Roanoke County Business License

Roanoke County Business License - New businesses locating in roanoke county must obtain a business license within 30 days of the day it begins business. The business license tax is. Business licenses the commissioner of the revenue assesses roanoke county business professional and occupational license taxes. Learn about obtaining a local business license, with links to the local application, state licensing, and fees. For most businesses the cost of the business license is based upon the estimate of total gross receipts from the day the business opens to. Read about how you can obtain the necessary business permits and licenses.

The business license tax is. Business licenses the commissioner of the revenue assesses roanoke county business professional and occupational license taxes. For most businesses the cost of the business license is based upon the estimate of total gross receipts from the day the business opens to. New businesses locating in roanoke county must obtain a business license within 30 days of the day it begins business. Learn about obtaining a local business license, with links to the local application, state licensing, and fees. Read about how you can obtain the necessary business permits and licenses.

For most businesses the cost of the business license is based upon the estimate of total gross receipts from the day the business opens to. The business license tax is. Business licenses the commissioner of the revenue assesses roanoke county business professional and occupational license taxes. Read about how you can obtain the necessary business permits and licenses. New businesses locating in roanoke county must obtain a business license within 30 days of the day it begins business. Learn about obtaining a local business license, with links to the local application, state licensing, and fees.

Roanoke County Business Partners Videos Roanoke County Economic

Business licenses the commissioner of the revenue assesses roanoke county business professional and occupational license taxes. New businesses locating in roanoke county must obtain a business license within 30 days of the day it begins business. Learn about obtaining a local business license, with links to the local application, state licensing, and fees. The business license tax is. Read about.

Roanoke County, Virginia on LinkedIn Congratulations to Roanoke County

New businesses locating in roanoke county must obtain a business license within 30 days of the day it begins business. For most businesses the cost of the business license is based upon the estimate of total gross receipts from the day the business opens to. The business license tax is. Read about how you can obtain the necessary business permits.

Roanoke County business owner announces campaign for board of supervisors

Read about how you can obtain the necessary business permits and licenses. Business licenses the commissioner of the revenue assesses roanoke county business professional and occupational license taxes. For most businesses the cost of the business license is based upon the estimate of total gross receipts from the day the business opens to. The business license tax is. Learn about.

Roanoke County Business Partners Roanoke Valley Television, VA

Read about how you can obtain the necessary business permits and licenses. New businesses locating in roanoke county must obtain a business license within 30 days of the day it begins business. For most businesses the cost of the business license is based upon the estimate of total gross receipts from the day the business opens to. Learn about obtaining.

Fillable Online Business License Zoning Verification Roanoke, VA Fax

The business license tax is. Read about how you can obtain the necessary business permits and licenses. Business licenses the commissioner of the revenue assesses roanoke county business professional and occupational license taxes. For most businesses the cost of the business license is based upon the estimate of total gross receipts from the day the business opens to. Learn about.

News Flash • Roanoke County, VA • CivicEngage

Business licenses the commissioner of the revenue assesses roanoke county business professional and occupational license taxes. For most businesses the cost of the business license is based upon the estimate of total gross receipts from the day the business opens to. The business license tax is. Read about how you can obtain the necessary business permits and licenses. New businesses.

Roanoke County Business Partners Roanoke Valley Television, VA

Business licenses the commissioner of the revenue assesses roanoke county business professional and occupational license taxes. Learn about obtaining a local business license, with links to the local application, state licensing, and fees. The business license tax is. For most businesses the cost of the business license is based upon the estimate of total gross receipts from the day the.

Roanoke County Business Partners September 2021 Roanoke Valley

Read about how you can obtain the necessary business permits and licenses. New businesses locating in roanoke county must obtain a business license within 30 days of the day it begins business. Learn about obtaining a local business license, with links to the local application, state licensing, and fees. Business licenses the commissioner of the revenue assesses roanoke county business.

Roanoke Regional SBDC

The business license tax is. New businesses locating in roanoke county must obtain a business license within 30 days of the day it begins business. Read about how you can obtain the necessary business permits and licenses. Business licenses the commissioner of the revenue assesses roanoke county business professional and occupational license taxes. For most businesses the cost of the.

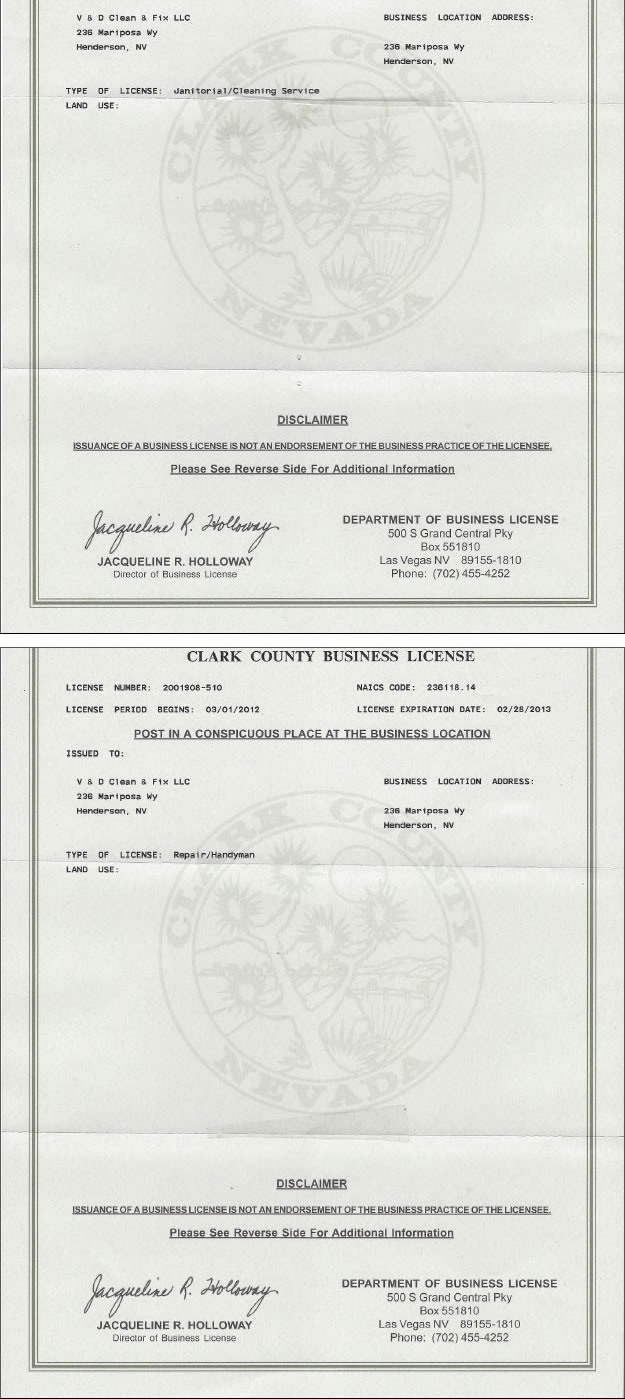

Clark county ohio business license oddras

New businesses locating in roanoke county must obtain a business license within 30 days of the day it begins business. Business licenses the commissioner of the revenue assesses roanoke county business professional and occupational license taxes. Learn about obtaining a local business license, with links to the local application, state licensing, and fees. For most businesses the cost of the.

Business Licenses The Commissioner Of The Revenue Assesses Roanoke County Business Professional And Occupational License Taxes.

Learn about obtaining a local business license, with links to the local application, state licensing, and fees. Read about how you can obtain the necessary business permits and licenses. New businesses locating in roanoke county must obtain a business license within 30 days of the day it begins business. The business license tax is.