Illinois Tax Lien Sale

Illinois Tax Lien Sale - To purchase a catalog of the properties, click here. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024. Iltaxsale.com advertises tax deed auctions for joseph e. What is a tax sale? The state tax lien registration act also provided for the sale. In the state of illinois, the sale of property tax liens goes through the following steps. Meyer & associates collects unwanted tax liens for 80. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been. How tax liens work in illinois.

How tax liens work in illinois. What is a tax sale? Iltaxsale.com advertises tax deed auctions for joseph e. The state tax lien registration act also provided for the sale. In the state of illinois, the sale of property tax liens goes through the following steps. To purchase a catalog of the properties, click here. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024. Meyer & associates collects unwanted tax liens for 80. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been.

The state tax lien registration act also provided for the sale. What is a tax sale? Meyer & associates collects unwanted tax liens for 80. Iltaxsale.com advertises tax deed auctions for joseph e. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. How tax liens work in illinois. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024. In the state of illinois, the sale of property tax liens goes through the following steps. To purchase a catalog of the properties, click here. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been.

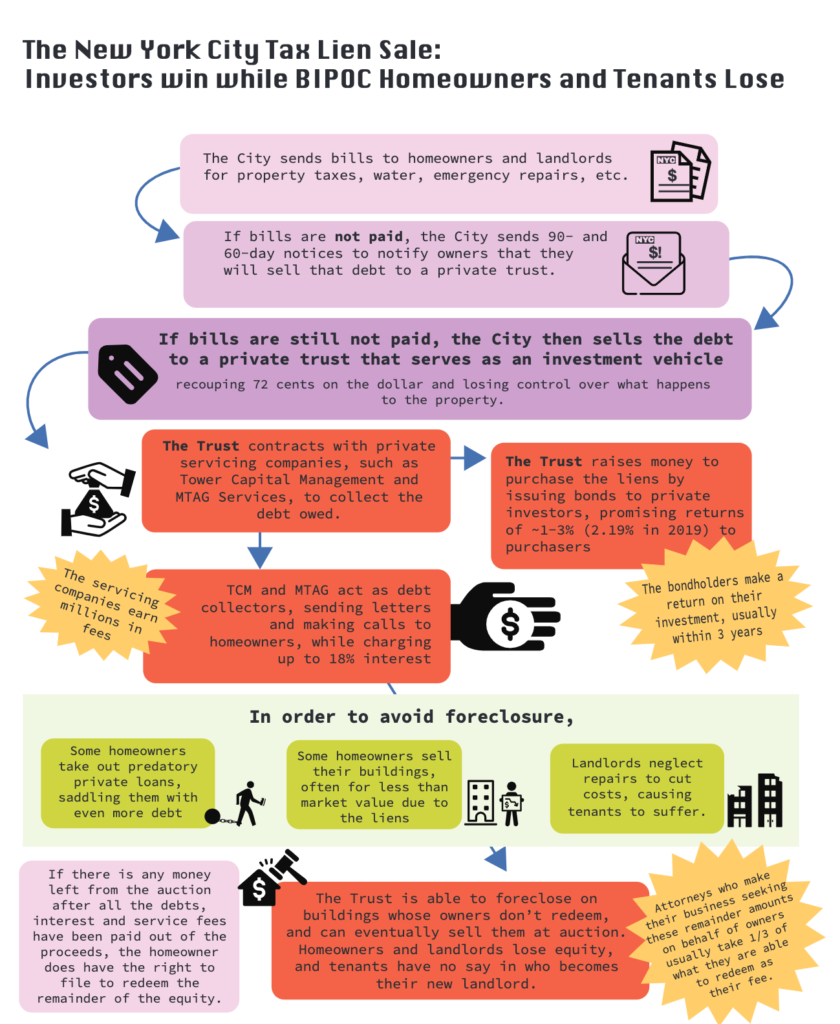

NYC Tax Lien Sale Reform Conference EastNewYorkCLT

Meyer & associates collects unwanted tax liens for 80. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024. In the state of illinois, the sale of property tax liens goes through the following steps. What is a tax sale? How tax liens work in illinois.

Tax Lien Training Special Expired — Financial Freedom University

For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024. How tax liens work in illinois. In the state of illinois, the sale of property tax liens goes through the following steps. The state tax lien registration act also provided for the sale. Meyer & associates collects unwanted tax.

Informational Brochure About the Tax Lien Sale EastNewYorkCLT

In the state of illinois, the sale of property tax liens goes through the following steps. Meyer & associates collects unwanted tax liens for 80. To purchase a catalog of the properties, click here. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only..

tax lien PDF Free Download

The state tax lien registration act also provided for the sale. Meyer & associates collects unwanted tax liens for 80. Iltaxsale.com advertises tax deed auctions for joseph e. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been. To purchase a catalog of the properties, click here.

Nyc Tax Lien Sale 2024 Kanya Maritsa

Meyer & associates collects unwanted tax liens for 80. The state tax lien registration act also provided for the sale. How tax liens work in illinois. In the state of illinois, the sale of property tax liens goes through the following steps. Iltaxsale.com advertises tax deed auctions for joseph e.

Property Tax Lien Sale Program Extended by City Council CityLand CityLand

To purchase a catalog of the properties, click here. In the state of illinois, the sale of property tax liens goes through the following steps. What is a tax sale? The state tax lien registration act also provided for the sale. Iltaxsale.com advertises tax deed auctions for joseph e.

NYC Tax Lien Sale Information Session Jamaica311

What is a tax sale? The state tax lien registration act also provided for the sale. In the state of illinois, the sale of property tax liens goes through the following steps. To purchase a catalog of the properties, click here. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual.

Abolish The Tax Lien Sale EastNewYorkCLT

Iltaxsale.com advertises tax deed auctions for joseph e. What is a tax sale? The state tax lien registration act also provided for the sale. Meyer & associates collects unwanted tax liens for 80. How tax liens work in illinois.

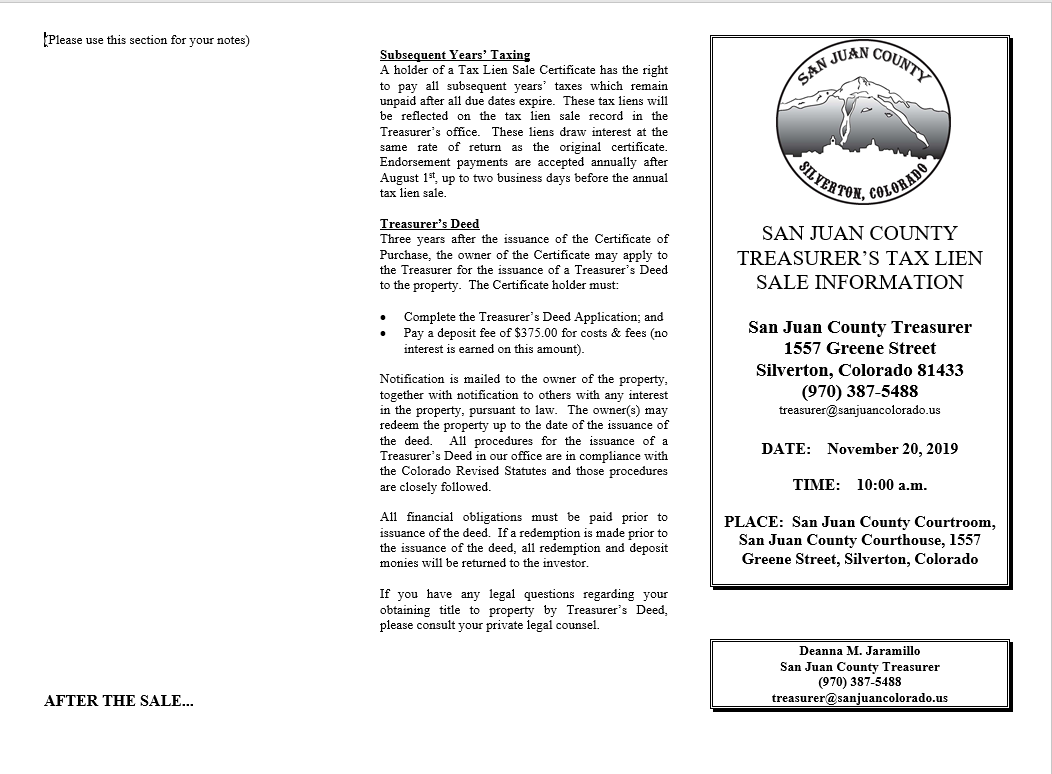

Tax Lien Sale San Juan County

To purchase a catalog of the properties, click here. Iltaxsale.com advertises tax deed auctions for joseph e. What is a tax sale? The state tax lien registration act also provided for the sale. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been.

What are Tax Lien Properties and Tax Lien Investments? — Tax Sales

The state tax lien registration act also provided for the sale. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been. To purchase a catalog of.

Meyer & Associates Collects Unwanted Tax Liens For 80.

Iltaxsale.com advertises tax deed auctions for joseph e. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been. The state tax lien registration act also provided for the sale. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only.

To Purchase A Catalog Of The Properties, Click Here.

How tax liens work in illinois. What is a tax sale? In the state of illinois, the sale of property tax liens goes through the following steps. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024.