Kansas City Mo Local Tax

Kansas City Mo Local Tax - We have information on the local income tax rates in 2 localities in missouri. Therefore, the amount of tax businesses collect from the purchaser. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Are we responsible for local taxes? How to use quick tax? You can click on any city or county for more details, including the. My business has a single employee working from a home office location in kansas city, missouri. Cities, counties, and certain districts may also impose local sales tax; Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to.

Therefore, the amount of tax businesses collect from the purchaser. How to use quick tax? Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. You can click on any city or county for more details, including the. My business has a single employee working from a home office location in kansas city, missouri. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. Cities, counties, and certain districts may also impose local sales tax; We have information on the local income tax rates in 2 localities in missouri. Are we responsible for local taxes? Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income.

How to use quick tax? Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Therefore, the amount of tax businesses collect from the purchaser. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. You can click on any city or county for more details, including the. Cities, counties, and certain districts may also impose local sales tax; We have information on the local income tax rates in 2 localities in missouri. My business has a single employee working from a home office location in kansas city, missouri. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. Are we responsible for local taxes?

Resident Engagement

Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. Cities, counties, and certain districts may also impose local sales tax; You can.

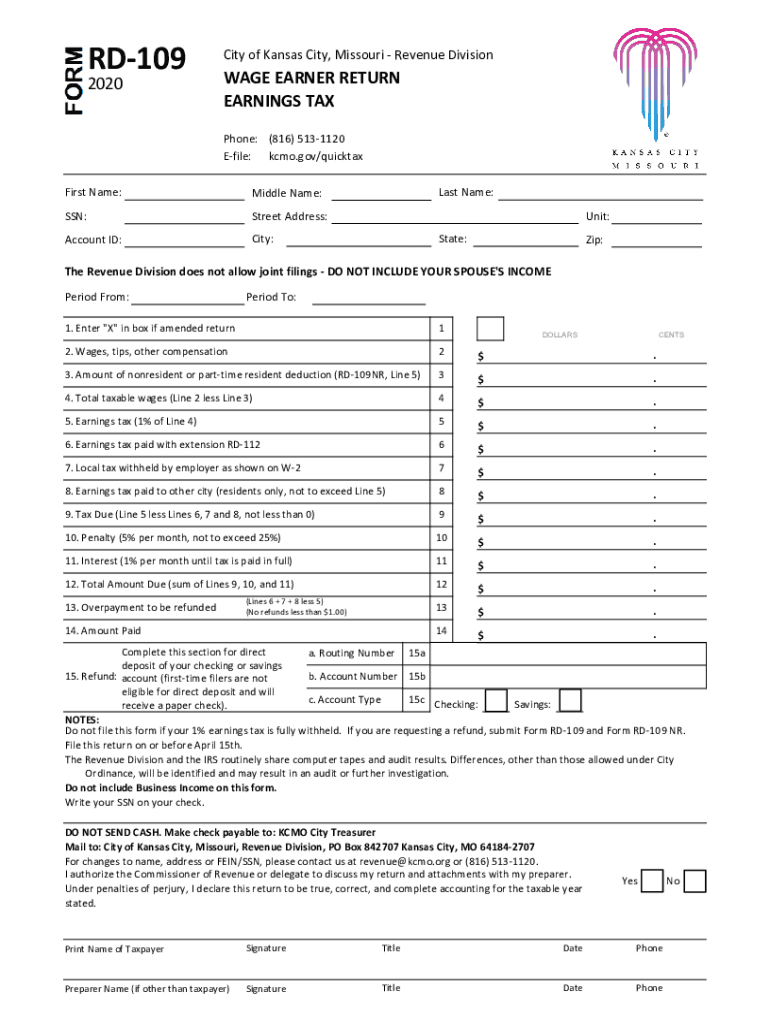

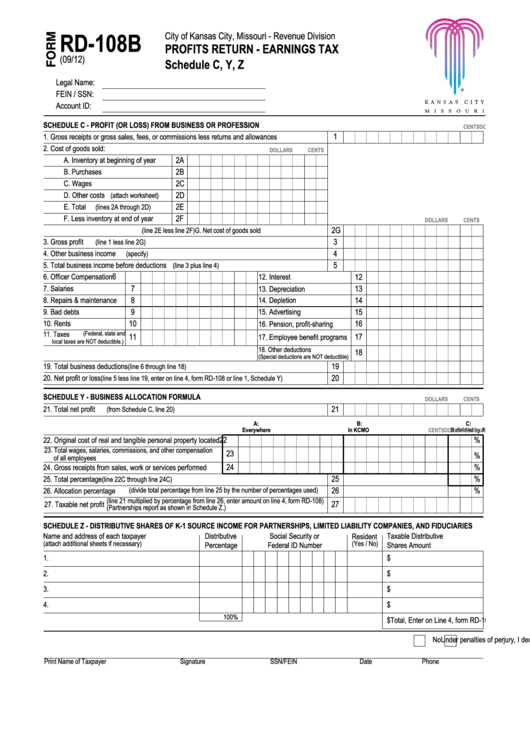

MO RD109 Kansas City 20202022 Fill out Tax Template Online US

Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Therefore, the amount of tax businesses collect from the purchaser. Are we responsible for local taxes? Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance.

Map of Kansas City, MO, Missouri

We have information on the local income tax rates in 2 localities in missouri. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. You can click on any city or county for more details, including the. Are we responsible for local taxes? My business has a single employee.

Map of Kansas City MO

Are we responsible for local taxes? We have information on the local income tax rates in 2 localities in missouri. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Quick tax is an online system kcmo taxpayers may use to file tax returns,.

Top 7 Kansas City Tax Forms And Templates free to download in PDF format

We have information on the local income tax rates in 2 localities in missouri. My business has a single employee working from a home office location in kansas city, missouri. Are we responsible for local taxes? You can click on any city or county for more details, including the. Forms to be filed with the division other than tax returns.

Kansas City Missouri Logo LogoDix

How to use quick tax? We have information on the local income tax rates in 2 localities in missouri. My business has a single employee working from a home office location in kansas city, missouri. Cities, counties, and certain districts may also impose local sales tax; Therefore, the amount of tax businesses collect from the purchaser.

Race, Diversity, and Ethnicity in Kansas City, MO

You can click on any city or county for more details, including the. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. Therefore, the amount of tax businesses collect from the purchaser. Are we responsible for local taxes? Quick tax is an online system kcmo taxpayers may use.

kansas city, mo Olivia Rodrigo Official Store

You can click on any city or county for more details, including the. Therefore, the amount of tax businesses collect from the purchaser. We have information on the local income tax rates in 2 localities in missouri. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes.

Best Restaurants In Kansas City, MO

Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. We have information on the local income tax rates in 2 localities in missouri. My business has a single employee working from a home office location in kansas city, missouri. How to use quick tax? You can click on.

Where are the new residents of Kansas City, MO moving from?

Therefore, the amount of tax businesses collect from the purchaser. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. Are we responsible for local taxes? You can click on any city or county for more details, including the. We have information on the local income tax rates in.

How To Use Quick Tax?

Therefore, the amount of tax businesses collect from the purchaser. You can click on any city or county for more details, including the. We have information on the local income tax rates in 2 localities in missouri. Are we responsible for local taxes?

My Business Has A Single Employee Working From A Home Office Location In Kansas City, Missouri.

Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. Cities, counties, and certain districts may also impose local sales tax;