Difference Between Tax Lien And Tax Deed

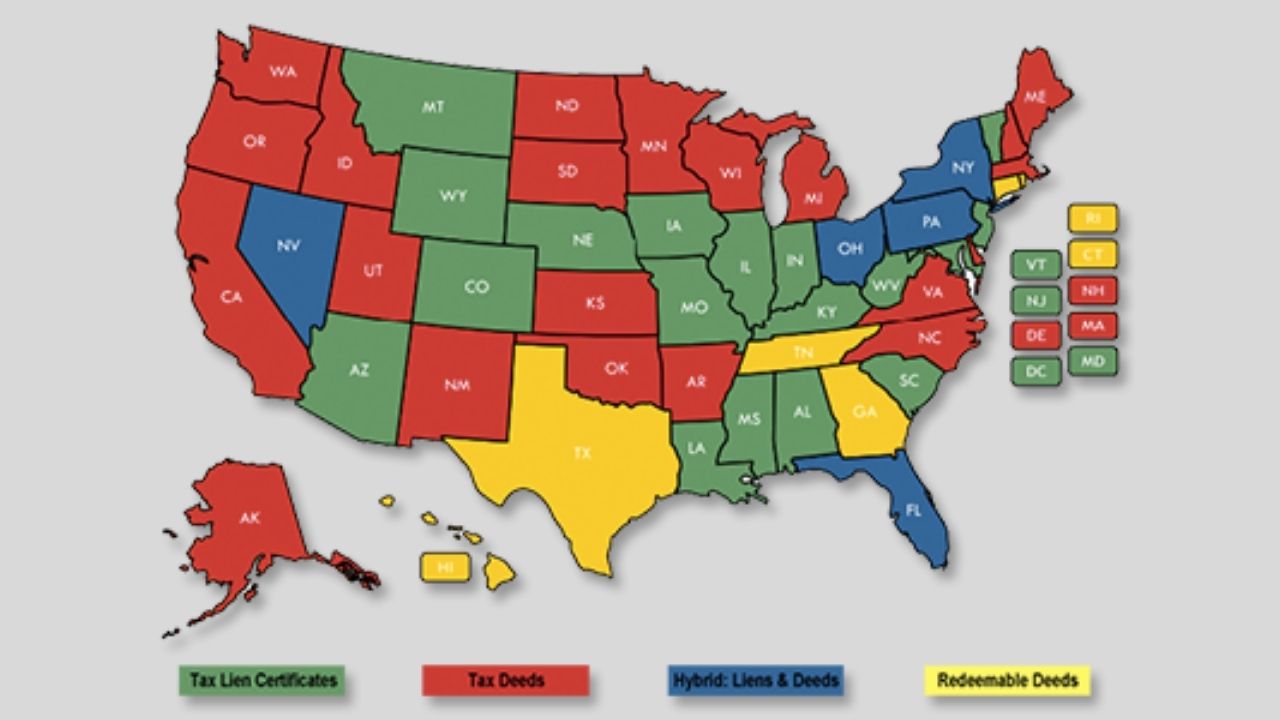

Difference Between Tax Lien And Tax Deed - The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and. Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien.

The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and. Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien.

The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and. Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien.

Tax Deed vs Tax Lien Finance Reference

Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien. The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and.

Learn Tax Lien & Tax Deed Investing

Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien. The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and.

Tax Lien Sale Download Free PDF Tax Lien Taxes

The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and. Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien.

Difference between a tax lien certificate and tax deed Orlando Law Firm

The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and. Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien.

Learn Tax Lien & Tax Deed Investing

Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien. The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and.

What is Tax Lien Tax Deed Investing? Explained in Detail

The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and. Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien.

12 Tax Lien & Tax Deed Auction Sources

The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and. Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien.

The Differences Between Tax Deed Vs Tax Lien The Business Gossip

Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien. The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and.

Tax Deed Vs Tax Lien (3)

Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien. The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and.

Difference Between A Tax Deed and A Tax Lien Jay Drexel & Jay Conner

Read on to learn more about tax lien property owners, local and municipal laws, and the difference between a tax deed and tax lien. The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and.

Read On To Learn More About Tax Lien Property Owners, Local And Municipal Laws, And The Difference Between A Tax Deed And Tax Lien.

The main difference between the two is that with a tax lien certificate an investor is purchasing the right to collect the taxes and.