Local Services Tax Pa

Local Services Tax Pa - The local service tax (lst), sometimes called the municipal service tax (mst), is a tax imposed by municipalities in pennsylvania on individuals working within. What is the local services tax? Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and municipal service tax (emst) Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax. Dced local government services act 32: The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax collector(s) for the worksite location(s).

The local service tax (lst), sometimes called the municipal service tax (mst), is a tax imposed by municipalities in pennsylvania on individuals working within. The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and municipal service tax (emst) What is the local services tax? Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax. Dced local government services act 32: You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax collector(s) for the worksite location(s).

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax collector(s) for the worksite location(s). Dced local government services act 32: Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and municipal service tax (emst) The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax. The local service tax (lst), sometimes called the municipal service tax (mst), is a tax imposed by municipalities in pennsylvania on individuals working within. What is the local services tax?

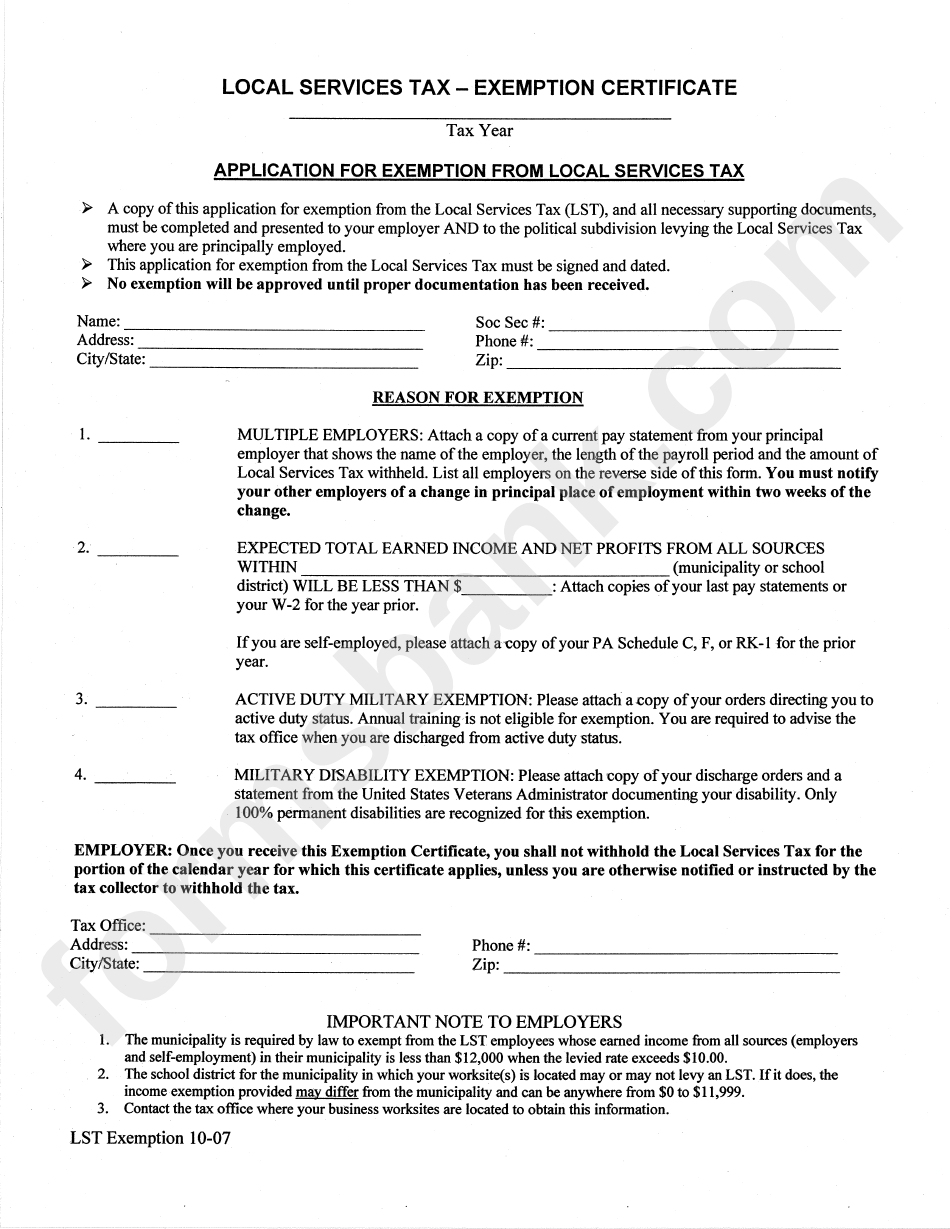

Application For Exemption From Local Services Tax printable pdf download

The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax collector(s) for the worksite location(s). Employers with worksites.

