Dekalb County Tax Lien Sale

Dekalb County Tax Lien Sale - When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current. Tax sale date parcel id map ref tax sale id owner address tenant defendant levy type lien book page levy date min year max year total. When they become delinquent for two or more years, by law, the collector must offer for sale. The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. When is the next tax sale? Learn how tax liens are attached, executed, and sold in dekalb county, georgia. The current tax sale listing is available as a downloadable csv file and can be viewed at the property information page. If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. Find out the conditions, procedures, and rights of tax deed. Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e.

Find out the conditions, procedures, and rights of tax deed. When is the next tax sale? Learn how tax liens are attached, executed, and sold in dekalb county, georgia. Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. The tax sale list is printed in a general. Tax sale date parcel id map ref tax sale id owner address tenant defendant levy type lien book page levy date min year max year total. The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current. When they become delinquent for two or more years, by law, the collector must offer for sale.

When they become delinquent for two or more years, by law, the collector must offer for sale. The tax sale list is printed in a general. Tax sale date parcel id map ref tax sale id owner address tenant defendant levy type lien book page levy date min year max year total. Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. When is the next tax sale? The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. Find out the conditions, procedures, and rights of tax deed. When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current. If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. Learn how tax liens are attached, executed, and sold in dekalb county, georgia.

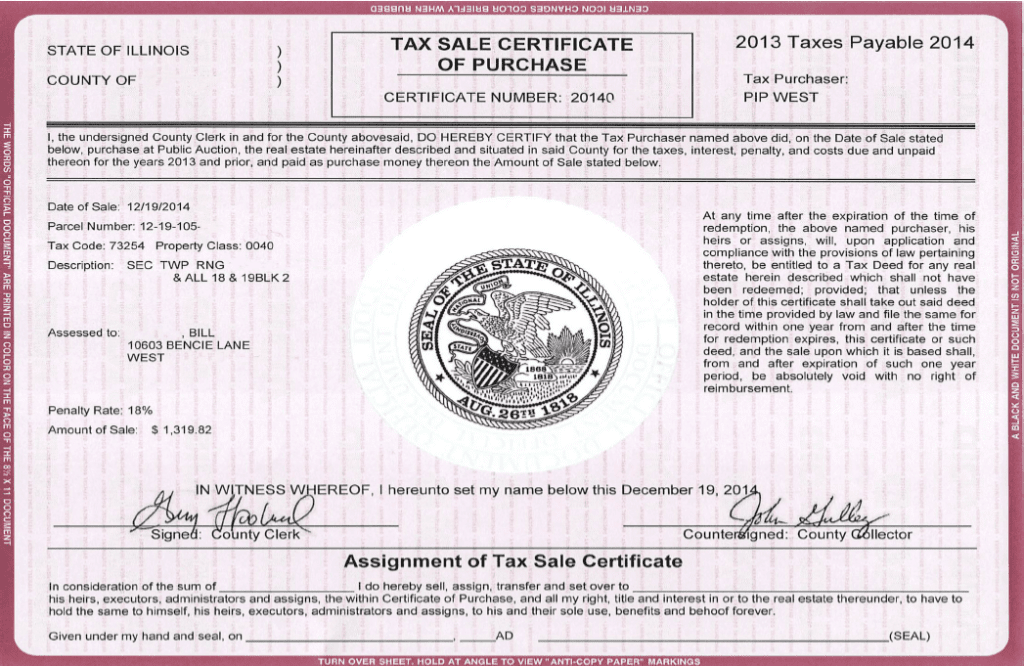

Default Notice For Lien Judgement by Acquiescence JR Affordable

Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. When a parcel goes to tax sale the minimum bid that is required.

Mohave County Tax Lien Sale 2024 Dore Nancey

Learn how tax liens are attached, executed, and sold in dekalb county, georgia. The tax sale list is printed in a general. The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. When a parcel goes to tax sale the minimum bid that is required will be.

Suffolk County Tax Lien Sale 2024 Marne Sharona

When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current. Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. If a tax sale is scheduled, an.

Charles County Tax Lien Sale 2024 Bryna Marleah

If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. The current tax sale listing is available as a downloadable csv file and can be viewed at the property information page. Learn how tax liens are attached, executed, and sold in dekalb county, georgia. Find out the conditions, procedures, and.

