Tax Lien Certificates Illinois

Tax Lien Certificates Illinois - A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. What is the state tax lien registry? With the case number search, you may use either the. Iltaxsale.com advertises tax deed auctions for joseph e. It is generated when the owner fails to. To search for a certificate of tax lien, you may search by case number or debtor name. Meyer & associates collects unwanted tax liens for 80. The registry will be an online, statewide system for maintaining notices of tax liens filed or. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all.

Meyer & associates collects unwanted tax liens for 80. It is generated when the owner fails to. Iltaxsale.com advertises tax deed auctions for joseph e. The registry will be an online, statewide system for maintaining notices of tax liens filed or. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. With the case number search, you may use either the. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. To search for a certificate of tax lien, you may search by case number or debtor name. A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. What is the state tax lien registry?

It is generated when the owner fails to. A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. To search for a certificate of tax lien, you may search by case number or debtor name. With the case number search, you may use either the. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. Meyer & associates collects unwanted tax liens for 80. What is the state tax lien registry? The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. The registry will be an online, statewide system for maintaining notices of tax liens filed or. Iltaxsale.com advertises tax deed auctions for joseph e.

Investing In Tax Lien Certificates AmeriLawyer Incorporate

Iltaxsale.com advertises tax deed auctions for joseph e. With the case number search, you may use either the. To search for a certificate of tax lien, you may search by case number or debtor name. Meyer & associates collects unwanted tax liens for 80. Each year, thousands of cook county property owners pay their real estate property taxes late or.

Tax Lien Sale Download Free PDF Tax Lien Taxes

To search for a certificate of tax lien, you may search by case number or debtor name. It is generated when the owner fails to. The registry will be an online, statewide system for maintaining notices of tax liens filed or. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay.

Tax Lien & Deeds For Beginners Copy Tax Lien Certificate School

The registry will be an online, statewide system for maintaining notices of tax liens filed or. It is generated when the owner fails to. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. Meyer & associates collects unwanted tax liens for 80. What is the state tax.

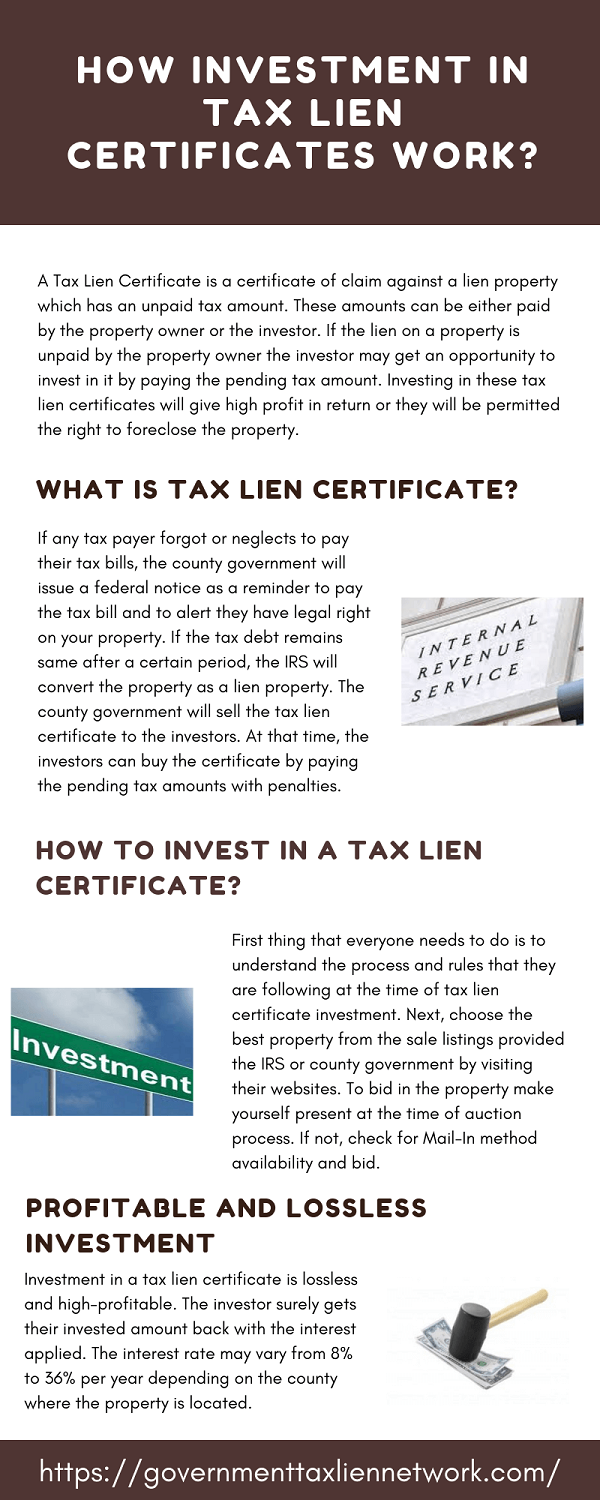

How Investment in Tax Lien Certificates Work? Latest Infographics

It is generated when the owner fails to. A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. Meyer & associates collects unwanted tax liens for 80. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the.

Where To Buy Tax Lien Certificates Online

To search for a certificate of tax lien, you may search by case number or debtor name. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. What is the state tax lien registry? The registry will be an online, statewide system for maintaining notices.

Complete Guide to Tax Lien Certificates Tax Lien Code

What is the state tax lien registry? Iltaxsale.com advertises tax deed auctions for joseph e. To search for a certificate of tax lien, you may search by case number or debtor name. A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. With the case number search, you may use either.

Printable Illinois Sales Tax Exemption Certificates

A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. Meyer & associates collects unwanted tax liens for 80. The state tax lien registry is an online, statewide system.

tax lien PDF Free Download

Iltaxsale.com advertises tax deed auctions for joseph e. A property tax lien is a claim on a piece of property for an amount owed in unpaid taxes. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. With the case number search, you may use either the. The.

Tax Lien Certificates vs. Tax Deeds What's the Difference? PropLogix

With the case number search, you may use either the. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. Iltaxsale.com advertises tax deed auctions for joseph e. What is the state tax lien registry? The state tax lien registry is an online, statewide system for maintaining notices.

Tax Lien Certificates and Tax Deeds How Tax Lien Auctions Work in Cook

With the case number search, you may use either the. The registry will be an online, statewide system for maintaining notices of tax liens filed or. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. Meyer & associates collects unwanted tax liens for 80. To search for.

To Search For A Certificate Of Tax Lien, You May Search By Case Number Or Debtor Name.

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. It is generated when the owner fails to. The registry will be an online, statewide system for maintaining notices of tax liens filed or.

A Property Tax Lien Is A Claim On A Piece Of Property For An Amount Owed In Unpaid Taxes.

What is the state tax lien registry? Iltaxsale.com advertises tax deed auctions for joseph e. With the case number search, you may use either the. Meyer & associates collects unwanted tax liens for 80.