Property Tax Foreclosure

Property Tax Foreclosure - All real estate taxes are due to our office by december 31st of the current tax year. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. All unpaid taxes must be turned over to the delinquent tax. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider.

If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. All unpaid taxes must be turned over to the delinquent tax. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. All real estate taxes are due to our office by december 31st of the current tax year. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other.

If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. All unpaid taxes must be turned over to the delinquent tax. All real estate taxes are due to our office by december 31st of the current tax year. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other.

stop property tax foreclosure

A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay.

stop property tax foreclosure

A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. All unpaid taxes must be turned over to the delinquent tax. All real estate taxes are due to our office by december 31st of the current tax year. Tax lien foreclosure is a legal process that occurs when a property.

stop property tax foreclosure

All real estate taxes are due to our office by december 31st of the current tax year. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. All unpaid taxes must.

How to Stop Property Tax Foreclosure Jarrett Law Firm

A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. All unpaid taxes must be turned over to the delinquent tax. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. Tax lien foreclosure is a.

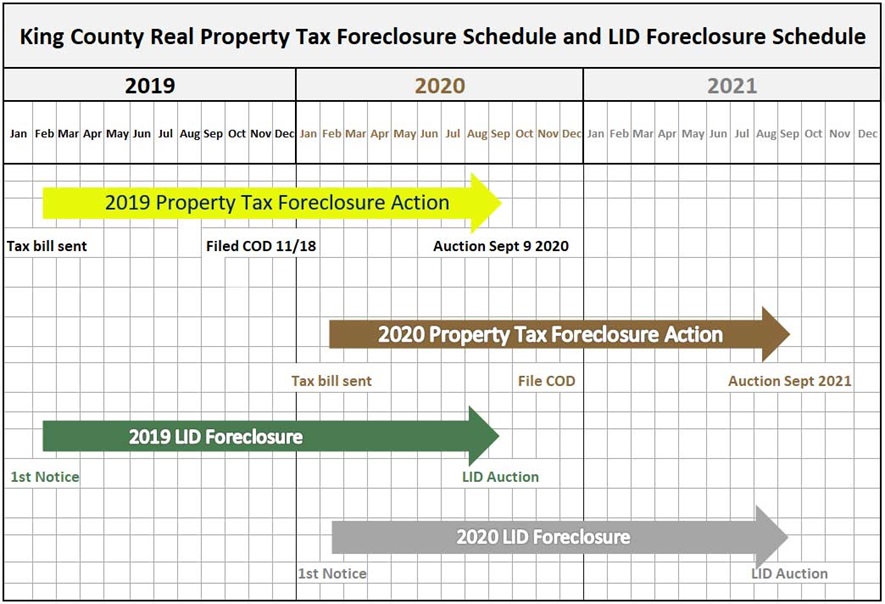

King County Property Tax Foreclosure List Tooyul Adventure

A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. All unpaid taxes must be turned over to the delinquent tax. If you’ve lost your home to a tax sale and.

Property Tax Foreclosure Chemung County, NY

A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. All unpaid taxes must be turned over to the delinquent tax. All real estate taxes are due to our office by.

What is a property Tax Lien? Real Estate Articles by

If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. All real estate taxes are due to our office by december 31st of the current tax year..

Property Tax Foreclosure Auction Set Keweenaw Report

All real estate taxes are due to our office by december 31st of the current tax year. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the.

Delinquent Property Taxes Houston Tax Foreclosure Jarrett Law Firm

A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. All unpaid taxes must be turned over to the delinquent tax. Tax lien foreclosure is a.

How to Stop Property Tax Foreclosure Property Nation™

If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. All real estate taxes are due to our office by december 31st of the current tax.

All Unpaid Taxes Must Be Turned Over To The Delinquent Tax.

If you’ve lost your home to a tax sale and want to learn more about setting the sale aside or redeeming the property, consider. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other. All real estate taxes are due to our office by december 31st of the current tax year.