Purchasing Tax Liens In Florida

Purchasing Tax Liens In Florida - Investors can purchase tax liens in florida by attending county auctions. How to purchase tax lien properties in florida? In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or. These sales occur when property owners default on. The most direct and reliable source for purchasing tax liens in florida is through the county tax collector's office. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales.

Investors can purchase tax liens in florida by attending county auctions. These sales occur when property owners default on. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. How to purchase tax lien properties in florida? In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or. The most direct and reliable source for purchasing tax liens in florida is through the county tax collector's office.

Investors can purchase tax liens in florida by attending county auctions. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. These sales occur when property owners default on. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or. How to purchase tax lien properties in florida? The most direct and reliable source for purchasing tax liens in florida is through the county tax collector's office.

Tax Lien Investing How Do Tax Liens Work in Florida hardmoneylenders.io

These sales occur when property owners default on. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or. Investors can purchase tax liens in florida by attending county auctions. How to purchase tax lien properties in florida? In an effort to recover unpaid property taxes, florida organizes annual tax lien sales.

Williams Accounting & Tax Services LLC McDonough GA

How to purchase tax lien properties in florida? Investors can purchase tax liens in florida by attending county auctions. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. These sales occur when property owners default on. The most direct and reliable source for purchasing tax liens in florida is through the county tax collector's office.

Philippine Tax Academy

In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. These sales occur when property owners default on. How to purchase tax lien properties in florida? The most direct and reliable source for purchasing tax liens in florida is through the county tax collector's office. Investors can purchase tax liens in florida by attending county auctions.

TAX LIENS & TAX DEEDS EXPLAINED! Each year Florida has 254 counties

In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. Investors can purchase tax liens in florida by attending county auctions. The most direct and reliable source for purchasing tax liens in florida is through the county.

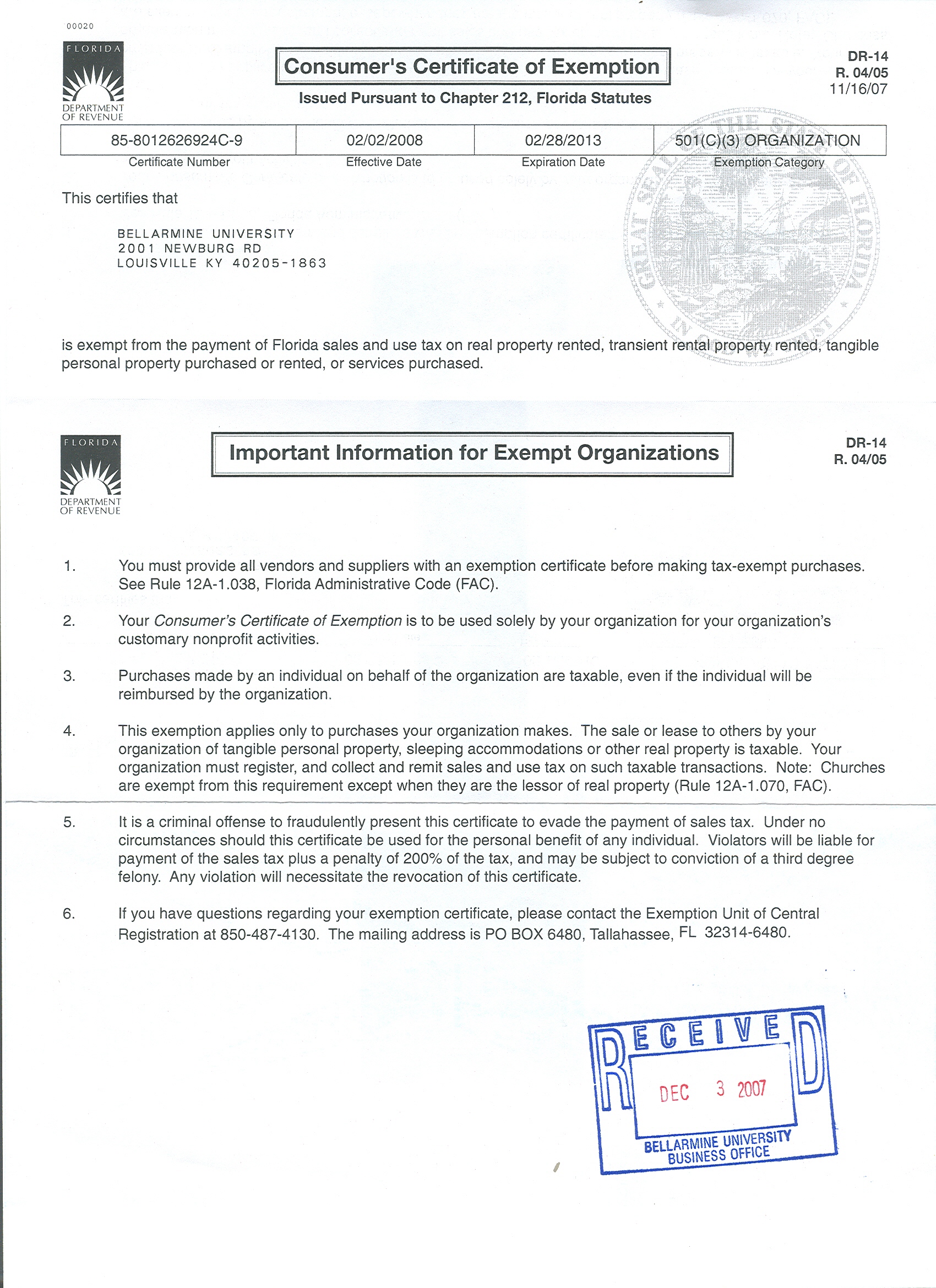

Tax Exemptions

In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. These sales occur when property owners default on. How to purchase tax lien properties in florida? Investors can purchase tax liens in florida by attending county auctions.

What are the Benefits of Purchasing Tax Audit Insurance? by

In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. How to purchase tax lien properties in florida? These sales occur when property owners default on. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or. The most direct and reliable source for purchasing tax liens in.

Clearing Tax Liens Boosting Your Financial Health

In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or. How to purchase tax lien properties in florida? The most direct and reliable source for purchasing tax liens in florida is through the county tax collector's office. These sales occur when property owners default on. In an effort to recover unpaid.

Florida Tax Liens What Are They and How to Invest? REICounsel

Investors can purchase tax liens in florida by attending county auctions. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or. How to purchase tax lien properties in florida? These sales occur when property owners default on. The most direct and reliable source for purchasing tax liens in florida is through.

Tax Preparation Business Startup

The most direct and reliable source for purchasing tax liens in florida is through the county tax collector's office. How to purchase tax lien properties in florida? In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales..

Tax Solution Point Purnia

The most direct and reliable source for purchasing tax liens in florida is through the county tax collector's office. Investors can purchase tax liens in florida by attending county auctions. These sales occur when property owners default on. In an effort to recover unpaid property taxes, florida organizes annual tax lien sales. How to purchase tax lien properties in florida?

Investors Can Purchase Tax Liens In Florida By Attending County Auctions.

The most direct and reliable source for purchasing tax liens in florida is through the county tax collector's office. How to purchase tax lien properties in florida? These sales occur when property owners default on. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or.