Montgomery County Tax Lien Sale

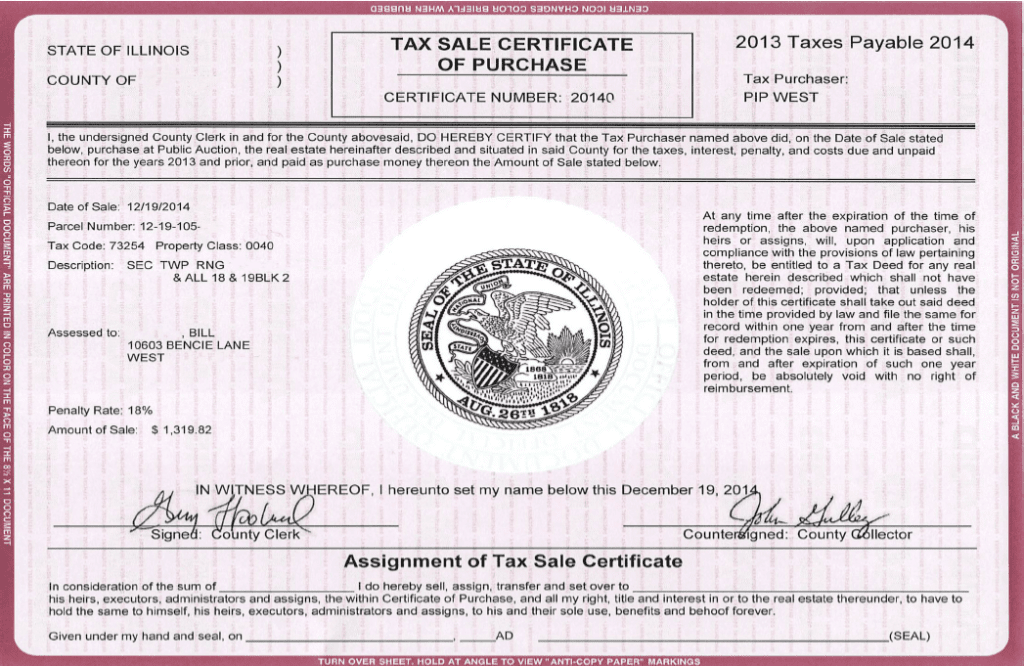

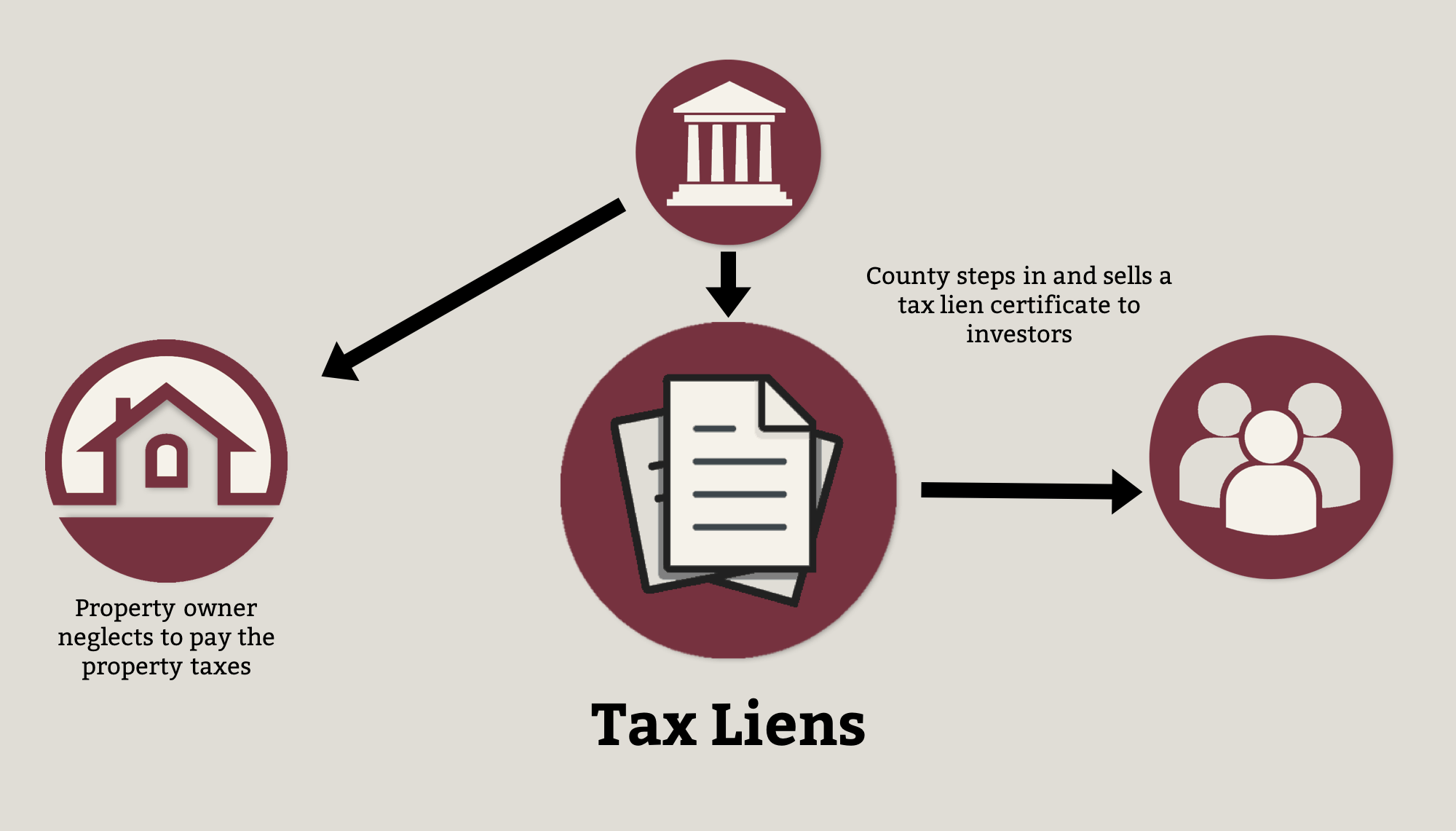

Montgomery County Tax Lien Sale - Sign up for a newsletter or update your subscription preferences. Once sold and the total amount due is paid by the. The tax sale program enables the county to collect all unpaid property taxes, charges, and fees. The upset sale is conducted once a year and is the first sale at which a delinquent taxpayer’s property may be sold. At the tax sale, a property tax lien is offered for sale to the highest bidder. When a property tax lien is sold and the. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. Learn about the new electronic foreclosure auction process and the. Find properties for sale by tax lien or foreclosure in montgomery county, ohio. 2003 tax lien sale result.

Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. When a property tax lien is sold and the. The tax sale program enables the county to collect all unpaid property taxes, charges, and fees. 2003 tax lien sale result. The upset sale is conducted once a year and is the first sale at which a delinquent taxpayer’s property may be sold. The montgomery county tax claim bureau accepts real estate tax liens for delinquent county, township/borough, and school districts. Learn about the new electronic foreclosure auction process and the. Sign up for a newsletter or update your subscription preferences. The montgomery county tax sale program enables the county to collect all unpaid and delinquent property taxes as required by. At the tax sale, a property tax lien is offered for sale to the highest bidder.

The upset sale is conducted once a year and is the first sale at which a delinquent taxpayer’s property may be sold. Once sold and the total amount due is paid by the. When a property tax lien is sold and the. The montgomery county tax sale program enables the county to collect all unpaid and delinquent property taxes as required by. Sign up for a newsletter or update your subscription preferences. Learn about the new electronic foreclosure auction process and the. Find properties for sale by tax lien or foreclosure in montgomery county, ohio. The tax sale program enables the county to collect all unpaid property taxes, charges, and fees. 2003 tax lien sale result. The montgomery county tax claim bureau accepts real estate tax liens for delinquent county, township/borough, and school districts.

Suffolk County Tax Lien Sale 2024 Marne Sharona

The upset sale is conducted once a year and is the first sale at which a delinquent taxpayer’s property may be sold. Find properties for sale by tax lien or foreclosure in montgomery county, ohio. Learn about the new electronic foreclosure auction process and the. Sign up for a newsletter or update your subscription preferences. At the tax sale, a.

Charles County Tax Lien Sale 2024 Bryna Marleah

At the tax sale, a property tax lien is offered for sale to the highest bidder. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. Learn about the new electronic foreclosure auction process and the. The montgomery county tax sale program enables the county to collect all.

