How Long From Pre Foreclosure To Foreclosure

How Long From Pre Foreclosure To Foreclosure - During this period, the homeowner can catch up on their missed payments and end the foreclosure process, or they can choose to sell their home to avoid foreclosure. The preforeclosure period usually lasts anywhere between three and ten months. If you fall two to three months behind on your mortgage, your lender is typically going to come calling with a default notice on the property; That's because you need to be at least 120 days behind on your mortgage payments before your lender can start the foreclosure process. Here’s a look at the steps a homeowner will likely go through—plus some ways to get off this train and stop the. Does a foreclosure always mean a lender will take away your home?

Here’s a look at the steps a homeowner will likely go through—plus some ways to get off this train and stop the. That's because you need to be at least 120 days behind on your mortgage payments before your lender can start the foreclosure process. If you fall two to three months behind on your mortgage, your lender is typically going to come calling with a default notice on the property; Does a foreclosure always mean a lender will take away your home? The preforeclosure period usually lasts anywhere between three and ten months. During this period, the homeowner can catch up on their missed payments and end the foreclosure process, or they can choose to sell their home to avoid foreclosure.

During this period, the homeowner can catch up on their missed payments and end the foreclosure process, or they can choose to sell their home to avoid foreclosure. Here’s a look at the steps a homeowner will likely go through—plus some ways to get off this train and stop the. The preforeclosure period usually lasts anywhere between three and ten months. If you fall two to three months behind on your mortgage, your lender is typically going to come calling with a default notice on the property; Does a foreclosure always mean a lender will take away your home? That's because you need to be at least 120 days behind on your mortgage payments before your lender can start the foreclosure process.

7 Ways to Find PreForeclosure Homes to Score a Bargain

If you fall two to three months behind on your mortgage, your lender is typically going to come calling with a default notice on the property; Here’s a look at the steps a homeowner will likely go through—plus some ways to get off this train and stop the. That's because you need to be at least 120 days behind on.

What is a Preforeclosure? Real Estate Articles by

Does a foreclosure always mean a lender will take away your home? That's because you need to be at least 120 days behind on your mortgage payments before your lender can start the foreclosure process. The preforeclosure period usually lasts anywhere between three and ten months. During this period, the homeowner can catch up on their missed payments and end.

Differences Between Preforeclosure And Foreclosure

Here’s a look at the steps a homeowner will likely go through—plus some ways to get off this train and stop the. If you fall two to three months behind on your mortgage, your lender is typically going to come calling with a default notice on the property; During this period, the homeowner can catch up on their missed payments.

What Does PreForeclosure Mean? Mortgage.info

That's because you need to be at least 120 days behind on your mortgage payments before your lender can start the foreclosure process. Does a foreclosure always mean a lender will take away your home? If you fall two to three months behind on your mortgage, your lender is typically going to come calling with a default notice on the.

Pre Foreclosure Letter Sample Template with Example PDF Word

If you fall two to three months behind on your mortgage, your lender is typically going to come calling with a default notice on the property; Here’s a look at the steps a homeowner will likely go through—plus some ways to get off this train and stop the. That's because you need to be at least 120 days behind on.

How to Find Preforeclosures in 10 Ways for Agents & Investors

If you fall two to three months behind on your mortgage, your lender is typically going to come calling with a default notice on the property; Here’s a look at the steps a homeowner will likely go through—plus some ways to get off this train and stop the. During this period, the homeowner can catch up on their missed payments.

