Ohio Tax Lien Auction

Ohio Tax Lien Auction - The purpose of the tax lien sale is to collect delinquent real estate taxes owed to the county which are needed to fund our schools, agencies. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. This page details the ohio revised code that. Effective june 10th, 2022, montgomery county sheriff's office will conduct tax lien sales along with the mortgage foreclosure sales on the. Tax lien and tax deed: Delinquent tax properties are offered twice for sale and properties not sold at the first sale are subsequently presented for sale at the next. Ohio, currently has 24,003 tax liens available as of january 6. In october of each year, the hamilton county treasurer’s office sells tax lien certificates against eligible tax delinquent properties.

Ohio, currently has 24,003 tax liens available as of january 6. This page details the ohio revised code that. Delinquent tax properties are offered twice for sale and properties not sold at the first sale are subsequently presented for sale at the next. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. In october of each year, the hamilton county treasurer’s office sells tax lien certificates against eligible tax delinquent properties. Effective june 10th, 2022, montgomery county sheriff's office will conduct tax lien sales along with the mortgage foreclosure sales on the. The purpose of the tax lien sale is to collect delinquent real estate taxes owed to the county which are needed to fund our schools, agencies. Tax lien and tax deed:

Tax lien and tax deed: The purpose of the tax lien sale is to collect delinquent real estate taxes owed to the county which are needed to fund our schools, agencies. Delinquent tax properties are offered twice for sale and properties not sold at the first sale are subsequently presented for sale at the next. Ohio, currently has 24,003 tax liens available as of january 6. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. Effective june 10th, 2022, montgomery county sheriff's office will conduct tax lien sales along with the mortgage foreclosure sales on the. This page details the ohio revised code that. In october of each year, the hamilton county treasurer’s office sells tax lien certificates against eligible tax delinquent properties.

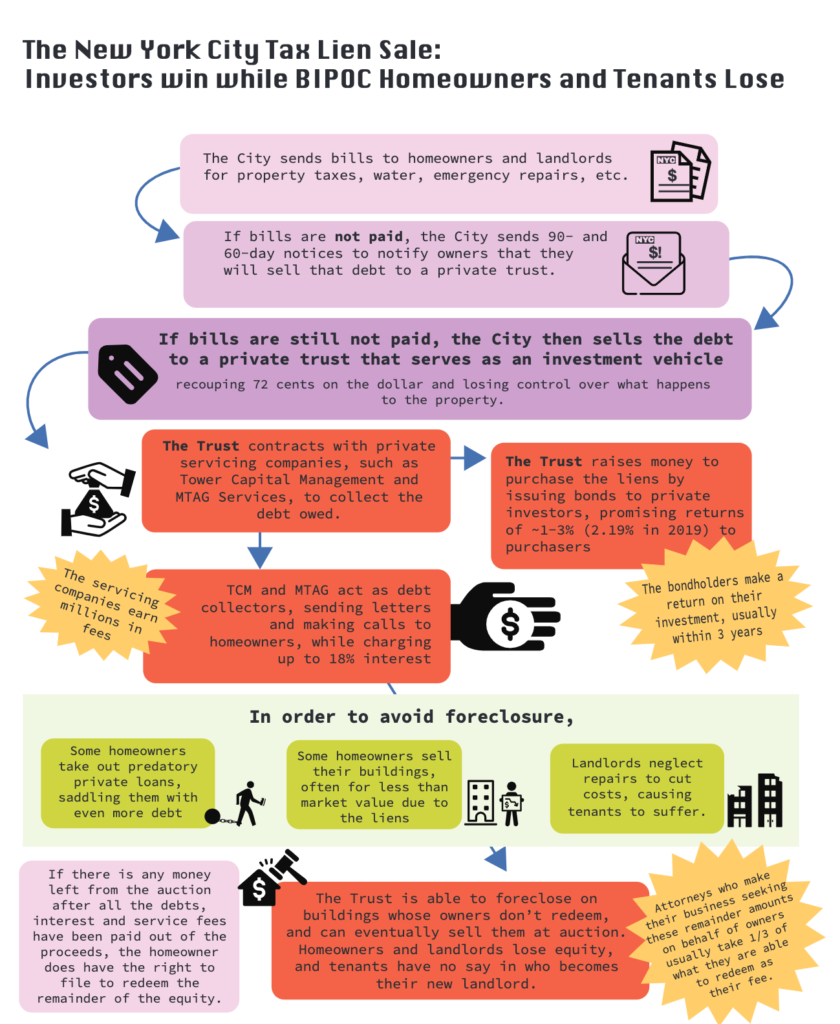

Abolish The Tax Lien Sale EastNewYorkCLT

The purpose of the tax lien sale is to collect delinquent real estate taxes owed to the county which are needed to fund our schools, agencies. Tax lien and tax deed: Delinquent tax properties are offered twice for sale and properties not sold at the first sale are subsequently presented for sale at the next. Ohio, currently has 24,003 tax.

