Invest In Tax Liens Reddit

Invest In Tax Liens Reddit - In my state (colorado), you will earn an interest rate of 10%. Not many tax lien investors invest in states that only issue tax deeds or hybrids. I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. I came across tax lien investing recently and wanted to give it a try. This is all very new to me and wanted to reach out to this community to.

I came across tax lien investing recently and wanted to give it a try. I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. This is all very new to me and wanted to reach out to this community to. In my state (colorado), you will earn an interest rate of 10%. Not many tax lien investors invest in states that only issue tax deeds or hybrids.

This is all very new to me and wanted to reach out to this community to. I came across tax lien investing recently and wanted to give it a try. In my state (colorado), you will earn an interest rate of 10%. I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. Not many tax lien investors invest in states that only issue tax deeds or hybrids.

TAX Consultancy Firm Gurugram

This is all very new to me and wanted to reach out to this community to. I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. I came across tax lien investing recently and wanted to give it a try. In my state (colorado),.

How to Invest in Tax Liens & Deeds with Your Plan

I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. I came across tax lien investing recently and wanted to give it a try. In my state (colorado), you will earn an interest rate of 10%. Not many tax lien investors invest in states.

Steps to invest in tax liens to make profit Latest Infographics

In my state (colorado), you will earn an interest rate of 10%. I came across tax lien investing recently and wanted to give it a try. I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. This is all very new to me and.

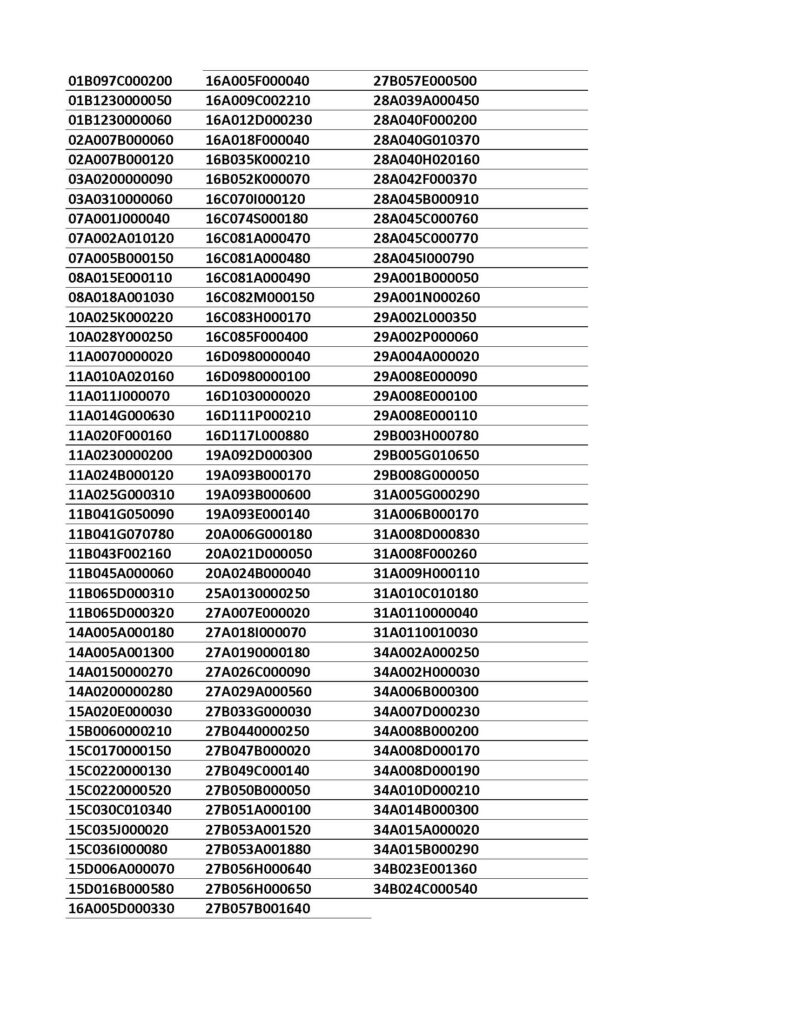

TAX LIENS PENDING CERTIFICATE FILING Treasurer

I came across tax lien investing recently and wanted to give it a try. I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. In my state (colorado), you will earn an interest rate of 10%. Not many tax lien investors invest in states.

How to Invest in Tax Liens A Comprehensive Guide The Enlightened

In my state (colorado), you will earn an interest rate of 10%. I came across tax lien investing recently and wanted to give it a try. This is all very new to me and wanted to reach out to this community to. Not many tax lien investors invest in states that only issue tax deeds or hybrids. I’m in sc.

How to Invest in Tax Liens Using Cash or Your IRA

This is all very new to me and wanted to reach out to this community to. Not many tax lien investors invest in states that only issue tax deeds or hybrids. I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. I came across.

Tax Preparation Business Startup

I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. Not many tax lien investors invest in states that only issue tax deeds or hybrids. This is all very new to me and wanted to reach out to this community to. I came across.

Tax Liens and Deeds Live Class Pips Path

This is all very new to me and wanted to reach out to this community to. In my state (colorado), you will earn an interest rate of 10%. I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. I came across tax lien investing.

Sparks Tax and Accounting Services Topeka KS

Not many tax lien investors invest in states that only issue tax deeds or hybrids. I came across tax lien investing recently and wanted to give it a try. In my state (colorado), you will earn an interest rate of 10%. This is all very new to me and wanted to reach out to this community to. I’m in sc.

Beyond Tax and Account Services

I came across tax lien investing recently and wanted to give it a try. I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. This is all very new to me and wanted to reach out to this community to. Not many tax lien.

Not Many Tax Lien Investors Invest In States That Only Issue Tax Deeds Or Hybrids.

I came across tax lien investing recently and wanted to give it a try. In my state (colorado), you will earn an interest rate of 10%. I’m in sc which is arguably one of the best states to invest in tax liens because our right to redemption period is only 12 months. This is all very new to me and wanted to reach out to this community to.