Oklahoma Tax Lien

Oklahoma Tax Lien - All taxes, interest and penalties imposed by any incorporated city, town or the oklahoma tax commission under authority of this act, or other. 2023 oklahoma statutes title 68. The oklahoma tax commission (otc), as authorized by 68 os sec. Oklahoma, currently has 6,242 tax liens available as of october 29. The tax lien shall be a lien on all personal and real property of the person, firm, or corporation owing the delinquent tax for a period of seven (7). Tax liens are liens filed by the internal revenue service for federal taxes and the state of oklahoma for state taxes. These are filed in the. Lien for unpaid taxes, interest and penalties. What are the grounds for requesting a settlement of tax liability? There are no tax lien certificates in oklahoma, but properties with past due property taxes are subject to tax lien auctions.

These are filed in the. 2023 oklahoma statutes title 68. Tax liens are liens filed by the internal revenue service for federal taxes and the state of oklahoma for state taxes. The oklahoma tax commission (otc), as authorized by 68 os sec. What are the grounds for requesting a settlement of tax liability? There are no tax lien certificates in oklahoma, but properties with past due property taxes are subject to tax lien auctions. Lien for unpaid taxes, interest and penalties. The tax lien shall be a lien on all personal and real property of the person, firm, or corporation owing the delinquent tax for a period of seven (7). All taxes, interest and penalties imposed by any incorporated city, town or the oklahoma tax commission under authority of this act, or other. Oklahoma, currently has 6,242 tax liens available as of october 29.

The tax lien shall be a lien on all personal and real property of the person, firm, or corporation owing the delinquent tax for a period of seven (7). There are no tax lien certificates in oklahoma, but properties with past due property taxes are subject to tax lien auctions. What are the grounds for requesting a settlement of tax liability? Oklahoma, currently has 6,242 tax liens available as of october 29. 2023 oklahoma statutes title 68. The oklahoma tax commission (otc), as authorized by 68 os sec. All taxes, interest and penalties imposed by any incorporated city, town or the oklahoma tax commission under authority of this act, or other. These are filed in the. Lien for unpaid taxes, interest and penalties. Tax liens are liens filed by the internal revenue service for federal taxes and the state of oklahoma for state taxes.

Investing Tax Lien Certificates SWFL Chronicle

2023 oklahoma statutes title 68. Oklahoma, currently has 6,242 tax liens available as of october 29. All taxes, interest and penalties imposed by any incorporated city, town or the oklahoma tax commission under authority of this act, or other. These are filed in the. The tax lien shall be a lien on all personal and real property of the person,.

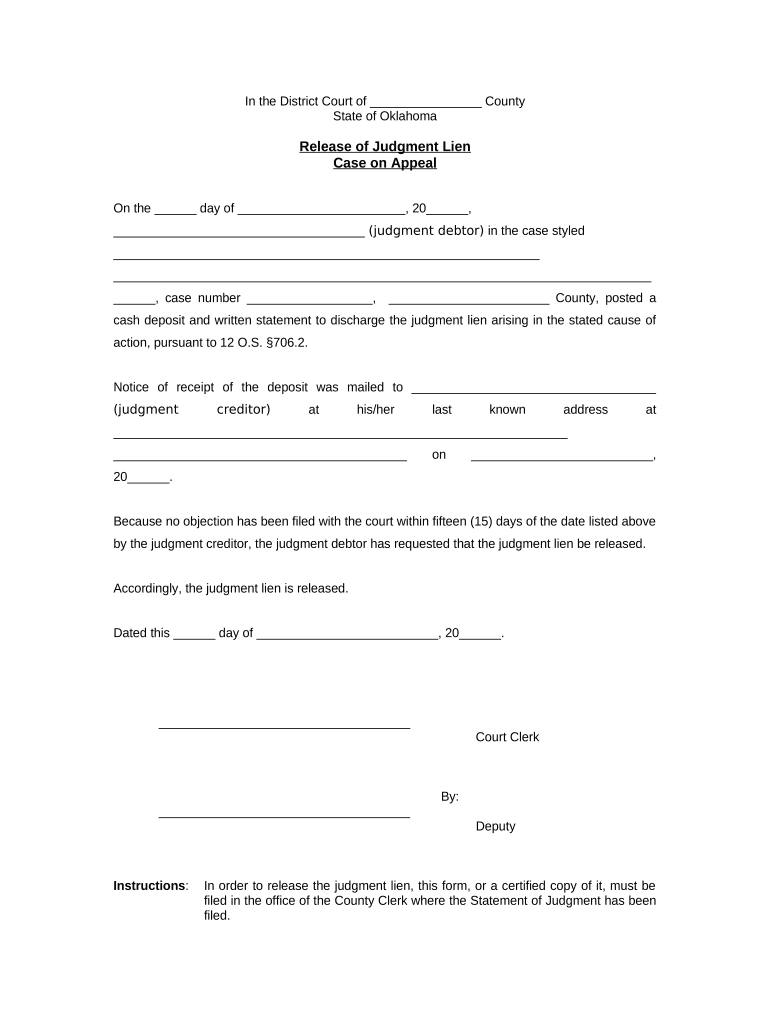

oklahoma release lien Doc Template pdfFiller

What are the grounds for requesting a settlement of tax liability? The tax lien shall be a lien on all personal and real property of the person, firm, or corporation owing the delinquent tax for a period of seven (7). Tax liens are liens filed by the internal revenue service for federal taxes and the state of oklahoma for state.

Insider Tips for Oklahoma Tax Deed Sales Success Tax Sale Insiders

The oklahoma tax commission (otc), as authorized by 68 os sec. Tax liens are liens filed by the internal revenue service for federal taxes and the state of oklahoma for state taxes. There are no tax lien certificates in oklahoma, but properties with past due property taxes are subject to tax lien auctions. 2023 oklahoma statutes title 68. Oklahoma, currently.

Guide On How To Start A Tax Lien Business Side Hustle

The tax lien shall be a lien on all personal and real property of the person, firm, or corporation owing the delinquent tax for a period of seven (7). Oklahoma, currently has 6,242 tax liens available as of october 29. All taxes, interest and penalties imposed by any incorporated city, town or the oklahoma tax commission under authority of this.

Tax Lien Sale Download Free PDF Tax Lien Taxes

The tax lien shall be a lien on all personal and real property of the person, firm, or corporation owing the delinquent tax for a period of seven (7). Tax liens are liens filed by the internal revenue service for federal taxes and the state of oklahoma for state taxes. All taxes, interest and penalties imposed by any incorporated city,.

Oklahoma Pre Lien Notice Form Download Free With Fact Sheet

What are the grounds for requesting a settlement of tax liability? There are no tax lien certificates in oklahoma, but properties with past due property taxes are subject to tax lien auctions. The tax lien shall be a lien on all personal and real property of the person, firm, or corporation owing the delinquent tax for a period of seven.

oklahoma release lien Doc Template pdfFiller

The oklahoma tax commission (otc), as authorized by 68 os sec. There are no tax lien certificates in oklahoma, but properties with past due property taxes are subject to tax lien auctions. The tax lien shall be a lien on all personal and real property of the person, firm, or corporation owing the delinquent tax for a period of seven.

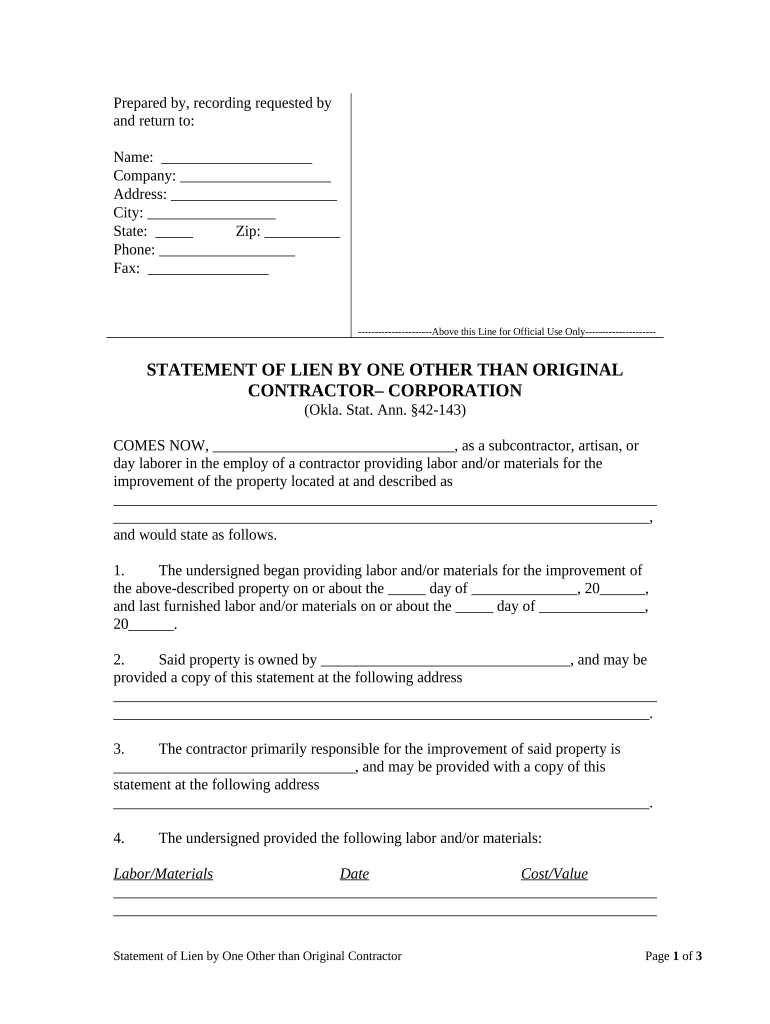

oklahoma lien Doc Template pdfFiller

Tax liens are liens filed by the internal revenue service for federal taxes and the state of oklahoma for state taxes. Oklahoma, currently has 6,242 tax liens available as of october 29. Lien for unpaid taxes, interest and penalties. The oklahoma tax commission (otc), as authorized by 68 os sec. All taxes, interest and penalties imposed by any incorporated city,.

Tax lien Finschool By 5paisa

These are filed in the. There are no tax lien certificates in oklahoma, but properties with past due property taxes are subject to tax lien auctions. Lien for unpaid taxes, interest and penalties. The oklahoma tax commission (otc), as authorized by 68 os sec. The tax lien shall be a lien on all personal and real property of the person,.

The Complete Guide to Oklahoma Lien & Notice Deadlines National Lien

There are no tax lien certificates in oklahoma, but properties with past due property taxes are subject to tax lien auctions. Tax liens are liens filed by the internal revenue service for federal taxes and the state of oklahoma for state taxes. Oklahoma, currently has 6,242 tax liens available as of october 29. These are filed in the. What are.

What Are The Grounds For Requesting A Settlement Of Tax Liability?

The oklahoma tax commission (otc), as authorized by 68 os sec. Oklahoma, currently has 6,242 tax liens available as of october 29. Tax liens are liens filed by the internal revenue service for federal taxes and the state of oklahoma for state taxes. 2023 oklahoma statutes title 68.

The Tax Lien Shall Be A Lien On All Personal And Real Property Of The Person, Firm, Or Corporation Owing The Delinquent Tax For A Period Of Seven (7).

Lien for unpaid taxes, interest and penalties. These are filed in the. All taxes, interest and penalties imposed by any incorporated city, town or the oklahoma tax commission under authority of this act, or other. There are no tax lien certificates in oklahoma, but properties with past due property taxes are subject to tax lien auctions.