Hawaii State Tax Lien

Hawaii State Tax Lien - Hawaii may use tax lien sales to recover unpaid taxes. An offer in compromise is a request by you to the department to pay less than the total amount of delinquent tax, penalty, and interest. Learn about property tax liens in hawaii, how they affect property ownership, and the steps to resolve them. Tcs may serve levies and seize and sell assets, as well as file a tax lien to protect the state’s best interests.

Hawaii may use tax lien sales to recover unpaid taxes. An offer in compromise is a request by you to the department to pay less than the total amount of delinquent tax, penalty, and interest. Learn about property tax liens in hawaii, how they affect property ownership, and the steps to resolve them. Tcs may serve levies and seize and sell assets, as well as file a tax lien to protect the state’s best interests.

Learn about property tax liens in hawaii, how they affect property ownership, and the steps to resolve them. Hawaii may use tax lien sales to recover unpaid taxes. Tcs may serve levies and seize and sell assets, as well as file a tax lien to protect the state’s best interests. An offer in compromise is a request by you to the department to pay less than the total amount of delinquent tax, penalty, and interest.

How To File a Hawaii Mechanics Lien Guidebook Notices, Liens

An offer in compromise is a request by you to the department to pay less than the total amount of delinquent tax, penalty, and interest. Hawaii may use tax lien sales to recover unpaid taxes. Tcs may serve levies and seize and sell assets, as well as file a tax lien to protect the state’s best interests. Learn about property.

