Pa Tax Liens

Pa Tax Liens - The department files liens for all types of state taxes: Corporation taxes, sales & use taxes, employer withholding taxes, personal income. You must include the county, township, or borough where the work is being. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. File the waiver of liens with the property address or legal description.

You must include the county, township, or borough where the work is being. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. The department files liens for all types of state taxes: File the waiver of liens with the property address or legal description. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the.

Corporation taxes, sales & use taxes, employer withholding taxes, personal income. File the waiver of liens with the property address or legal description. You must include the county, township, or borough where the work is being. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. The department files liens for all types of state taxes:

Investing In Tax Liens Alts.co

You must include the county, township, or borough where the work is being. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. File the waiver of liens with the property address or legal description. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. If a.

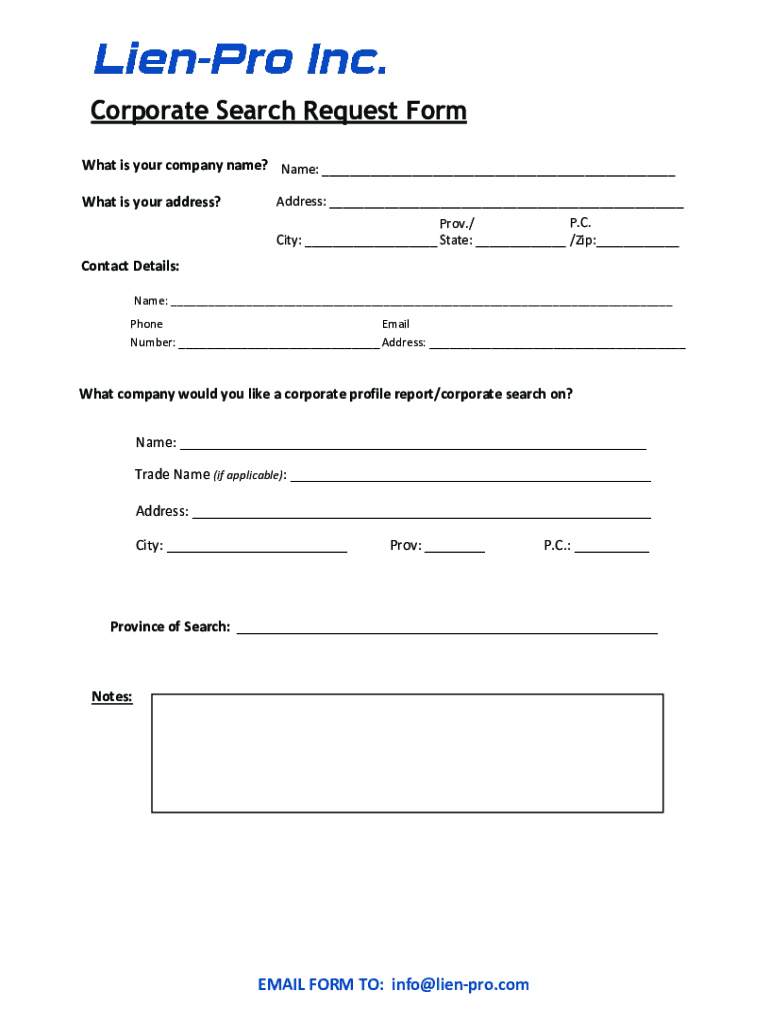

Fillable Online PA Tax Liens Fax Email Print pdfFiller

Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. Corporation taxes, sales & use taxes, employer withholding taxes, personal income..

What Is A Tax Lien? Atlanta Tax Lawyer Alyssa Maloof Whatley

File the waiver of liens with the property address or legal description. You must include the county, township, or borough where the work is being. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. If a.

Understanding Federal Tax Liens Causes, Consequences, and Solutions

If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. You must include the county, township, or borough where the work is being. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. File the waiver of liens with the property address.

Buying Tax Liens Online home study course is updated for 2024

If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. The department files liens for all types of state taxes: Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. You.

Tax Liens What You Need to Know Cumberland Law Group

Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. File the waiver of liens with the property address or legal description. The department files liens for all types of state taxes: If a person liable to pay a tax, interest, addition or penalty neglects or refuses to.

Exploring Tax Liens How Does Buying Tax Liens Work

File the waiver of liens with the property address or legal description. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. The department files liens for all types of state taxes: You must include the county, township, or borough where the work is being. If a person liable to pay a tax, interest, addition or penalty neglects or.

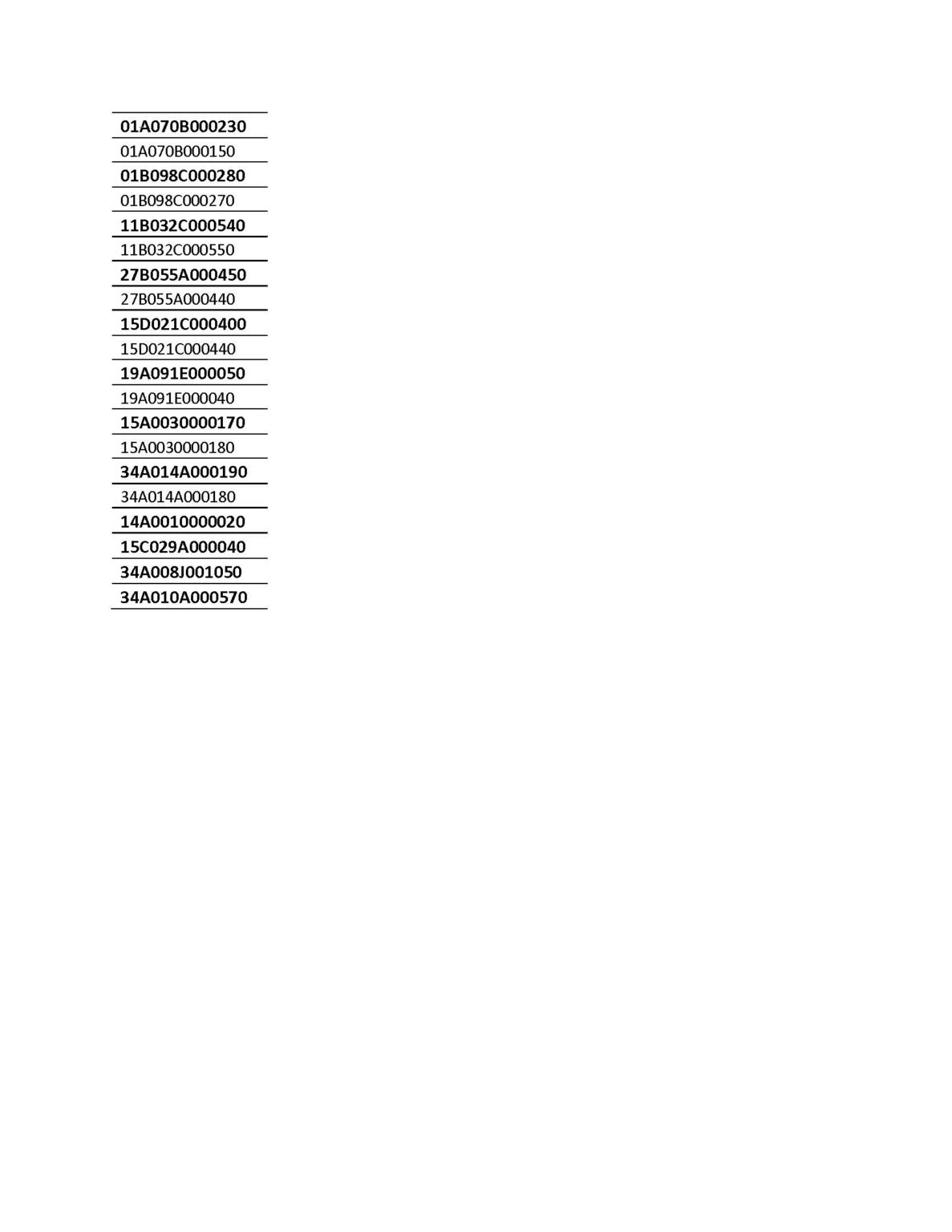

TAX LIENS PENDING CERTIFICATE FILING Treasurer

Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. You must include the county, township, or borough where the work is being. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record.

Tax Liens Certificates Silver Pack

File the waiver of liens with the property address or legal description. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. The department files liens for all types of state taxes: Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. You must include the county,.

Tax Liens and Deeds Live Class Pips Path

File the waiver of liens with the property address or legal description. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the. You must include the county, township, or borough where the work is being. Corporation taxes, sales & use taxes, employer withholding.

File The Waiver Of Liens With The Property Address Or Legal Description.

The department files liens for all types of state taxes: Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. If a person liable to pay a tax, interest, addition or penalty neglects or refuses to pay the same after demand, upon entry of record by the.