Suffolk County Tax Lien Auction 2024 Valli Isabelle

This page details the ohio revised code that. The purpose of the tax lien sale is to collect delinquent real estate taxes owed to the county which are needed to fund our schools, agencies. Effective june 10th, 2022, montgomery county sheriff's office will conduct tax lien sales along with the mortgage foreclosure sales on the. Tax lien and tax deed:.

Tax Lien What Is A State Tax Lien Ohio

Ohio, currently has 24,003 tax liens available as of january 6. Effective june 10th, 2022, montgomery county sheriff's office will conduct tax lien sales along with the mortgage foreclosure sales on the. This page details the ohio revised code that. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. Tax lien and tax deed:

Ohio Release of Lien Form Free Template Download

Effective june 10th, 2022, montgomery county sheriff's office will conduct tax lien sales along with the mortgage foreclosure sales on the. The purpose of the tax lien sale is to collect delinquent real estate taxes owed to the county which are needed to fund our schools, agencies. Tax lien and tax deed: Ohio, currently has 24,003 tax liens available as.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

This page details the ohio revised code that. In october of each year, the hamilton county treasurer’s office sells tax lien certificates against eligible tax delinquent properties. Delinquent tax properties are offered twice for sale and properties not sold at the first sale are subsequently presented for sale at the next. The purpose of the tax lien sale is to.

tax lien PDF Free Download

Ohio, currently has 24,003 tax liens available as of january 6. Tax lien and tax deed: In october of each year, the hamilton county treasurer’s office sells tax lien certificates against eligible tax delinquent properties. Delinquent tax properties are offered twice for sale and properties not sold at the first sale are subsequently presented for sale at the next. The.

How to Buy Tax Lien and Auction Properties (Live Webinar + Replay)

Tax lien and tax deed: Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. In october of each year, the hamilton county treasurer’s office sells tax lien certificates against eligible tax delinquent properties. Effective june 10th, 2022, montgomery county sheriff's office will conduct tax lien sales along with the mortgage foreclosure sales on the..

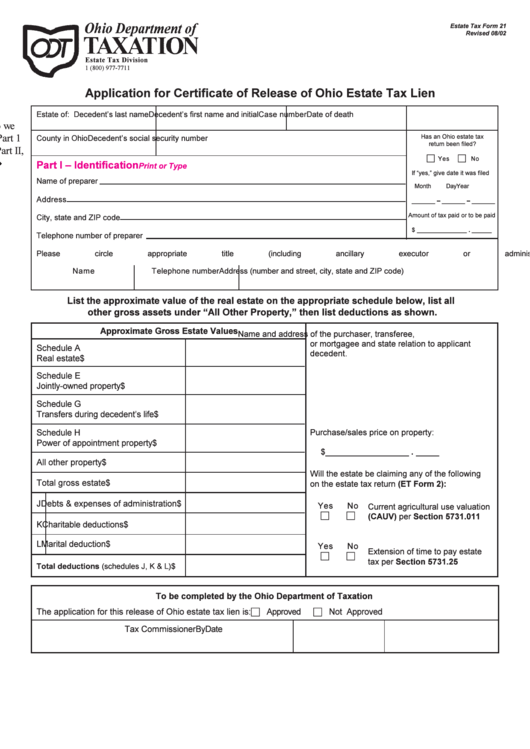

Estate Tax Form 21 Application For Certificate Of Release Of Ohio

This page details the ohio revised code that. Delinquent tax properties are offered twice for sale and properties not sold at the first sale are subsequently presented for sale at the next. In october of each year, the hamilton county treasurer’s office sells tax lien certificates against eligible tax delinquent properties. The purpose of the tax lien sale is to.

Everything to know about tax lien certificate Latest Infographics

Tax lien and tax deed: Ohio, currently has 24,003 tax liens available as of january 6. Delinquent tax properties are offered twice for sale and properties not sold at the first sale are subsequently presented for sale at the next. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. Effective june 10th, 2022, montgomery.

Tax Lien Sale Download Free PDF Tax Lien Taxes

Effective june 10th, 2022, montgomery county sheriff's office will conduct tax lien sales along with the mortgage foreclosure sales on the. In october of each year, the hamilton county treasurer’s office sells tax lien certificates against eligible tax delinquent properties. Tax lien and tax deed: Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes..

This Page Details The Ohio Revised Code That.

In october of each year, the hamilton county treasurer’s office sells tax lien certificates against eligible tax delinquent properties. Ohio, currently has 24,003 tax liens available as of january 6. Effective june 10th, 2022, montgomery county sheriff's office will conduct tax lien sales along with the mortgage foreclosure sales on the. The purpose of the tax lien sale is to collect delinquent real estate taxes owed to the county which are needed to fund our schools, agencies.

Cuyahoga County Is Permitted To Sell Tax Lien Certificates On Parcels That Have Delinquent Taxes.

Delinquent tax properties are offered twice for sale and properties not sold at the first sale are subsequently presented for sale at the next. Tax lien and tax deed: