Texas State And Local Sales Tax Rate 2023

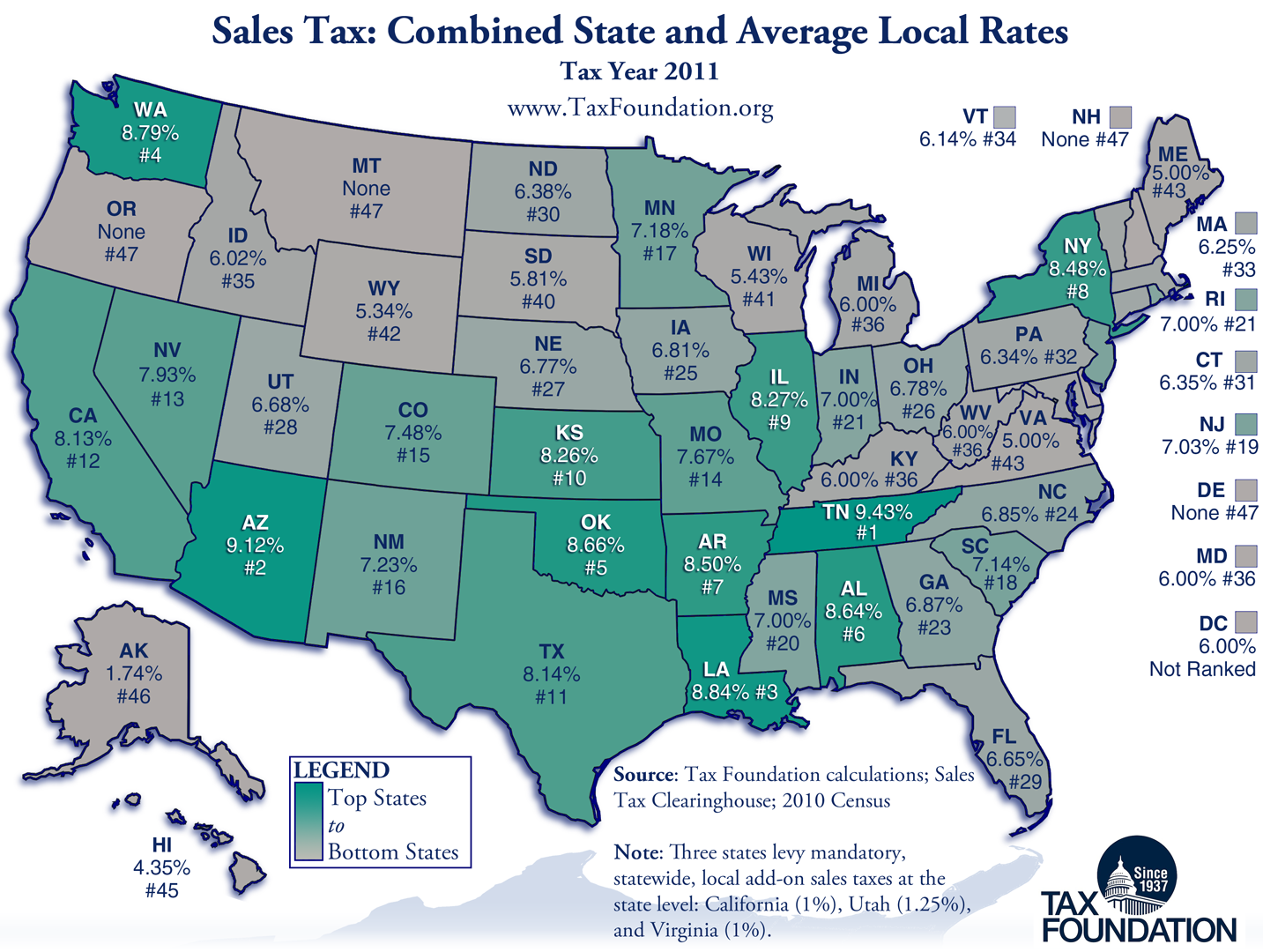

Texas State And Local Sales Tax Rate 2023 - Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Welcome to the new sales tax rate locator. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. In the tabs below, discover new map and latitude/longitude search options alongside the. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. The rates shown are for each jurisdiction and.

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. The rates shown are for each jurisdiction and. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. In the tabs below, discover new map and latitude/longitude search options alongside the. Welcome to the new sales tax rate locator.

This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. Welcome to the new sales tax rate locator. The rates shown are for each jurisdiction and. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. In the tabs below, discover new map and latitude/longitude search options alongside the.

Texas Sales Tax Rate 2024 Jeanne Maudie

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. This report shows jurisdictions adopting new or changed sales.

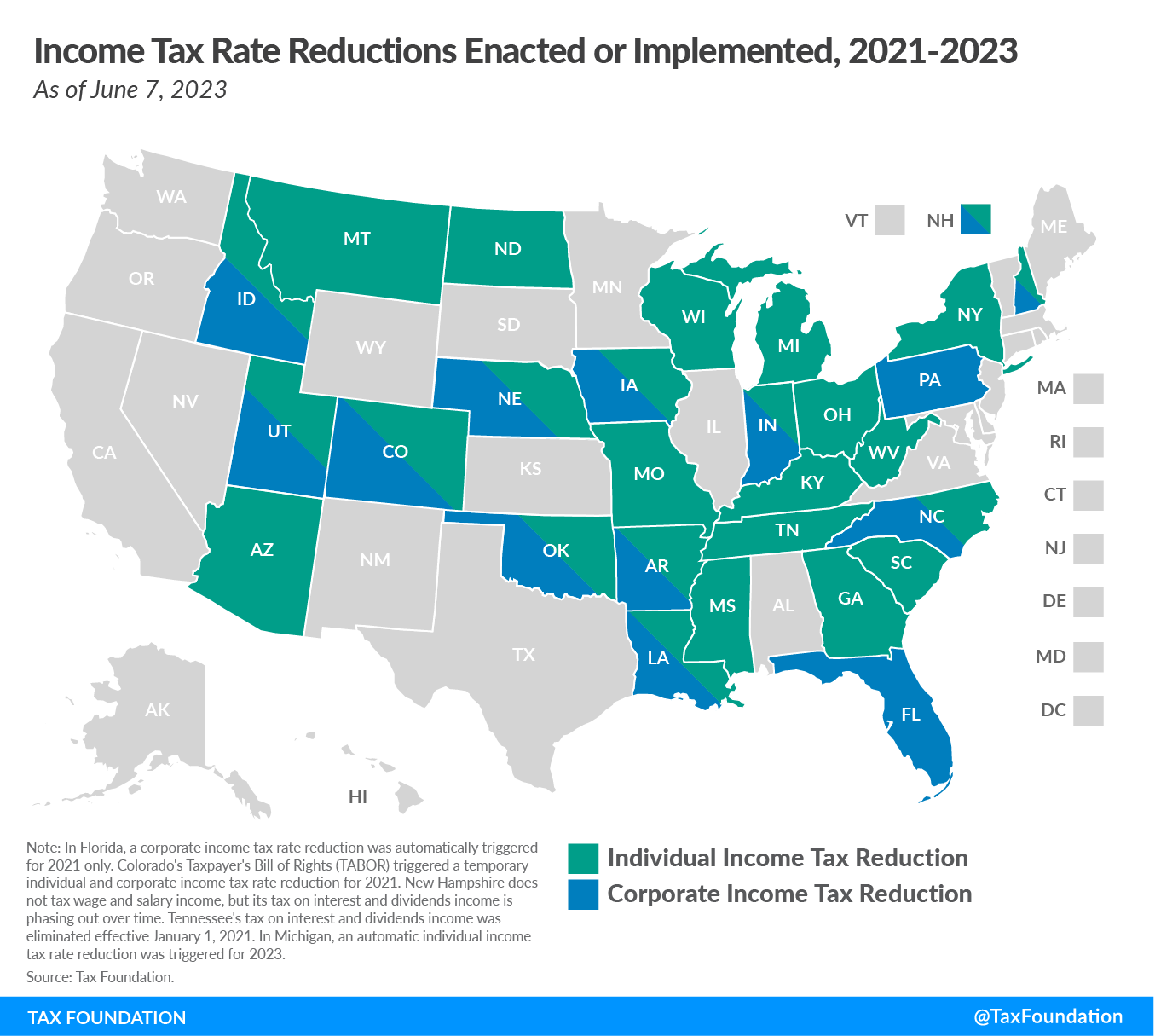

State Tax Reform and Relief Trend Continues in 2023

Welcome to the new sales tax rate locator. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as.

Texas Sales Tax Rate 2024 Jeanne Maudie

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Welcome to the new sales tax rate locator. The.

State Sales Tax Rates 2023 Louisiana

This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. The rates shown are for each jurisdiction and. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. Welcome to the new sales tax rate locator. Texas imposes.

Sales Tax Rate Texas 2024 Karee Marjory

In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along.

Texas Sales Tax 2024 2025

In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. The local sales and use tax.

Houston Texas Sales Tax Rate 2024 Meg Margeaux

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. The rates shown are for each jurisdiction and. In the tabs below, discover new map and latitude/longitude search options alongside the. This report shows jurisdictions adopting new or changed sales tax rates in the.

