What Is The Local Sales Tax

What Is The Local Sales Tax - The 7% sales tax rate in west mifflin consists of 6% pennsylvania state sales tax and 1% allegheny county sales tax. There is no applicable city. With local taxes, the total sales tax rate is between 6.000% and 8.000%. Discover our free online 2024 us sales tax calculator specifically for 15122, west mifflin residents. 31 rows the state sales tax rate in pennsylvania is 6.000%. This is the total of state, county, and city sales tax rates. The current total local sales tax rate in west mifflin, pa is 7.000%. Taxes imposed by the borough are through ordinances that. The december 2020 total local sales tax rate was also 7.000%. How 2024 sales taxes are calculated in west mifflin.

How 2024 sales taxes are calculated in west mifflin. Taxes imposed by the borough are through ordinances that. The current total local sales tax rate in west mifflin, pa is 7.000%. This is the total of state, county, and city sales tax rates. There is no applicable city. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania is 7.0%. With local taxes, the total sales tax rate is between 6.000% and 8.000%. The 7% sales tax rate in west mifflin consists of 6% pennsylvania state sales tax and 1% allegheny county sales tax. The sales tax rate is. The december 2020 total local sales tax rate was also 7.000%.

31 rows the state sales tax rate in pennsylvania is 6.000%. The current total local sales tax rate in west mifflin, pa is 7.000%. Taxes imposed by the borough are through ordinances that. West mifflin borough has a number of taxes that impact residents and businesses. How 2024 sales taxes are calculated in west mifflin. This is the total of state, county, and city sales tax rates. There is no applicable city. The sales tax rate is. The west mifflin, pennsylvania, general sales tax rate is 6%. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania is 7.0%.

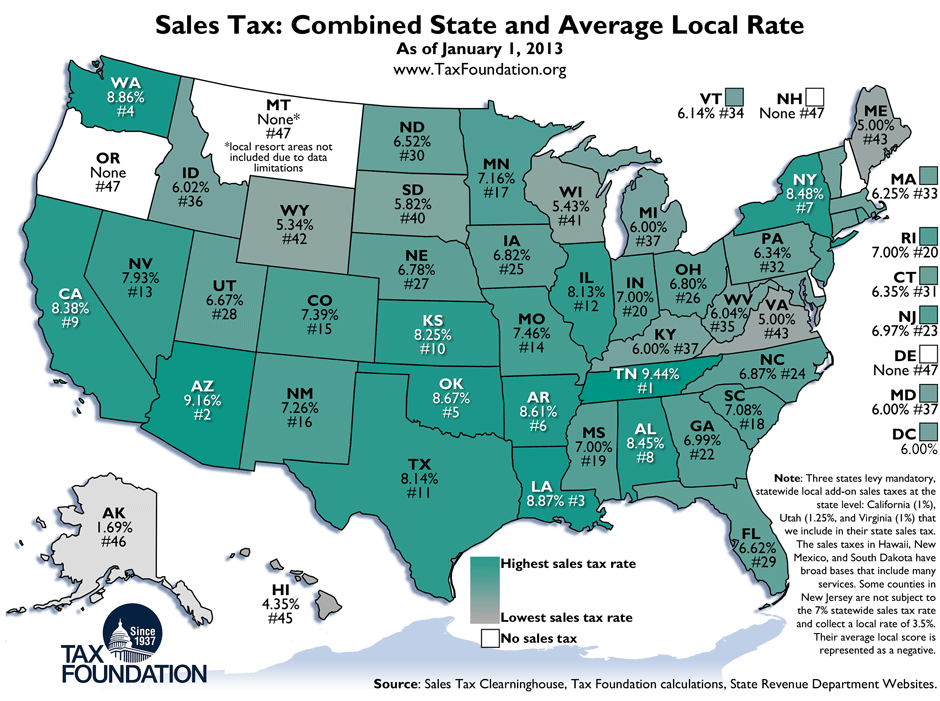

Combined State and Average Local Sales Tax Rates Tax Foundation

This is the total of state, county, and city sales tax rates. The 7% sales tax rate in west mifflin consists of 6% pennsylvania state sales tax and 1% allegheny county sales tax. The current total local sales tax rate in west mifflin, pa is 7.000%. West mifflin borough has a number of taxes that impact residents and businesses. The.

Weekly Map State and Local Sales Tax Rates, 2013 Tax Foundation

The current total local sales tax rate in west mifflin, pa is 7.000%. West mifflin borough has a number of taxes that impact residents and businesses. How 2024 sales taxes are calculated in west mifflin. With local taxes, the total sales tax rate is between 6.000% and 8.000%. The west mifflin, pennsylvania, general sales tax rate is 6%.

State and Local Sales Tax Rates Midyear 2013 Tax Foundation

Discover our free online 2024 us sales tax calculator specifically for 15122, west mifflin residents. This is the total of state, county, and city sales tax rates. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania is 7.0%. The current total local sales tax rate in west mifflin, pa is 7.000%. With local taxes, the total sales tax.

State and Local Sales Tax Rates, Midyear 2020 Tax Foundation

53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. The sales tax rate is. There is no applicable city. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania is 7.0%. The december 2020 total local sales tax rate was also 7.000%.

Monday Map Sales Tax Combined State and Average Local Rates

Discover our free online 2024 us sales tax calculator specifically for 15122, west mifflin residents. 53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania is 7.0%. This is the total of state, county, and city sales.

Updated State and Local Option Sales Tax Tax Foundation

Discover our free online 2024 us sales tax calculator specifically for 15122, west mifflin residents. This is the total of state, county, and city sales tax rates. Taxes imposed by the borough are through ordinances that. With local taxes, the total sales tax rate is between 6.000% and 8.000%. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania.

Local Sales Tax Rates Tax Policy Center

This is the total of state, county, and city sales tax rates. There is no applicable city. 53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. West mifflin borough has a number of taxes that impact residents and businesses. The sales tax rate is.

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

31 rows the state sales tax rate in pennsylvania is 6.000%. The 7% sales tax rate in west mifflin consists of 6% pennsylvania state sales tax and 1% allegheny county sales tax. 53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. The current total local sales tax.

Ranking State and Local Sales Taxes Tax Foundation

53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. West mifflin borough has a number of taxes that impact residents and businesses. This is the total of state, county, and city sales tax rates. The december 2020 total local sales tax rate was also 7.000%. The 7%.

State Sales Tax State Sales Tax Vs Local Sales Tax

West mifflin borough has a number of taxes that impact residents and businesses. The sales tax rate is. The december 2020 total local sales tax rate was also 7.000%. The current total local sales tax rate in west mifflin, pa is 7.000%. How 2024 sales taxes are calculated in west mifflin.

31 Rows The State Sales Tax Rate In Pennsylvania Is 6.000%.

There is no applicable city. The december 2020 total local sales tax rate was also 7.000%. The west mifflin, pennsylvania, general sales tax rate is 6%. West mifflin borough has a number of taxes that impact residents and businesses.

The Current Total Local Sales Tax Rate In West Mifflin, Pa Is 7.000%.

53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. The sales tax rate is. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania is 7.0%. This is the total of state, county, and city sales tax rates.

The 7% Sales Tax Rate In West Mifflin Consists Of 6% Pennsylvania State Sales Tax And 1% Allegheny County Sales Tax.

With local taxes, the total sales tax rate is between 6.000% and 8.000%. Taxes imposed by the borough are through ordinances that. How 2024 sales taxes are calculated in west mifflin. Discover our free online 2024 us sales tax calculator specifically for 15122, west mifflin residents.

.png)

.png)