Georgia State Tax Lien

Georgia State Tax Lien - If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Also called a state tax. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Search for pending liens issued by the georgia department of revenue. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent. Search the georgia consolidated lien indexes by county, book and page. Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due.

Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Search for pending liens issued by the georgia department of revenue. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Also called a state tax. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent. Search the georgia consolidated lien indexes by county, book and page.

Also called a state tax. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Search for pending liens issued by the georgia department of revenue. Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent. Search the georgia consolidated lien indexes by county, book and page. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you.

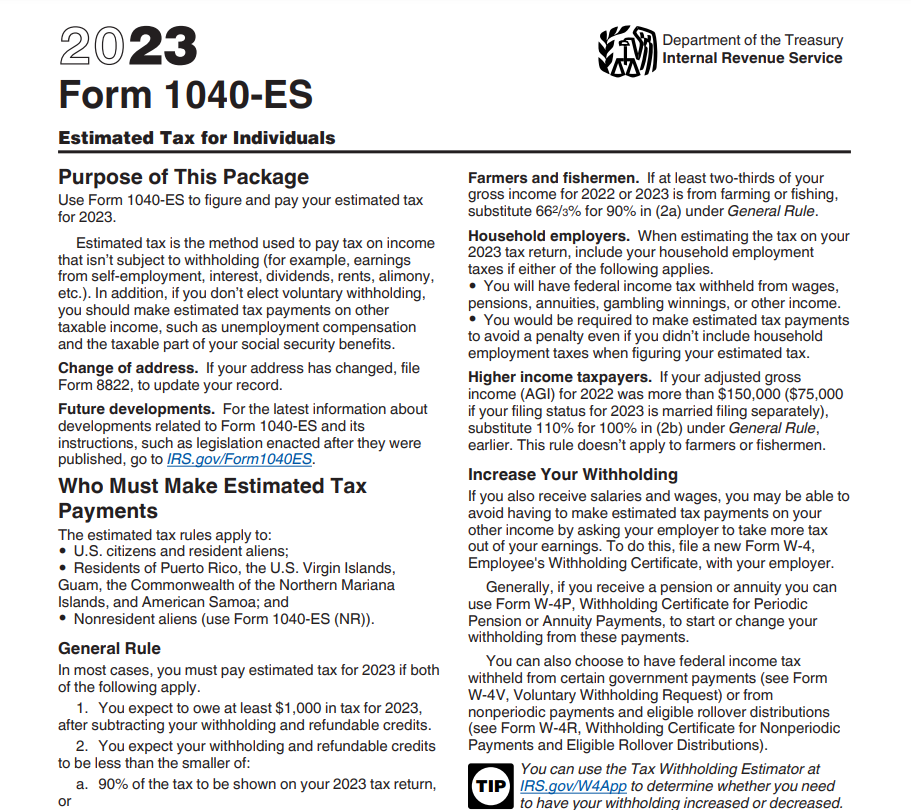

Tax Rebate 2024 How to Claim and Eligibility Requirements

Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Search the georgia consolidated lien indexes by county, book and page. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. This tool allows for searching.

Tax Lien Sale PDF Tax Lien Taxes

Also called a state tax. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Search for pending liens issued by the georgia department of revenue. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for.

Auto Lien Release Form Form Resume Examples

Search the georgia consolidated lien indexes by county, book and page. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Also called a state tax. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of.