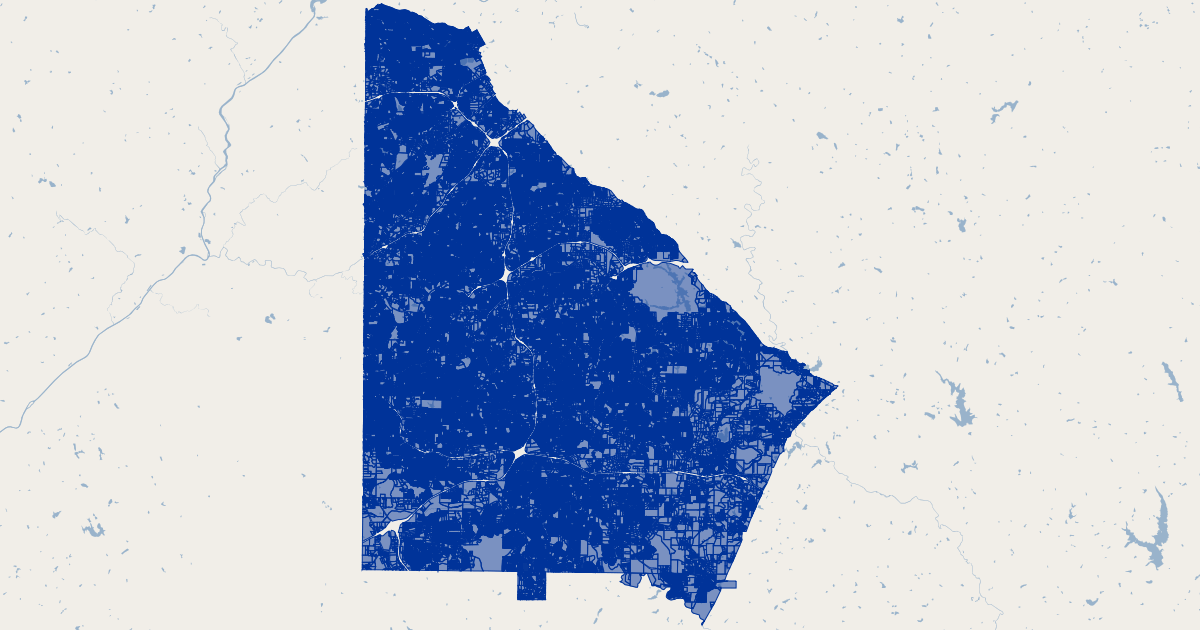

DeKalb County, GA Tax Parcels GIS Map Data DeKalb County,

Learn how tax liens are attached, executed, and sold in dekalb county, georgia. Find out the conditions, procedures, and rights of tax deed. When is the next tax sale? The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. The current tax sale listing is available as.

Mohave County Tax Lien Sale 2024 Dore Nancey

When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current. The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. When they become delinquent for two or more.

Charles County Tax Lien Sale 2024 Bryna Marleah

When they become delinquent for two or more years, by law, the collector must offer for sale. The tax sale list is printed in a general. Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. The current tax sale listing is available as a downloadable.

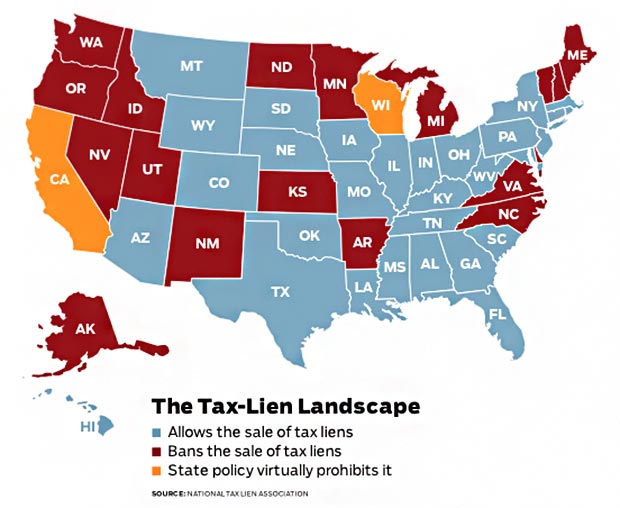

Tax Lien Sale San Juan County

When is the next tax sale? The current tax sale listing is available as a downloadable csv file and can be viewed at the property information page. Learn how tax liens are attached, executed, and sold in dekalb county, georgia. The tax sale list is printed in a general. Delinquent tax tax sale listing excess funds tax credit card icons.

Mohave County Tax Lien Sale 2024 Dore Nancey

Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. The tax sale list is printed in a general. Learn how tax liens are attached, executed, and sold in dekalb county, georgia. When a parcel goes to tax sale the minimum bid that is required will.

Suffolk County Tax Lien Sale 2024 Marne Sharona

Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. The current tax sale listing is available as a downloadable csv file and can be viewed at the property information page. When they become delinquent for two or more years, by law, the collector must offer.

The Current Tax Sale Listing Is Available As A Downloadable Csv File And Can Be Viewed At The Property Information Page.

The tax commissioner's office in dekalb county, georgia, conducts tax sales on a regular basis, specifically on the first tuesday of each month. Learn how tax liens are attached, executed, and sold in dekalb county, georgia. Find out the conditions, procedures, and rights of tax deed. Tax sale date parcel id map ref tax sale id owner address tenant defendant levy type lien book page levy date min year max year total.

When Is The Next Tax Sale?

Delinquent tax tax sale listing excess funds tax credit card icons property tax online payment forms accepted debit / credit fee = 2.35% e. If a tax sale is scheduled, an auction of the property taxes is conducted in front of the dekalb county. When a parcel goes to tax sale the minimum bid that is required will be the total of all of the delinquencies, the tax sale fee and the current. The tax sale list is printed in a general.