Tax Lien Interest Rates By State

Tax Lien Interest Rates By State - Some states have strict laws about when you can foreclose, and in some states,. The highest bidder gets the lien. The interest rate is 9% over the prime rate so it varies. The tax lien certificate may foreclose on the property. Ted thomas explains the rules, process, and. Colorado lets people bid more. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. If the property owner does not pay all.

The highest bidder gets the lien. The tax lien certificate may foreclose on the property. If the property owner does not pay all. Colorado lets people bid more. The interest rate is 9% over the prime rate so it varies. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. Ted thomas explains the rules, process, and. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. Some states have strict laws about when you can foreclose, and in some states,.

If the property owner does not pay all. The tax lien certificate may foreclose on the property. Ted thomas explains the rules, process, and. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. The highest bidder gets the lien. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. Some states have strict laws about when you can foreclose, and in some states,. The interest rate is 9% over the prime rate so it varies. Colorado lets people bid more.

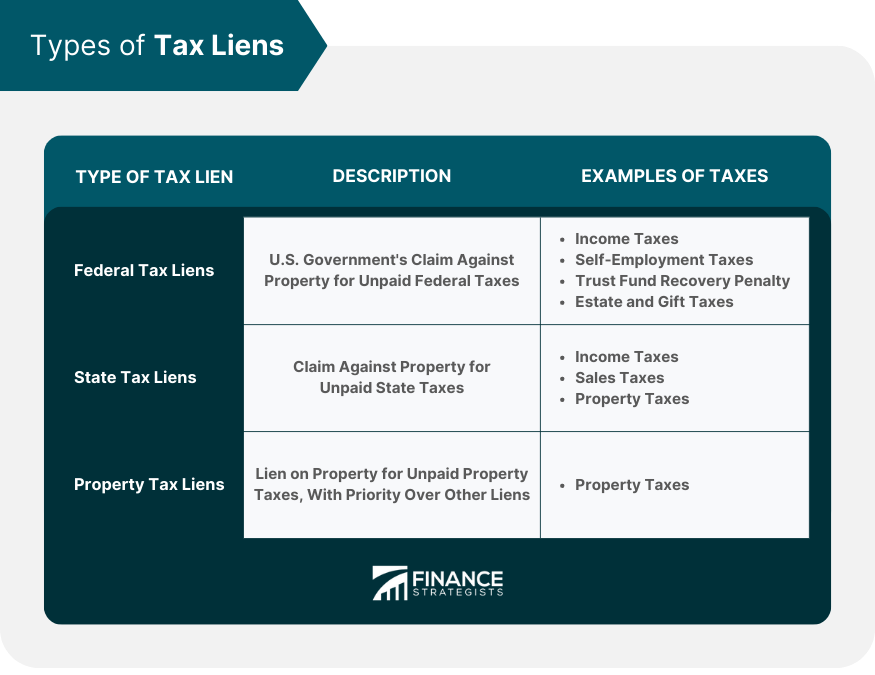

Tax Lien Definition, Process, Consequences, How to Handle

Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. Colorado lets people bid more. The interest rate is 9% over the prime rate so it varies. Ted thomas explains the rules, process, and. The tax lien certificate may foreclose on the property.

The Importance of Hiring a Tax Lien Attorney for Your Insurance

Ted thomas explains the rules, process, and. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. The interest rate is 9% over the prime rate so it varies. The highest bidder gets.

2024 List Of Tax Lien Percentages By State The Leinlord

Some states have strict laws about when you can foreclose, and in some states,. The highest bidder gets the lien. Ted thomas explains the rules, process, and. The interest rate is 9% over the prime rate so it varies. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states.

Tax Lien Form Free Word Templates

Colorado lets people bid more. Ted thomas explains the rules, process, and. Some states have strict laws about when you can foreclose, and in some states,. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. The interest rate is 9% over the prime rate so it varies.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

If the property owner does not pay all. Colorado lets people bid more. The highest bidder gets the lien. Some states have strict laws about when you can foreclose, and in some states,. Ted thomas explains the rules, process, and.

Tax lien Finschool By 5paisa

Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. Some states have strict laws about when you can foreclose, and in some states,. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. Colorado lets people bid more. The tax lien certificate.

Federal tax lien on foreclosed property laderdriver

The tax lien certificate may foreclose on the property. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. If the property owner does not pay all. Some states have strict laws about when you can foreclose, and in some states,. The interest rate is 9% over the prime rate so.

State Tax Rates 2025 Trish Henrieta

Colorado lets people bid more. The tax lien certificate may foreclose on the property. The highest bidder gets the lien. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. Some states have strict laws about when you can foreclose, and in some states,.

Tax Lien Training Special Expired — Financial Freedom University

Ted thomas explains the rules, process, and. If the property owner does not pay all. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. Some states have strict laws about when you can foreclose, and in some states,. The interest rate is 9% over the prime rate so it varies.

Federal tax lien on foreclosed property laderdriver

The interest rate is 9% over the prime rate so it varies. If the property owner does not pay all. The tax lien certificate may foreclose on the property. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. Learn how to invest in tax liens and tax deeds with 16% or.

If The Property Owner Does Not Pay All.

The highest bidder gets the lien. Some states have strict laws about when you can foreclose, and in some states,. Ted thomas explains the rules, process, and. The interest rate is 9% over the prime rate so it varies.

Colorado Lets People Bid More.

Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. The tax lien certificate may foreclose on the property. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns.