Investing In Tax Lien

Investing In Tax Lien - To do tax lien investing, the following events must take place: To trigger a tax lien on a. A homeowner or landowner defaults.

To trigger a tax lien on a. To do tax lien investing, the following events must take place: A homeowner or landowner defaults.

To do tax lien investing, the following events must take place: To trigger a tax lien on a. A homeowner or landowner defaults.

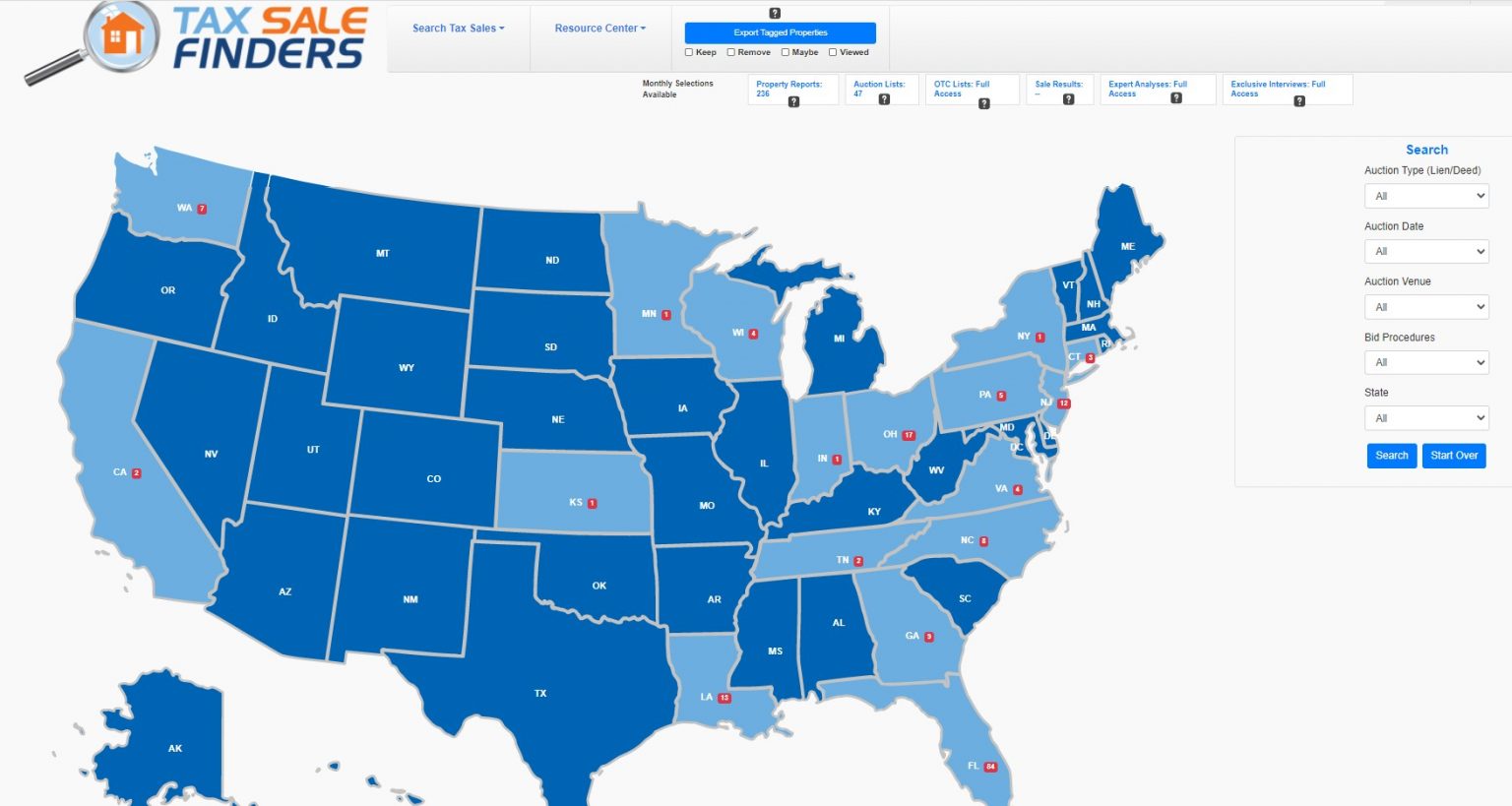

Tax Lien Investing Tips Which States have tax sales in the next 30

To do tax lien investing, the following events must take place: A homeowner or landowner defaults. To trigger a tax lien on a.

Tax Lien Investing A Unique Avenue in Real Estate Investments Wealth

To do tax lien investing, the following events must take place: A homeowner or landowner defaults. To trigger a tax lien on a.

Tax Lien Investing What is Tax Lien Investing?

A homeowner or landowner defaults. To trigger a tax lien on a. To do tax lien investing, the following events must take place:

Why Tax Lien Investing A Good Business? Tax Lien Certificate School

To trigger a tax lien on a. To do tax lien investing, the following events must take place: A homeowner or landowner defaults.

ABCs of Tax Lien and Deed Investing Special 90 Off Tax Lien

To do tax lien investing, the following events must take place: To trigger a tax lien on a. A homeowner or landowner defaults.

Tax Lien and Tax Deed Investing ReaderHouse

To trigger a tax lien on a. To do tax lien investing, the following events must take place: A homeowner or landowner defaults.

Tax Lien Investing Tips Tax Lien Investing Tips brought to you by

A homeowner or landowner defaults. To trigger a tax lien on a. To do tax lien investing, the following events must take place:

Tax Lien Investing A Beginner's Guide FortuneBuilders

To trigger a tax lien on a. A homeowner or landowner defaults. To do tax lien investing, the following events must take place:

What are Tax Lien Investing Benefits? Finance.Gov.Capital

A homeowner or landowner defaults. To do tax lien investing, the following events must take place: To trigger a tax lien on a.

A Homeowner Or Landowner Defaults.

To do tax lien investing, the following events must take place: To trigger a tax lien on a.