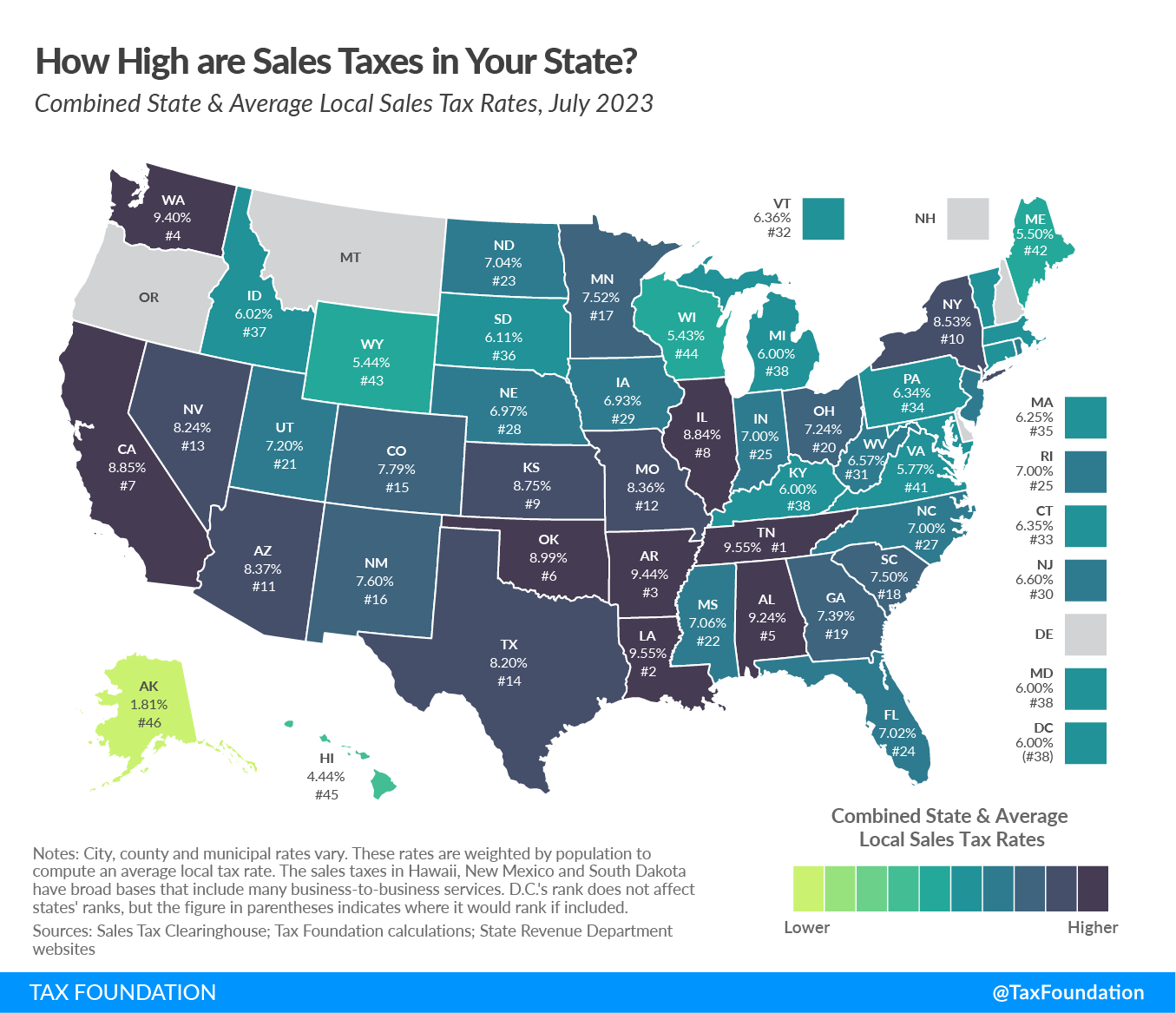

State and Local Sales Tax Rates, Midyear 2023

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. The rates shown are for each jurisdiction and. In the tabs below, discover new map and latitude/longitude search options alongside the. This report shows jurisdictions adopting new or changed sales tax rates in the.

State & Local Sales Tax Rates 2023 Sales Tax Rates American Legal

Welcome to the new sales tax rate locator. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The rates shown are for each jurisdiction and. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a.

What Is The Texas State Sales Tax Rate 2023

In the tabs below, discover new map and latitude/longitude search options alongside the. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. The rates shown are for.

Welcome To The New Sales Tax Rate Locator.

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. The rates shown are for each jurisdiction and. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date.

.png)