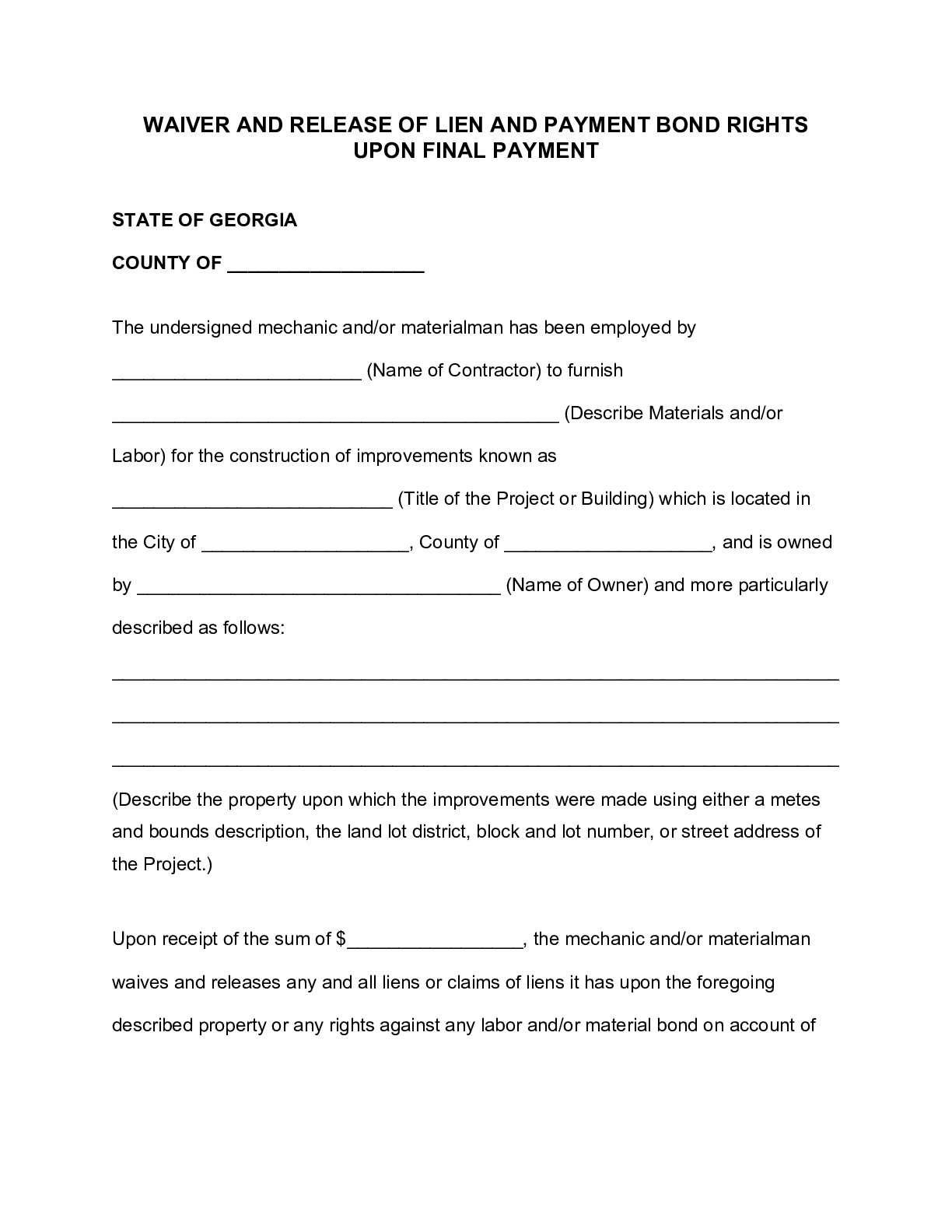

Final Lien Waiver Form Free Template Download

Search for pending liens issued by the georgia department of revenue. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. This tool allows for searching.

Tax Lien Tax Lien Certificates

This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Notice of state tax execution (letter) this letter informs you that a state tax execution,.