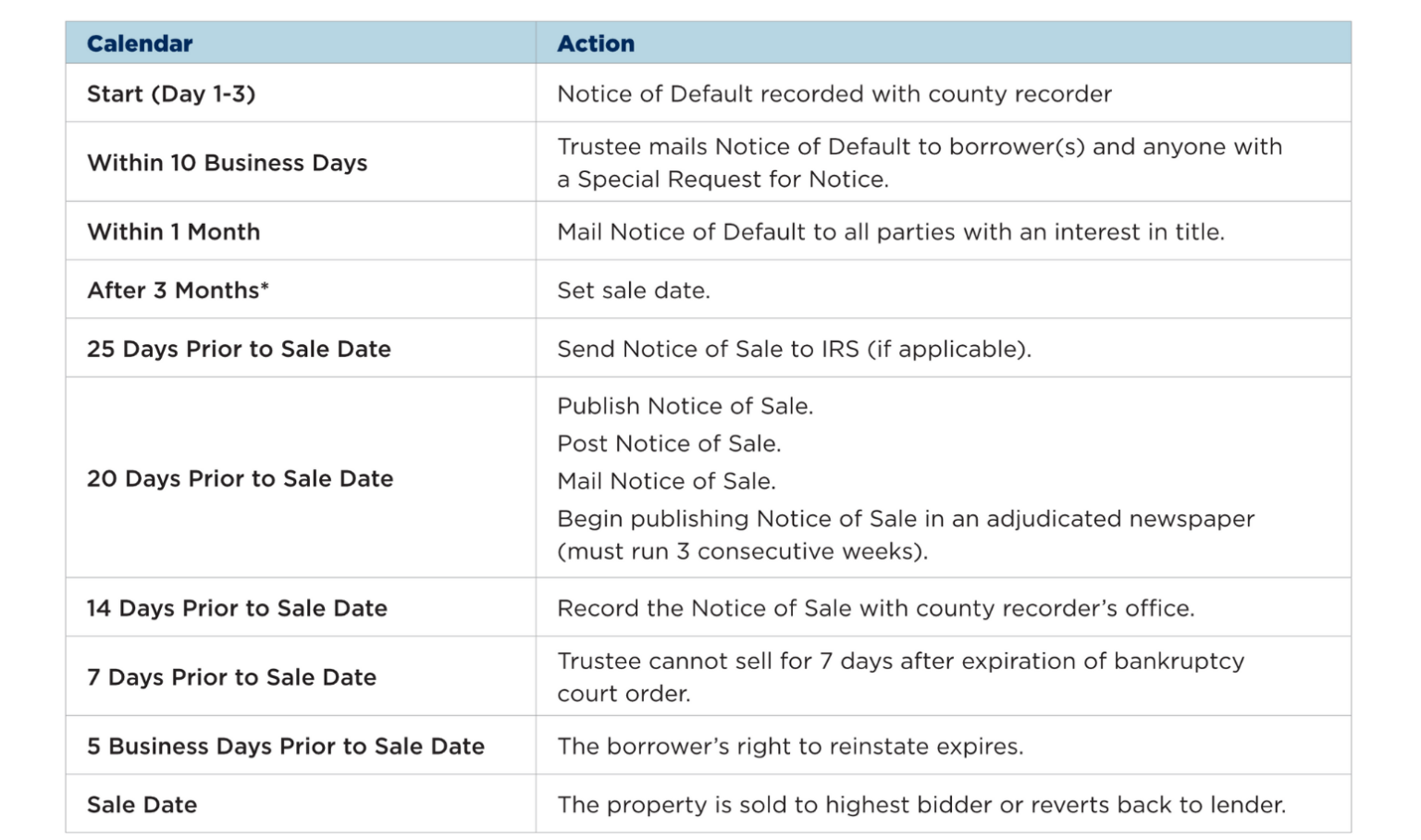

FORECLOSURE TIMELINE California Foreclosure Protection

During this period, the homeowner can catch up on their missed payments and end the foreclosure process, or they can choose to sell their home to avoid foreclosure. Does a foreclosure always mean a lender will take away your home? Here’s a look at the steps a homeowner will likely go through—plus some ways to get off this train and.

PreForeclosure Guide Ohana Legacy Properties

That's because you need to be at least 120 days behind on your mortgage payments before your lender can start the foreclosure process. The preforeclosure period usually lasts anywhere between three and ten months. Does a foreclosure always mean a lender will take away your home? During this period, the homeowner can catch up on their missed payments and end.

The Difference Between a Short Sale, PreForeclosure, and Foreclosure

The preforeclosure period usually lasts anywhere between three and ten months. That's because you need to be at least 120 days behind on your mortgage payments before your lender can start the foreclosure process. Does a foreclosure always mean a lender will take away your home? During this period, the homeowner can catch up on their missed payments and end.

PreForeclosure Investing MillionDollar Strategy Legacy Fuel

That's because you need to be at least 120 days behind on your mortgage payments before your lender can start the foreclosure process. Does a foreclosure always mean a lender will take away your home? The preforeclosure period usually lasts anywhere between three and ten months. If you fall two to three months behind on your mortgage, your lender is.

Does A Foreclosure Always Mean A Lender Will Take Away Your Home?

During this period, the homeowner can catch up on their missed payments and end the foreclosure process, or they can choose to sell their home to avoid foreclosure. Here’s a look at the steps a homeowner will likely go through—plus some ways to get off this train and stop the. If you fall two to three months behind on your mortgage, your lender is typically going to come calling with a default notice on the property; That's because you need to be at least 120 days behind on your mortgage payments before your lender can start the foreclosure process.