Texas Local State Tax Rate

Texas Local State Tax Rate - Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. In the tabs below, discover new map and latitude/longitude search options alongside the. Welcome to the new sales tax rate locator. The rates shown are for each jurisdiction and.

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Welcome to the new sales tax rate locator. The rates shown are for each jurisdiction and. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. In the tabs below, discover new map and latitude/longitude search options alongside the.

This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Welcome to the new sales tax rate locator. The rates shown are for each jurisdiction and.

Ca State Tax Brackets 2024 Bobbi Chrissy

Welcome to the new sales tax rate locator. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. The rates shown are for each jurisdiction and. In the tabs.

Does Your State Have a Gross Receipts Tax? State Gross Receipts Taxes

Welcome to the new sales tax rate locator. The rates shown are for each jurisdiction and. In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. This report shows jurisdictions adopting new.

Tax Burden By State Map

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. In the tabs below, discover new map and latitude/longitude search options alongside the. The rates shown are for each.

Combined State and Local Sales Taxes New Report Tax Foundation

Welcome to the new sales tax rate locator. In the tabs below, discover new map and latitude/longitude search options alongside the. The rates shown are for each jurisdiction and. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. This report shows jurisdictions adopting new.

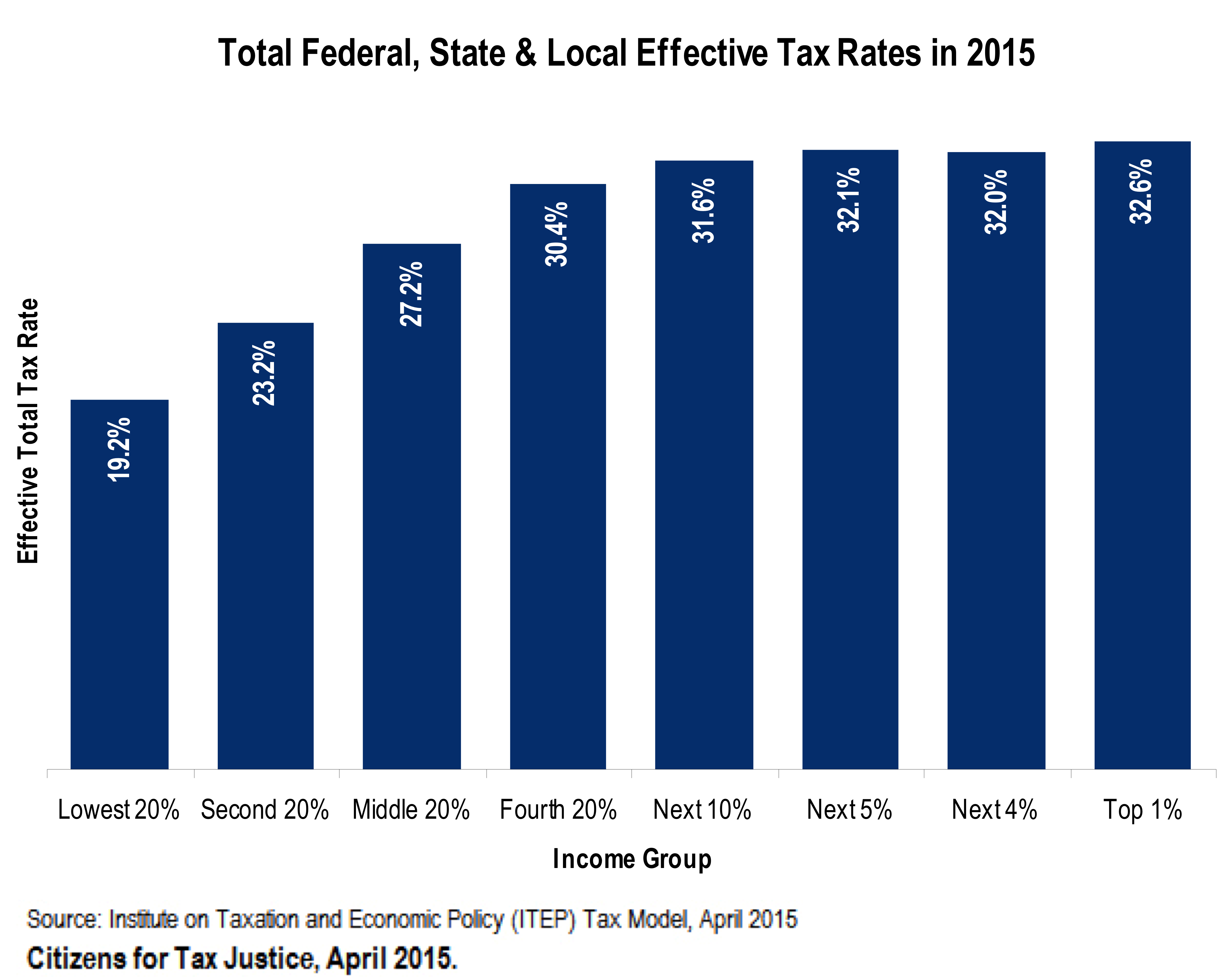

Think the poor don’t pay taxes? This chart proves you very wrong. Vox

In the tabs below, discover new map and latitude/longitude search options alongside the. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Welcome to the new sales tax.

Massachusetts Tax Rates 2022 & 2021 Internal Revenue Code Simplified 2022

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Welcome to the new sales tax rate locator. In the tabs below, discover new map and latitude/longitude search options alongside the. This report shows jurisdictions adopting new or changed sales tax rates in the past.

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. In the tabs below, discover new map and latitude/longitude search options alongside the. Welcome to the new sales tax.

2023 State Corporate Tax Rates & Brackets Tax Foundation

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. In the tabs below, discover new map and latitude/longitude search options alongside the. The rates shown are for each jurisdiction and. Welcome to the new sales tax rate locator. This report shows jurisdictions adopting new.

State and Local Sales Tax Rates Sales Taxes Tax Foundation

Welcome to the new sales tax rate locator. In the tabs below, discover new map and latitude/longitude search options alongside the. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as.

Monday Map Combined State and Local Sales Tax Rates

Welcome to the new sales tax rate locator. In the tabs below, discover new map and latitude/longitude search options alongside the. The rates shown are for each jurisdiction and. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases.

Welcome To The New Sales Tax Rate Locator.

The rates shown are for each jurisdiction and. In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months.

.png)