Local Pennsylvania Tax Forms

Local Pennsylvania Tax Forms - Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Commonwealth of pennsylvania government websites and email systems use. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Dced local government services act 32: Local, state, and federal government websites often end in.gov. Employers with worksites located in pennsylvania are required. Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15.

Local income tax requirements for employers. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Local, state, and federal government websites often end in.gov. Employers with worksites located in pennsylvania are required. Employers with worksites located in pennsylvania are required to withhold and remit the local. Commonwealth of pennsylvania government websites and email systems use. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. Dced local government services act 32: For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you.

Local, state, and federal government websites often end in.gov. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. Commonwealth of pennsylvania government websites and email systems use. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Dced local government services act 32: Employers with worksites located in pennsylvania are required. Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15.

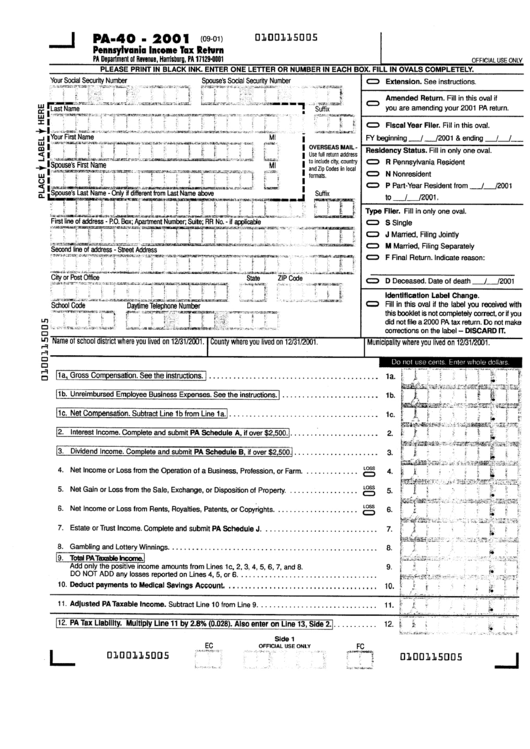

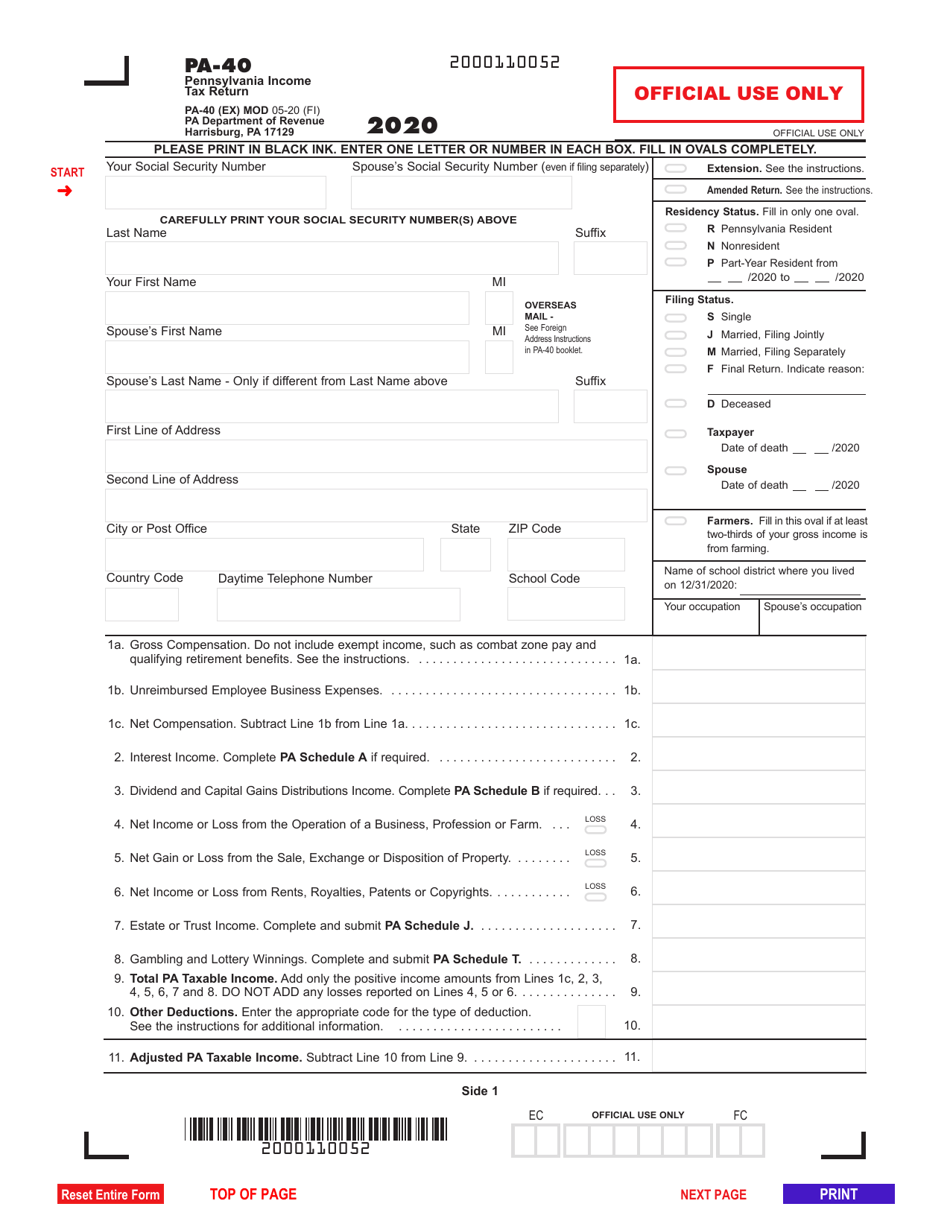

Form Pa40 Pennsylvania Tax Return 2001 printable pdf download

Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Local, state, and federal government websites often end in.gov. Commonwealth of pennsylvania government websites and.

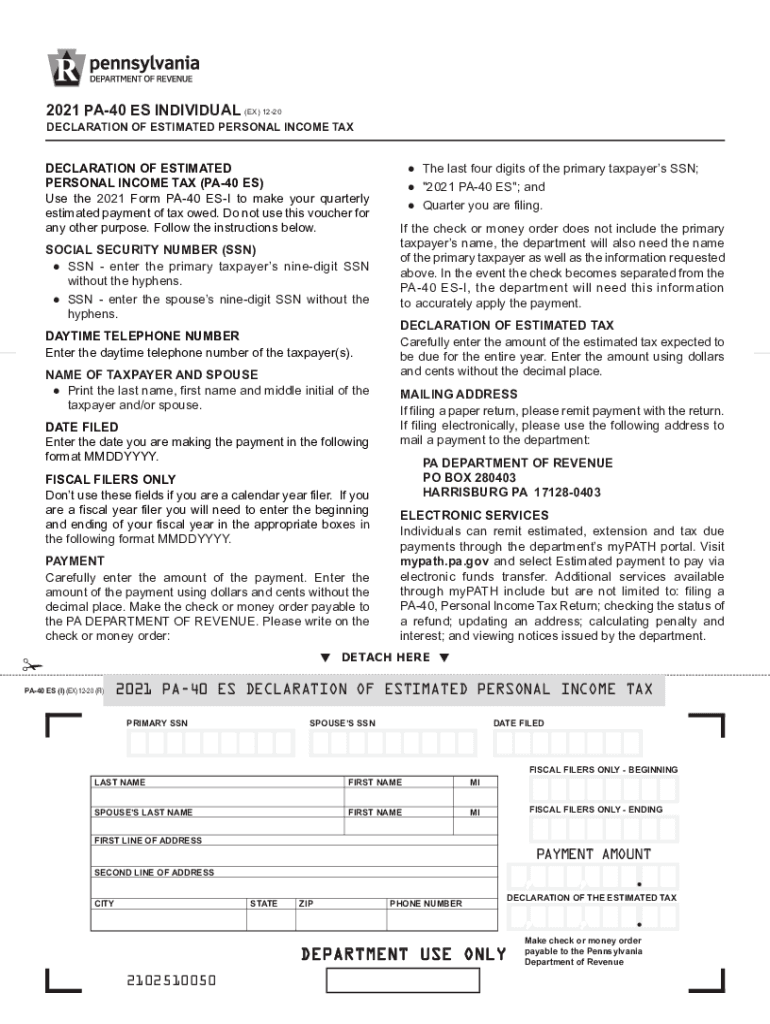

Printable Pennsylvania State Tax Forms Printable Forms Free Online

Local, state, and federal government websites often end in.gov. Employers with worksites located in pennsylvania are required to withhold and remit the local. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Commonwealth of pennsylvania government websites and email systems use. For local earned income tax.

