Local Earned Income Tax For Pa

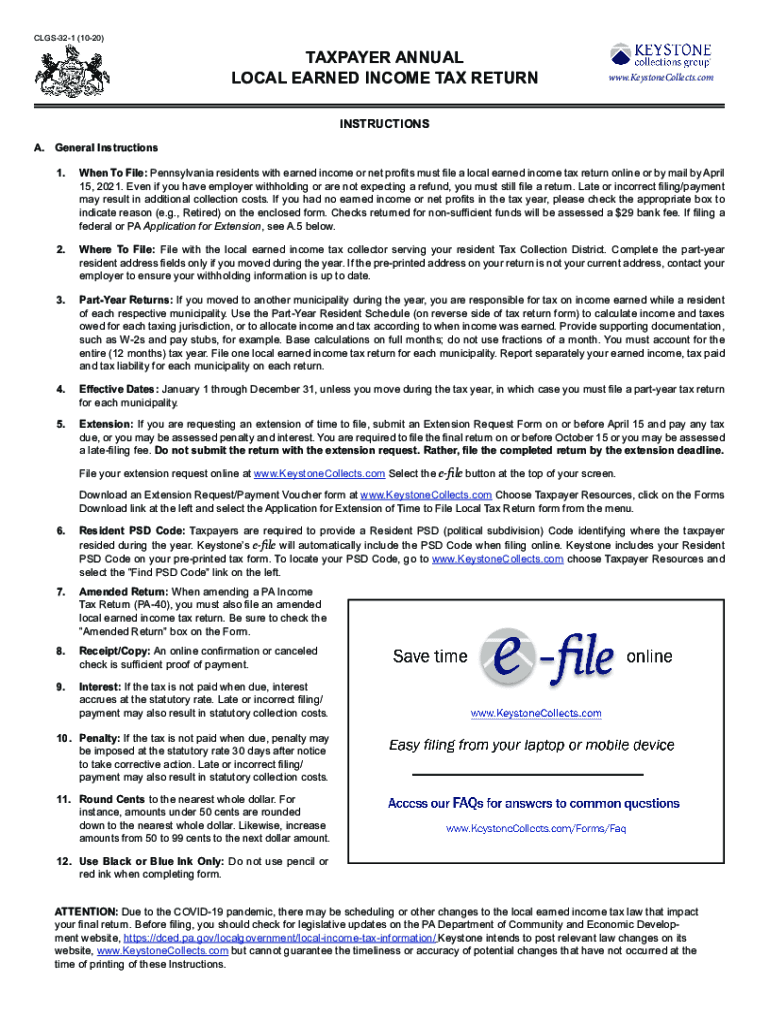

Local Earned Income Tax For Pa - Dced local government services act 32: Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. We have information on the local income tax rates in 12 localities in pennsylvania. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Employers with worksites located in pennsylvania are required. Employers with worksites located in pennsylvania are required to withhold and remit the local. You can click on any city or county for more details, including. If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be. Local income tax requirements for employers.

Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers. We have information on the local income tax rates in 12 localities in pennsylvania. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Employers with worksites located in pennsylvania are required. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. You can click on any city or county for more details, including. Dced local government services act 32: If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be.

Local income tax requirements for employers. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be. We have information on the local income tax rates in 12 localities in pennsylvania. Employers with worksites located in pennsylvania are required to withhold and remit the local. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Employers with worksites located in pennsylvania are required. You can click on any city or county for more details, including. Dced local government services act 32:

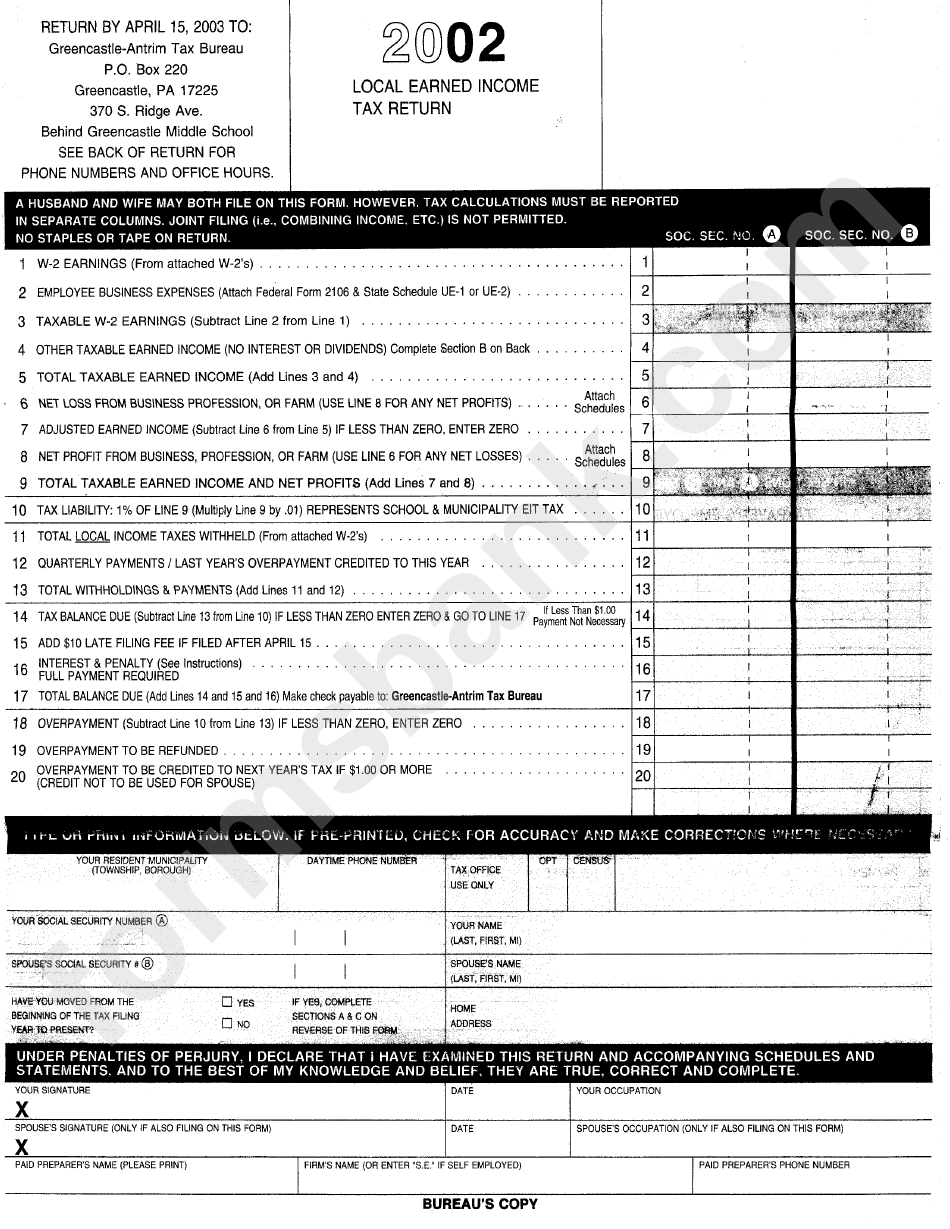

Local Earned Tax Return GreencastleAntrim, 2002 printable pdf

We have information on the local income tax rates in 12 localities in pennsylvania. You can click on any city or county for more details, including. Dced local government services act 32: Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers.

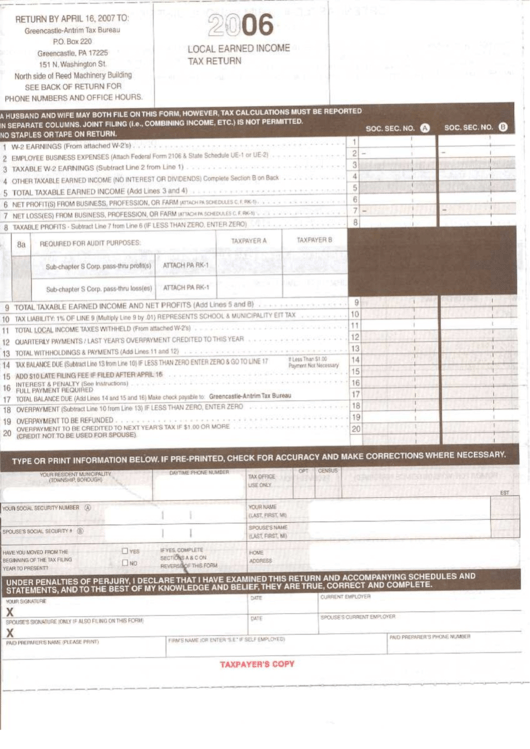

Local Earned Tax Return Form printable pdf download

Employers with worksites located in pennsylvania are required to withhold and remit the local. You can click on any city or county for more details, including. Dced local government services act 32: Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Employers with worksites located in.

Tax Forms Pa Tax Forms Printable

For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be. Dced local government services act 32: We have information on the local.

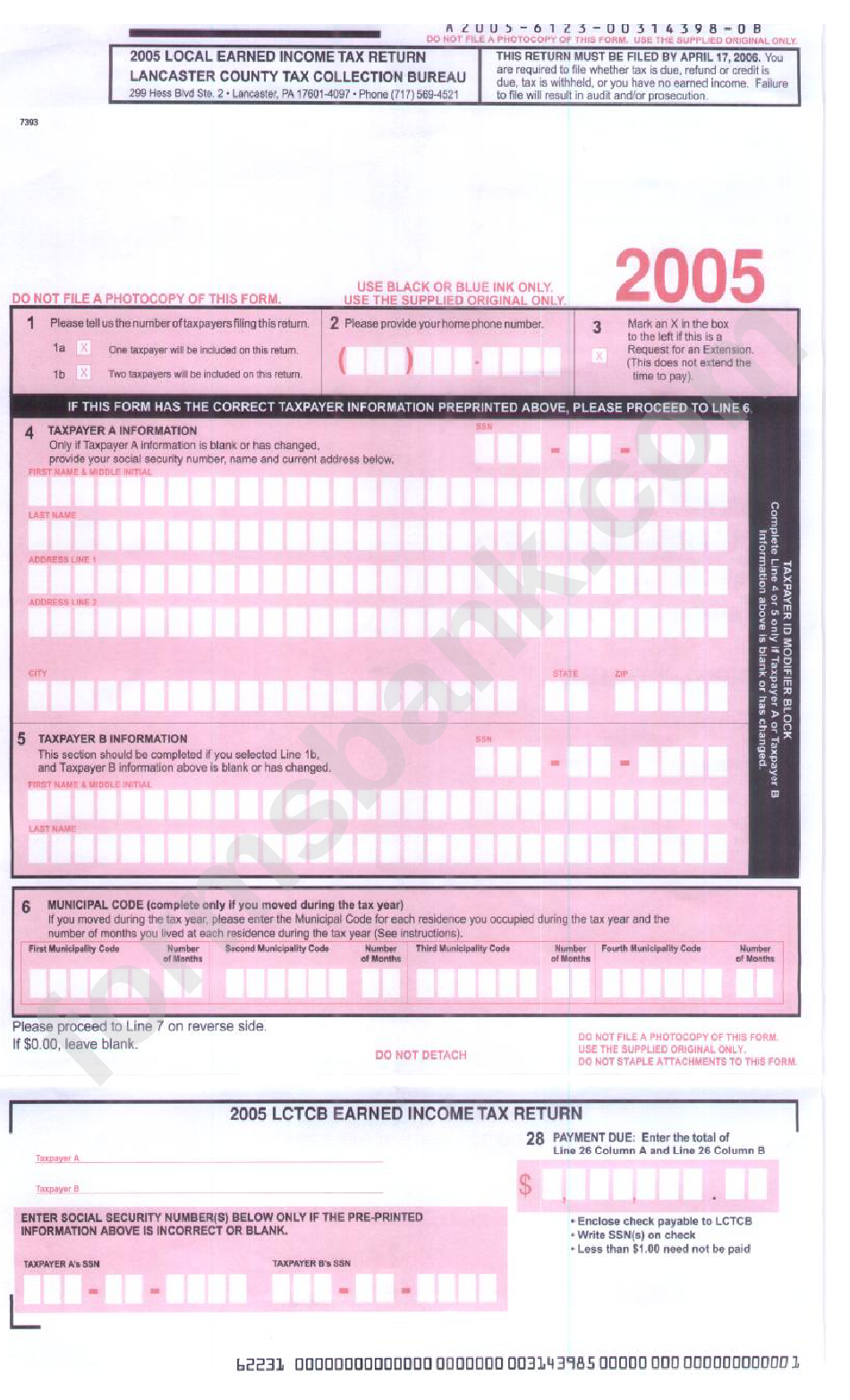

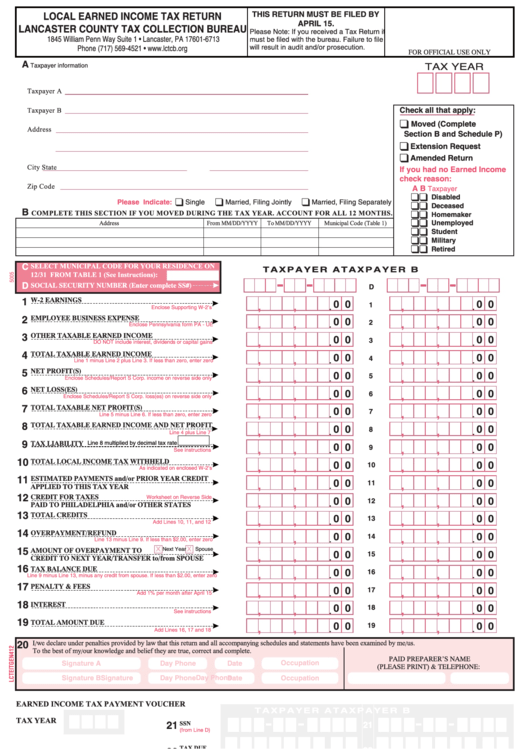

Local Earned Tax Return Form Lancaster County 2005 printable

If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be. We have information on the local income tax rates in 12 localities in pennsylvania. Local income tax requirements for employers. Pennsylvania residents with earned income or net profits must file a local.