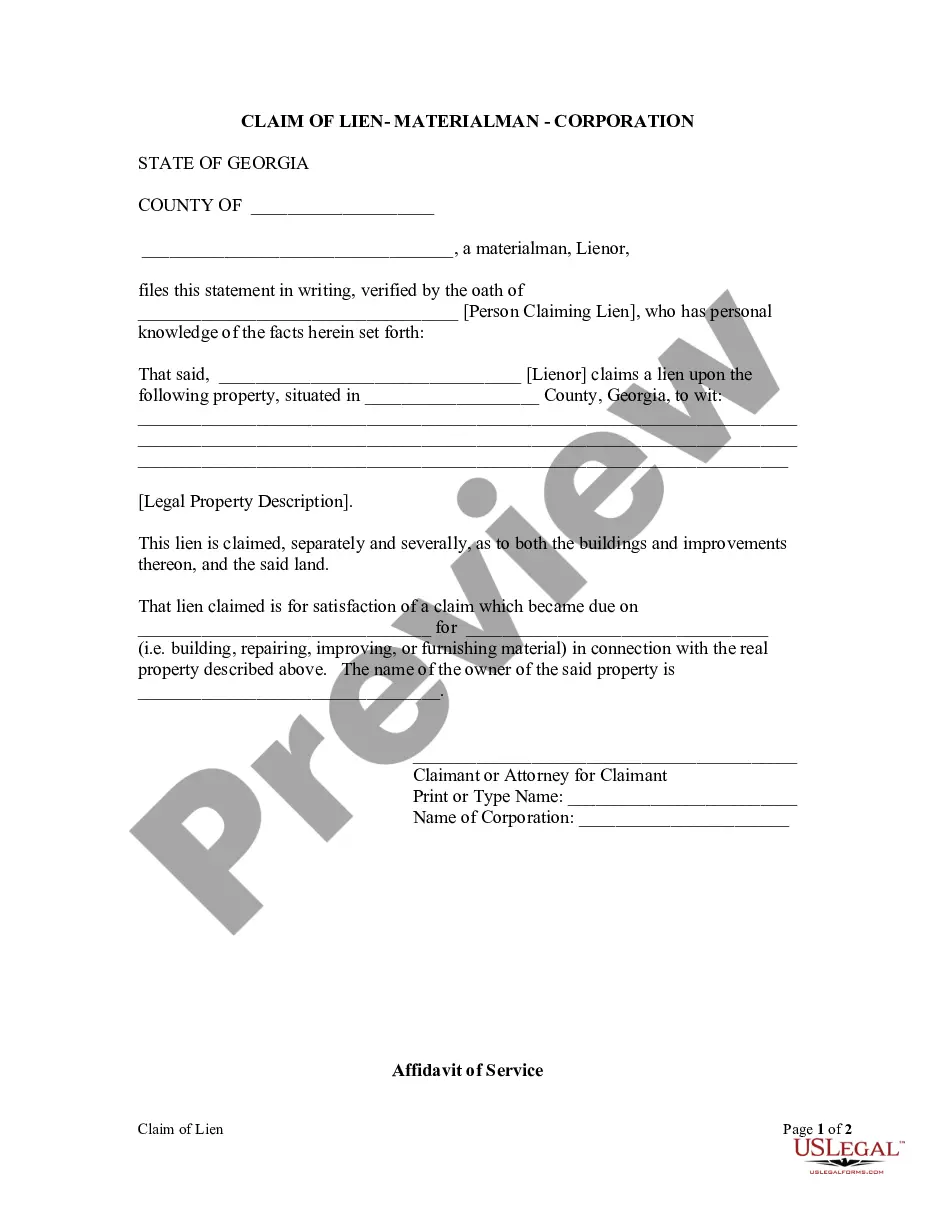

Claim Lien Form Form US Legal Forms

Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Search the georgia consolidated lien indexes by county, book and page. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Also called a state tax..

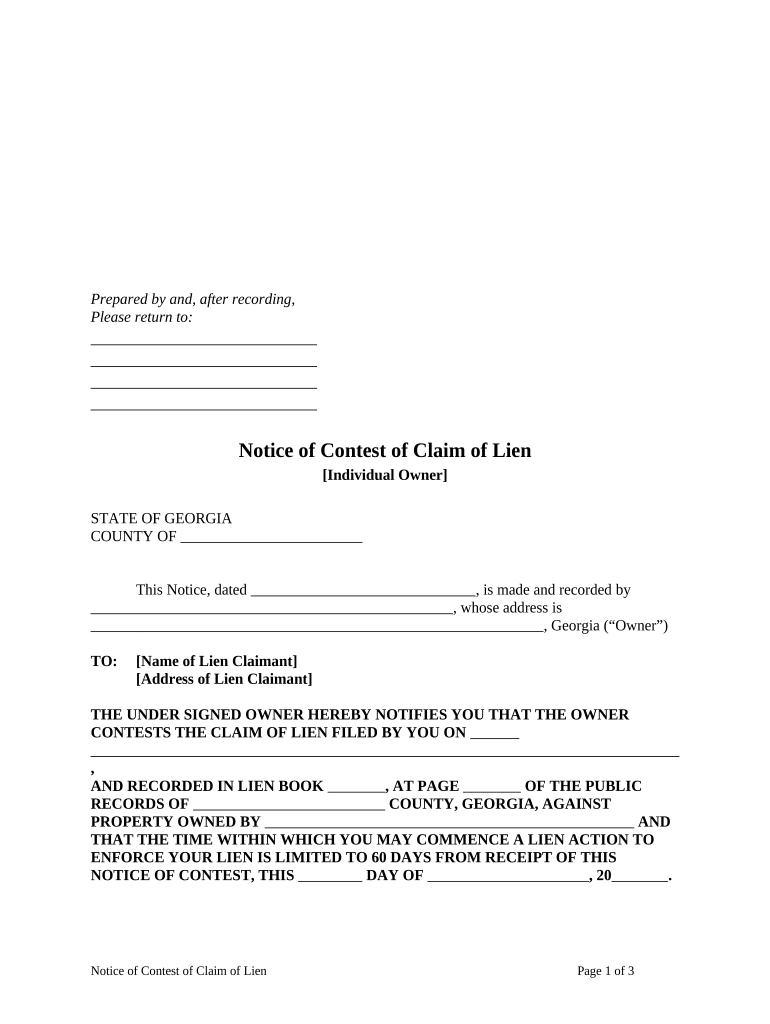

lien Fill out & sign online DocHub

Search the georgia consolidated lien indexes by county, book and page. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Search for pending liens issued by the georgia department of revenue. Also called a state tax. This tool allows for searching for state tax liens and related documents.

20132024 Form GA T4 Fill Online, Printable, Fillable, Blank pdfFiller

Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due. Also called a state tax. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. If you don't pay your.

Changes State Tax Lien Law

Search for pending liens issued by the georgia department of revenue. Search the georgia consolidated lien indexes by county, book and page. Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due. Also called a state tax. If you don't pay your taxes.

Property Lien Form Form example download

If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Search for pending liens issued by the georgia department of revenue. Also called a state tax. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for.

Notice Of State Tax Execution (Letter) This Letter Informs You That A State Tax Execution, Or State Tax Lien, Has Been Issued To Collect An Amount Due.

Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Search the georgia consolidated lien indexes by county, book and page. Search for pending liens issued by the georgia department of revenue. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent.

If You Don't Pay Your Taxes In Georgia, The Department Of Revenue (Dor) Can Issue A State Tax Lien Against You.

Also called a state tax.