Tax Liens In Pa

Tax Liens In Pa - By act 93 of 2014, pennsylvania recently amended the municipal claim and tax lien law to broaden the scope of a. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. You’ll need to address any liens or encumbrances on the. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. After winning a pennsylvania upset tax sale, the real work begins. The department files liens for all types of state taxes: Pennsylvania, currently has 24,252 tax liens available as of january 7.

Pennsylvania, currently has 24,252 tax liens available as of january 7. You’ll need to address any liens or encumbrances on the. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. After winning a pennsylvania upset tax sale, the real work begins. The department files liens for all types of state taxes: Corporation taxes, sales & use taxes, employer withholding taxes, personal income. By act 93 of 2014, pennsylvania recently amended the municipal claim and tax lien law to broaden the scope of a.

The department files liens for all types of state taxes: You’ll need to address any liens or encumbrances on the. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. Pennsylvania, currently has 24,252 tax liens available as of january 7. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. By act 93 of 2014, pennsylvania recently amended the municipal claim and tax lien law to broaden the scope of a. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. After winning a pennsylvania upset tax sale, the real work begins.

How To Prevent and Remove Federal Tax Liens

Corporation taxes, sales & use taxes, employer withholding taxes, personal income. By act 93 of 2014, pennsylvania recently amended the municipal claim and tax lien law to broaden the scope of a. You’ll need to address any liens or encumbrances on the. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. Amending.

Tax Liens An Overview CheckBook IRA LLC

Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. Pennsylvania, currently has 24,252 tax liens available as of january 7. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. The department files liens for all types of state taxes:.

Tax Liens What You Need to Know Cumberland Law Group

You’ll need to address any liens or encumbrances on the. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. The department files liens for all types of state taxes: After winning a pennsylvania upset tax sale, the real work begins. Authorize the release of pennsylvania tax records.

Understanding Federal Tax Liens Winchester, VA

By act 93 of 2014, pennsylvania recently amended the municipal claim and tax lien law to broaden the scope of a. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. The department files liens for all types of state taxes: After winning a pennsylvania upset tax sale,.

TAX Consultancy Firm Gurugram

By act 93 of 2014, pennsylvania recently amended the municipal claim and tax lien law to broaden the scope of a. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. After winning a pennsylvania upset tax sale, the real work begins. The department files liens for all types of state taxes: Amending the act of may 16, 1923.

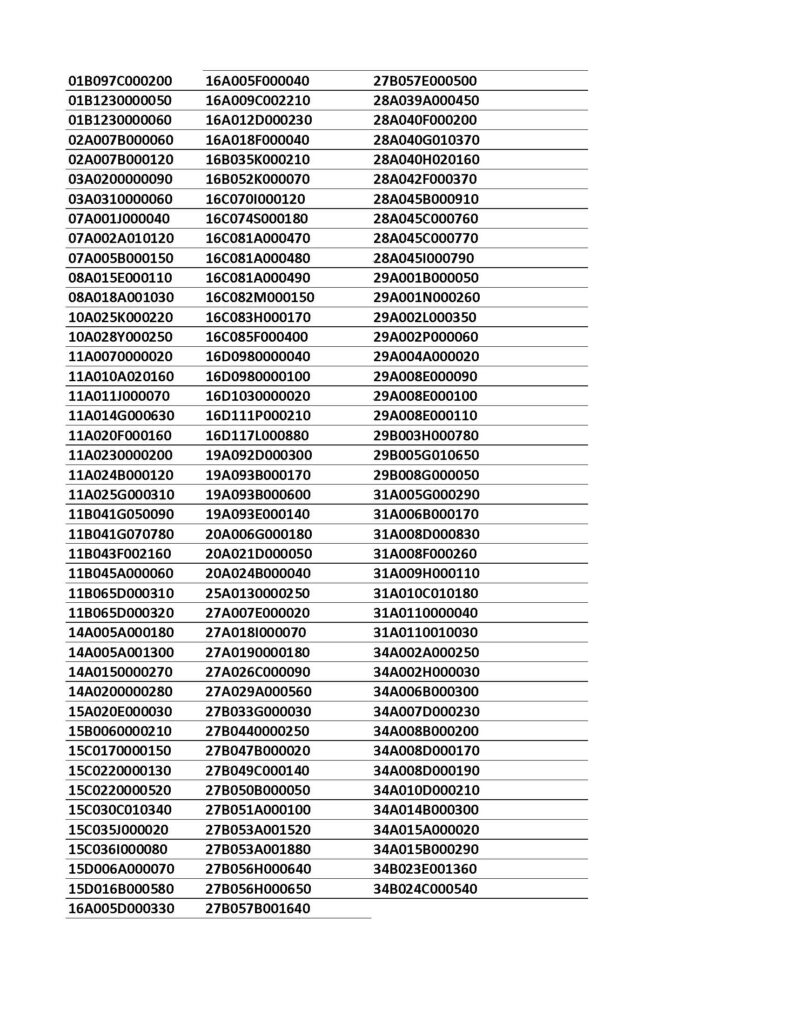

TAX LIENS PENDING CERTIFICATE FILING Treasurer

You’ll need to address any liens or encumbrances on the. Pennsylvania, currently has 24,252 tax liens available as of january 7. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. After winning a pennsylvania upset tax.

Tax Preparation Business Startup

The department files liens for all types of state taxes: After winning a pennsylvania upset tax sale, the real work begins. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. Pennsylvania, currently has 24,252 tax liens available as of january 7. By act 93 of 2014, pennsylvania.

Investing In Tax Liens Alts.co

The department files liens for all types of state taxes: After winning a pennsylvania upset tax sale, the real work begins. Pennsylvania, currently has 24,252 tax liens available as of january 7. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. You’ll need to address any liens or encumbrances on the.

Investing In Tax Liens Alts.co

After winning a pennsylvania upset tax sale, the real work begins. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. Corporation taxes, sales & use taxes, employer withholding taxes, personal income. The department files liens for all types of state taxes: By act 93 of 2014, pennsylvania recently amended the municipal claim.

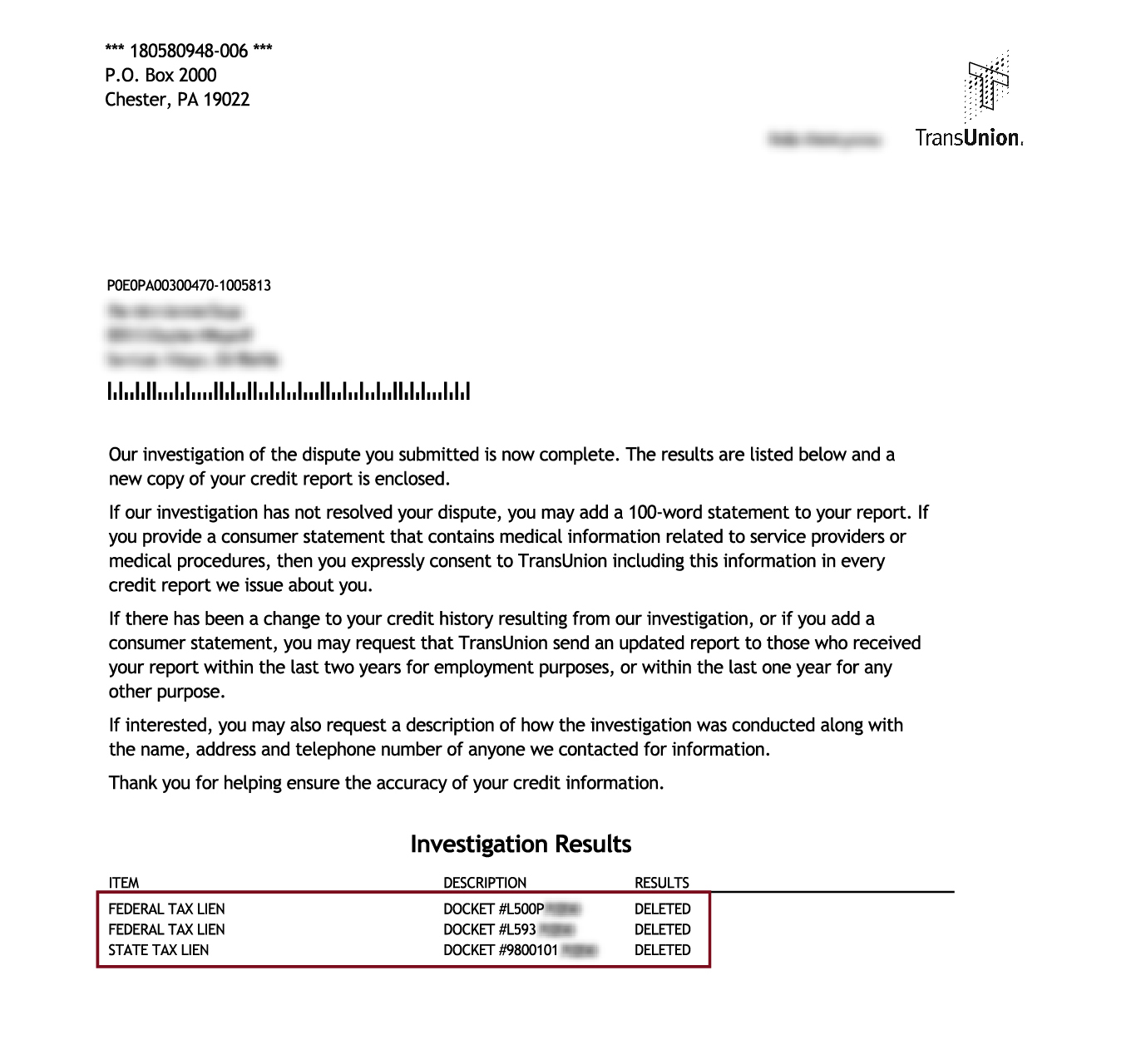

How to Remove an IRS Tax Lien from Your Credit Report

After winning a pennsylvania upset tax sale, the real work begins. Authorize the release of pennsylvania tax records customer feedback survey about us apply for employment at pennsylvania. By act 93 of 2014, pennsylvania recently amended the municipal claim and tax lien law to broaden the scope of a. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an.

Authorize The Release Of Pennsylvania Tax Records Customer Feedback Survey About Us Apply For Employment At Pennsylvania.

By act 93 of 2014, pennsylvania recently amended the municipal claim and tax lien law to broaden the scope of a. Pennsylvania, currently has 24,252 tax liens available as of january 7. Amending the act of may 16, 1923 (p.l.207, no.153), entitled an act providing when, how, upon what property, and to what extent,. You’ll need to address any liens or encumbrances on the.

The Department Files Liens For All Types Of State Taxes:

After winning a pennsylvania upset tax sale, the real work begins. Corporation taxes, sales & use taxes, employer withholding taxes, personal income.

/federal-tax-liens-3193403_final-ae94abda07d54e318b9b6388610fee1f.gif)