Local Income Tax Maryland By Zipcode

Local Income Tax Maryland By Zipcode - The rates vary from 2.62% to 3.20%. You should report your local income tax amount. Median local tax rates of maryland’s 23 counties and baltimore city. Archive of comparison reports for local income tax distributions by counties, cities, and towns. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the. The rates vary from 2.2480% to 3.20% for real property tax and from. Click on any county for more details, including the nonresident income tax. 27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Withholding is a combination of the state income tax, which has rates. Find the local income tax rates for each county in maryland by fiscal year.

Archive of comparison reports for local income tax distributions by counties, cities, and towns. Find the local income tax rates for each county in maryland for different tax years and income levels. 27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the. Click on any county for more details, including the nonresident income tax. Median local tax rates of maryland’s 23 counties and baltimore city. Withholding is a combination of the state income tax, which has rates. Find the local income tax rates for each county in maryland by fiscal year. Find the local income tax rates in 24 localities in maryland for 2024. You should report your local income tax amount.

The rates vary from 2.62% to 3.20%. Click on any county for more details, including the nonresident income tax. Withholding is a combination of the state income tax, which has rates. You should report your local income tax amount. The rates vary from 2.2480% to 3.20% for real property tax and from. Archive of comparison reports for local income tax distributions by counties, cities, and towns. Median local tax rates of maryland’s 23 counties and baltimore city. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the. 27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Find the local income tax rates for each county in maryland for different tax years and income levels.

