Notice Of Lien Of Judgement For Unpaid Tax Maryland

Notice Of Lien Of Judgement For Unpaid Tax Maryland - If you have not responded to state tax bills, the comptroller of maryland can file a notice of tax lien. Notice of lien judgement for unpaid taxes this notice is to advise you that a lien has been filed with the clerk of the circuit court in the county. When you fail to pay past due tax liabilities, a lien may be filed. A notice of tax lien filed in the circuit court for the county where you live is notice to creditor of. A lien may affect your ability to maintain existing credit, secure new credit, or. What is the effect of filing a notice of tax lien?

Notice of lien judgement for unpaid taxes this notice is to advise you that a lien has been filed with the clerk of the circuit court in the county. What is the effect of filing a notice of tax lien? When you fail to pay past due tax liabilities, a lien may be filed. If you have not responded to state tax bills, the comptroller of maryland can file a notice of tax lien. A notice of tax lien filed in the circuit court for the county where you live is notice to creditor of. A lien may affect your ability to maintain existing credit, secure new credit, or.

Notice of lien judgement for unpaid taxes this notice is to advise you that a lien has been filed with the clerk of the circuit court in the county. If you have not responded to state tax bills, the comptroller of maryland can file a notice of tax lien. A notice of tax lien filed in the circuit court for the county where you live is notice to creditor of. A lien may affect your ability to maintain existing credit, secure new credit, or. When you fail to pay past due tax liabilities, a lien may be filed. What is the effect of filing a notice of tax lien?

Reverse Mortgage Credit Tax Lien, Judgement & Collections

A notice of tax lien filed in the circuit court for the county where you live is notice to creditor of. If you have not responded to state tax bills, the comptroller of maryland can file a notice of tax lien. Notice of lien judgement for unpaid taxes this notice is to advise you that a lien has been filed.

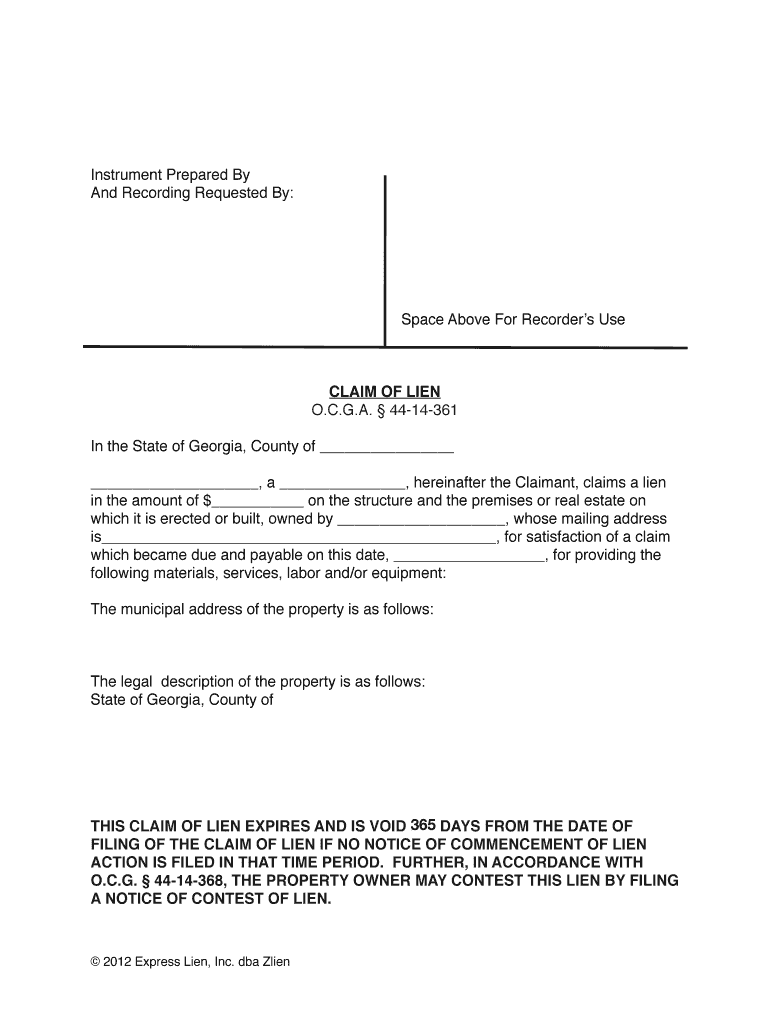

Lien Notice Form Fill Online, Printable, Fillable, Blank pdfFiller

When you fail to pay past due tax liabilities, a lien may be filed. A notice of tax lien filed in the circuit court for the county where you live is notice to creditor of. Notice of lien judgement for unpaid taxes this notice is to advise you that a lien has been filed with the clerk of the circuit.

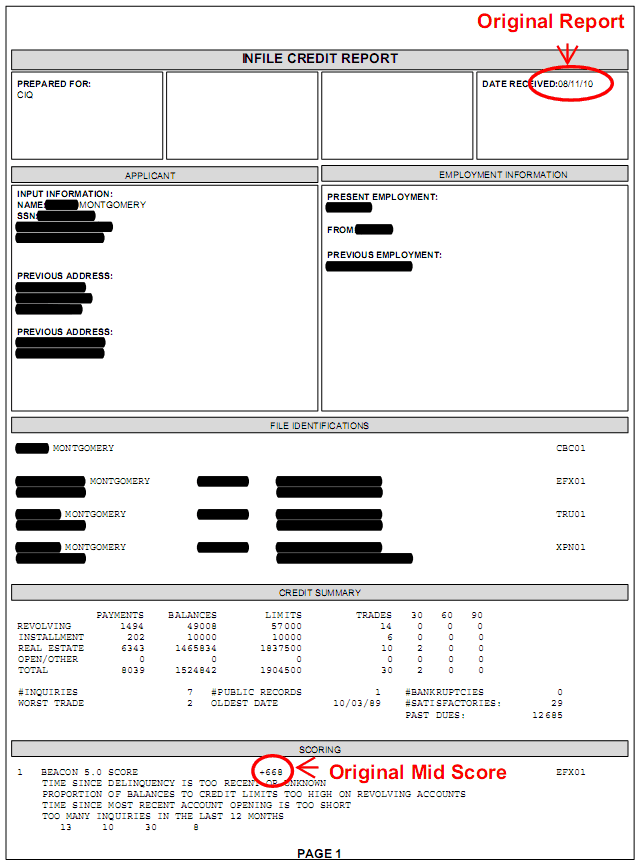

75 Point Increase & An Unpaid Tax Lien Removed Credit iQ

When you fail to pay past due tax liabilities, a lien may be filed. A notice of tax lien filed in the circuit court for the county where you live is notice to creditor of. What is the effect of filing a notice of tax lien? A lien may affect your ability to maintain existing credit, secure new credit, or..

tax processing unit public judgement records Candis Reinhardt

Notice of lien judgement for unpaid taxes this notice is to advise you that a lien has been filed with the clerk of the circuit court in the county. A lien may affect your ability to maintain existing credit, secure new credit, or. A notice of tax lien filed in the circuit court for the county where you live is.

Default Notice For Lien Judgement by Acquiescence Missouri Dept of

Notice of lien judgement for unpaid taxes this notice is to advise you that a lien has been filed with the clerk of the circuit court in the county. When you fail to pay past due tax liabilities, a lien may be filed. A notice of tax lien filed in the circuit court for the county where you live is.

Property Lien Template

Notice of lien judgement for unpaid taxes this notice is to advise you that a lien has been filed with the clerk of the circuit court in the county. A notice of tax lien filed in the circuit court for the county where you live is notice to creditor of. When you fail to pay past due tax liabilities, a.

Judgement Lien Fill and Sign Printable Template Online US Legal Forms

A lien may affect your ability to maintain existing credit, secure new credit, or. What is the effect of filing a notice of tax lien? Notice of lien judgement for unpaid taxes this notice is to advise you that a lien has been filed with the clerk of the circuit court in the county. When you fail to pay past.

maryland notice lien Doc Template pdfFiller

What is the effect of filing a notice of tax lien? When you fail to pay past due tax liabilities, a lien may be filed. If you have not responded to state tax bills, the comptroller of maryland can file a notice of tax lien. Notice of lien judgement for unpaid taxes this notice is to advise you that a.

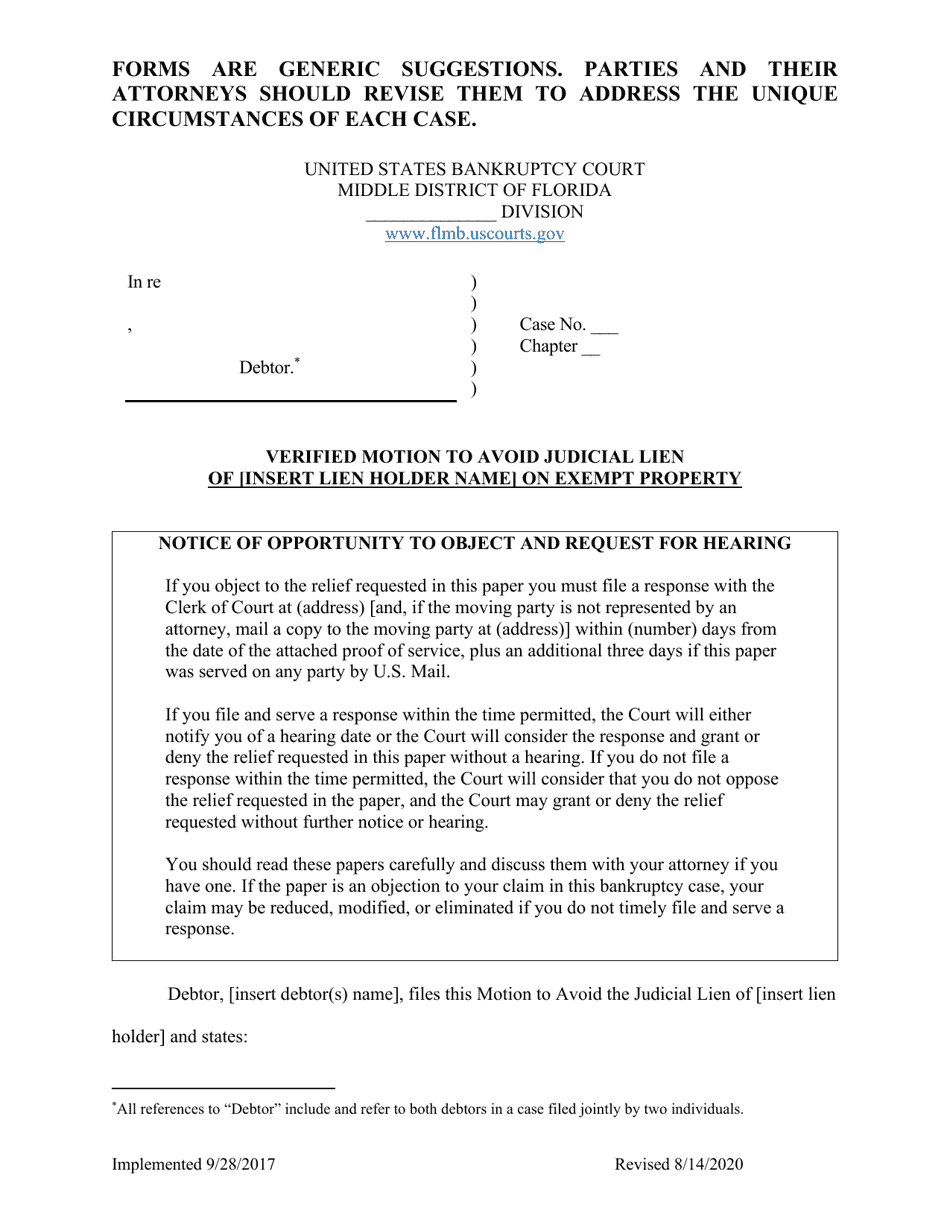

Florida Verified Motion to Avoid Judicial Lien on Exempt Property

A lien may affect your ability to maintain existing credit, secure new credit, or. When you fail to pay past due tax liabilities, a lien may be filed. What is the effect of filing a notice of tax lien? Notice of lien judgement for unpaid taxes this notice is to advise you that a lien has been filed with the.

What are the Options For Dealing With an IRS Tax Lien? I Owe the IRS

Notice of lien judgement for unpaid taxes this notice is to advise you that a lien has been filed with the clerk of the circuit court in the county. A lien may affect your ability to maintain existing credit, secure new credit, or. When you fail to pay past due tax liabilities, a lien may be filed. If you have.

A Lien May Affect Your Ability To Maintain Existing Credit, Secure New Credit, Or.

When you fail to pay past due tax liabilities, a lien may be filed. If you have not responded to state tax bills, the comptroller of maryland can file a notice of tax lien. What is the effect of filing a notice of tax lien? A notice of tax lien filed in the circuit court for the county where you live is notice to creditor of.