Enter The State Or Local Income Tax Refund Information

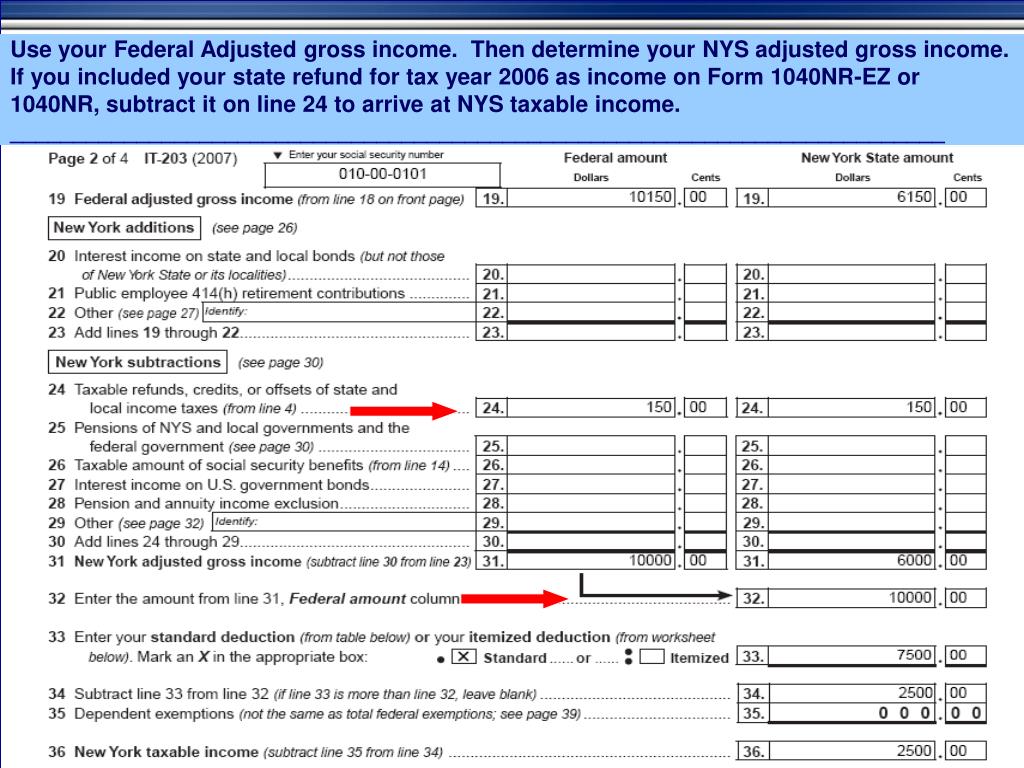

Enter The State Or Local Income Tax Refund Information - State or local income tax refunds, credits, or offsets. If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax info. Use a copy of the. Use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. Go to screen 14.2 , state tax refunds, unemployment comp. Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. To override the state and local income tax refund:

If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax info. Use a copy of the. To override the state and local income tax refund: Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. Go to screen 14.2 , state tax refunds, unemployment comp. State or local income tax refunds, credits, or offsets. Use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year.

Use a copy of the. Go to screen 14.2 , state tax refunds, unemployment comp. State or local income tax refunds, credits, or offsets. To override the state and local income tax refund: If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax info. Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. Use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year.

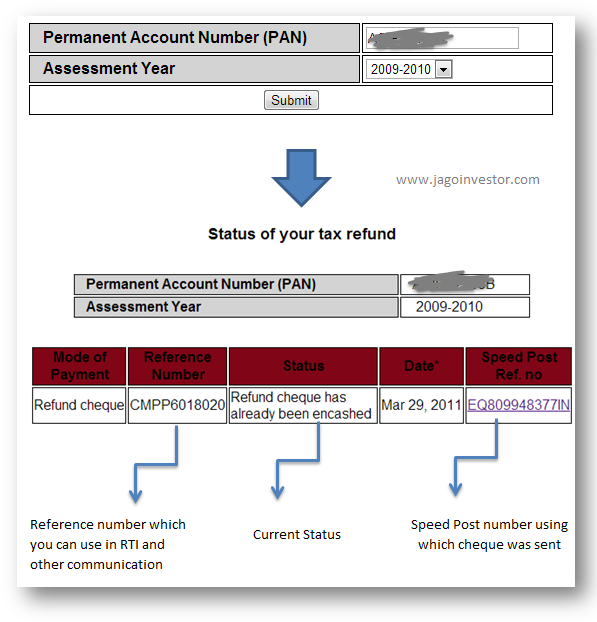

Tax Refund PDF Tax Refund Corporations

Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. To override the state and local income tax refund: State or local income tax refunds, credits, or offsets. Use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. Use a.

State Tax Refund Worksheet Fill Online, Printable, Fillable

Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. Go to screen 14.2 , state tax refunds, unemployment comp. Use a copy of the. State or local income tax refunds, credits, or offsets. If you transferred last year’s tax data to this year's return, your state and local refunds are automatically.

State And Local Tax Refund Worksheet

To override the state and local income tax refund: Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. Use a copy of the. State or local income tax refunds, credits, or offsets. Go to screen 14.2 , state tax refunds, unemployment comp.

State And Local Tax Refund Worksheet

Go to screen 14.2 , state tax refunds, unemployment comp. Use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. State or local income tax refunds, credits, or offsets. Use a copy of the. If you transferred last year’s tax data to this year's return, your state and.

State Tax Refund State Tax Refund Included In Federal

To override the state and local income tax refund: Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. Use a copy of the. Use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. State or local income tax refunds,.

State Tax Refund State Tax Refund On Federal Return

Use a copy of the. Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. To override the state and local income tax refund: Use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. Go to screen 14.2 , state.

State Tax Refund Calculate State Tax Refund

Use a copy of the. Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. To override the state and local income tax refund: State or local income tax refunds, credits, or offsets. Use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in.

State And Local Tax Refund Worksheet 2019

Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. State or local income tax refunds, credits, or offsets. To override the state and local income tax refund: Go to screen 14.2 , state tax refunds, unemployment comp. Use this worksheet to determine the portion of the taxpayer’s prior year state refund.

State Tax Refund State Tax Refund Line 10

Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. Use a copy of the. State or local income tax refunds, credits, or offsets. To override the state and local income tax refund: Go to screen 14.2 , state tax refunds, unemployment comp.

State Tax Refund State Tax Refund Taxable Worksheet

To override the state and local income tax refund: Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to. Go to screen 14.2 , state tax refunds, unemployment comp. State or local income tax refunds, credits, or offsets. Use a copy of the.

State Or Local Income Tax Refunds, Credits, Or Offsets.

To override the state and local income tax refund: Use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax info. Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to.

Go To Screen 14.2 , State Tax Refunds, Unemployment Comp.

Use a copy of the.