How To Change Business Name For Ein

How To Change Business Name For Ein - You’ll get your ein in 4 business. You don’t need a new ein if you just change your. Business owners and other authorized individuals can submit a name change for their business. When you file your business taxes, the irs uses your ein and business name to identify your business. You need a new ein, in general, when you change your entity’s ownership or structure. If your business name changes, but your structure (sole proprietorship, llc, etc.) remains the same, you. Write a letter to the. There are a few different methods of changing the name associated with a federal ein depending on business type. If you decide to change your. Here's a good rule of thumb:

Here's a good rule of thumb: You need a new ein, in general, when you change your entity’s ownership or structure. If your business name changes, but your structure (sole proprietorship, llc, etc.) remains the same, you. When you file your business taxes, the irs uses your ein and business name to identify your business. Business owners and other authorized individuals can submit a name change for their business. Write a letter to the. There are a few different methods of changing the name associated with a federal ein depending on business type. You’ll get your ein in 4 business. The specific action required may vary. If you decide to change your.

You’ll get your ein in 4 business. You don’t need a new ein if you just change your. Get an ein now, free, direct from the irs. When you file your business taxes, the irs uses your ein and business name to identify your business. Business owners and other authorized individuals can submit a name change for their business. There are a few different methods of changing the name associated with a federal ein depending on business type. Write a letter to the. Here's a good rule of thumb: If your business name changes, but your structure (sole proprietorship, llc, etc.) remains the same, you. If you decide to change your.

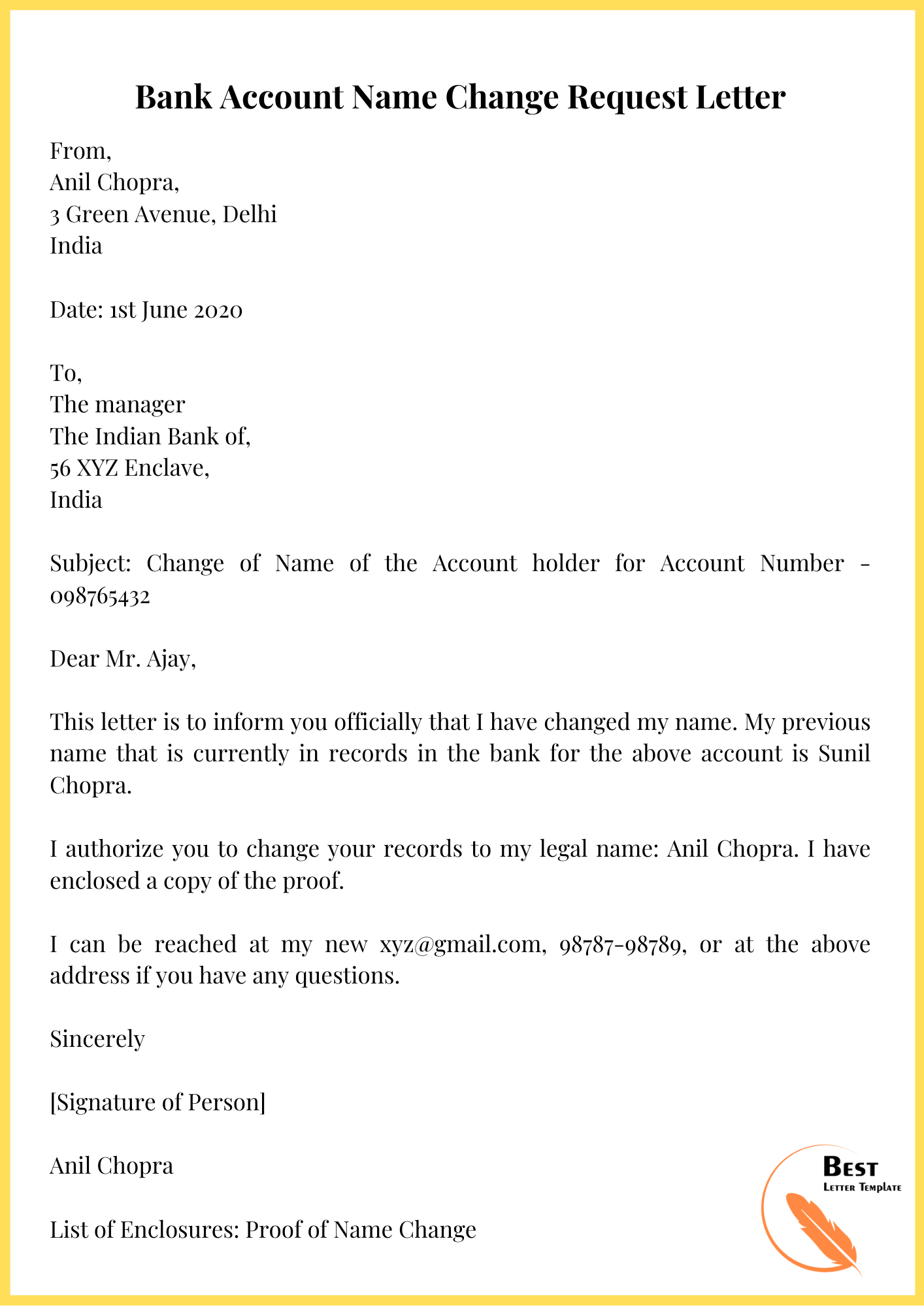

Ein Name Change Letter Template

Write a letter to the. You’ll get your ein in 4 business. You need a new ein, in general, when you change your entity’s ownership or structure. There are a few different methods of changing the name associated with a federal ein depending on business type. Business owners and other authorized individuals can submit a name change for their business.

Changing Your Business Name Tips for Naming Your Creative Business

You need a new ein, in general, when you change your entity’s ownership or structure. Get an ein now, free, direct from the irs. There are a few different methods of changing the name associated with a federal ein depending on business type. Write a letter to the. If your business name changes, but your structure (sole proprietorship, llc, etc.).

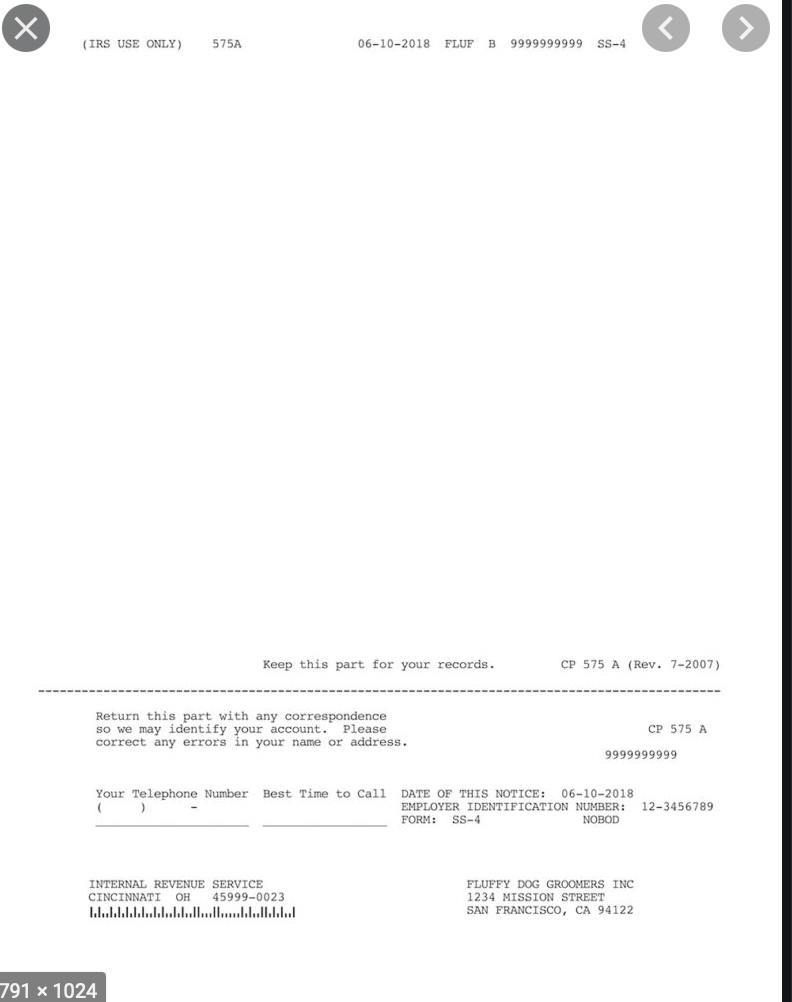

Irs Business Name Change Letter Template

The specific action required may vary. There are a few different methods of changing the name associated with a federal ein depending on business type. If you decide to change your. You’ll get your ein in 4 business. Business owners and other authorized individuals can submit a name change for their business.

Business Name Change Letter Template To Irs

Get an ein now, free, direct from the irs. You need a new ein, in general, when you change your entity’s ownership or structure. Here's a good rule of thumb: If your business name changes, but your structure (sole proprietorship, llc, etc.) remains the same, you. If you decide to change your.

Business Name Change Letter Gotilo

Write a letter to the. You don’t need a new ein if you just change your. You need a new ein, in general, when you change your entity’s ownership or structure. If you decide to change your. Here's a good rule of thumb:

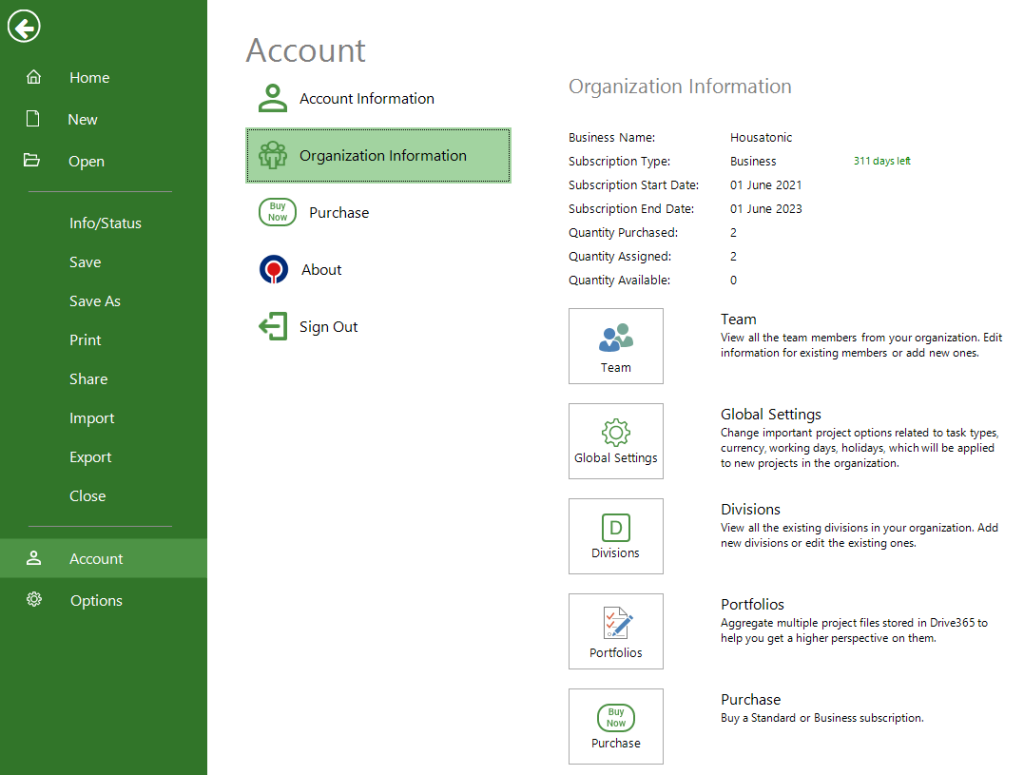

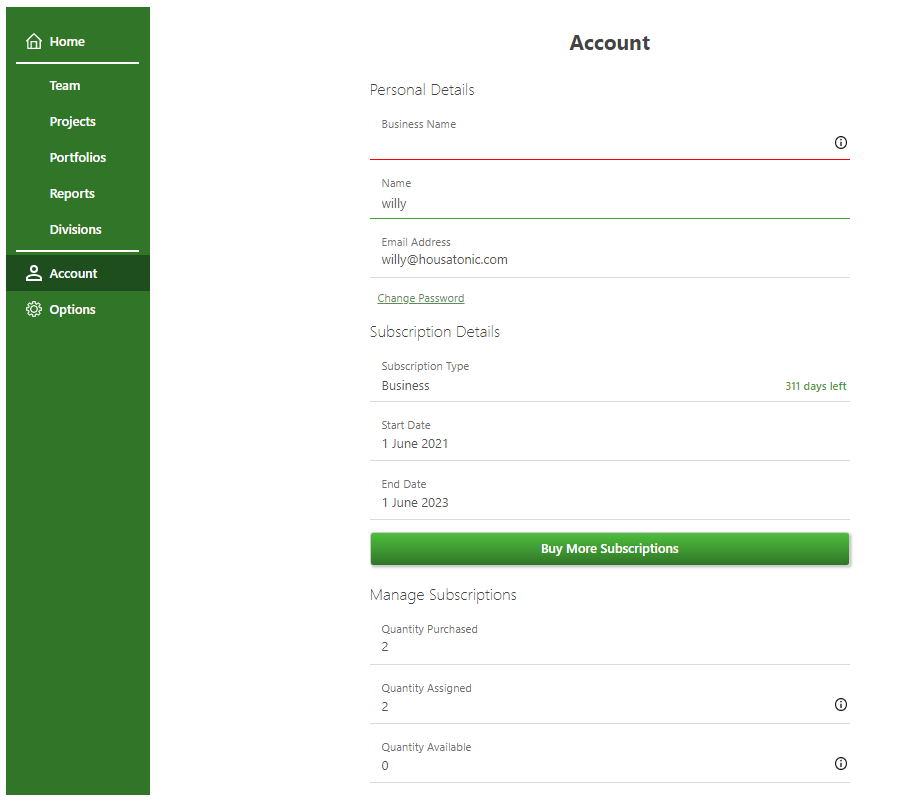

Change Business Name Project Plan 365

You’ll get your ein in 4 business. Write a letter to the. When you file your business taxes, the irs uses your ein and business name to identify your business. Here's a good rule of thumb: You need a new ein, in general, when you change your entity’s ownership or structure.

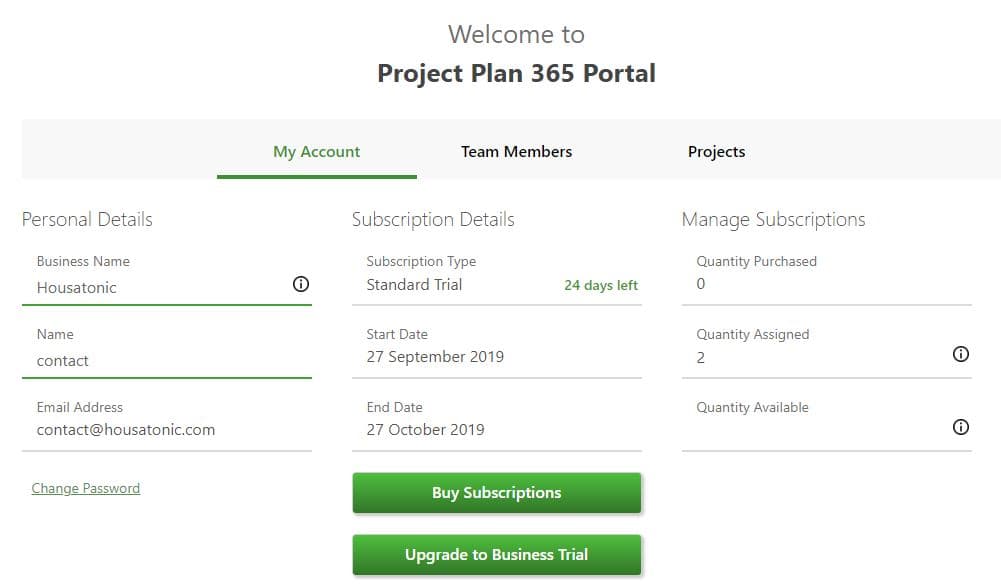

Change Business Name LEPROC ACCOUNTING

You don’t need a new ein if you just change your. Here's a good rule of thumb: Write a letter to the. If you decide to change your. Business owners and other authorized individuals can submit a name change for their business.

Change Business Name Project Plan 365

You need a new ein, in general, when you change your entity’s ownership or structure. The specific action required may vary. Get an ein now, free, direct from the irs. If your business name changes, but your structure (sole proprietorship, llc, etc.) remains the same, you. If you decide to change your.

How To Change A Business Name In 6 Simple Steps Forbes Advisor

If you decide to change your. When you file your business taxes, the irs uses your ein and business name to identify your business. Write a letter to the. You don’t need a new ein if you just change your. You need a new ein, in general, when you change your entity’s ownership or structure.

Change Business Name Project Plan 365

There are a few different methods of changing the name associated with a federal ein depending on business type. You need a new ein, in general, when you change your entity’s ownership or structure. You don’t need a new ein if you just change your. Here's a good rule of thumb: The specific action required may vary.

You Need A New Ein, In General, When You Change Your Entity’s Ownership Or Structure.

Write a letter to the. You’ll get your ein in 4 business. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary.

Get An Ein Now, Free, Direct From The Irs.

There are a few different methods of changing the name associated with a federal ein depending on business type. You don’t need a new ein if you just change your. If you decide to change your. When you file your business taxes, the irs uses your ein and business name to identify your business.

Here's A Good Rule Of Thumb:

If your business name changes, but your structure (sole proprietorship, llc, etc.) remains the same, you.