkCLT

A tax lien is attached to a property as soon as it becomes delinquent. (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. Liens for taxes or assessments.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

Liens for taxes or assessments — confirmation of sale; (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Please encourage any individual interested in purchasing property at the 2024 annual.

Tax Lien Training Special Expired — Financial Freedom University

Any property that is deemed residential and owner occupied,. (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. A tax lien is attached to a property as soon as it.

NYC Tax Lien Sale Information Session Jamaica311

Liens for taxes or assessments — confirmation of sale; Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Any property that is deemed residential and owner occupied,. A tax lien is.

Informational Brochure About the Tax Lien Sale EastNewYorkCLT

A tax lien is attached to a property as soon as it becomes delinquent. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. Any property that is deemed residential and.

Liens For Taxes Or Assessments — Confirmation Of Sale;

(a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. Any property that is deemed residential and owner occupied,. A tax lien is attached to a property as soon as it becomes delinquent.