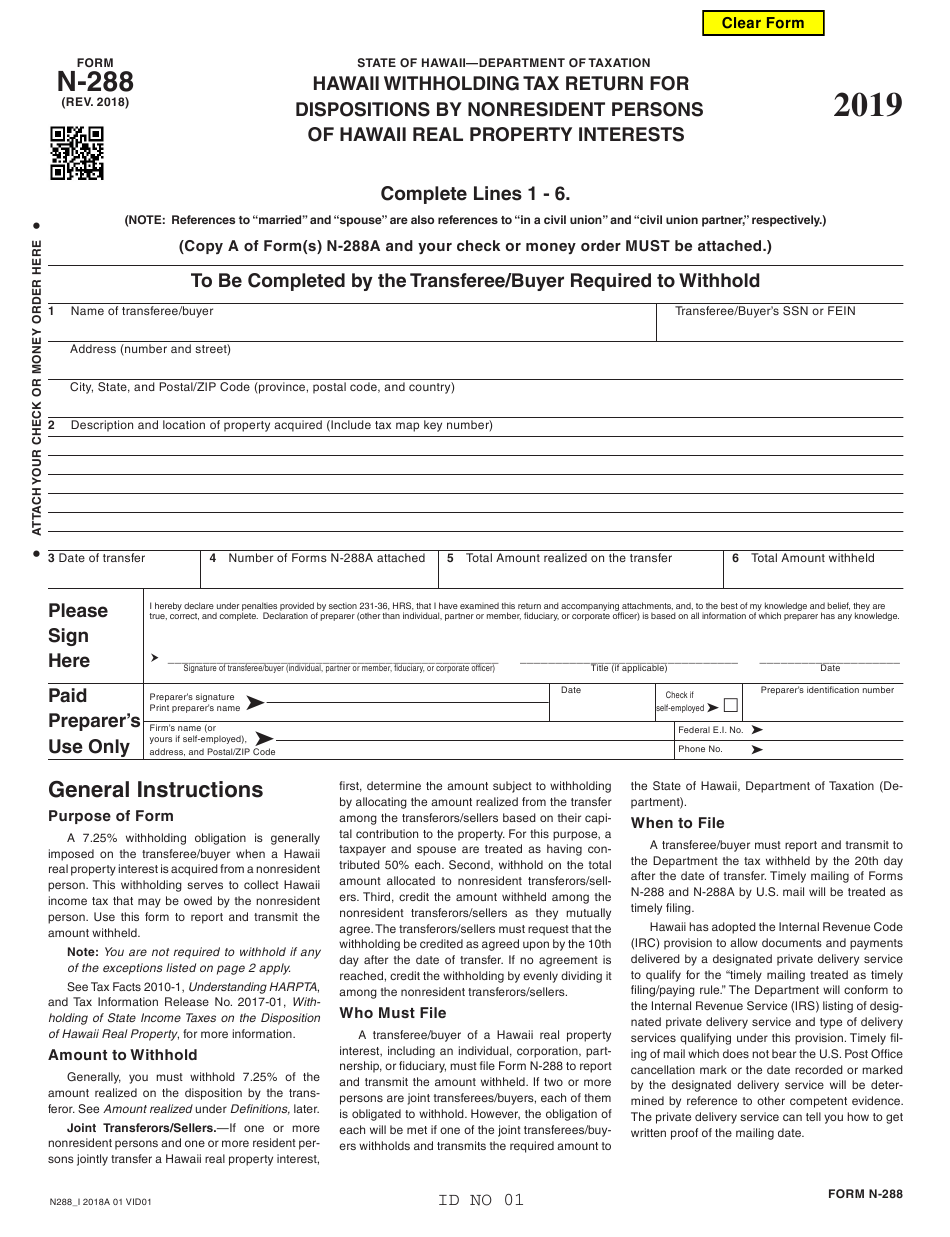

Hawaii State Tax Withholding Form 2022

Learn about property tax liens in hawaii, how they affect property ownership, and the steps to resolve them. Hawaii may use tax lien sales to recover unpaid taxes. An offer in compromise is a request by you to the department to pay less than the total amount of delinquent tax, penalty, and interest. Tcs may serve levies and seize and.

Tax Lien Properties In Montana Brightside Tax Relief

Learn about property tax liens in hawaii, how they affect property ownership, and the steps to resolve them. An offer in compromise is a request by you to the department to pay less than the total amount of delinquent tax, penalty, and interest. Hawaii may use tax lien sales to recover unpaid taxes. Tcs may serve levies and seize and.

tax lien PDF Free Download

Hawaii may use tax lien sales to recover unpaid taxes. Tcs may serve levies and seize and sell assets, as well as file a tax lien to protect the state’s best interests. Learn about property tax liens in hawaii, how they affect property ownership, and the steps to resolve them. An offer in compromise is a request by you to.

The Complete Guide to Hawaii Lien & Notice Deadlines National Lien & Bond

Tcs may serve levies and seize and sell assets, as well as file a tax lien to protect the state’s best interests. Hawaii may use tax lien sales to recover unpaid taxes. An offer in compromise is a request by you to the department to pay less than the total amount of delinquent tax, penalty, and interest. Learn about property.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

An offer in compromise is a request by you to the department to pay less than the total amount of delinquent tax, penalty, and interest. Learn about property tax liens in hawaii, how they affect property ownership, and the steps to resolve them. Tcs may serve levies and seize and sell assets, as well as file a tax lien to.

Tax Lien Sale Download Free PDF Tax Lien Taxes

Tcs may serve levies and seize and sell assets, as well as file a tax lien to protect the state’s best interests. Learn about property tax liens in hawaii, how they affect property ownership, and the steps to resolve them. An offer in compromise is a request by you to the department to pay less than the total amount of.

Tax Lien Form Free Word Templates

An offer in compromise is a request by you to the department to pay less than the total amount of delinquent tax, penalty, and interest. Tcs may serve levies and seize and sell assets, as well as file a tax lien to protect the state’s best interests. Learn about property tax liens in hawaii, how they affect property ownership, and.

Hawaii State Tax Return Information Keystone Support Center

Tcs may serve levies and seize and sell assets, as well as file a tax lien to protect the state’s best interests. Hawaii may use tax lien sales to recover unpaid taxes. An offer in compromise is a request by you to the department to pay less than the total amount of delinquent tax, penalty, and interest. Learn about property.

Investing in Tax Lien Seminars and Courses

Hawaii may use tax lien sales to recover unpaid taxes. Tcs may serve levies and seize and sell assets, as well as file a tax lien to protect the state’s best interests. An offer in compromise is a request by you to the department to pay less than the total amount of delinquent tax, penalty, and interest. Learn about property.

An Offer In Compromise Is A Request By You To The Department To Pay Less Than The Total Amount Of Delinquent Tax, Penalty, And Interest.

Learn about property tax liens in hawaii, how they affect property ownership, and the steps to resolve them. Hawaii may use tax lien sales to recover unpaid taxes. Tcs may serve levies and seize and sell assets, as well as file a tax lien to protect the state’s best interests.