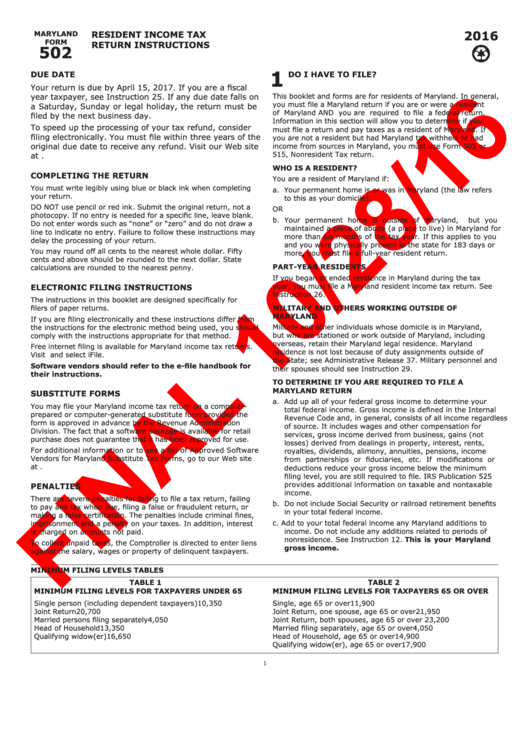

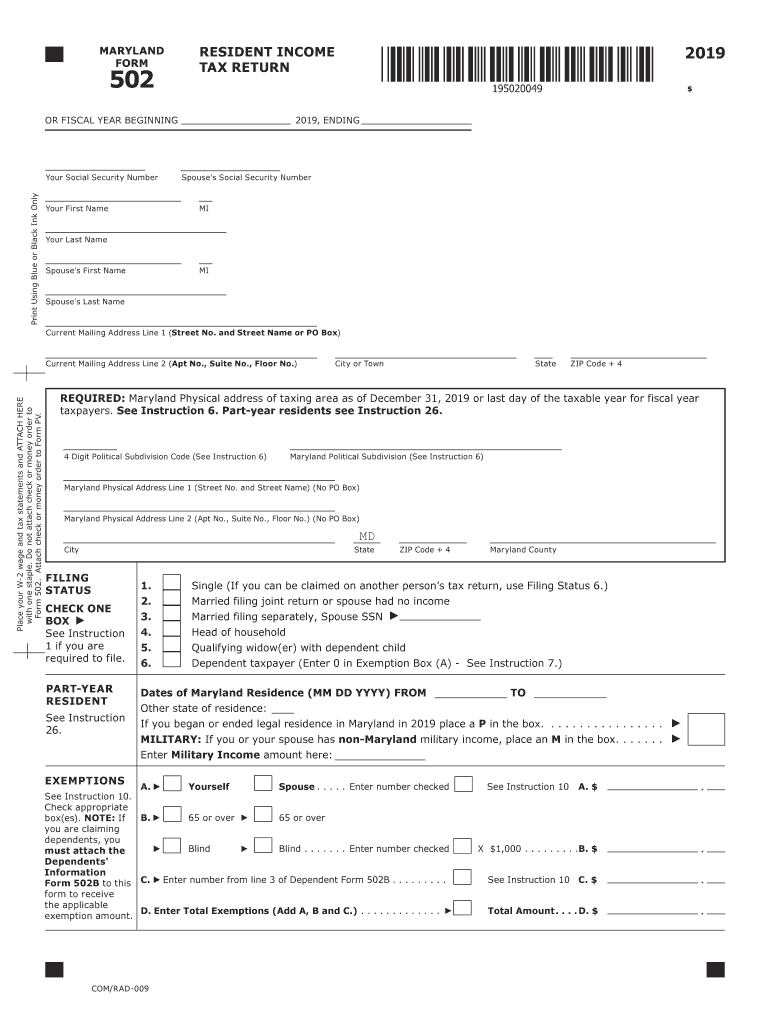

Instructions For Resident Tax Return (Maryland Form 502

Find the local income tax rates for each county in maryland by fiscal year. 27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Find the local income tax rates in 24 localities in maryland for 2024. You should report your local income tax amount. Median local tax rates of maryland’s 23.

Maryland form 502 instructions 2023 Fill out & sign online DocHub

Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the. Withholding is a combination of the state income tax, which has rates. The rates vary from 2.2480% to 3.20% for real property tax and from. You should report your local income tax amount. Find the.

Maryland Local Tax Reform Details & Analysis

Find the local income tax rates for each county in maryland by fiscal year. Click on any county for more details, including the nonresident income tax. Withholding is a combination of the state income tax, which has rates. Find the local income tax rates for each county in maryland for different tax years and income levels. 27 rows local officials.

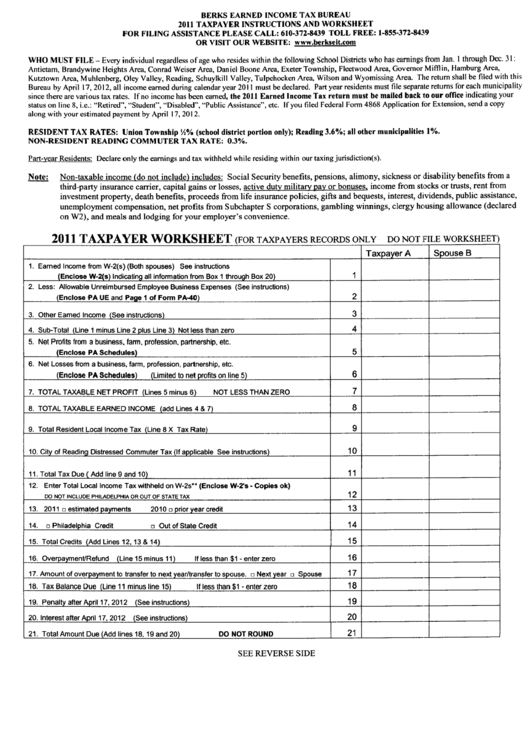

Instructions And Definitions For Filing Final Return For Local Earned

Median local tax rates of maryland’s 23 counties and baltimore city. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the. 27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Archive of comparison reports for local.

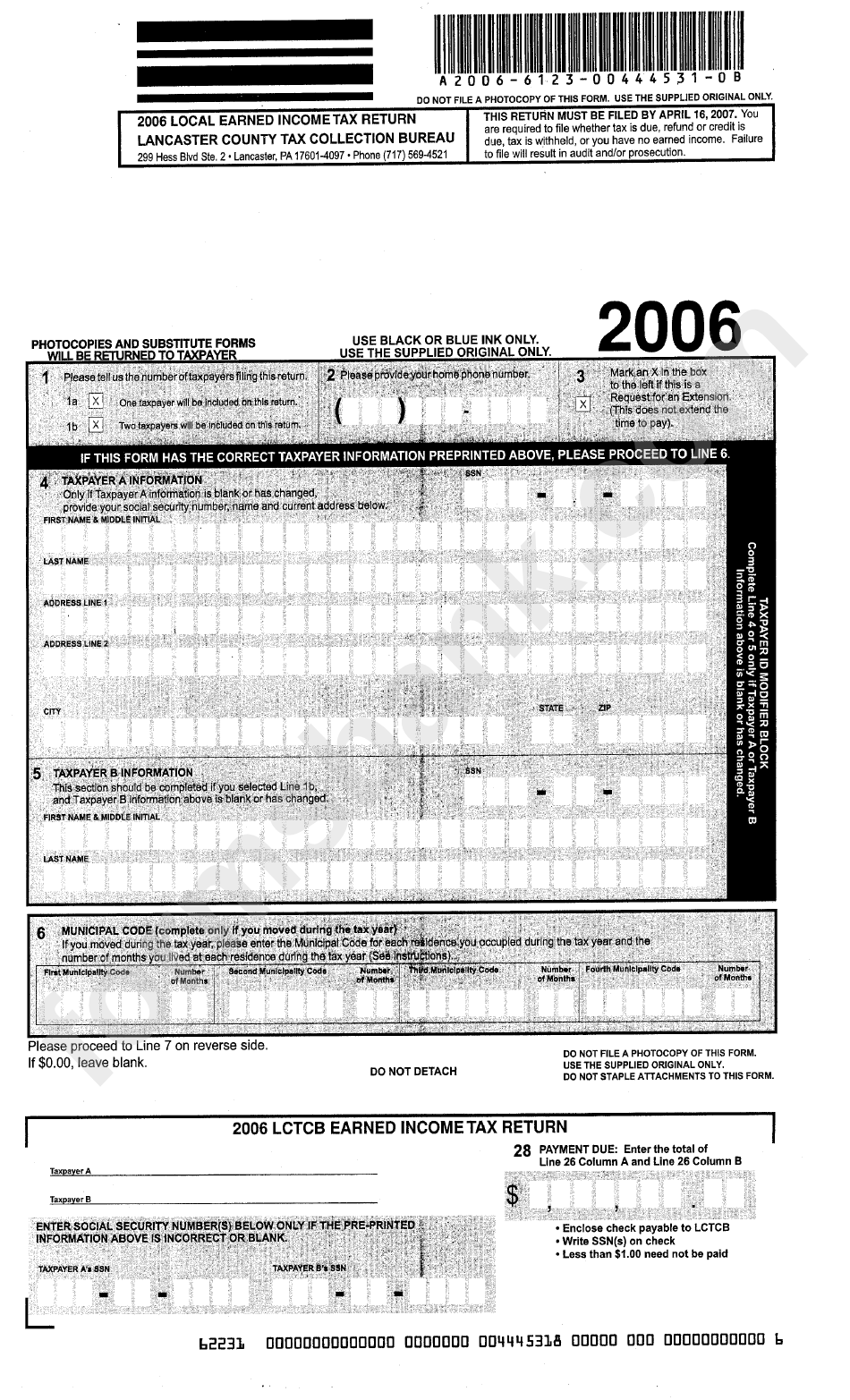

Local Earned Tax Return Form 2006 Lancaster County Tax

27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Archive of comparison reports for local income tax distributions by counties, cities, and towns. Find the local income tax rates for each county in maryland for different tax years and income levels. Median local tax rates of maryland’s 23 counties and baltimore.

Maryland lawmakers could soon eliminate state tax for retirees

Withholding is a combination of the state income tax, which has rates. Archive of comparison reports for local income tax distributions by counties, cities, and towns. The rates vary from 2.2480% to 3.20% for real property tax and from. Find the local income tax rates in 24 localities in maryland for 2024. Find the local income tax rates for each.

Maryland Tax Deadline 2024 Adah Linnie

You should report your local income tax amount. Archive of comparison reports for local income tax distributions by counties, cities, and towns. Find the local income tax rates for each county in maryland for different tax years and income levels. The rates vary from 2.62% to 3.20%. 27 rows local officials set the rates, which range between 2.25% and 3.20%.

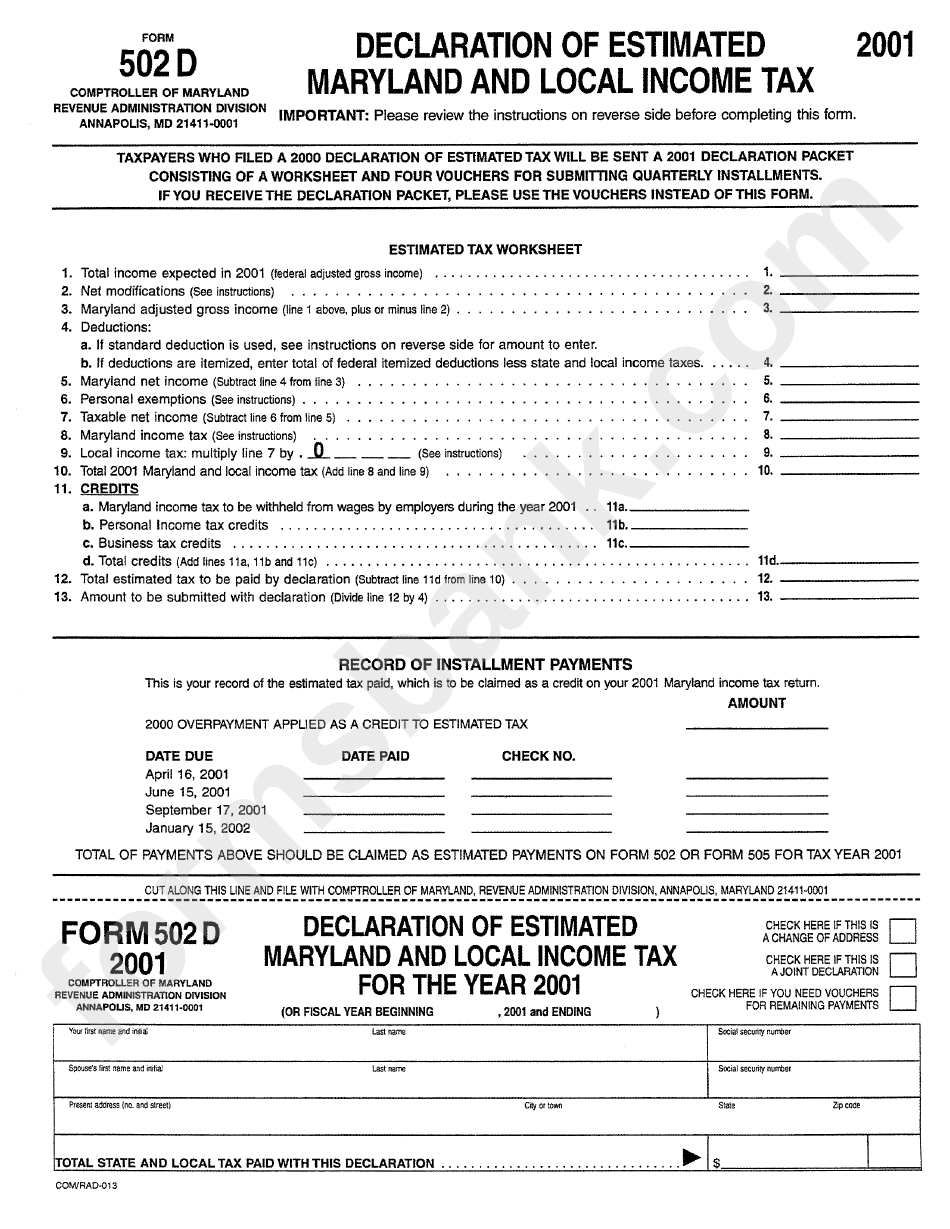

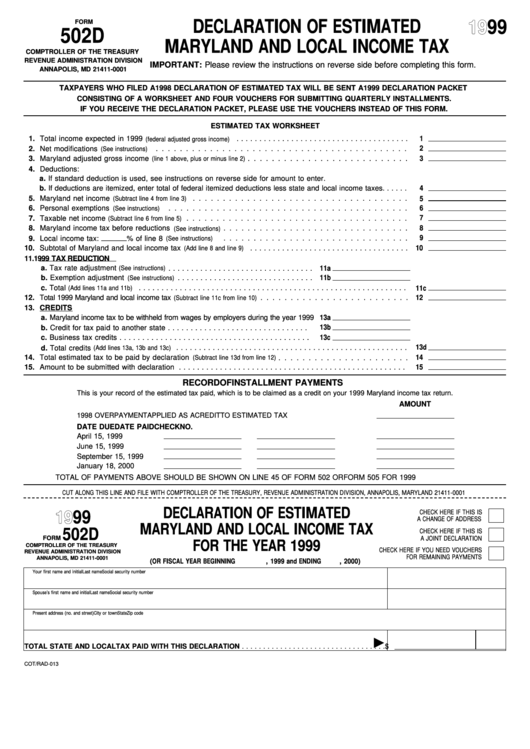

Form 502d Declaration Of Estimated Maryland And Local Tax

Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the. Click on any county for more details, including the nonresident income tax. The rates vary from 2.2480% to 3.20% for real property tax and from. Median local tax rates of maryland’s 23 counties and baltimore.

Fillable Form 502 D Declaration Of Estimated Maryland And Local

Find the local income tax rates in 24 localities in maryland for 2024. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the. Find the local income tax rates for each county in maryland for different tax years and income levels. You should report your.

Maryland Tax Calculator 2024 2025

Find the local income tax rates for each county in maryland for different tax years and income levels. The rates vary from 2.2480% to 3.20% for real property tax and from. Median local tax rates of maryland’s 23 counties and baltimore city. Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates,.

The Rates Vary From 2.62% To 3.20%.

Median local tax rates of maryland’s 23 counties and baltimore city. Find the local income tax rates for each county in maryland by fiscal year. You should report your local income tax amount. Withholding is a combination of the state income tax, which has rates.

Find The Local Income Tax Rates In 24 Localities In Maryland For 2024.

27 rows local officials set the rates, which range between 2.25% and 3.20% for the current tax year. The rates vary from 2.2480% to 3.20% for real property tax and from. Archive of comparison reports for local income tax distributions by counties, cities, and towns. Find the local income tax rates for each county in maryland for different tax years and income levels.

Click On Any County For More Details, Including The Nonresident Income Tax.

Counties are responsible for the county tax rates, local towns and cities are responsible for their tax rates, and the state is responsible for the.