Cumberland County Pa Local Earned Tax Return

You can click on any city or county for more details, including. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be..

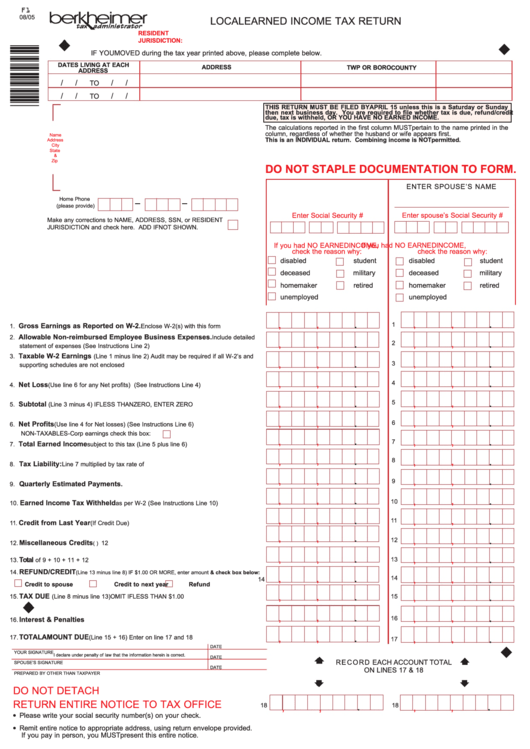

Form F1 Local Earned Tax Return Pennsylvania printable pdf

Employers with worksites located in pennsylvania are required. We have information on the local income tax rates in 12 localities in pennsylvania. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or.

Fillable Online Local Earned Tax Return Form Fax Email Print

Dced local government services act 32: For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Employers with worksites located in pennsylvania are required to withhold and remit the local. If you live in a jurisdiction with an earned income tax in place and had wages for the year in.

Fillable Local Earned Tax Form Pa Printable Forms Free Online

You can click on any city or county for more details, including. Dced local government services act 32: If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be. Employers with worksites located in pennsylvania are required to withhold and remit the local..

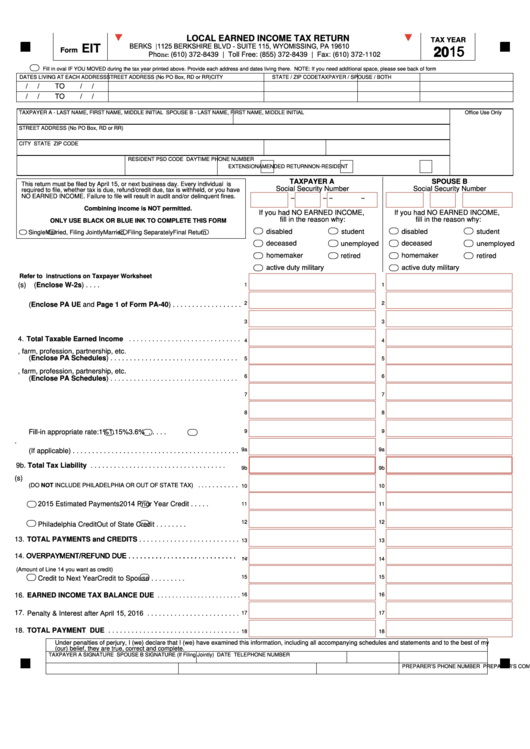

Fillable Local Earned Tax Return Pa Eit 2015 printable pdf download

We have information on the local income tax rates in 12 localities in pennsylvania. Dced local government services act 32: Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Employers with worksites located in pennsylvania are required to withhold and remit the local. Employers with worksites.

Local Earned Tax Return Form Lancaster County 2005 Printable

Employers with worksites located in pennsylvania are required to withhold and remit the local. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Employers with worksites located in pennsylvania are required. We have information on the local income tax rates in 12 localities in pennsylvania. If you live in.

You Can Click On Any City Or County For More Details, Including.

Dced local government services act 32: Employers with worksites located in pennsylvania are required. Employers with worksites located in pennsylvania are required to withhold and remit the local. We have information on the local income tax rates in 12 localities in pennsylvania.

Pennsylvania Residents With Earned Income Or Net Profits Must File A Local Earned Income Tax Return Online Or By Mail By April 15.

For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be. Local income tax requirements for employers.