Tucson Local Tax Rates

Tucson Local Tax Rates - The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%.

The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. This is the total of state, county, and city sales tax rates. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax.

The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. This is the total of state, county, and city sales tax rates. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a.

Monday Map Combined State and Local Sales Tax Rates

The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales.

Tucson water rates higher than Phx, usage lower here

This is the total of state, county, and city sales tax rates. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson.

State local effective tax rates map Infogram

The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. This is the total of state, county, and city sales tax rates. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of.

Monday Map State and Local Sales Tax Rates, 2011 Tax Foundation

This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales.

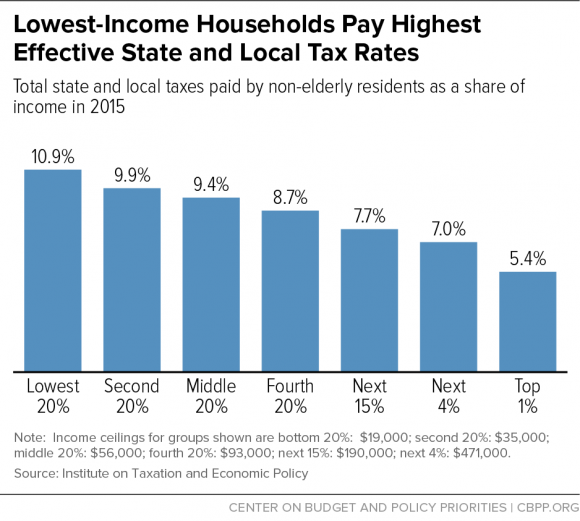

Households Pay Highest Effective State & Local Tax Rates

This is the total of state, county, and city sales tax rates. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales.

Combined State and Average Local Sales Tax Rates Tax Foundation

This is the total of state, county, and city sales tax rates. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of.

Tucson Tax Team Tax Services 6111 E Grant Rd, Tucson, AZ Phone

The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of.

City Of Tucson Sales Tax Rate 2018 Tax Walls

This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. The 8.7% sales tax rate in tucson consists of 5.6%.

tucson sales tax rate change He Was A Great Cyberzine Art Gallery

This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales.

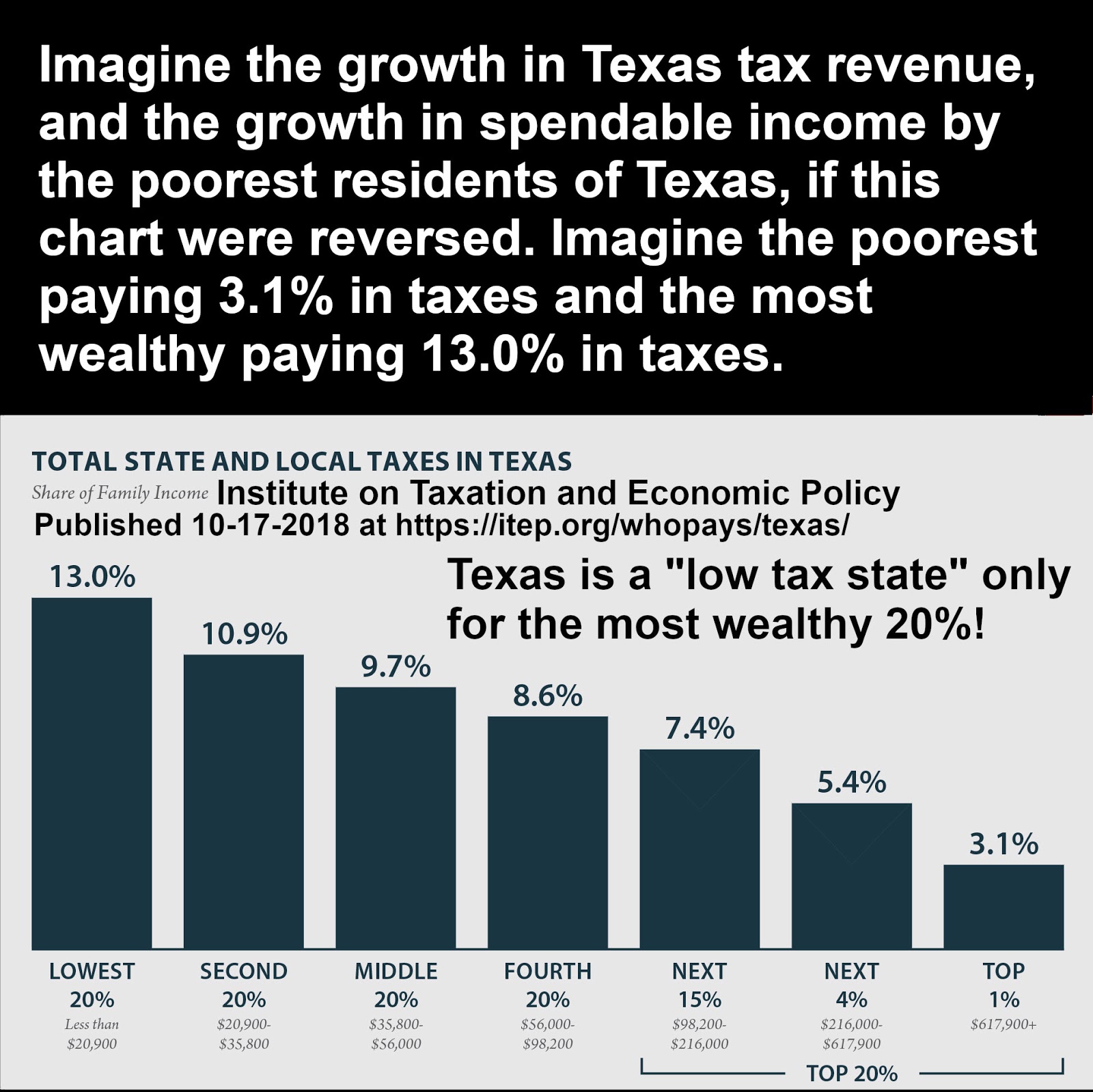

Bill Betzen's Blog Flip Texas State and Local Tax Rates for Prosperity

The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. This is the total of state, county, and city sales tax rates. The 8.7% sales tax rate in tucson consists of 5.6%.

This Is The Total Of State, County, And City Sales Tax Rates.

The 8.7% sales tax rate in tucson consists of 5.6% arizona state sales tax, 0.5% pima county sales tax and 2.6% tucson tax. The tucson, arizona sales tax is 8.60%, consisting of 5.60% arizona state sales tax and 3.00% tucson local sales taxes.the local sales tax consists of a. The minimum combined 2025 sales tax rate for tucson, arizona is 8.7%.

.png)

.png)