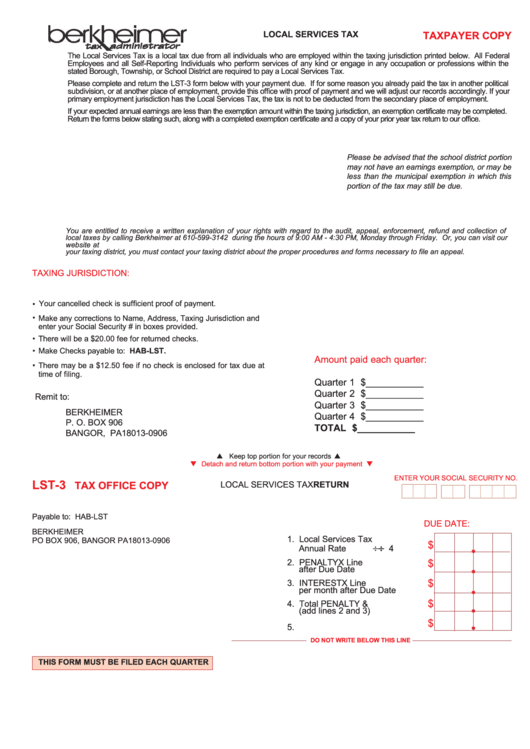

Local Services Tax printable pdf download

Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax collector(s) for the worksite location(s). Local services tax (lst) act 7 of 2007 amends the local.

