State And Local Income Tax Refund Worksheet

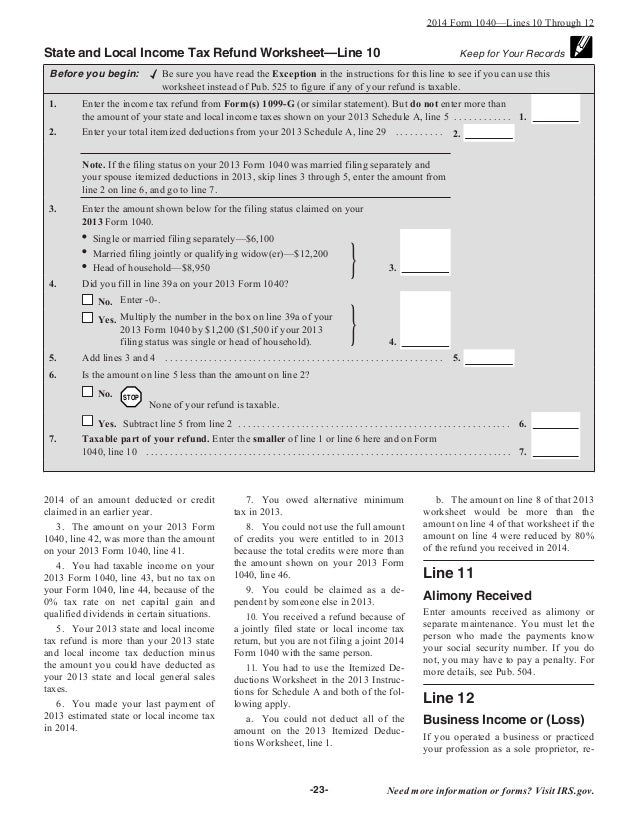

State And Local Income Tax Refund Worksheet - If you did not itemize your deductions or elected to deduct the state and local sales tax rather than the state and local income tax on your prior. This article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. Go to screen 14.2, state tax refunds, unemployment comp. To override the state and local income tax refund:

This article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit. Go to screen 14.2, state tax refunds, unemployment comp. To override the state and local income tax refund: If you did not itemize your deductions or elected to deduct the state and local sales tax rather than the state and local income tax on your prior. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the.

This article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit. To override the state and local income tax refund: Go to screen 14.2, state tax refunds, unemployment comp. If you did not itemize your deductions or elected to deduct the state and local sales tax rather than the state and local income tax on your prior. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the.

State And Local Tax Refund Worksheet

If you did not itemize your deductions or elected to deduct the state and local sales tax rather than the state and local income tax on your prior. To override the state and local income tax refund: Go to screen 14.2, state tax refunds, unemployment comp. This article will help you understand how the state and local refunds taxable worksheet.

State And Local Tax Refund Worksheet 2019

Go to screen 14.2, state tax refunds, unemployment comp. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. This article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit. To override the.

State And Local Tax Refund Worksheet

Go to screen 14.2, state tax refunds, unemployment comp. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. This article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit. If you did.

State Tax Refund Worksheet Fill Online, Printable, Fillable

Go to screen 14.2, state tax refunds, unemployment comp. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. To override the state and local income tax refund: If you did not itemize your deductions or elected to deduct the state and local.

State And Local Tax Refund Worksheet

Go to screen 14.2, state tax refunds, unemployment comp. This article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. If you did.

IRS Schedule 1 Additional Worksheets Library

If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. This article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit. If you did not itemize your deductions or elected to deduct the.

Free state and local tax refund worksheet, Download Free state

If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. If you did not itemize your deductions or elected to deduct the state and local sales tax rather than the state and local income tax on your prior. To override the state and.

Free state and local tax refund worksheet, Download Free state

If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. If you did not itemize your deductions or elected to deduct the state and local sales tax rather than the state and local income tax on your prior. To override the state and.

State/Local Tax Refunds ppt download Worksheets Library

If you did not itemize your deductions or elected to deduct the state and local sales tax rather than the state and local income tax on your prior. To override the state and local income tax refund: If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment.

Free state and local tax refund worksheet, Download Free state

If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. Go to screen 14.2, state tax refunds, unemployment comp. This article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit. To override the.

If You Received A Refund For Your 2023 State Tax Return, A Portion Of That Refund Needs To Be Allocated To The Payment You Made In The.

To override the state and local income tax refund: Go to screen 14.2, state tax refunds, unemployment comp. If you did not itemize your deductions or elected to deduct the state and local sales tax rather than the state and local income tax on your prior. This article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit.