State Tax Lien Definition

State Tax Lien Definition - What is a tax lien? It gives the agency an interest in your property if. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. How state tax liens work. A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax liens come into effect when you fail to pay your state taxes by the deadline.

A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax liens come into effect when you fail to pay your state taxes by the deadline. It gives the agency an interest in your property if. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. What is a tax lien? How state tax liens work.

It gives the agency an interest in your property if. How state tax liens work. A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax liens come into effect when you fail to pay your state taxes by the deadline. What is a tax lien? State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants, LLC

How state tax liens work. State tax liens come into effect when you fail to pay your state taxes by the deadline. What is a tax lien? State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. It gives the agency an interest in your property if.

State Tax Lien vs. Federal Tax Lien How to Remove Them

State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax liens come into effect when you fail to pay your state taxes by the deadline. It gives the agency an interest in your.

HopOn Inc (HPNN) State and Federal Tax Liens and Judgment...

State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. State tax liens come into effect when you fail to pay your state taxes by the deadline. A tax lien is a tactic state tax authorities use to collect outstanding debt. What is a tax lien? How state tax.

Quiz & Worksheet State Tax Liens

State tax liens come into effect when you fail to pay your state taxes by the deadline. How state tax liens work. It gives the agency an interest in your property if. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. What is a tax lien?

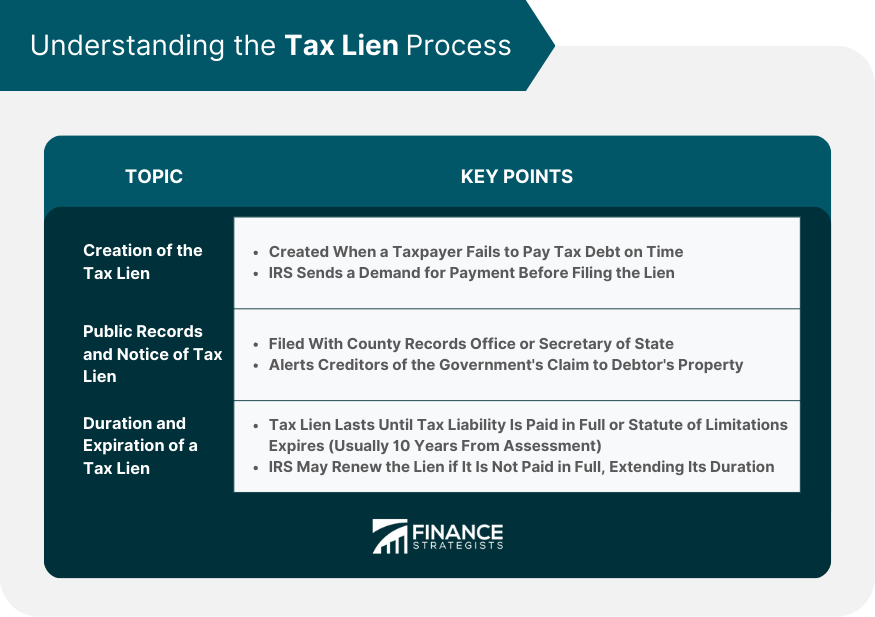

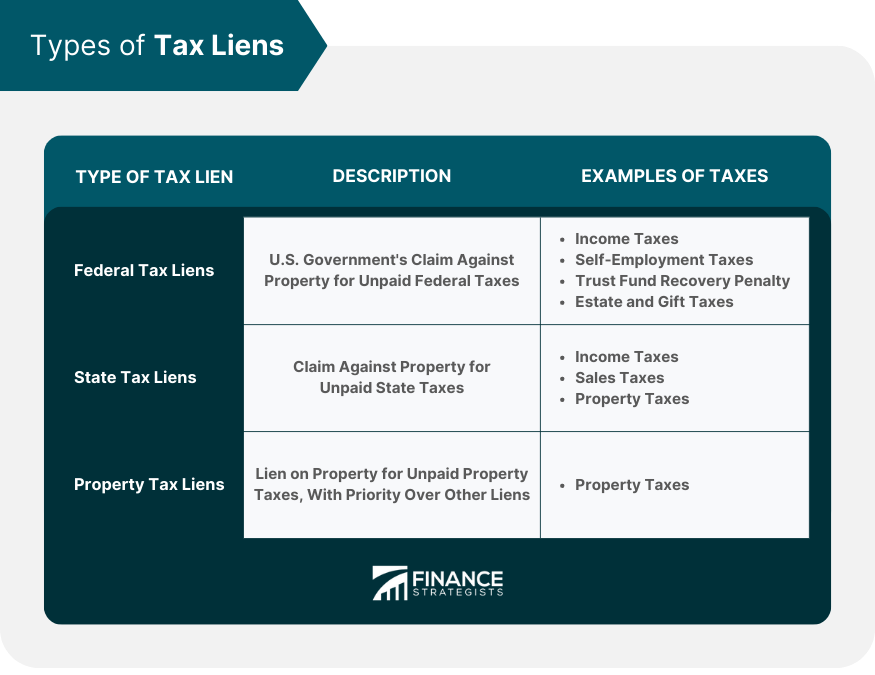

Tax Lien Definition, Process, Consequences, How to Handle

A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. How state tax liens work. It gives the agency an interest in your property if. What is a tax lien?

PPT STATE TAX LIENS PowerPoint Presentation, free download ID5396160

How state tax liens work. A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax liens come into effect when you fail to pay your state taxes by the deadline. What is a tax lien? It gives the agency an interest in your property if.

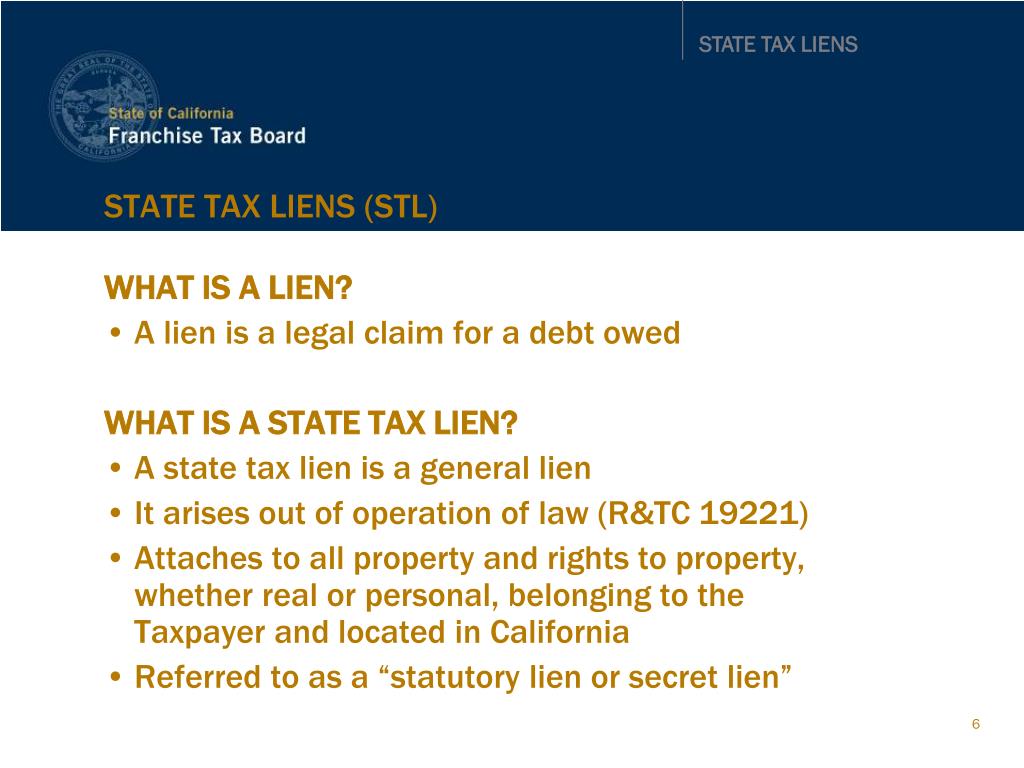

PPT STATE TAX LIENS PowerPoint Presentation, free download ID5396160

How state tax liens work. What is a tax lien? A tax lien is a tactic state tax authorities use to collect outstanding debt. It gives the agency an interest in your property if. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes.

PPT STATE TAX LIENS PowerPoint Presentation, free download ID5396160

A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. It gives the agency an interest in your property if. How state tax liens work. State tax liens come into effect when you fail to.

Tax Lien Definition, Process, Consequences, How to Handle

It gives the agency an interest in your property if. How state tax liens work. What is a tax lien? State tax liens come into effect when you fail to pay your state taxes by the deadline. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes.

Senator Browne

What is a tax lien? How state tax liens work. State tax liens come into effect when you fail to pay your state taxes by the deadline. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. A tax lien is a tactic state tax authorities use to collect.

What Is A Tax Lien?

It gives the agency an interest in your property if. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. A tax lien is a tactic state tax authorities use to collect outstanding debt. How state tax liens work.