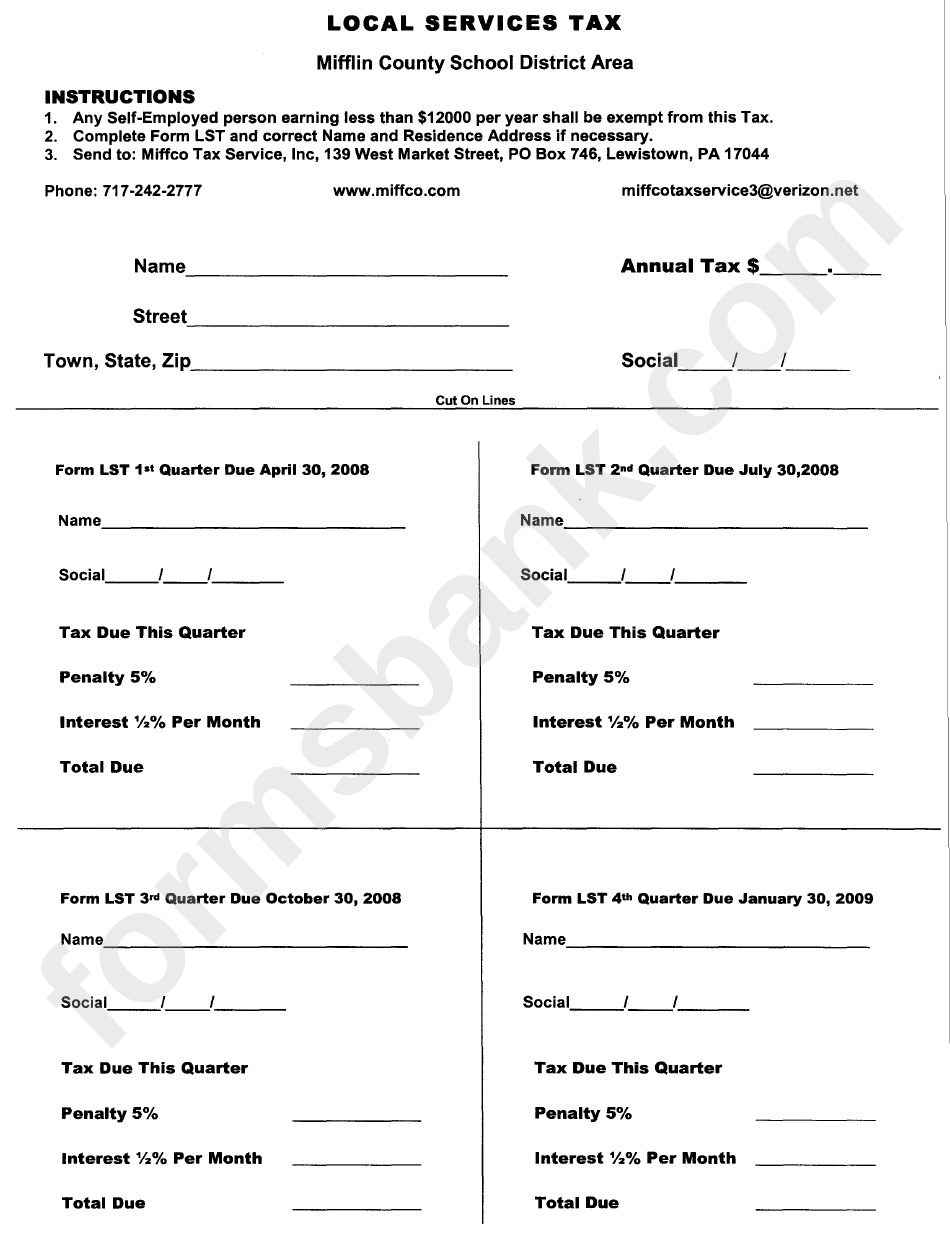

Local Services Tax Form Miffco Tax Service printable pdf download

The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965,.

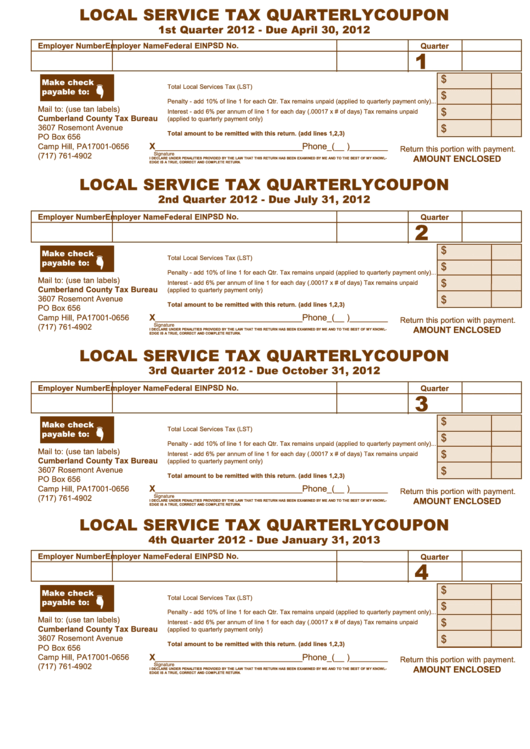

Local Service Tax Quarterly Coupon Cumberland County Tax Bureau

Dced local government services act 32: You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax collector(s) for the worksite location(s). The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction.

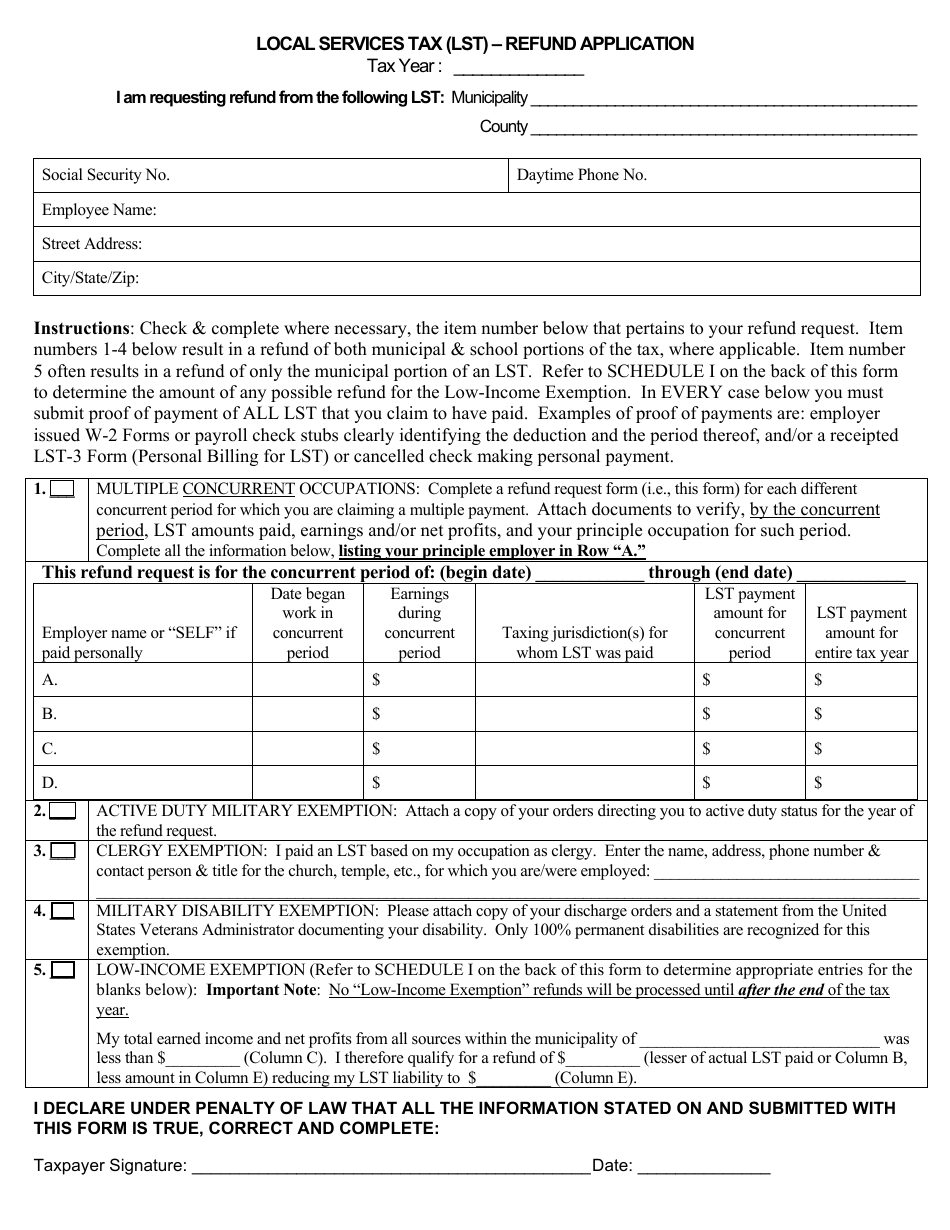

Local Services Tax (Lst) Refund Application Form Fill Out, Sign

Dced local government services act 32: The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. The local service tax (lst), sometimes called the municipal service tax (mst), is a tax imposed by municipalities in pennsylvania on individuals working within. Employers with worksites located in.

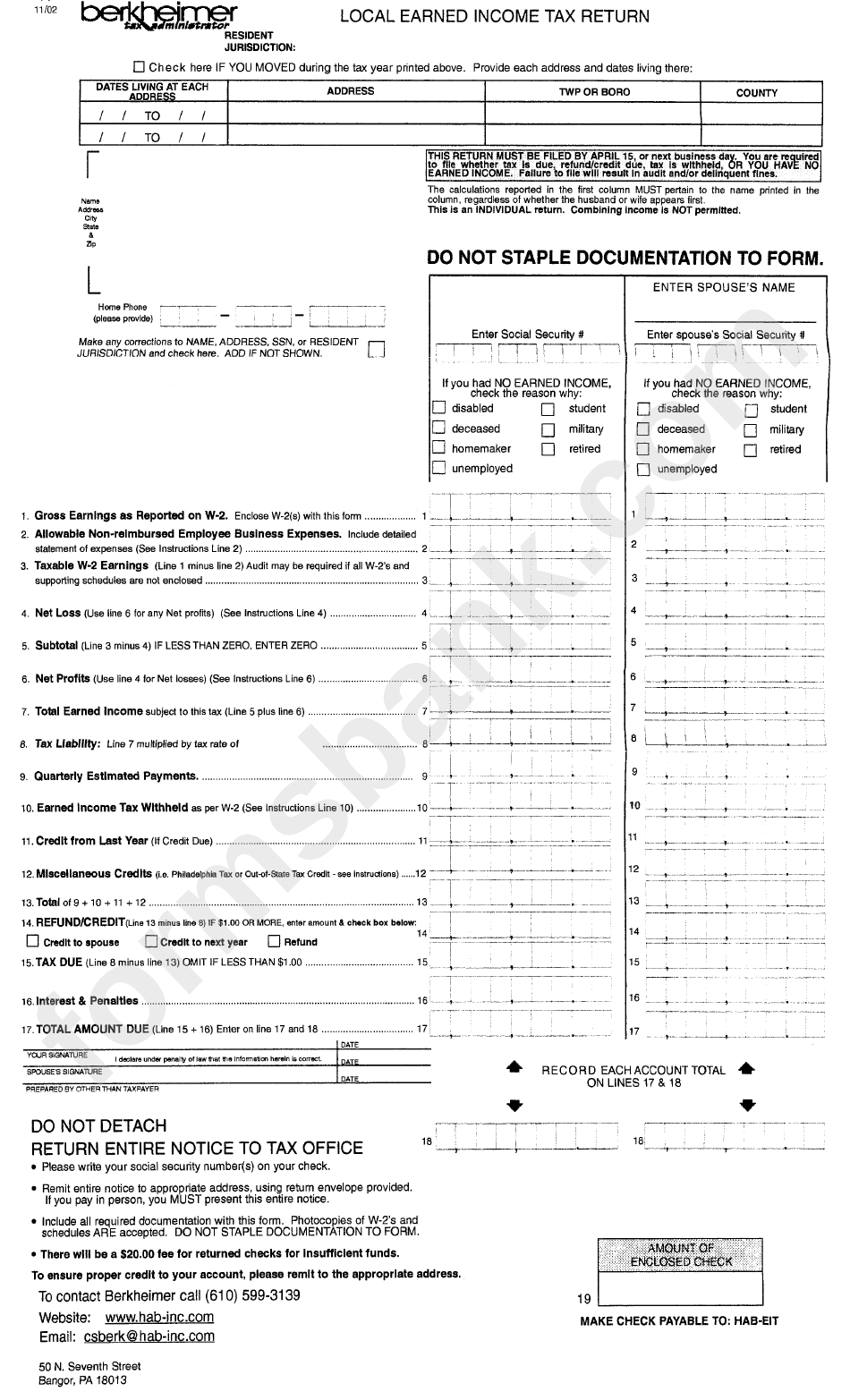

Local Earned Tax Return Form Berkheimer Tax Administrator

Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax. Dced local government services act 32: The local service tax (lst), sometimes called the municipal service tax (mst), is a tax imposed by municipalities in pennsylvania on individuals working within. The local services tax is a local tax payable by all individuals who.

Kels Financial Services Tax Pro Network Independence MO

Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and municipal service tax (emst) The local service tax (lst), sometimes called the municipal service tax (mst), is a tax imposed by municipalities in pennsylvania on individuals working within. The local services tax.

Mifflin County Local Tax Forms

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax collector(s) for the worksite location(s). Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and.

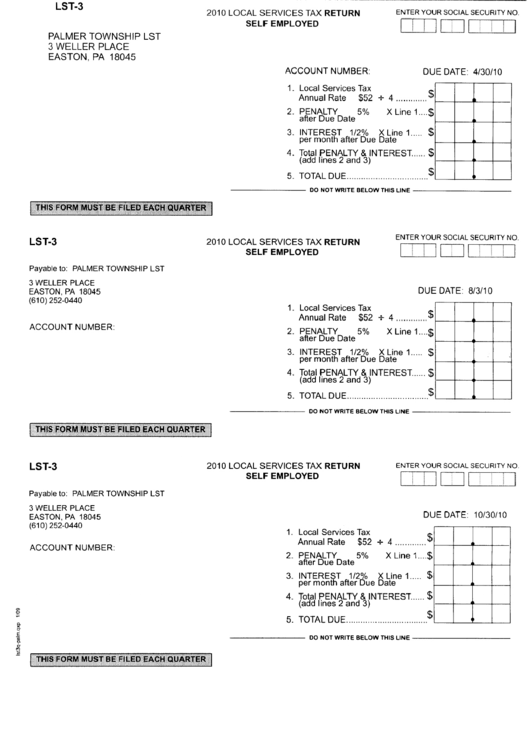

Form Lst3 Local Services Tax Return Self Employed printable pdf

Dced local government services act 32: Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax. What is the local services tax? The local service tax (lst), sometimes called the municipal service tax (mst), is a tax imposed by municipalities in pennsylvania on individuals working within. You are required to withhold the higher.

pa local services tax refund application Mari Peterman

Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and municipal service tax (emst) Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax. You are required to withhold the higher of the two eit.

Employers With Worksites Located In Pennsylvania Are Required To Withhold And Remit The Local Earned Income Tax.

The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the emergency and municipal service tax (emst) What is the local services tax? You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax collector(s) for the worksite location(s).

The Local Service Tax (Lst), Sometimes Called The Municipal Service Tax (Mst), Is A Tax Imposed By Municipalities In Pennsylvania On Individuals Working Within.

Dced local government services act 32: