Illinois Property Lien

Illinois Property Lien - How does a creditor go about getting a judgment lien in. Liens and claims are the two legal actions used to collect the amount received by aabd clients. Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing. In illinois, a judgment lien can be attached to real estate only, not to personal property. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. Property liens in illinois are vital for securing creditors’ interests in a debtor’s property, ensuring debts are settled before any sale or. If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. A lien can be filed on any real property you own.

How does a creditor go about getting a judgment lien in. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. In illinois, a judgment lien can be attached to real estate only, not to personal property. A lien can be filed on any real property you own. Property liens in illinois are vital for securing creditors’ interests in a debtor’s property, ensuring debts are settled before any sale or. Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing. Liens and claims are the two legal actions used to collect the amount received by aabd clients.

A lien can be filed on any real property you own. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. Property liens in illinois are vital for securing creditors’ interests in a debtor’s property, ensuring debts are settled before any sale or. Liens and claims are the two legal actions used to collect the amount received by aabd clients. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing. How does a creditor go about getting a judgment lien in. In illinois, a judgment lien can be attached to real estate only, not to personal property.

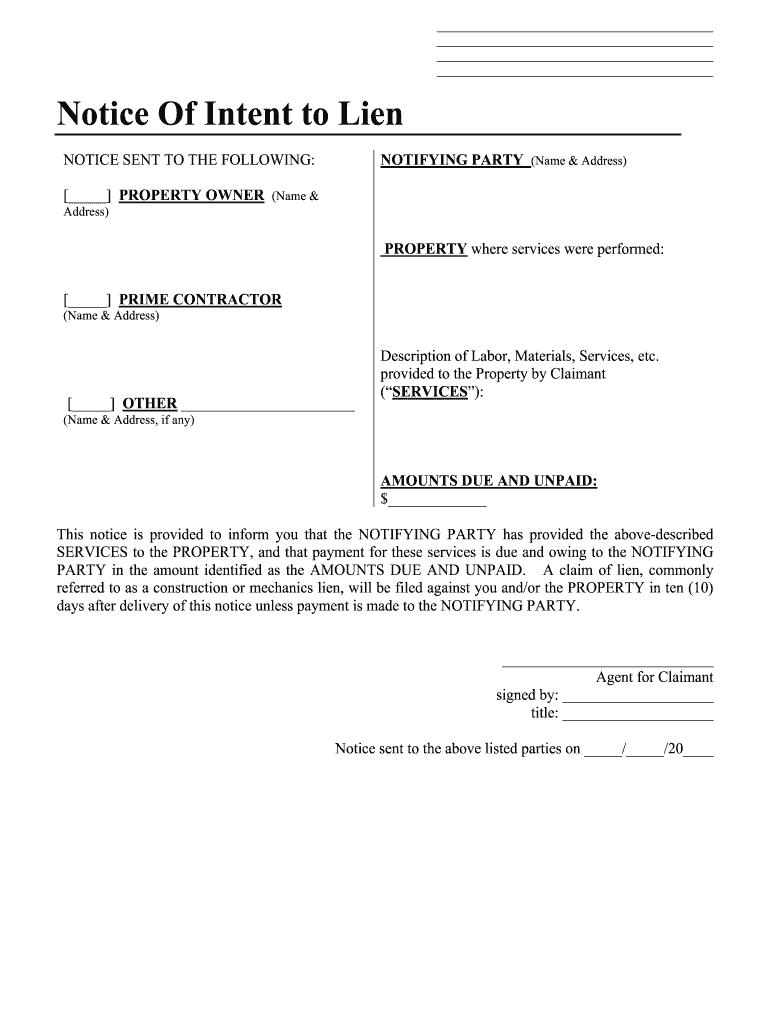

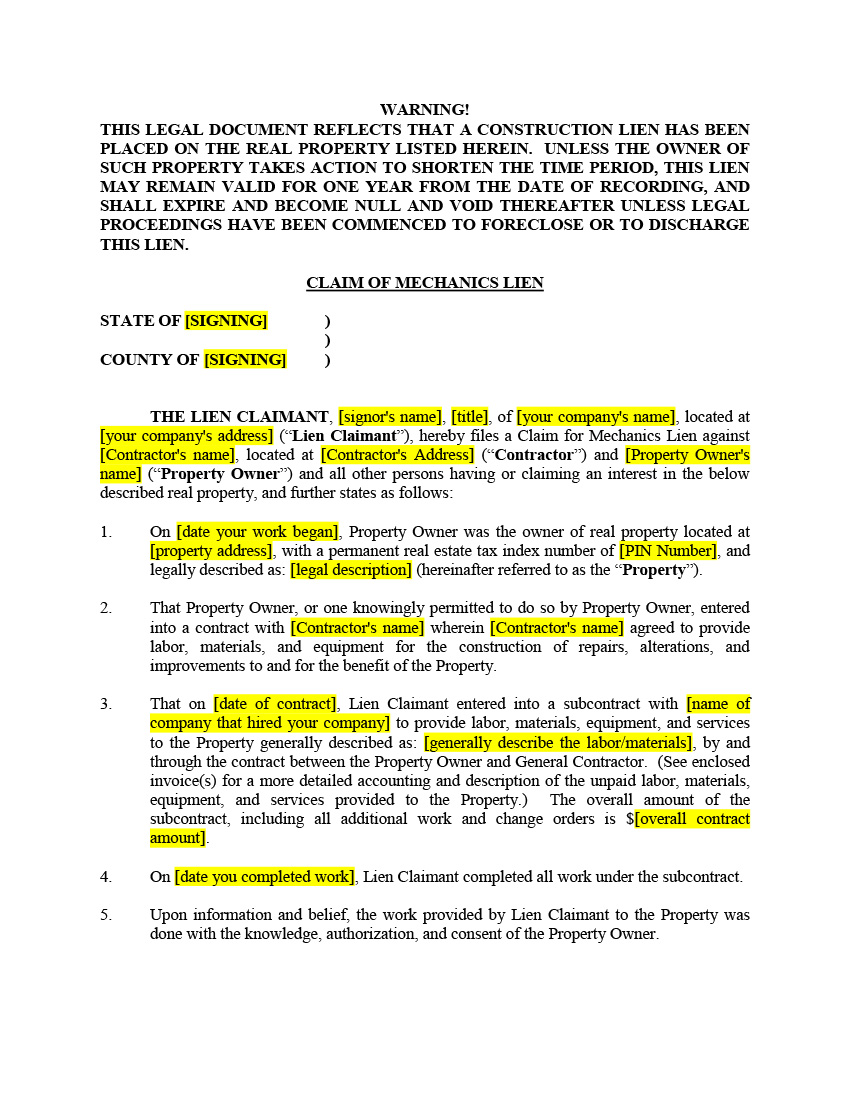

Notice Of Intent To Lien Illinois Pdf Fill Online, Printable

Property liens in illinois are vital for securing creditors’ interests in a debtor’s property, ensuring debts are settled before any sale or. If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. The liens included in the state tax lien registry are liens filed by.

Federal tax lien on foreclosed property laderdriver

If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. Property liens in illinois are vital for securing creditors’ interests in a debtor’s property, ensuring debts are settled before any sale or. A lien can be filed on any real property you own. In illinois,.

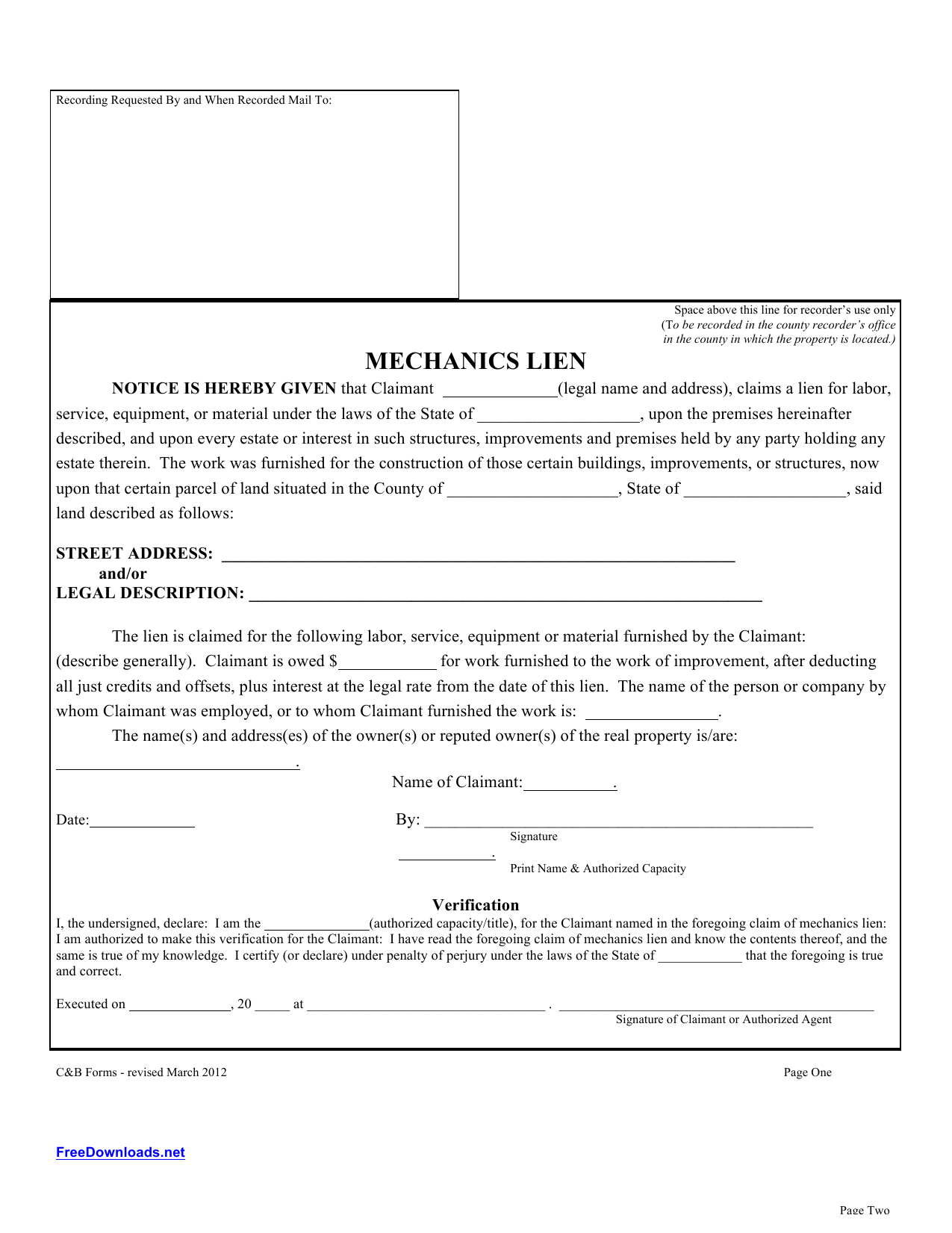

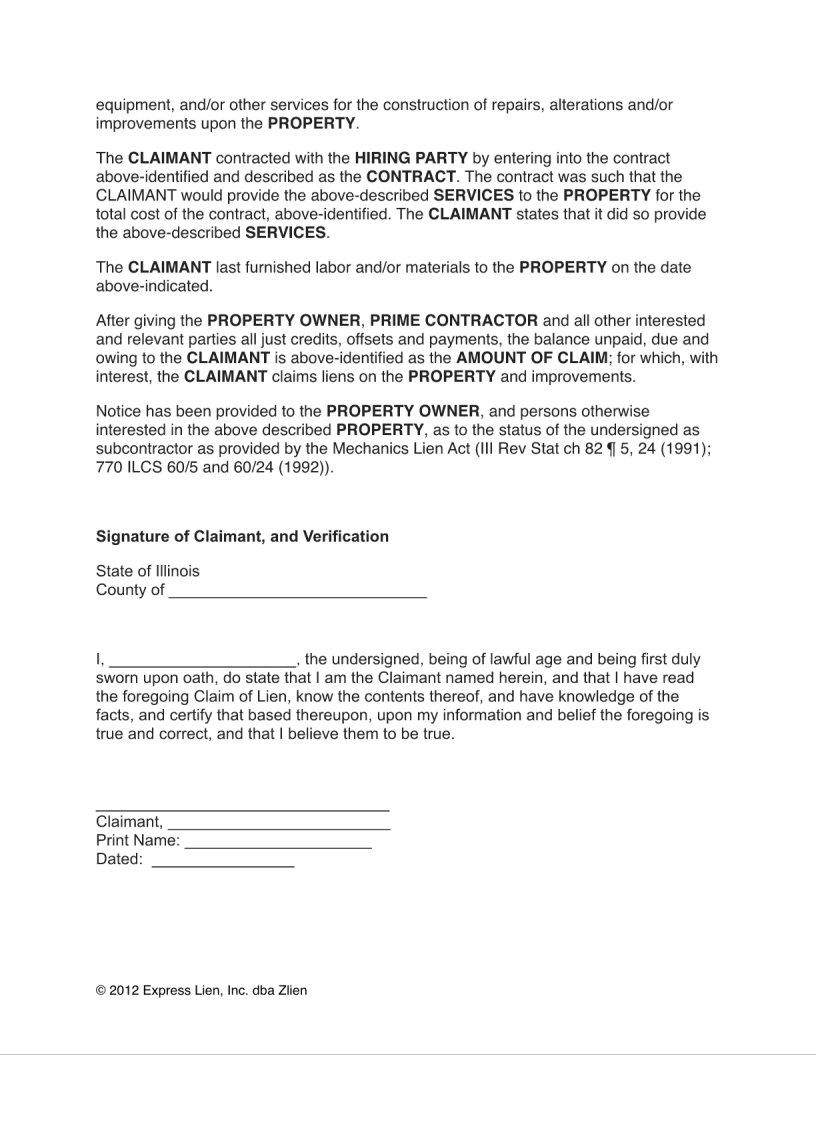

Lien Template Free

How does a creditor go about getting a judgment lien in. A lien can be filed on any real property you own. Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing. In illinois, a judgment lien can be attached to real estate only, not to personal property. In illinois, filing.

Illinois Notice Lien Form ≡ Fill Out Printable PDF Forms Online

A lien can be filed on any real property you own. How does a creditor go about getting a judgment lien in. Liens and claims are the two legal actions used to collect the amount received by aabd clients. Property liens in illinois are vital for securing creditors’ interests in a debtor’s property, ensuring debts are settled before any sale.

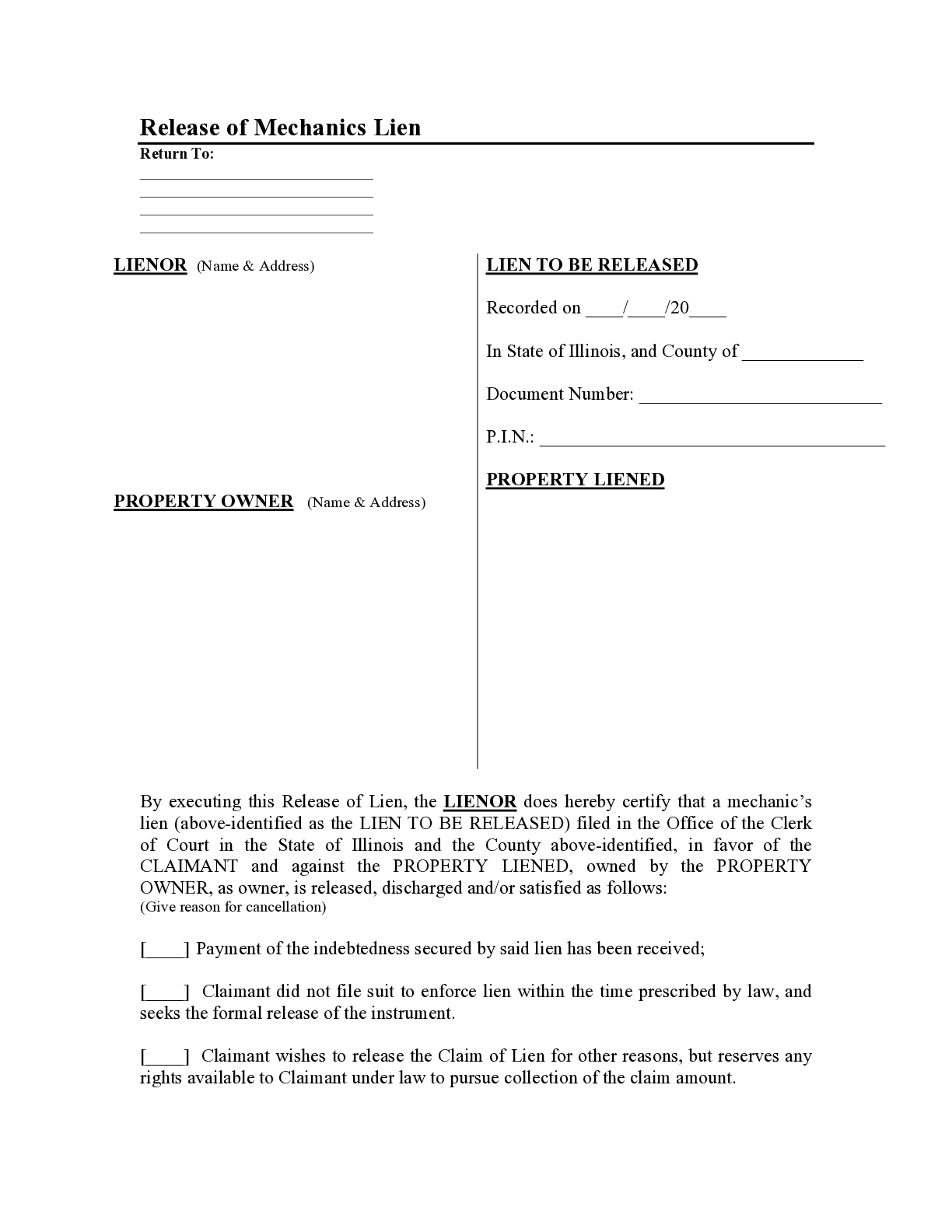

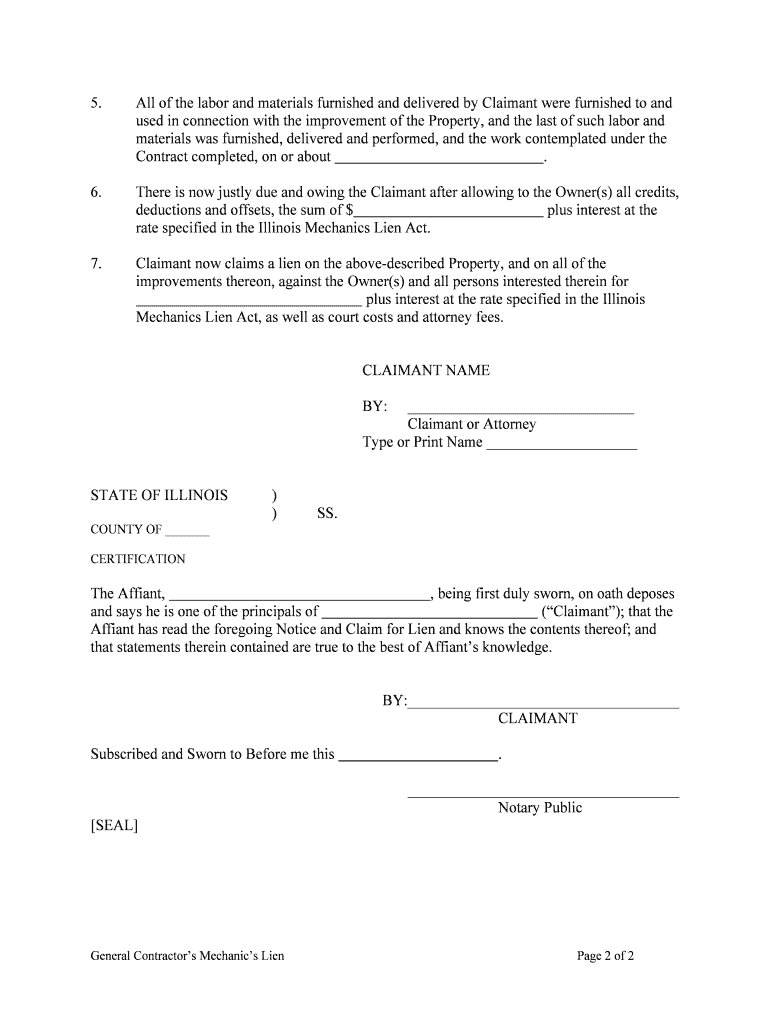

Illinois Mechanics Lien Release Form Free Template

Liens and claims are the two legal actions used to collect the amount received by aabd clients. If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed. In illinois, a judgment lien can be attached to real estate only, not to personal property. A lien.

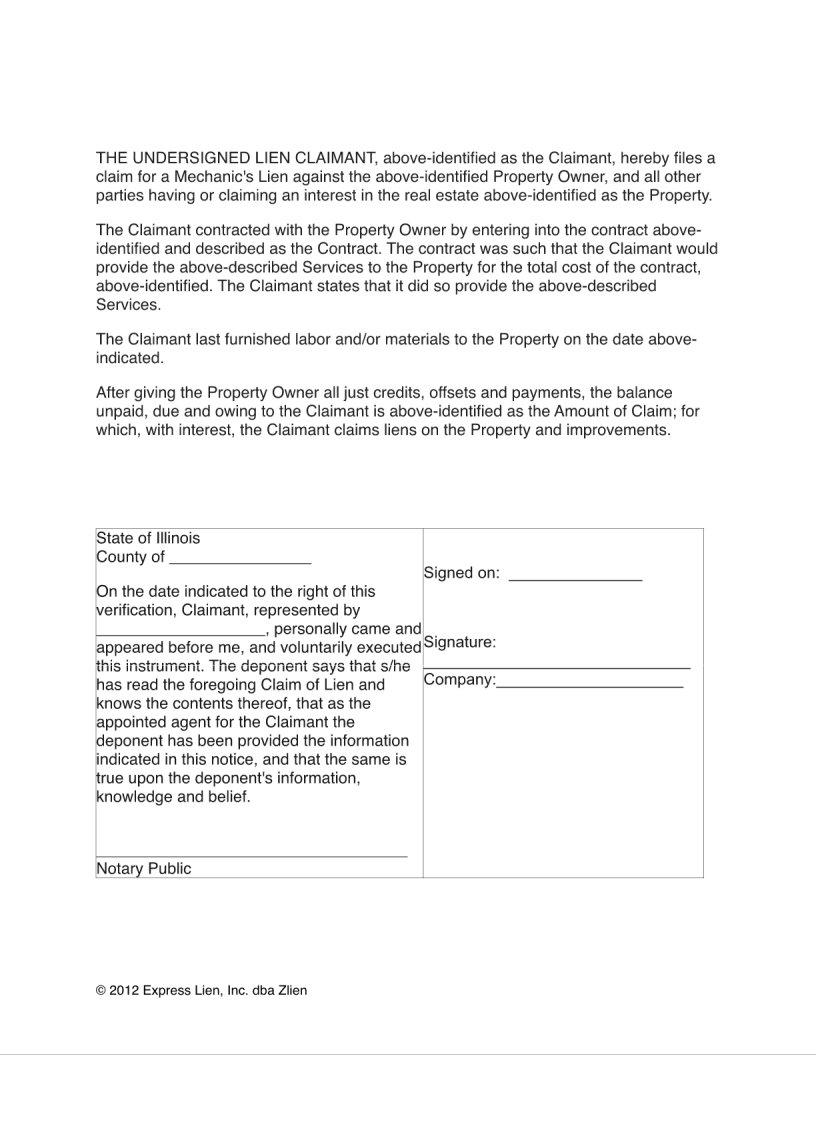

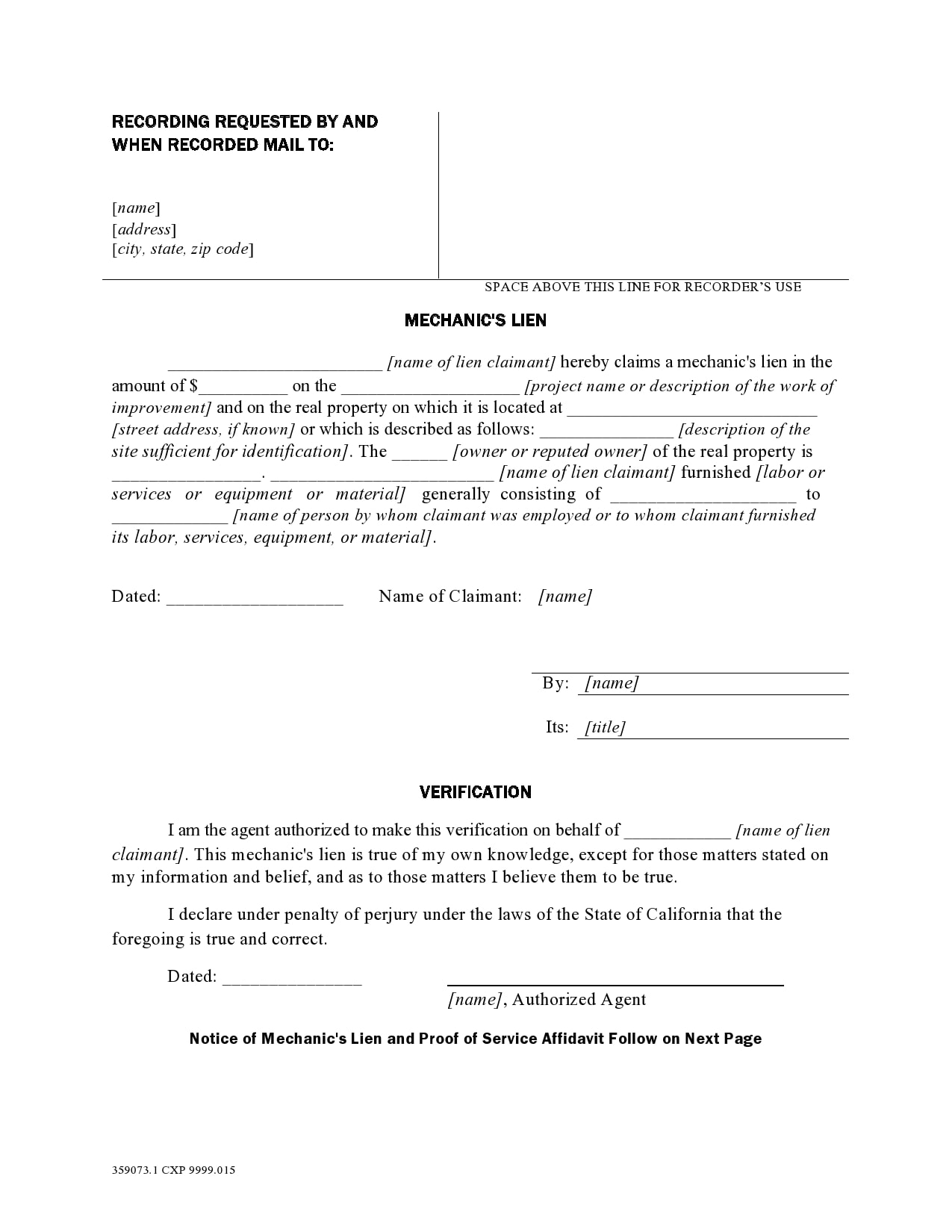

Illinois Lien Complete with ease airSlate SignNow

Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. In illinois, a judgment lien can be attached to real estate only, not to personal property..

Commercial Illinois Mechanic Lien Forms and Kits

Liens and claims are the two legal actions used to collect the amount received by aabd clients. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. A lien can be filed on any real property you own. Property liens in illinois are vital for securing creditors’ interests in a.

Release Lien Fill and Sign Printable Template Online US Legal Forms

How does a creditor go about getting a judgment lien in. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing. In illinois, a judgment lien can be attached to real.

Illinois Notice Lien Form ≡ Fill Out Printable PDF Forms Online

In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. How does a creditor go about getting a judgment lien in. In illinois, a judgment lien can be attached to real estate only, not to personal property. Liens and claims are the two legal actions used to collect the amount.

30 Free Mechanics Lien Forms (All States) TemplateArchive

The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. In illinois, a judgment lien can be attached to real estate only, not to personal property. Liens and claims are the two legal actions used to collect the amount received by aabd clients. Explore the.

In Illinois, Filing A Lien Is A Simple Process, But One That Comes With Specific Time Limits For Legal Action.

Explore the intricacies of property liens in illinois, including their types, impacts on ownership, and essential steps for clearing. How does a creditor go about getting a judgment lien in. A lien can be filed on any real property you own. If a creditor (such as a lender or contractor) or government agency receives a judgment for unpaid debts or fines, a lien will be filed.

Property Liens In Illinois Are Vital For Securing Creditors’ Interests In A Debtor’s Property, Ensuring Debts Are Settled Before Any Sale Or.

In illinois, a judgment lien can be attached to real estate only, not to personal property. Liens and claims are the two legal actions used to collect the amount received by aabd clients. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and.