Pennsylvania Local Tax Return

Pennsylvania Local Tax Return - How do i find out where to file and pay my local taxes? Keystone collections group collects current and delinquent tax revenue and fees for pennsylvania school districts, boroughs, cities,. Learn how to file your local earned income tax return online or by mail by april 15, 2024. 71 rows download the list of local income tax collector into excel. If you would like to report a tax. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. To connect with the governor’s center for local government. For local earned income tax (eit) forms and assistance, contact the local. Visit our frequently asked questions webpage for answers to act 32 and local earned income tax questions.

To connect with the governor’s center for local government. Visit our frequently asked questions webpage for answers to act 32 and local earned income tax questions. For local earned income tax (eit) forms and assistance, contact the local. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. If you would like to report a tax. How do i find out where to file and pay my local taxes? 71 rows download the list of local income tax collector into excel. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Keystone collections group collects current and delinquent tax revenue and fees for pennsylvania school districts, boroughs, cities,. Learn how to file your local earned income tax return online or by mail by april 15, 2024.

To connect with the governor’s center for local government. Visit our frequently asked questions webpage for answers to act 32 and local earned income tax questions. Learn how to file your local earned income tax return online or by mail by april 15, 2024. Keystone collections group collects current and delinquent tax revenue and fees for pennsylvania school districts, boroughs, cities,. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. For local earned income tax (eit) forms and assistance, contact the local. 71 rows download the list of local income tax collector into excel. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. If you would like to report a tax. How do i find out where to file and pay my local taxes?

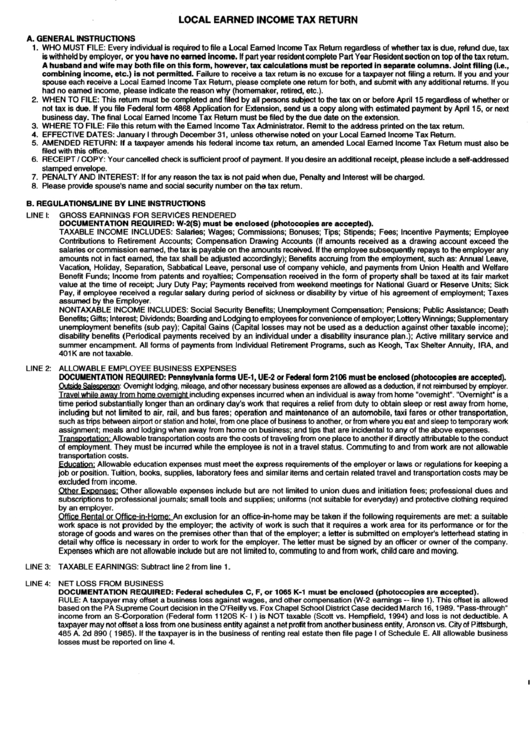

Instructions For Local Earned Tax Return Form Pennsylvania

If you would like to report a tax. Visit our frequently asked questions webpage for answers to act 32 and local earned income tax questions. 71 rows download the list of local income tax collector into excel. To connect with the governor’s center for local government. Learn how to file your local earned income tax return online or by mail.

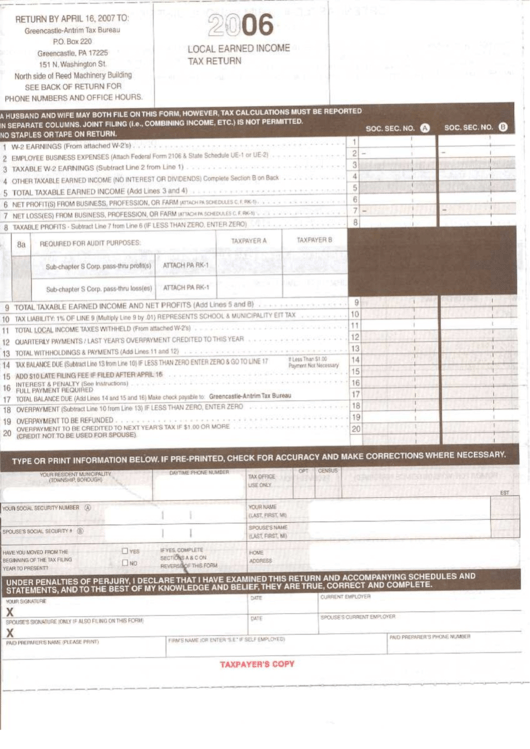

Local Earned Tax Return Form printable pdf download

Learn how to file your local earned income tax return online or by mail by april 15, 2024. If you would like to report a tax. How do i find out where to file and pay my local taxes? 71 rows download the list of local income tax collector into excel. To connect with the governor’s center for local government.

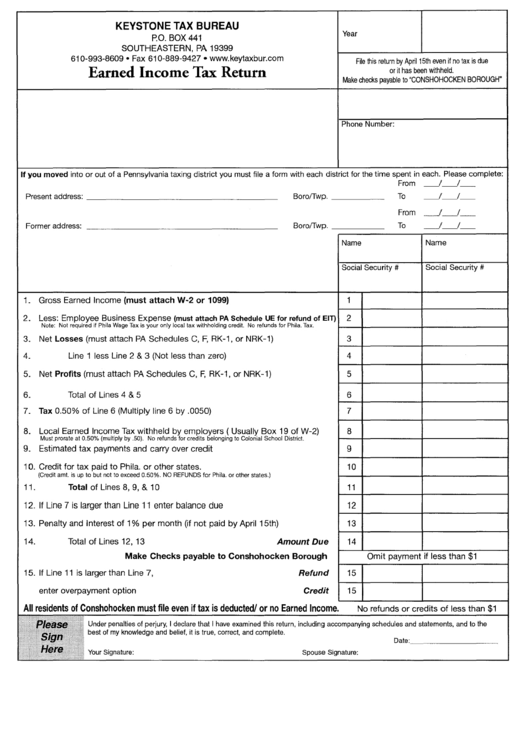

Earned Tax Return Form Pennsylvania printable pdf download

If you would like to report a tax. Learn how to file your local earned income tax return online or by mail by april 15, 2024. To connect with the governor’s center for local government. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. How do i find out.

Local Earned Tax Return Form printable pdf download

Keystone collections group collects current and delinquent tax revenue and fees for pennsylvania school districts, boroughs, cities,. If you would like to report a tax. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Visit our frequently asked questions webpage for answers.

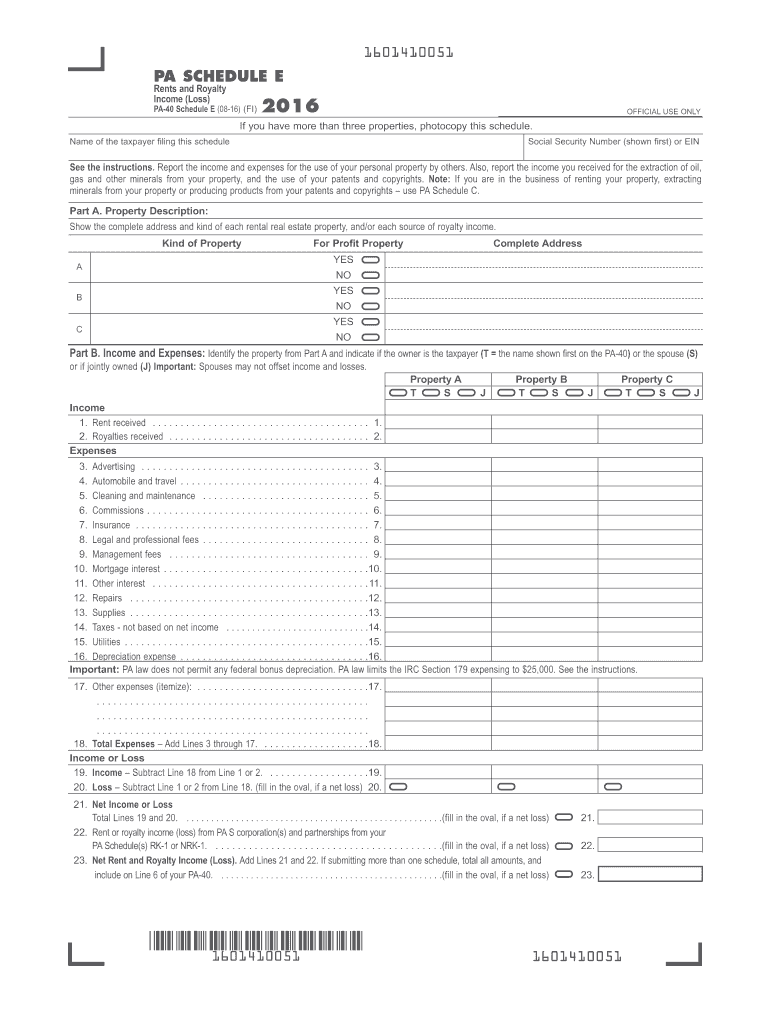

Pennsylvania Tax Return PA 40 Revenue Pa Gov Fill Out and Sign

The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. For local earned income tax (eit) forms and assistance, contact the local. Visit our frequently asked questions webpage for answers to act 32 and local earned income tax questions. To connect with the governor’s center for local government. Learn how.