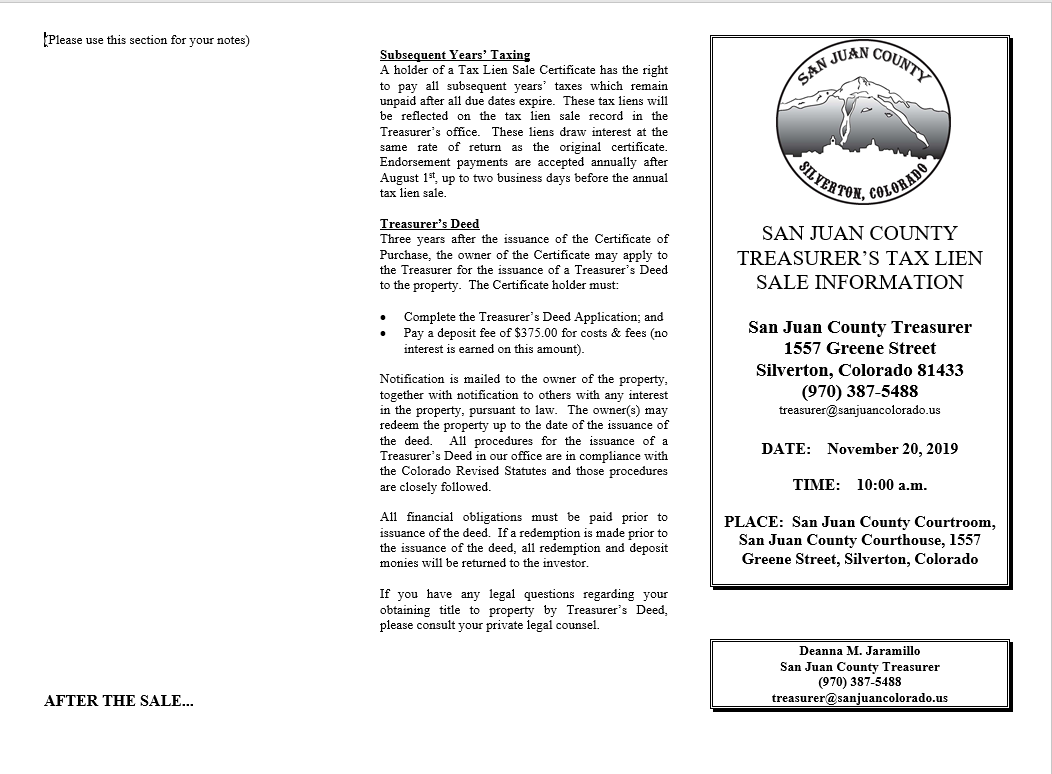

Tax Lien Sale San Juan County

The montgomery county tax claim bureau accepts real estate tax liens for delinquent county, township/borough, and school districts. The tax sale program enables the county to collect all unpaid property taxes, charges, and fees. Once sold and the total amount due is paid by the. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an.

Mohave County Tax Lien Sale 2024 Dore Nancey

The tax sale program enables the county to collect all unpaid property taxes, charges, and fees. Sign up for a newsletter or update your subscription preferences. The montgomery county tax sale program enables the county to collect all unpaid and delinquent property taxes as required by. Find properties for sale by tax lien or foreclosure in montgomery county, ohio. When.

Charles County Tax Lien Sale 2024 Bryna Marleah

Find properties for sale by tax lien or foreclosure in montgomery county, ohio. When a property tax lien is sold and the. Sign up for a newsletter or update your subscription preferences. The montgomery county tax claim bureau accepts real estate tax liens for delinquent county, township/borough, and school districts. The montgomery county tax sale program enables the county to.

Fillable Online NOTICE TO TAXPAYERS Montgomery County Tax Lien Fax

The tax sale program enables the county to collect all unpaid property taxes, charges, and fees. Sign up for a newsletter or update your subscription preferences. Find properties for sale by tax lien or foreclosure in montgomery county, ohio. The upset sale is conducted once a year and is the first sale at which a delinquent taxpayer’s property may be.

Mohave County Tax Lien Sale 2024 Dore Nancey

The upset sale is conducted once a year and is the first sale at which a delinquent taxpayer’s property may be sold. Sign up for a newsletter or update your subscription preferences. 2003 tax lien sale result. The montgomery county tax sale program enables the county to collect all unpaid and delinquent property taxes as required by. Find properties for.

Tax Lien Maricopa County Tax Lien Sale

The montgomery county tax claim bureau accepts real estate tax liens for delinquent county, township/borough, and school districts. When a property tax lien is sold and the. Sign up for a newsletter or update your subscription preferences. The tax sale program enables the county to collect all unpaid property taxes, charges, and fees. 2003 tax lien sale result.

Suffolk County Tax Lien Sale 2024 Marne Sharona

Sign up for a newsletter or update your subscription preferences. The montgomery county tax sale program enables the county to collect all unpaid and delinquent property taxes as required by. The montgomery county tax claim bureau accepts real estate tax liens for delinquent county, township/borough, and school districts. Find properties for sale by tax lien or foreclosure in montgomery county,.

Maricopa County Tax Lien Sale 2024 Maure Shirlee

Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. Sign up for a newsletter or update your subscription preferences. Find properties for sale by tax lien or foreclosure in montgomery county, ohio. The montgomery county tax claim bureau accepts real estate tax liens for delinquent county, township/borough,.

Sign Up For A Newsletter Or Update Your Subscription Preferences.

At the tax sale, a property tax lien is offered for sale to the highest bidder. The upset sale is conducted once a year and is the first sale at which a delinquent taxpayer’s property may be sold. The montgomery county tax sale program enables the county to collect all unpaid and delinquent property taxes as required by. Find properties for sale by tax lien or foreclosure in montgomery county, ohio.

2003 Tax Lien Sale Result.

When a property tax lien is sold and the. Learn about the new electronic foreclosure auction process and the. Once sold and the total amount due is paid by the. The tax sale program enables the county to collect all unpaid property taxes, charges, and fees.

The Montgomery County Tax Claim Bureau Accepts Real Estate Tax Liens For Delinquent County, Township/Borough, And School Districts.

Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at.