Diaz Company Owns A Machine That Cost

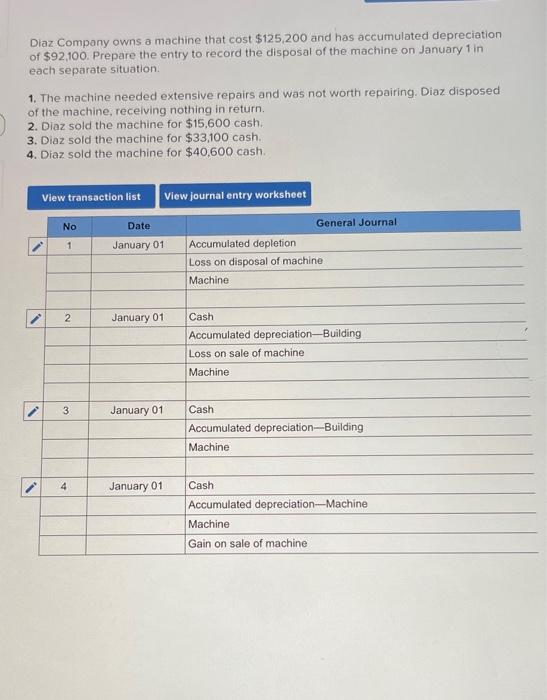

Diaz Company Owns A Machine That Cost - Prepare the entry to record the. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. In order to record the. Prepare the entry to record the disposal of the. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Prepare the entry to record the disposal of the. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200. Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000.

In order to record the. Prepare the entry to record the. Prepare the entry to record the disposal of the. Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Prepare the entry to record the disposal of the. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000.

Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. Prepare the entry to record the disposal of the. Prepare the entry to record the disposal of the. In order to record the. Prepare the entry to record the. Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. Prepare the entry to record the. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an.

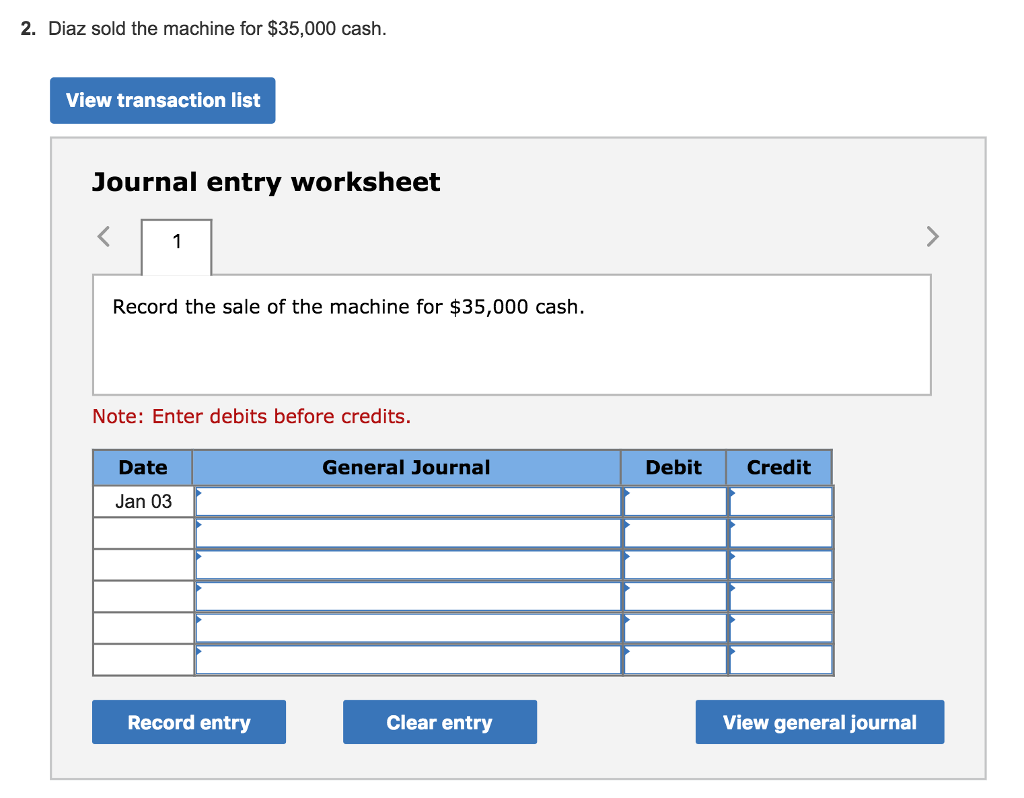

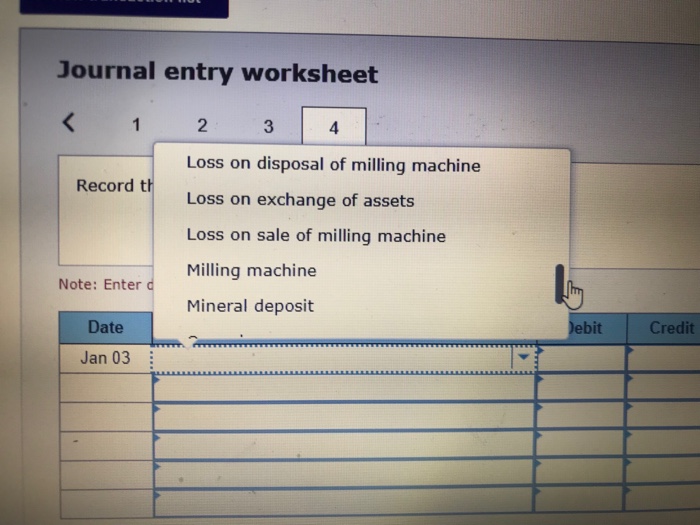

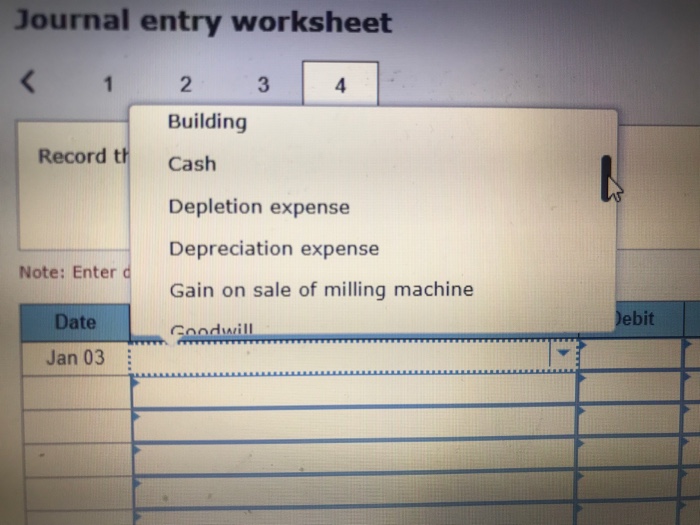

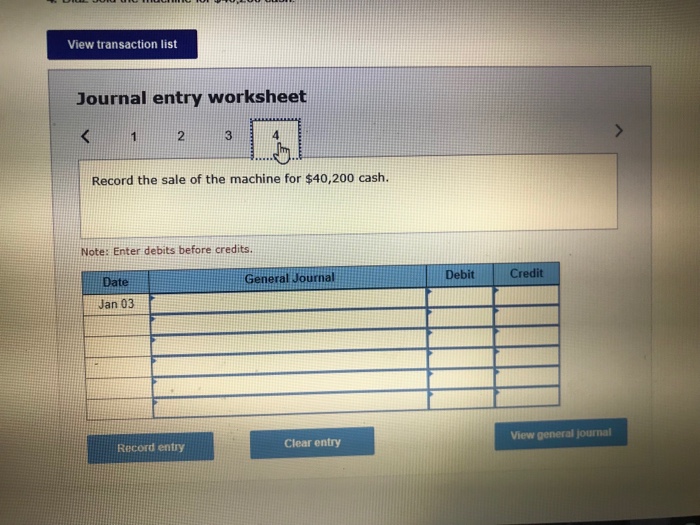

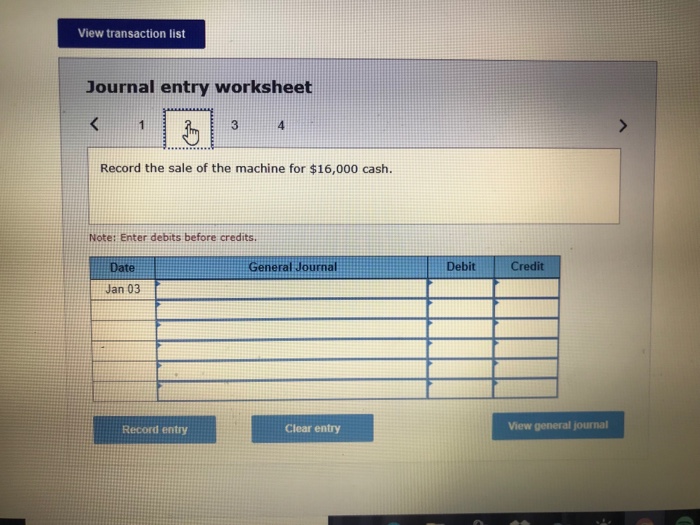

Solved Diaz Company owns a milling machine that cost

Prepare the entry to record the disposal of the. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Prepare the entry to record the. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on.

[Solved] Diaz Company owns a machine that cost ( 126,

Prepare the entry to record the disposal of the. Prepare the entry to record the. Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Diaz company owns a machine with a cost of.

Solved Diaz Company owns a miling machine that cost 125,900

Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. In order to record the. Prepare the entry to record the disposal of the. Prepare the entry to record the. Prepare the entry to record the disposal of the.

Solved Diaz Company owns a miling machine that cost 125,900

Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. Prepare the entry to record the. Prepare the entry to record the. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Diaz company owns a machine that cost $250,000 and has accumulated depreciation.

Solved Diaz Company owns a miling machine that cost 125,900

Prepare the entry to record the. Prepare the entry to record the disposal of the. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. Prepare the entry to record the.

[Solved] Diaz Company owns a machine that cost 126,300 an

A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. Prepare the entry to record the disposal of the. In.

Solved Diaz Company owns a milling machine that cost

Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. Prepare the entry to record the. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Prepare the entry to.

[Solved] . Diaz Company owns a machine that cost 126,300 and has

Prepare the entry to record the. Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200. Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. Prepare the entry to record the disposal of the. Prepare the entry to record the.

Solved Diaz Company owns a miling machine that cost 125,900

Prepare the entry to record the disposal of the. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Prepare the entry to record the. Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000.

Solved Diaz Company owns a machine that cost 125,200 and

Prepare the entry to record the. Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200. Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. In order to record the. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000.

In Order To Record The.

Prepare the entry to record the disposal of the. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. Prepare the entry to record the. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000.

Prepare The Entry To Record The.

Prepare the entry to record the disposal of the. Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000.

![[Solved] Diaz Company owns a machine that cost ( 126,](https://media.cheggcdn.com/media/332/3324dc67-a9ce-4dab-96b7-4d78a4d1a559/phpFSy2iw)

![[Solved] Diaz Company owns a machine that cost 126,300 an](https://media.cheggcdn.com/media/3a9/3a98ced5-7da8-4b12-9577-e8430585131e/phpeK0K2B)