2013 Form PA DCED CLGS321 Fill Online, Printable, Fillable, Blank

How do i find out where to file and pay my local taxes? To connect with the governor’s center for local government. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. 71 rows download the list of local income tax collector into excel. For local earned income tax (eit).

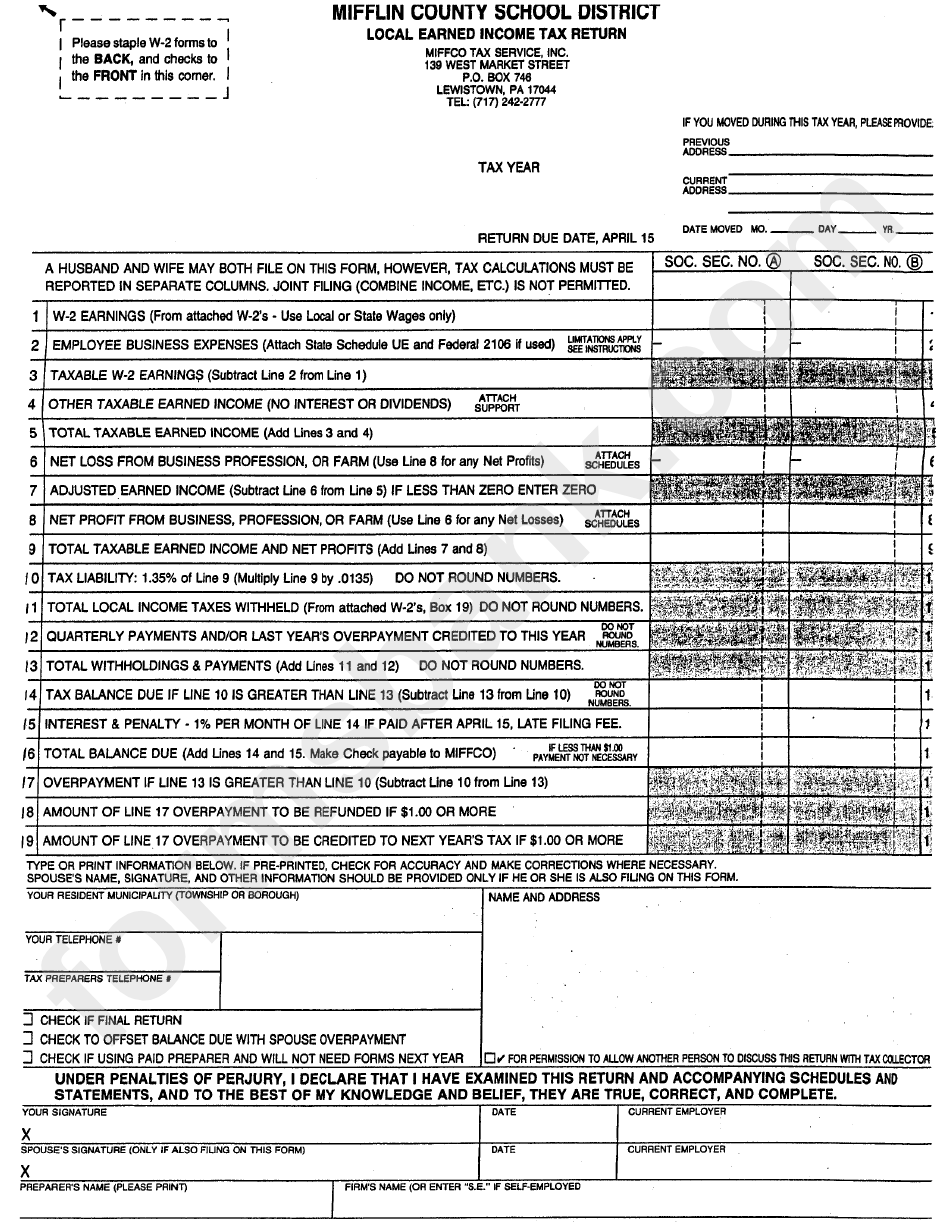

Local Earned Tax Return Form Pennsylvania Mifflin County

For local earned income tax (eit) forms and assistance, contact the local. To connect with the governor’s center for local government. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Keystone collections group collects current and delinquent tax revenue and fees for pennsylvania school districts, boroughs, cities,. How do.