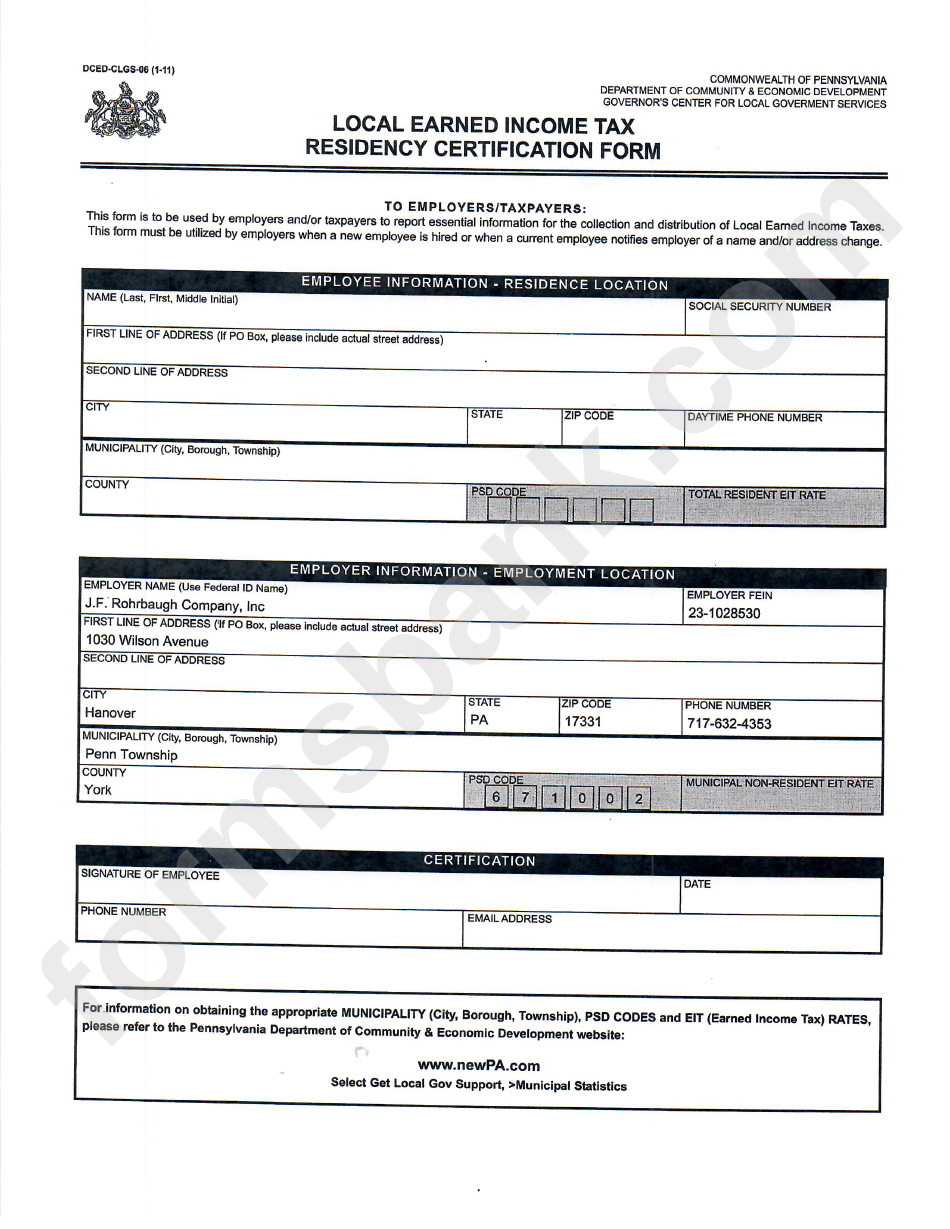

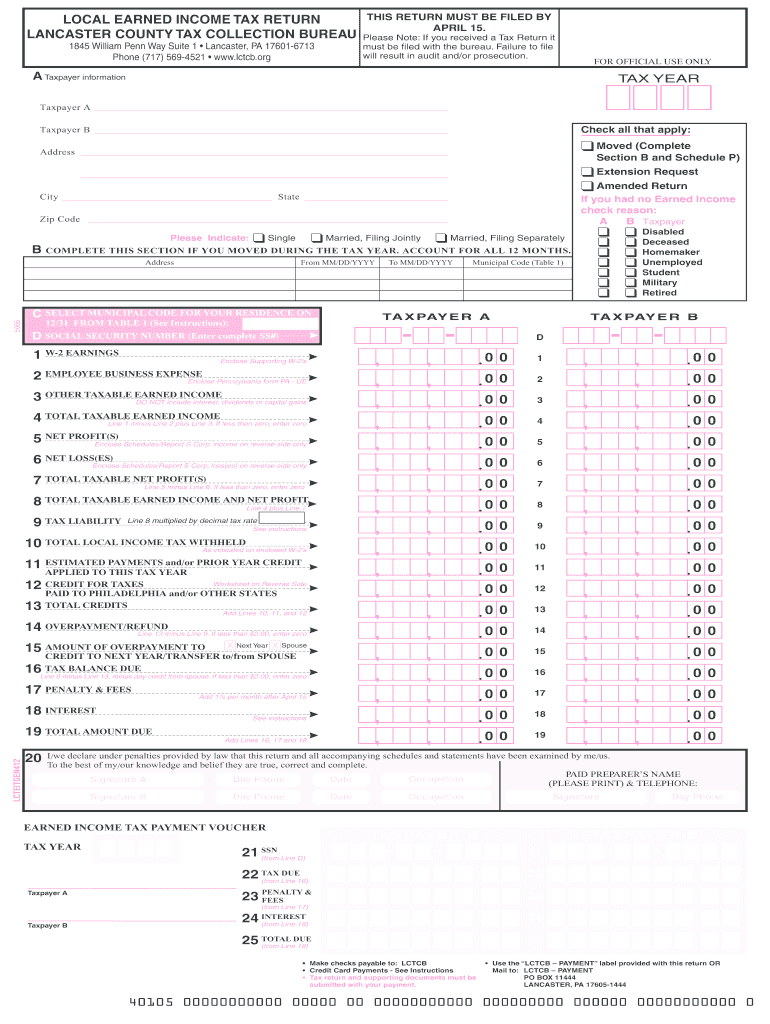

Printable Pa Local Tax Form Printable Forms Free Online

Local income tax requirements for employers. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Employers with worksites located in pennsylvania are required to withhold and.

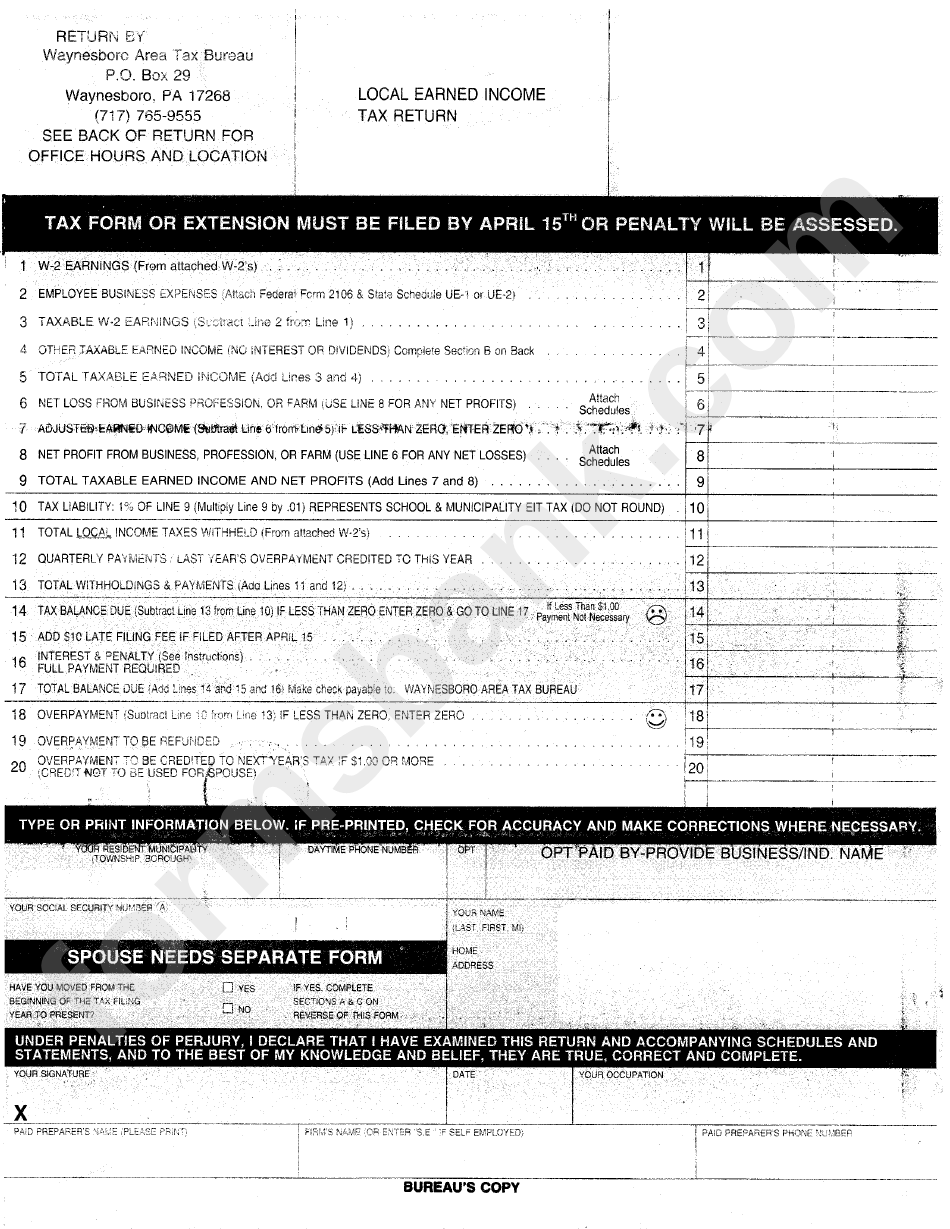

Local Earned Tax Return Form printable pdf download

Local income tax requirements for employers. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Commonwealth of pennsylvania government websites and email systems use. Dced local.

Fillable Local Earned Tax Form Pa Printable Forms Free Online

Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Local income tax requirements for employers. Dced local government services act 32: Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. Employers with.

PA REV72 2017 Fill out Tax Template Online US Legal Forms

Employers with worksites located in pennsylvania are required. Dced local government services act 32: Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount.

2023 Pa Tax Exempt Form Printable Forms Free Online

Commonwealth of pennsylvania government websites and email systems use. Local, state, and federal government websites often end in.gov. Employers with worksites located in pennsylvania are required. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Assuming the current pennsylvania state tax rate is 3.07% for the.

Pa Printable Tax Forms

Local, state, and federal government websites often end in.gov. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Local income tax requirements for employers. Commonwealth.

Tax Forms Pa Local Tax Forms

Dced local government services act 32: Local income tax requirements for employers. Employers with worksites located in pennsylvania are required to withhold and remit the local. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Employers with worksites located in pennsylvania are required.

Pennsylvania State Fillable Tax Forms Printable Forms Free Online

Local, state, and federal government websites often end in.gov. Employers with worksites located in pennsylvania are required to withhold and remit the local. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Commonwealth of pennsylvania government websites and email systems use. Dced local government services act 32:

Employers With Worksites Located In Pennsylvania Are Required To Withhold And Remit The Local.

Dced local government services act 32: Local income tax requirements for employers. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Employers with worksites located in pennsylvania are required.

Commonwealth Of Pennsylvania Government Websites And Email Systems Use.

Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Local, state, and federal government websites often end in.gov. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15.