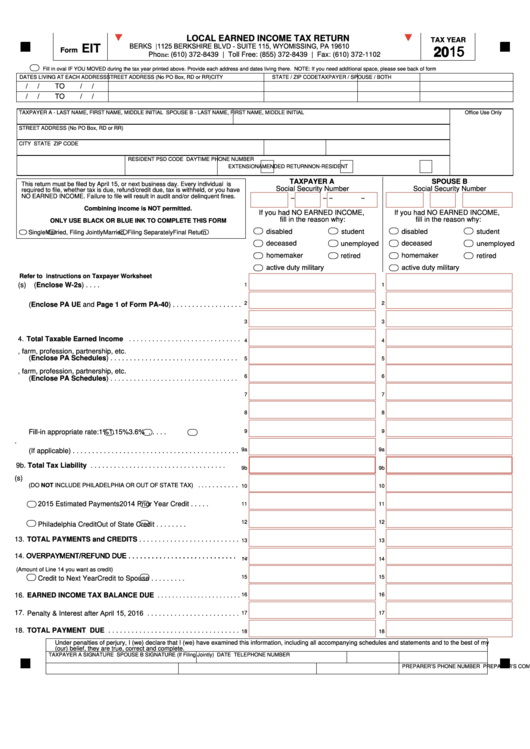

Fillable Local Earned Tax Return Pa Eit 2015 printable pdf download

Keystone collections group collects current and delinquent tax revenue and fees for pennsylvania school districts, boroughs, cities,. If you would like to report a tax. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. How do i find out where to file and pay my local taxes? Visit our.

2023 Pa Tax Form Printable Forms Free Online

To connect with the governor’s center for local government. How do i find out where to file and pay my local taxes? Visit our frequently asked questions webpage for answers to act 32 and local earned income tax questions. 71 rows download the list of local income tax collector into excel. For local earned income tax (eit) forms and assistance,.

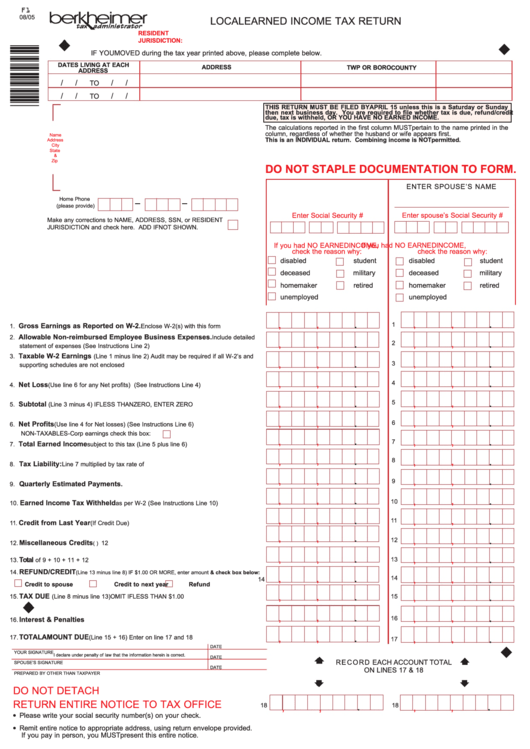

Form F1 Local Earned Tax Return Pennsylvania printable pdf

If you would like to report a tax. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Learn how to file your local earned income tax return online or by mail by april 15, 2024. You are required to withhold the higher of the two eit rates, as well.

The Pennsylvania Local Income Tax Exchange (Palite) System Allows Taxpayers In Participating Localities To Quickly Prepare A Tax Return, Which.

To connect with the governor’s center for local government. Visit our frequently asked questions webpage for answers to act 32 and local earned income tax questions. If you would like to report a tax. 71 rows download the list of local income tax collector into excel.

Learn How To File Your Local Earned Income Tax Return Online Or By Mail By April 15, 2024.

How do i find out where to file and pay my local taxes? For local earned income tax (eit) forms and assistance, contact the local. Keystone collections group collects current and delinquent tax revenue and fees for pennsylvania school districts, boroughs, cities,. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax.